Nifty Mar F: 8915 [ 9358 / 8851 ]

HVNs – (8680) / (8900) / (9110-120) / 9200 / 9380 / [9425] / (9530) / 9680 / 9740 / 9900 / 9950 / 10450 / 10544

NF opened with a first gap up in 7 days of more than 100 points which was promptly sold into as it got stalled just below previous day’s extension handle of 9255 as it not only probed through the entire spike zone from 9255 to 9055 (breaking the HVN of 9120 with ease in the process) but went on to break below it making new lows for the week at 8962 in the opening 15 minutes from where there was swift rejection as the auction got back into previous day’s range immediately and reversed the entire move down and even made new highs for the day at 9262 as it got above the extension handle in the next 15 minutes. The auction continued to probe higher in the ‘B’ period as it hit 9325 leaving a pretty big IB range of 363 points and looked set to tag previous day’s POC of 9380 if not for the dreaded ‘C’ side extension which happened as NF made new highs of 9358 but was unable to sustain above the IBH and this led to a move to VWAP in the ‘D’ period which was promptly broken as the auction continued to probe lower in the ‘E’ period as it made lows of 9093. Break of the VWAP was a bearish sign though NF managed to get back above it in the ‘F’ period as it started to balance in a narrow range for sometime before it made an attempt to probe higher in the ‘H’ period as it got above the 9250 level and made highs of 9293 and followed it up by a similar high in the ‘I’ period indicating exhaustion in this upmove. The auction then broke below VWAP as soon as the ‘J’ period began confirming that the PLR (Path of Least Resistance) has turned to the downside and this was followed by a trending move lower into the close as NF once again spiked lower breaking below the IBL as it left an extension handle at 8962 thereby confirming a FA (Failed Auction) at day highs and went on to make lows of 8851 before closing the day at 8915 leaving a Neutral Extreme profile. The Neutral Extreme reference for the next day is from 8962 to 8851.

- The NF Open was a late Open Rejection Reverse (ORR) which failed

- The day type was a Neutral Extreme Day – Down (NeuX)

- Largest volume was traded at 9196 F

- Vwap of the session was at 9162 with volumes of 297 L and range of 507 points as it made a High-Low of 9358-8851

- NF confirmed a FA at 9358 on 17/03 and tagged the 1 ATR move of 8985 on same day. The 2 ATR objective down comes to 8613

- The settlement day Roll Over point (Mar) is 11610

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9092-9196-9321

Main Hypos for the next session:

a) NF needs to sustain above 8920 for a rise to 8962-75 / 9030-55 / 9087-9120 / 9150-60 & 9200-25

b) The auction has immediate support at 8900 below which could it fall to 8870-50 / 8690-80 & 8613-00

Extended Hypos:

c) Above 9225, NF can probe higher to 9270-95 / 9325 / 9358-9412 / 9460-80 & 9510

d) Below 8600, the auction can move lower to 8525 / 8400 / 8299 / 8250 & 8200

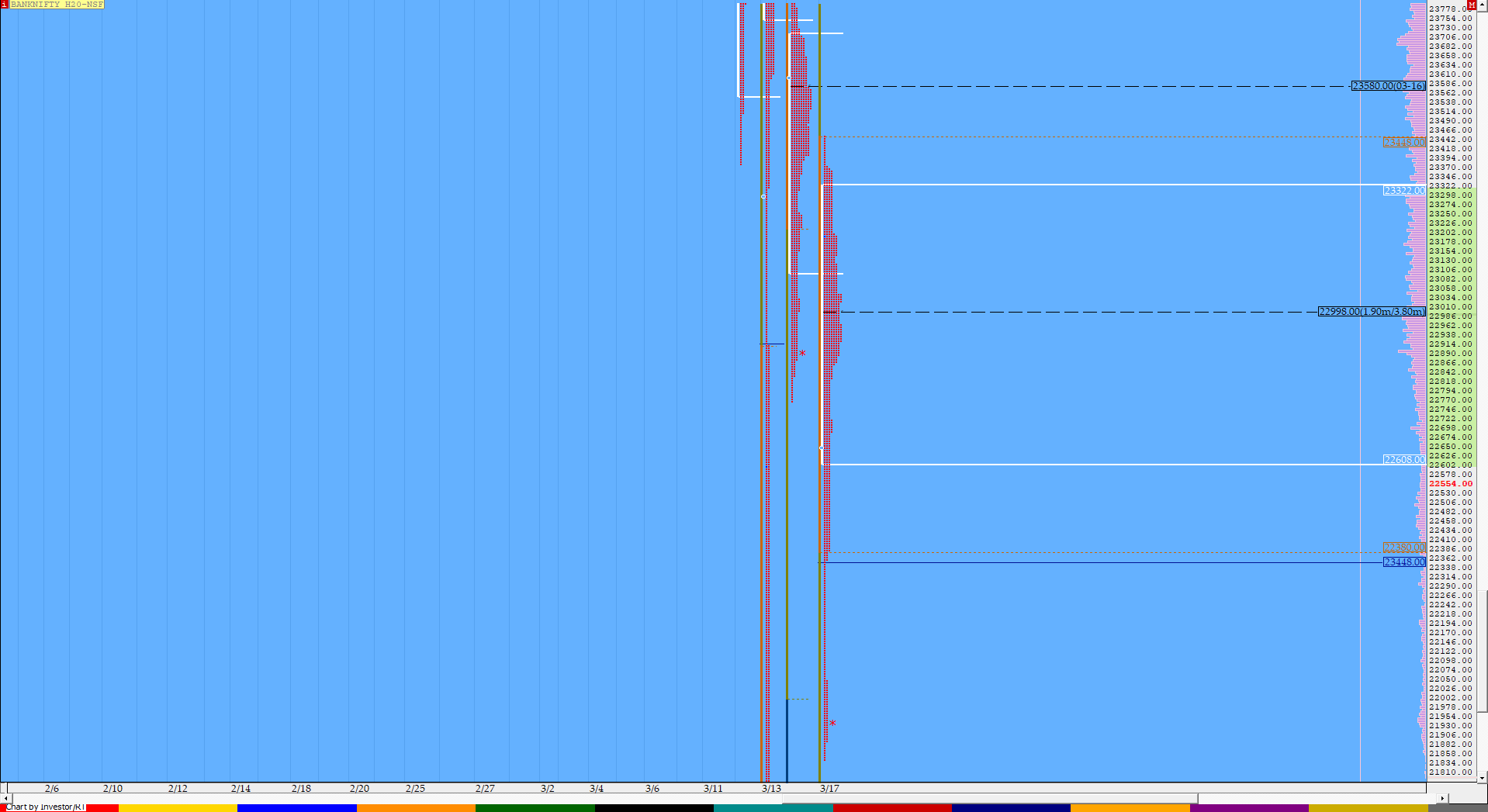

BankNifty Mar F: 22037 [ 23448 / 21840 ]

HVNs – 23000 / (23680) / (23920) / 24260 / 24500 / 24980 / 25039 / 25156 / (26150) / 26480

BNF also opened higher for the first time in 7 days but similar to NF, the gap up was sold into as it broke below PDL (Previous Day Low) of 22766 and went on to make lows of 22380 in the first 15 minutes before giving a swift reversal which saw it probe higher by more than 1000 points as it tagged 23448 in the ‘B’ period to give a huge IB range. Understandably, the auction remained in this IB range for most part of the day forming a balance in previous day’s low volume zone before it spiked lower into the close leaving an extension handle at 22360 from where it went on to drop more than 500 points making lows of 21840 before closing the day at 22037 leaving a Normal Variation Day down with a spike. Spike rules will be in play for the next session and the spike zone is from 21846 to 22360.

- The BNF Open was a late Open Rejection Reverse (ORR) which failed

- The day type was a Normal Variation Day – Down (with a spike close)

- Largest volume was traded at 22998 F

- Vwap of the session was at 22827 with volumes of 54 L and range of 1668 points as it made a High-Low of 24434-22766

- The settlement day Roll Over point (Mar) is 30520

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 22608-22998-23357

Main Hypos for the next session:

a) BNF needs to stay above 22050 for rise to 22200 / 22360-380 / 22520-560 / 22720-780 / 22875 & 22980-23000

b) The auction has immediate support at 21960 below which it could fall to 21870-800 / 21568-*542* / 21425 / 21300-233 & 20992

Extended Hypos:

c) Above 23000, BNF can probe higher to 23100 / 23235-290 / 23385 / 23450 / 23550-580 & 23630

d) Below 20992, lower levels of 20918*-876 / 20734 / 20639 / 20505-470 & 20334-283* could be tagged

-Additional Hypo on downside*-

e) Below 20283*, the auction could further fall to 20130-055 / 19970 / 19803 / 19636* & 19526-492

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout