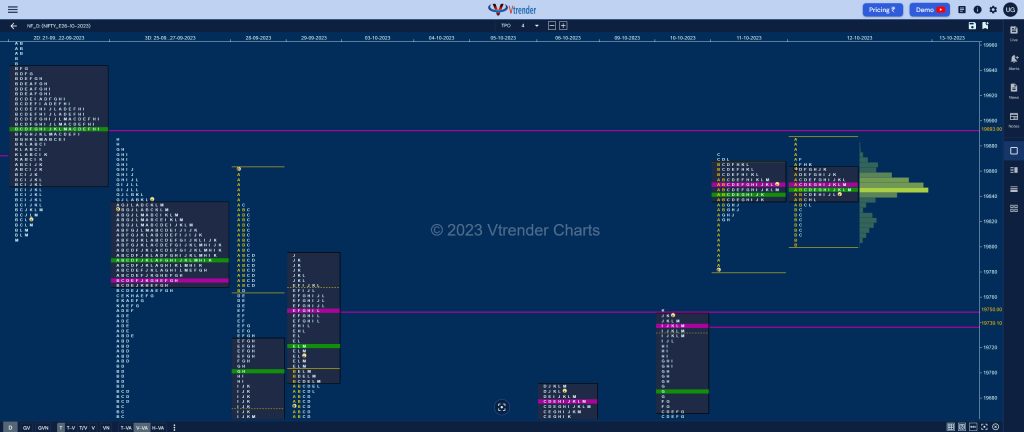

Nifty Oct F: 19843 [ 19884 / 19802 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 7,747 contracts |

| Initial Balance |

|---|

| 82 points (19884 – 19802) |

| Volumes of 23,302 contracts |

| Day Type |

|---|

| Normal – 82 points |

| Volumes of 83,809 contracts |

NF opened with a look up above previous high as it hit 19884 but did not find any fresh demand triggering a probe back into the tiny 28 point range of previous Value from 19864 to 19834 in the A period which was followed by new lows of 19802 in the B as it seemed to leave an extension handle at 19833.

The auction however could not extend any further indicating lack of supply and more confirmation came in the C TPO where it scaled above 19833 initiating the 80% Rule to the upside which was promptly completed in the F period but could not sustain as it became clear that it was only locals who were in play.

NF continued to make rotations on previous Value for the rest of the day as it did not get the initiative volumes to move away from the magnetic POC of 19848 and in fact continued the build volumes there as the big boys used this distribution to book out their long positions as the 2-day overlapping POC of 19848 is also now the series POC as we are all set to get a move away from this 2-day balance on Friday the 13th with the PLR (Path of Least Resistance) biased towards the downside which gets negated only above 19893. (Click here to view the composite #MarketProfile chart only on Vtrender)

Click here to view the latest profile in NF on Vtrender Charts

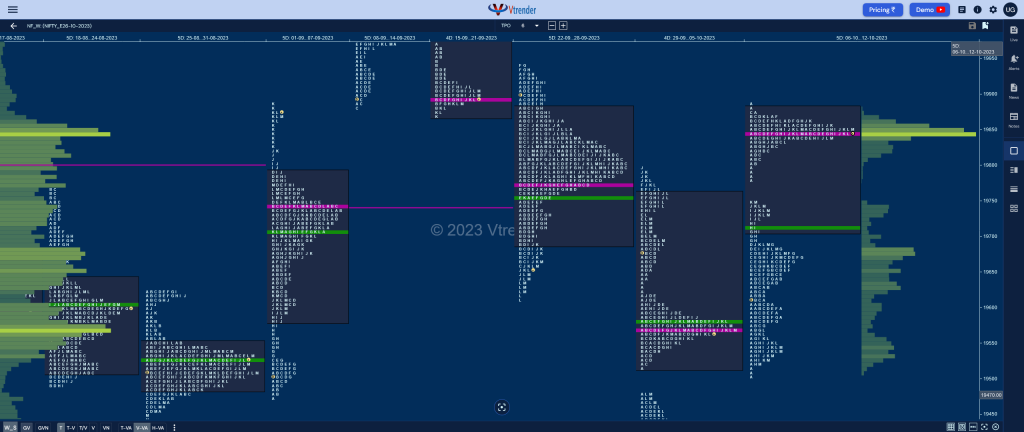

Weekly Settlement (06th to 12th Oct) : 19843 [ 19884 / 19506 ]

The weekly profile is a Neutral Extreme One to the upside which saw rejection when it probed below previous Value and went on to scale above previous highs forming mostly higher Value at 19705-19848-19883 and has closed with a 2-day balance and an ultra prominent POC at 19848 with the structure looking too top heavy which can bring about a probe lower to the daily VPOCs of 19739 & 19550 from 10th & 09th Oct respectively provided the higher 2-day POC of 19893 (21-22 Sep) holds on the upside in the coming settlement week with the NeuX VWAP of 19710 being an important support level.

Daily Zones

- Largest volume (POC) was traded at 19848 F and VWAP of the session was at 19845

- Value zones (volume profile) are at 19838-19848-19860

- HVNs are at 19569 / 19750 / 19848** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (October 2023) is 19635

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively

Business Areas for 13th Oct 2023

| Up |

| 19864 – 2-day VAH (11-12 Oct) 19893 – 2-day VPOC (21-22 Sep) 19943 – 2-day VAH (21-22 Sep) 19986 – 1 ATR (yPOC 19848) 20013 – 2 ATR (VPOC 19739) 20039 – Tail Top (29 Sep) |

| Down |

| 19836 – 2-day VAL (11-12 Oct) 19796 – 2-day tail (11-12 Oct) 19746 – Tail from 10 Oct 19710 – Weekly NeuX VWAP 19677 – Ext Handle (10 Oct) 19629 – Buying Tail (10 Oct) |

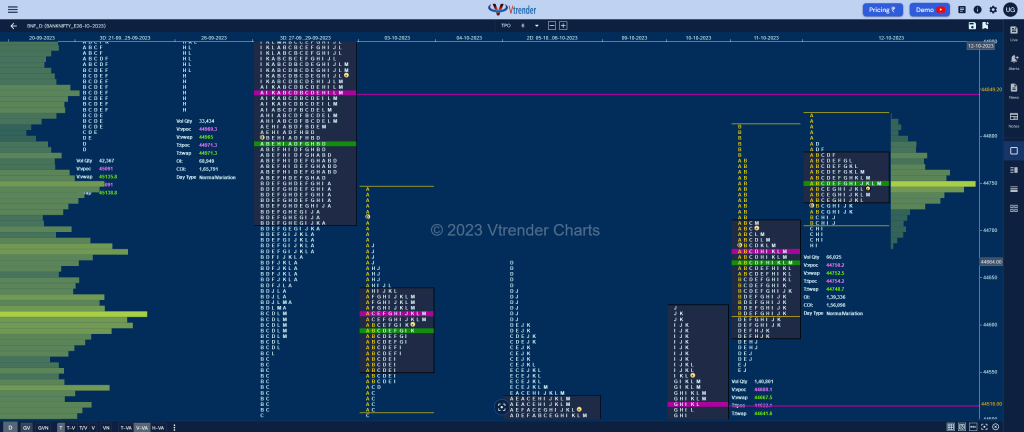

BankNifty Oct F: 44748 [ 44820 / 44682 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 12,527 contracts |

| Initial Balance |

|---|

| 111 points (44820 – 44710) |

| Volumes of 22,483 contracts |

| Day Type |

|---|

| Normal (Gaussian) – 138 points |

| Volumes of 66,025 contracts |

BNF opened above previous Value and even made a look up above PDH as it hit 44820 in the opening minutes but similar to NF, failed to get fresh demand triggering a probe lower for the rest of the IB where it formed a narrow 111 point range taking support just above yVAH of 44706.

The auction then made a typical C side extension to 44690 resulting in a probe higher back to 44794 in the D where it confirmed a PBH and made a slow grind lower even making a fresh RE in the H TPO making new lows of 44682 stalling just above yPOC of 44680 and remained in a subdued range for the rest of the day forming a nice Gaussian Curve with an ultra prominent POC at 44750 from where it it likely to give a move away in the coming session.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 44750 F and VWAP of the session was at 44752

- Value zones (volume profile) are at 44730-44750-44782

- HVNs are at 44413 / 44535 / 44611** / 44849 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (October 2023) is 44595

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively

Business Areas for 13th Oct 2023

| Up |

| 44782 – VAH from 12 Oct 44849 – 2-day VPOC (28-29 Sep) 44998 – Swing High (28 Sep) 45091 – 3-day POC (21-25 Sep) 45198 – 3-day HVN (21-25 Sep) 45294 – 3-day VAH (21-25 Sep) |

| Down |

| 44730 – VAL from 12 Oct 44630 – K TPO POC (11 Oct) 44516 – VPOC from 10 Oct 44412 – DD VWAP (10 Oct) 44317 – Mid-profile singles (10 Oct) 44201 – Buying Tail (10 Oct) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.