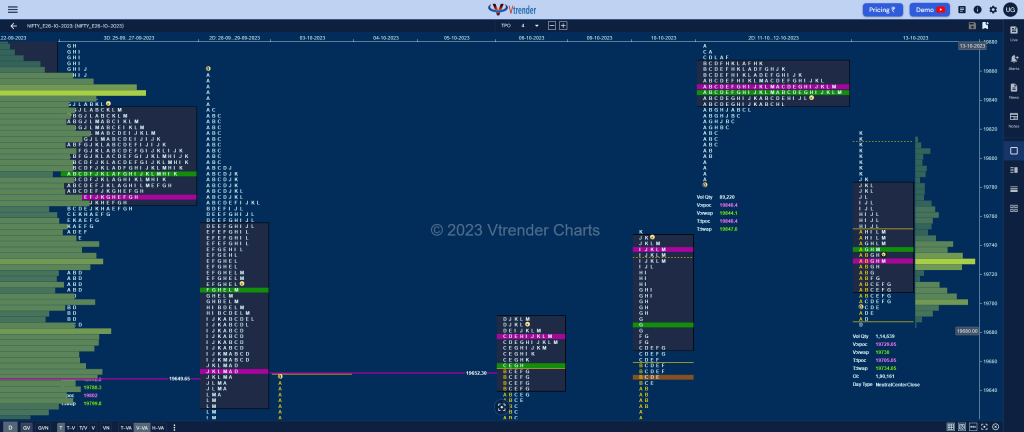

Nifty Oct F: 19742 [ 19817 / 19685 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 25,172 contracts |

| Initial Balance |

|---|

| 59 points (19749 – 19690) |

| Volumes of 42,879 contracts |

| Day Type |

|---|

| Neutral Centre (NeuC) – 132 points |

| Volumes of 1,14,693 contracts |

NF opened with a big gap down of 145 points but took support just above 10th Oct’s DD VWAP of 19686 as it made a low of 19690 and settled down into an OAOR with the B period forming a narrow 30 point range inside bar which was followed by an even more narrow C side of just 18 points.

The auction then made an attempt to extend lower in the D TPO but could only manage to tag 19685 and once again formed a mere 18 point range indicating exhaustion to the downside which triggered a slow probe higher as the range also began to expand even resulting in a fresh RE in the H period confirming a FA at lows.

NF continued to make higher highs in the I & J periods too and made a swipe to 19817 in the K almost completing the 1 ATR objective of 19818 from 19685 but saw the return of aggressive sellers who left a responsive selling tail till 19786 and made a retracement back to day’s VWAP even breaking below it to settle down near the dPOC of 19729 leaving a Neutral Centre Day with completely lower Value.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19729 F and VWAP of the session was at 19738

- Value zones (volume profile) are at 19709-19729-19783

- HVNs are at 19569 / 19750 / 19848** (** denotes series POC)

- NF confirmed a FA at 19685 on 13/10 and almost tagged the 1 ATR objective of 19818 on the same day. The 2 ATR target comes to 19950

Monthly Zones

- The settlement day Roll Over point (October 2023) is 19635

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively

Business Areas for 16th Oct 2023

| Up |

| 19738 – VWAP from 13 Oct 19770 – SOC from 13 Oct 19818 – 1 ATR (FA of 19685) 19848 – 2-day VPOC (11-12 Oct) 19893 – 2-day VPOC (21-22 Sep) 19943 – 2-day VAH (21-22 Sep) |

| Down |

| 19725 – G TPO POC (13 Oct) 19677 – Ext Handle (10 Oct) 19629 – Buying Tail (10 Oct) 19584 – Singles mid (10 Oct) 19550 – VPOC from 09 Oct 19522 – Closing PBL (09 Oct) |

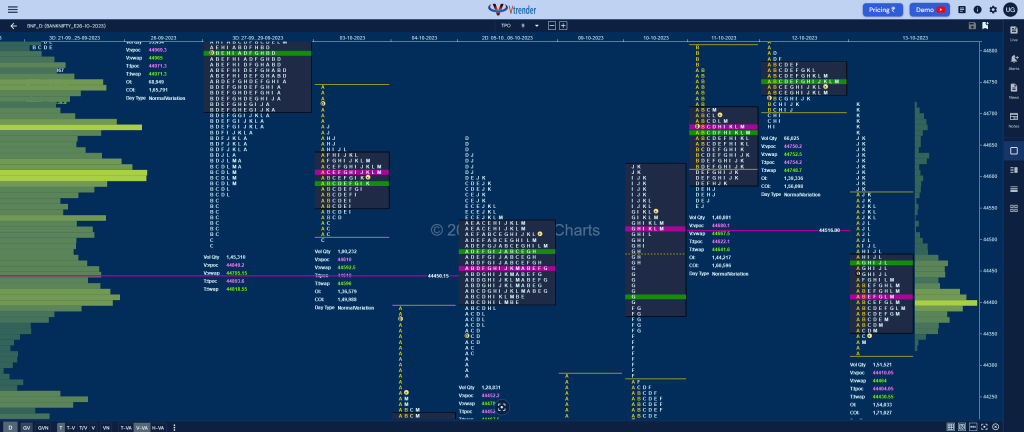

BankNifty Oct F: 44394 [ 44720 / 44318 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 22,632 contracts |

| Initial Balance |

|---|

| 246 points (44574 – 44318) |

| Volumes of 44,082 contracts |

| Day Type |

|---|

| Normal Variation (NV) – 402 points |

| Volumes of 1,51,521 contracts |

BNF also opened with a 298 point gap down and made freak ticks of 44574 on the upside and 44318 on the downside in the opening minute taking support in the mid-profile singles from 10th Oct settling down into an OAOR as the range began to contract till the D period where it remained in a 36 point range between 44355 to 44391.

The auction then made a higher high for the first time in the E TPO which began a slow OTF probe higher till the I period but gained momentum in the J where it got above the morning freak tick making new highs for the day at 44664 and followed it with another RE in the K TPO stalling just below previous Value while recording new highs of 44720.

The inability to get back above 44730 got the aggressive sellers back in play as they first confrimed a selling tail from 44720 to 44665 getting back into the IB and not only broke below day’s VWAP but made a sharp liquidation drop to 44341 into the close leaving a Normal Variation Day Up but with completely lower Value and a close around the lows which means the imbalance could continue in the coming session.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 44410 F and VWAP of the session was at 44461

- Value zones (volume profile) are at 44357-44410-44475

- HVNs are at 44413** / 44535 / 44611 / 44849 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (October 2023) is 44595

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively

Business Areas for 16th Oct 2023

| Up |

| 44410 – dPOC from 13 Oct 44564 – SOC from 13 Oct 44665 – Selling tail (13 Oct) 44750 – VPOC from 12 Oct 44849 – 2-day VPOC (28-29 Sep) 44998 – Swing High (28 Sep) |

| Down |

| 44341 – Buying Tail (13 Oct) 44201 – Buying Tail (10 Oct) 44105 – Singles mid (10 Oct) 44029 – VPOC from 09 Oct 43935 – Swing Low (09 Oct) 43782 – Weekly ATR |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.