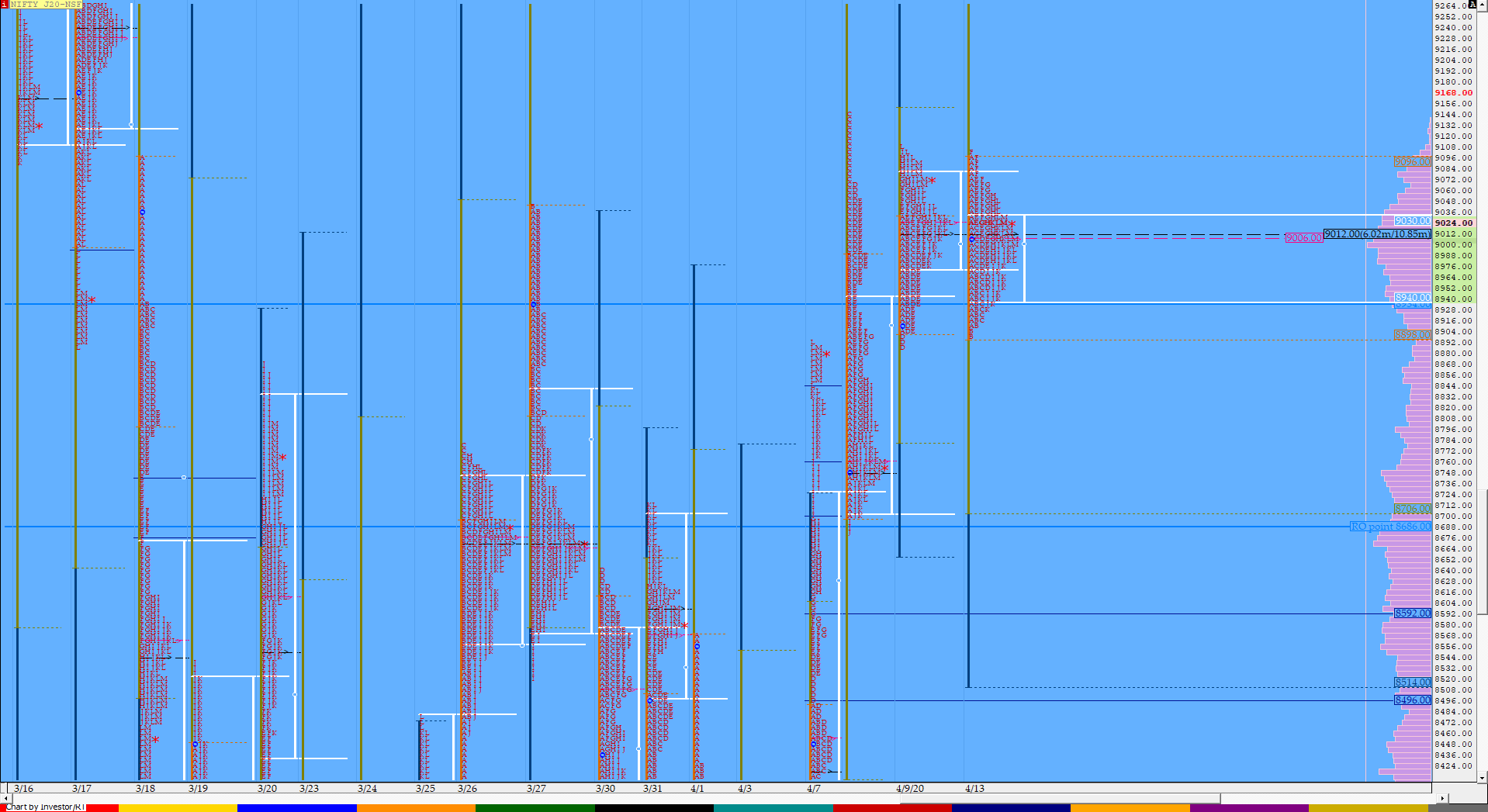

Nifty Apr F: 9011 [ 9107 / 8903 ]

HVNs – 7900 / 8130 / 8259 / 8305-35 / 8420-55 / 8555 / 8604 / 8670 / 8750 / 8800 / (8865) / 9015 / 9080

NF opened lower right at the yPOC of 9010 once again not giving any follow up to a Neutral Extreme profile and continued to probe lower in the IB (Initial Balance) completing the 80% Rule in previous day’s Value as it made a low of 8903 taking support just above the FA of 8891 indicating that this leg of the downside was getting over. The auction then probed higher for the next 4 periods doing the reverse 80% Rule even attempting a RE (Range Extension) in the ‘F’ period as it made new highs of 9107 but was immediately sent back into the IB indicating that the demand was not good enough to continue higher. NF then made a retracement for the next 5 periods breaking below VWAP & leaving a PBL (Pull Back Low) at 8930 in the ‘K’ period completing a hat-trick of the 80% Rule forming a nice Gaussian profile for the day and as happens with a perfect bell curve, the close was at the dPOC of 9012. We also have an inside day in terms of the range in NF and as a result there is a nice balance forming on the 2-day composite with the POC at 9007 hence there is good chance of the auction moving away from here in the coming session.

Click here to view the 2-day composite on MPLite

- The NF Open was a Open Auction In Range (OAIR)

- The day type was a Normal Day – Gaussian Profile

- Largest volume was traded at 9012 F

- Vwap of the session was at 8998 with volumes of 179.3 L and range of 204 points as it made a High-Low of 9107-8903

- NF confirmed a multi-day FA at 8686 on 09/04 and the 1 ATR objective comes to 9211.

- NF confirmed another FA at 8891 on 09/04 and the 1 ATR objective comes to 9416.

- NF confirmed a FA at 7521 on 24/03 and tagged the 2 ATR objective of 8595 on 26/03. This FA has not been tagged and is now positional support.

- NF confirmed a FA at 9384 on 17/03 and tagged the 2 ATR move of 8613 on 18/03. This FA has not been tagged and is positional supply point.

- The Trend Day VWAP of 8620 would be important support level.

- The settlement day Roll Over point (Apr) is 8686

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 8949-9012-9045

Main Hypos for the next session:

a) NF has immediate supply at 9045 above which it could rise to 9062-75 / 9100-25 / 9150-60* / 9181 & 9211-34

b) The auction staying below 9015 could test levels of 8988-63 / 8949-35 / 8904-8891 / 8860 & 8828-04

Extended Hypos:

c) Above 9234, NF can probe higher to 9270-95 / 9325 / 9358-65 / 9385 & 9412-16

d) Below 8804, the auction can fall further to 8775 / 8748*-36 / 8715-00 / 8667-62 & *8620*

-Additional Hypos*-

e) Sustaining above 9416* could take NF to 9460-80 / 9510 / 9550-70 & 9615

f) If 8620* is taken out, NF can start a new leg down to 8590 / 8559-45 / 8525-8490 & 8455-45

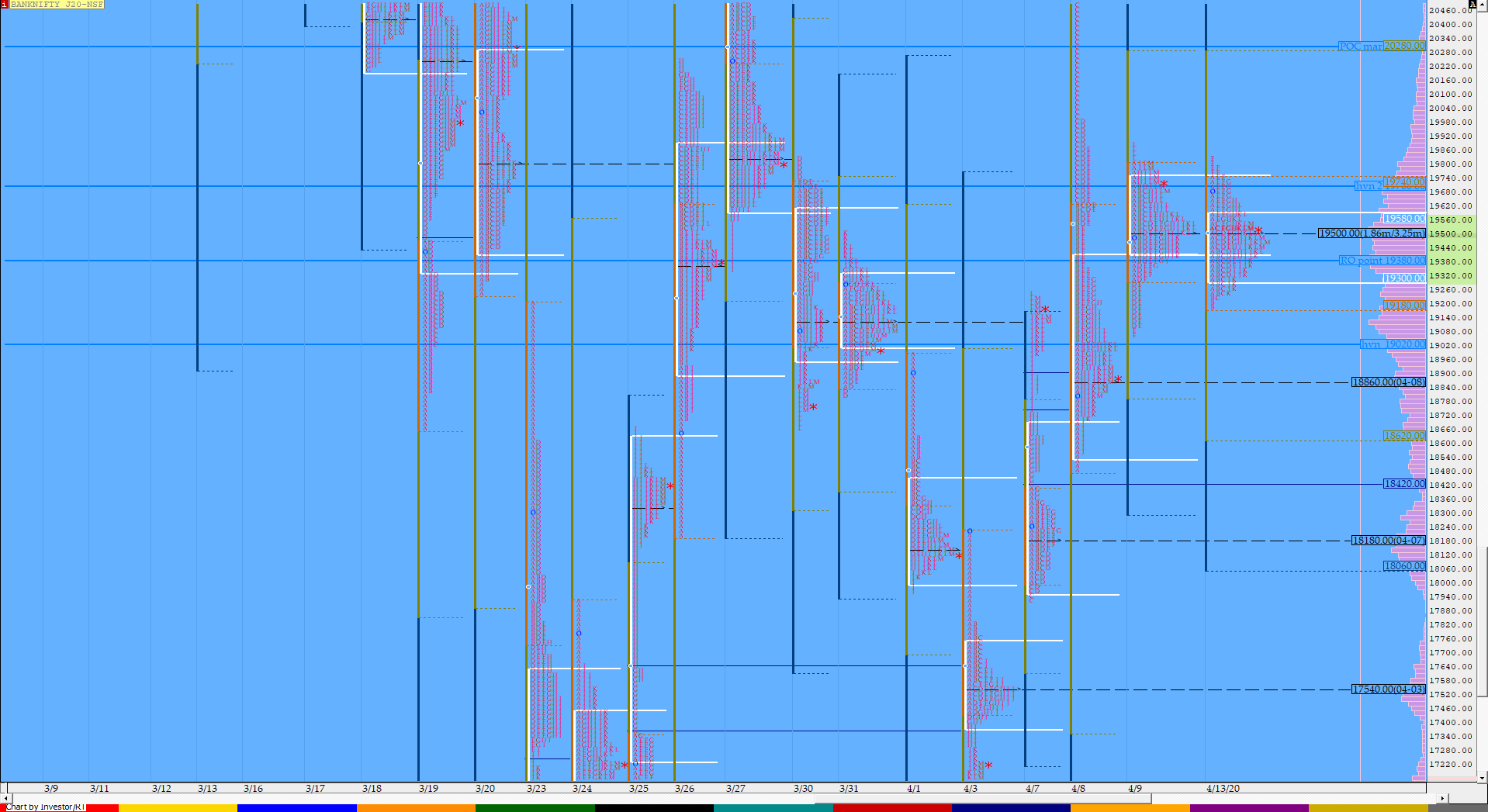

BankNifty Apr F: 19484 [ 19826 / 19185 ]

HVNs – 17075 / 17540 / 18180 /18260 / 18790 / 18890 / 19125 / 19345 / 19410 / 19500 / 19820

BNF also opened lower at 19680 and got rejected at yVAH to probe lower in the IB with the auction similar to that of NF as it made lows of 19185 after which it rotated back higher making multiple attempts in the ‘E’ & ‘F’ periods to make a RE higher but got rejected back into the IB after getting stalled near that HVN of 19820. BNF remained in the IB for the rest of the day leaving an inside bar on the daily with the narrowest range in a month of just 641 points forming a perfect Gaussian profile with a close near the prominent POC. As in NF, BNF has also formed a neat 2-day balance with Value at 19339-19503-19666 and has a very strong chance of moving away from this Value in the next session.

Click here to view the 2-day composite on MPLite

- The BNF Open was a Open Auction In Range (OAIR)

- The day type was a Normal Day – Gaussian Profile

- Largest volume was traded at 19500 F

- Vwap of the session was at 19458 with volumes of 54.9 L and range of 641 points as it made a High-Low of 19826-19185

- BNF confirmed a FA at 17921 on 07/04 and tagged the 1 ATR target of 19818 on 08/04. The 2 ATR objective from this FA is at 21715.

- BNF confirmed a FA at 19820 on 30/03 and tagged the 1 ATR objective of 17880 on 03/04. This FA got tagged on 08/04 which was the ‘T+5’ Day.

- The settlement day Roll Over point (Apr) is 19380

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 19306-19500-19562

Main Hypos for the next session:

a) BNF needs to sustain above 19500 for a move to 19625-680 / 19720-800 / 19850 / 19970-981 / 20040 & 20130-180

b) The auction gets weak below 19450 for a test of 19380-350 / 19306-250 / 19185-175 / 19115-040 / 18970-940 & 18890-860*

Extended Hypos:

c) Above 20180, BNF can probe higher to 20251-295 / 20326-350 / 20450-520 / 20600 / 20666-715 & 20795-925

d) Below 18860, lower levels of 18800-725 / 18675-555 / 18495-430 / 18375-300 / 18225-195* & 18150 could come into play

-Additional Hypos*-

e) BNF sustaining above 20925* could start a new leg up to 21000-095 / 21150 / 21250-312 / 21400-480 / 21530 & 21600-635

f) If 18150* is taken out, BNF could fall further to 18075-010 / 17920-826 / 17740 / 17665-600 / 17540* & 17490-462

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout