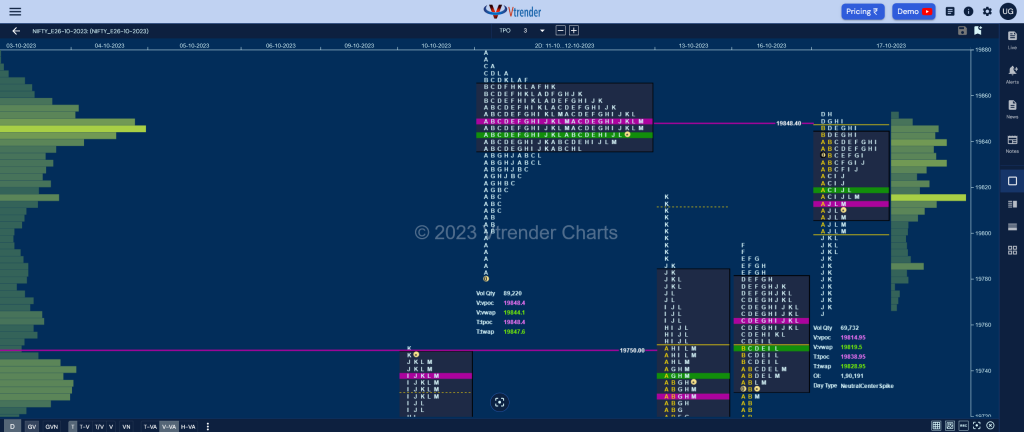

Nifty Oct F: 19811 [ 19853 / 19765 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 10,003 contracts |

| Initial Balance |

|---|

| 45 points (19845 – 19800) |

| Volumes of 20,668 contracts |

| Day Type |

|---|

| Neutral Centre – 88 points |

| Volumes of 69,732 contracts |

NF opened with a gap up of 94 points but settled down into an OAOR forming a narrow 45 point range IB (Initial Balance) while making a high of 19840 and gave a typical contra move down to 19817 in the C side leaving a PBL which meant that the upside probe was not yet over.

The auction then made a RE (Range Extension) in the D TPO where it tagged the 2-day ultra prominent VPOC of 19848 (11-12 Oct) while making a high of 19851 but failed to get fresh demand even as supply was missing which was the reason for the coiling till the G period before it made another attempt to extend higher but could only manage marginal new highs of 19853.

The lack of demand in this zone got the sellers back into play and a small push lower in the I TPO triggered a liquidation break and a RE lower in the J period where it completed the 1.5 IB objective of 19778 while making a low of 19764 taking support just above the yPOC of 19761 after which NF have a bounce back to day’s POC & VWAP into the close leaving a Neutral Centre Day with completely higher Value.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19815 F and VWAP of the session was at 19820

- Value zones (volume profile) are at 19809-19815-19845

- HVNs are at 19569 / 19750 / 19848** (** denotes series POC)

- NF confirmed a FA at 19685 on 13/10 and tagged the 1 ATR objective of 19818 on 17/10. The 2 ATR target comes to 19950

Monthly Zones

- The settlement day Roll Over point (October 2023) is 19635

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively

Business Areas for 18th Oct 2023

| Up |

| 19820 – VWAP from 17 Oct 19852 – Selling tail (17 Oct) 19893 – 2-day VPOC (21-22 Sep) 19943 – 2-day VAH (21-22 Sep) 19986 – 1 ATR (yPOC 19848) 20010 – Monthly 1.5 IB |

| Down |

| 19798 – SOC from 17 Oct 19761 – VPOC from 16 Oct 19730 – Closing PBL (16 Oct) 19685 – FA from 13 Oct 19646 – PBL from 10 Oct 19611 – IB singles mid (10 Oct) |

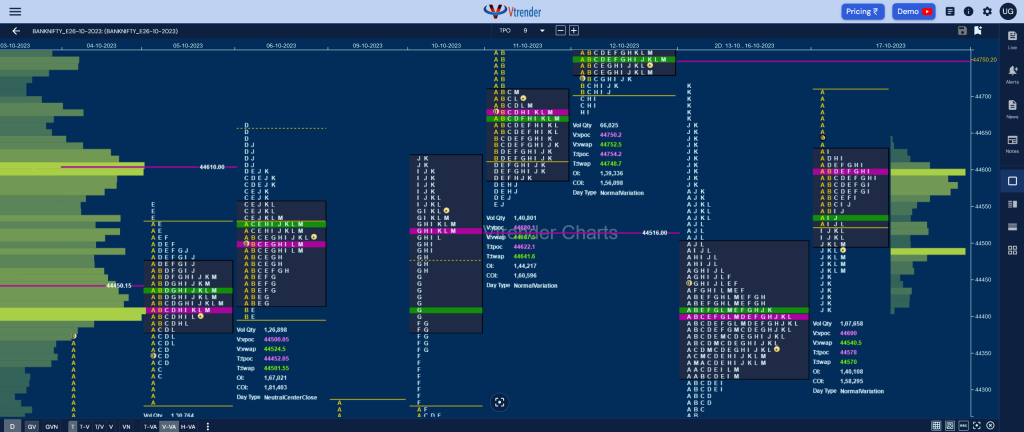

BankNifty Oct F: 44493 [ 44703 / 44410 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 16,244 contracts |

| Initial Balance |

|---|

| 176 points (44703 – 44528) |

| Volumes of 31,040 contracts |

| Day Type |

|---|

| Normal Variation (NV) – 294 points |

| Volumes of 1,07,658 contracts |

BNF opened with a gap up of almost 300 points and made a freak tick at 44703 but did not have any volumes above 44665 which was the Selling Tail from 13th Oct indicating supply being active in this zone as it settled down into an Open Auction taking support just above the 2-day VAH of 44497 as it made a low of 44528 in the A period and made a slow probe higher making higher lows in all TPOs except the D till the H period.

The auction started the I TPO with a higher high at 44630 but was rejected triggering a big liquidation drop as it made a RE lower making new lows for the day at 44510 and followed it up with an entry into the 2-day Value in the J period and almost tagged the POC of 44405 while making a low of 44410 in the K where it saw some profit booking by the sellers resulting in a probe back to day’s VWAP into the close.

The day’s profile represents a ‘b’ shape long liquidation one though Value was mostly higher with a close around the HVN of 44487 which will be the immediate reference on the downside for the coming session along with the 2-day VPOC of 44405 & VAL of 44322 whereas on the upside, BNF will need to show some demand above today’s VWAP of 44540 for a test of the selling singles from 44630 & the higher VPOC of 44750 from 12th Oct.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 44600 F and VWAP of the session was at 44540

- Value zones (volume profile) are at 44496-44600-44624

- HVNs are at 44413** / 44535 / 44611 / 44849 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (October 2023) is 44595

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively

Business Areas for 18th Oct 2023

| Up |

| 44540 – VWAP from 17 Oct 44630 – Selling Tail (17 Oct) 44750 – VPOC from 12 Oct 44849 – 2-day VPOC (28-29 Sep) 44998 – Swing High (28 Sep) – |

| Down |

| 44487 – Closing HVN (17 Oct) 44405 – 2-day VPOC (13-16 Oct) 44322 – 2-day VAL (13-16 Oct) 44239 – Buying Tail (16 Oct) 44105 – Singles mid (10 Oct) 44029 – VPOC from 09 Oct |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.