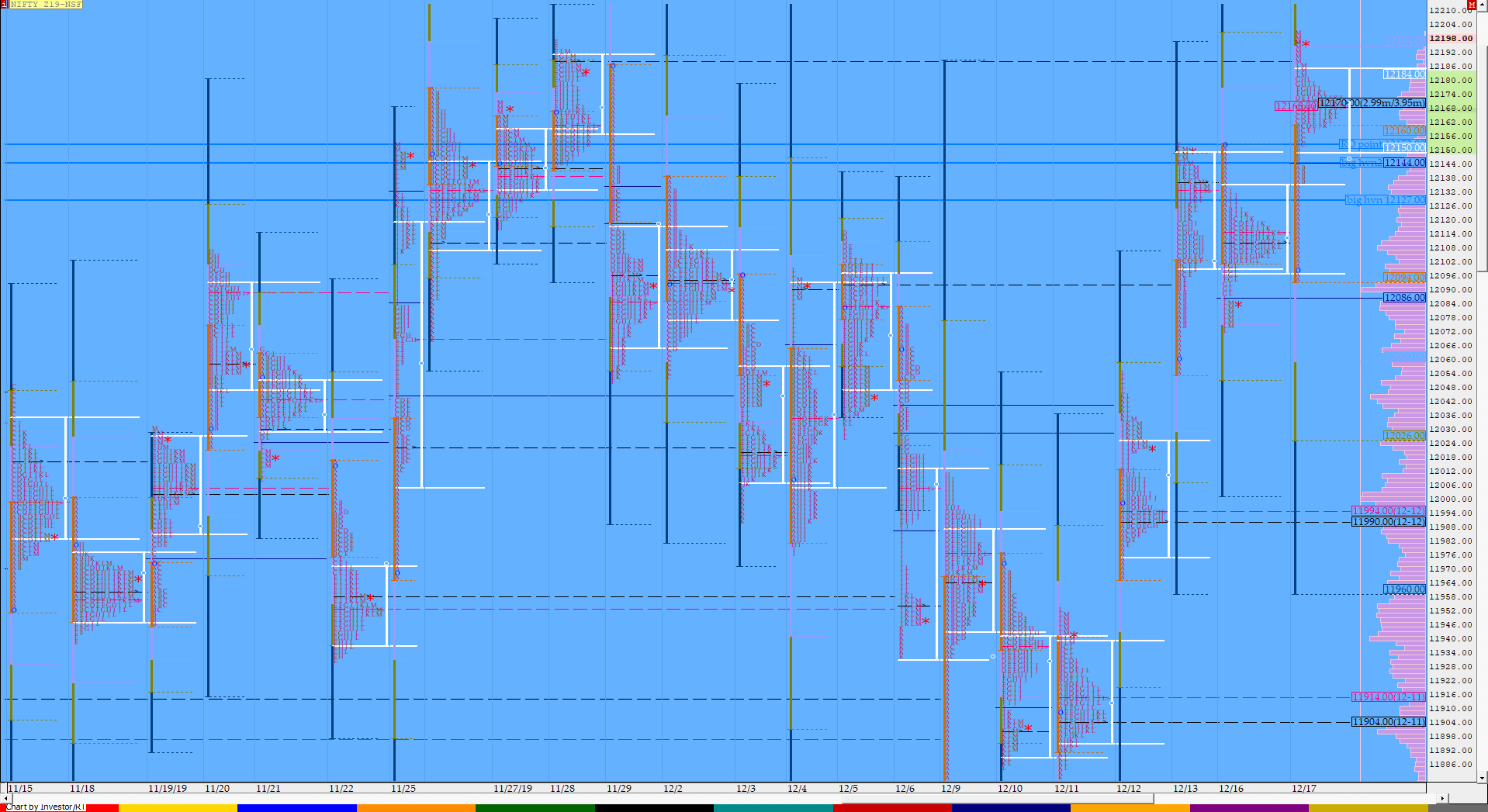

Nifty Dec F: 12187 [ 12200/ 12094 ]

HVNs – 11900-910 / (11940) / 11990 / 12024 / (12082) / 12112 / 12170 / 12198

NF not only rejected the spike close of previous day but also gave a move away from the prominent POC of 12112 as it left a buying tail from 12136 to 12082 in the IB (Initial Balance) to give a slow probe higher all day as it got accepted above the RO point of 12153 and formed a ‘p’ shape profile for the day to hit new all time highs of 12200 once again closing in a spike but this time it was to the upside. Spike Rules would be in play for the open next session with the reference being 12180 to 12200.

Click here to view NF move away from the 2-day composite

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a slow Normal Variation Day – Up (NV) ‘p’ shape profile with a spike

- Largest volume was traded at 12170 F

- Vwap of the session was at 12161 with volumes of 74. L and range of 106 points as it made a High-Low of 12200-12094

- The Trend Day VWAP of 29/10 at 11848 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 12153

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12153-12170-12186

Hypos / Estimates for the next session:

a) NF needs to get above supply of 12198 for a rise to 12216-224 / 12245 & 12271-280

b) Immediate support is at 12180-170 below which the auction could test 12152-150 / 12130 & 12112-102

c) Above 12280, NF can probe higher to 12310 & 12340

d) Below 12102, auction could fall to 12082-74 & 12054

e) If 12340 is taken out, the auction go up to to 12362-368 & 12384

f) Break of 12054 can trigger a move lower to 12024-18 & 11994*-988

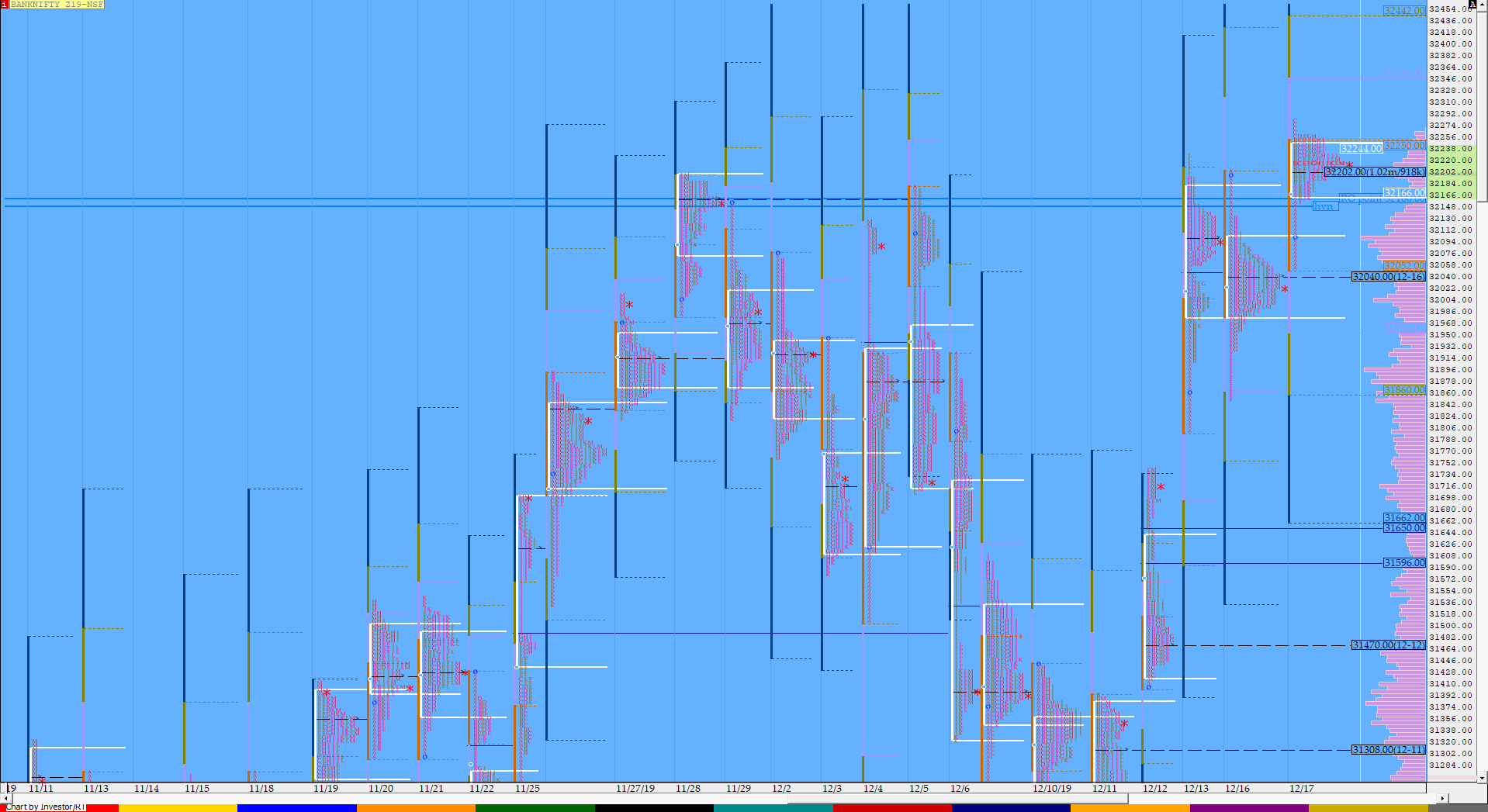

BankNifty Dec F: 32206 [ 32285 / 32055]

HVNs – 31370-400 / 31470 / 31715 / 31855 / 31896 / 32040 / 32100 / 32200

As expected, BNF gave a move away from the 2-day composite as it opened above the POC of 32040 and left a big buying tail from 32161 to 32010 in the IB and went on to make a ‘C’ side extension as it hit new all time highs of 32285 but was not able to get new demand above the IBH which resulted in the narrowest daily range for this series of just 230 points and a rare Normal Day in BNF as it left a ‘p’ shape profile with a close around the dPOC of 32200.

Click here to view a rare Normal Day in BNF

- The BNF Open was an Open Auction In Range plus a Drive Up (OAIR)

- The day type was a slow Normal Day – Down (‘p’ shape profile)

- Largest volume was traded at 32200 F

- Vwap of the session was at 32208 with volumes of 21.1 L and range of 230 points as it made a High-Low of 32285-32055

- The Trend Day VWAP of 06/11 at 30587 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 32160

- The VWAP of Nov Series is 30699.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 32185-32200-32256

Hypos / Estimates for the next session:

a) BNF needs to stay above 32200 for a probe to 32265-285 / 32326 & 32384

b) Immediate support is at 32180 below which the auction could test 32130-120 / 32055-40* & 31980

c) Above 32384, BNF can probe higher to 32450-465 / 32510 & 32573-577

d) Below 31980, lower levels of 31925-896 / 31848 & 31805 could be tagged

e) If 32577 is taken out, BNF can give a fresh move up to 32628 / 32682 & 32725

f) Below 31805, we could see lower levels of 31745-715 / 31670-645 & 31590

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout