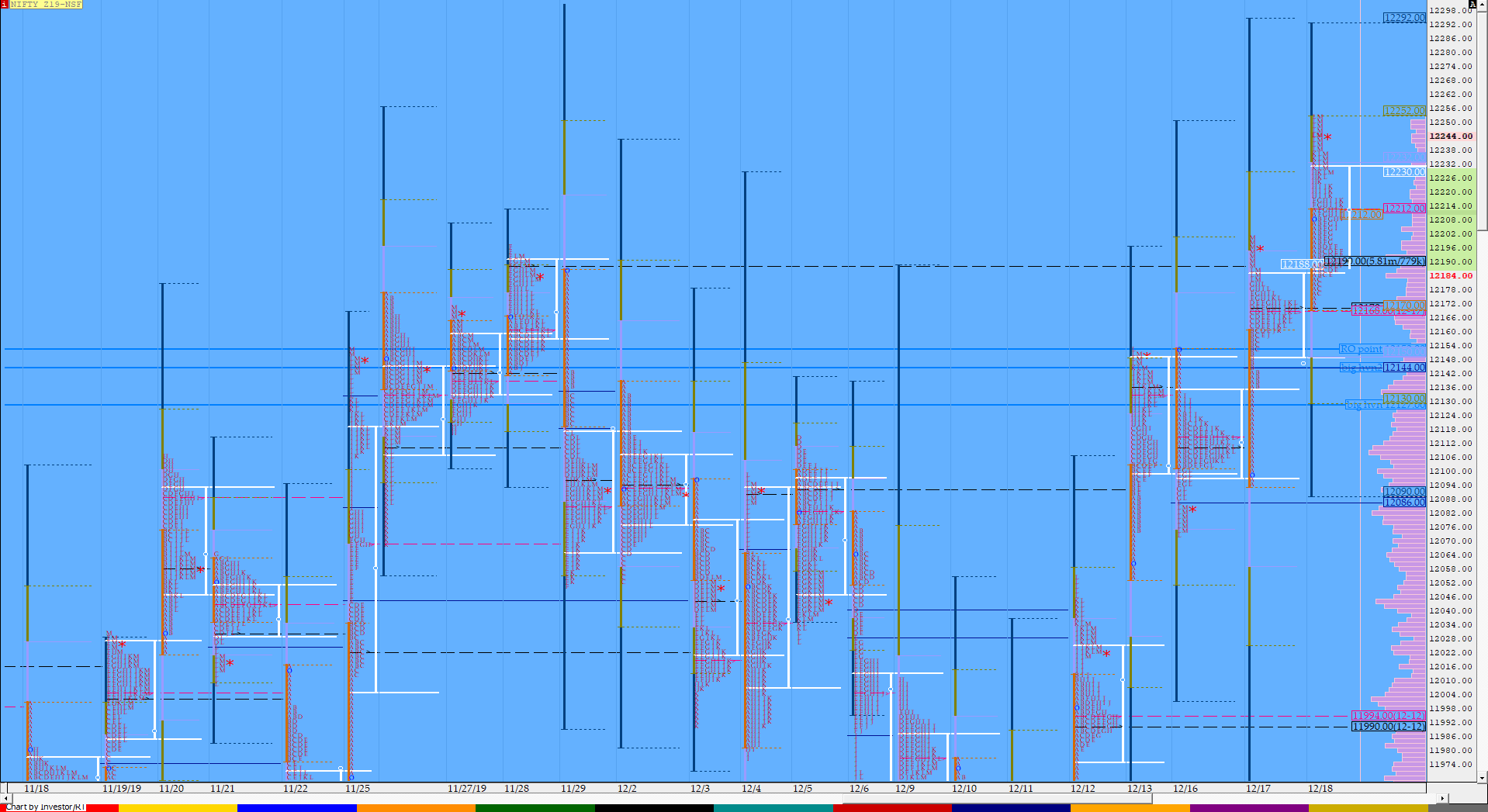

Nifty Dec F: 12243 [ 12253/ 12171 ]

HVNs – 11900-910 / (11940) / 11990 / 12024 / (12082) / 12112 / 12170 / 12190

NF opened above the PDH (Previous Day High) as it tagged 12212 but got back into the spike zone of 12200 to 12180 giving an Open Auction (OA) start as the probe down stalled just above the yPOC of 12170 which was a signal that buyers are defending this HVN (High Volume Node). The auction then remained in the spike range for the next 4 periods with a failed attempt in the ‘C’ period to break below the spike where it got rejected from 12177 which was further confirmation that the demand is active below the spike. The ‘F’ period then made a RE (Range Extension) to the upside after which NF continued to probe higher making 4 more REs into the close tagging the 2 IB objective to the dot as it made highs of 12253 giving a hat-trick of spike closes. Value for the day was higher once again with the maximum volumes being traded at 12190 which will be an important reference for the rest of the series. Spike Rules will once again be in play and the reference for tomorrow’s open would be from 12226 to 12253.

- The NF Open was an Open Auction (OA)

- The day type was a slow Normal Variation Day – Up (NV)

- Largest volume was traded at 12190 F

- Vwap of the session was at 12211 with volumes of 70.2 L and range of 81 points as it made a High-Low of 12253-12171

- Today’s failed attempt in the ‘C’ period in NF can be considered to be a FA which was at 12177 and the 1 ATR objective comes to 12275.

- The Trend Day VWAP of 29/10 at 11848 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 12153

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12187-12190-12229

Hypos / Estimates for the next session:

a) NF needs to get above supply of 12255 for a rise to 12275-280 & 12310

b) Immediate support is at 12230 below which the auction could test 12208-205 & 12190-185

c) Above 12310, NF can probe higher to 12340 & 12362-368

d) Below 12185, auction could fall to 12170-150 & 12130

e) If 12368 is taken out, the auction go up to to 12384 & 12407-413

f) Break of 12130 can trigger a move lower to 12112-102 & 12082-74

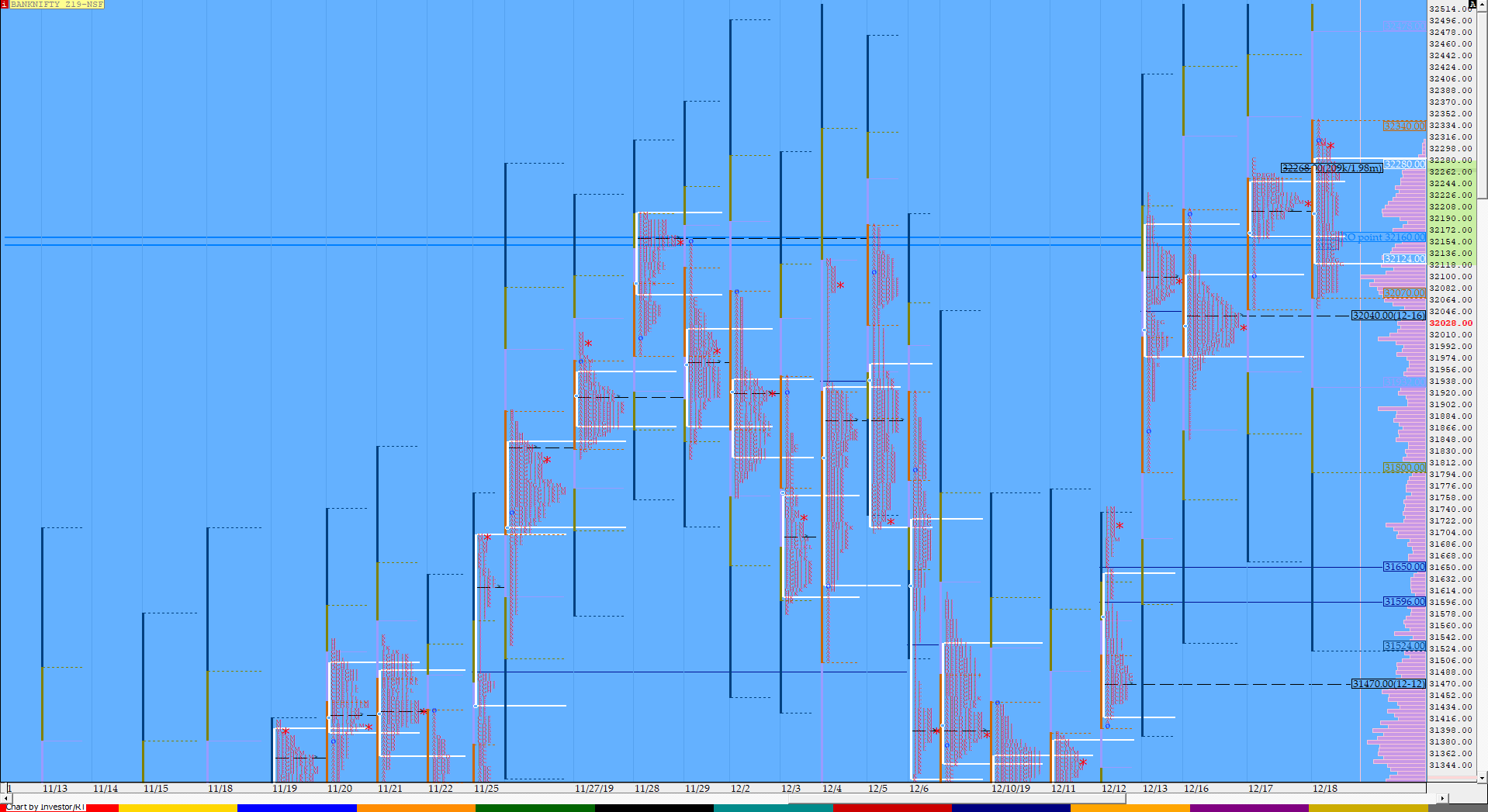

BankNifty Dec F: 32279 [ 32344 / 32055]

HVNs – 31370-400 / 31470 / 31715 / 31855 / 31896 / 32040 / 32090 / (32200-240)

BNF also opened higher and gave a freak high of 32344 but could not sustain above PDH as it probed lower in the IB breaking below the yPOC of 32200 and making a low of 32070. The auction then made a ‘C’ side extension to the downside as it matched PDL of 32055 but could not get break below it indicating that the supply had dried up and it got back into the IB with the next 2 periods ‘D’ & ‘E’ making double inside bars staying below VWAP while building volumes at 32090. The ‘F’ period then began an OTF (One Time Frame) move higher into the close once it got above VWAP almost confirming a FA at lows as BNF made highs of 32315. Value for the day was overlapping just like the range and the 2-day composite has a HVZ (High Volume Zone) at 32200-32240 which would be the reference for the coming session(s).

- The BNF Open was an Open Auction (OA)

- The day type was a slow Neutral Day

- Largest volume was traded at 32240 F

- Vwap of the session was at 32178 with volumes of 23.1 L and range of 260 points as it made a High-Low of 32344-32055

- BNF has left a probable FA at 32055 on 18/12 and the 1 ATR objective comes to 32431.

- The Trend Day VWAP of 06/11 at 30587 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 32160

- The VWAP of Nov Series is 30699.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 32122-32240-32282

Hypos / Estimates for the next session:

a) BNF needs to stay above 32285 for a probe to 32326-384 & 32450-465

b) Immediate support is at 32265 below which the auction could test 32200 / 32148 & 32090

c) Above 32465, BNF can probe higher to 32510 & 32573-577

d) Below 32090, lower levels of 32040* & 31980 could be tagged

e) If 32577 is taken out, BNF can give a fresh move up to 32628 / 32682 & 32725

f) Below 31980, we could see lower levels of 31925-896 / 31848 & 31805

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout