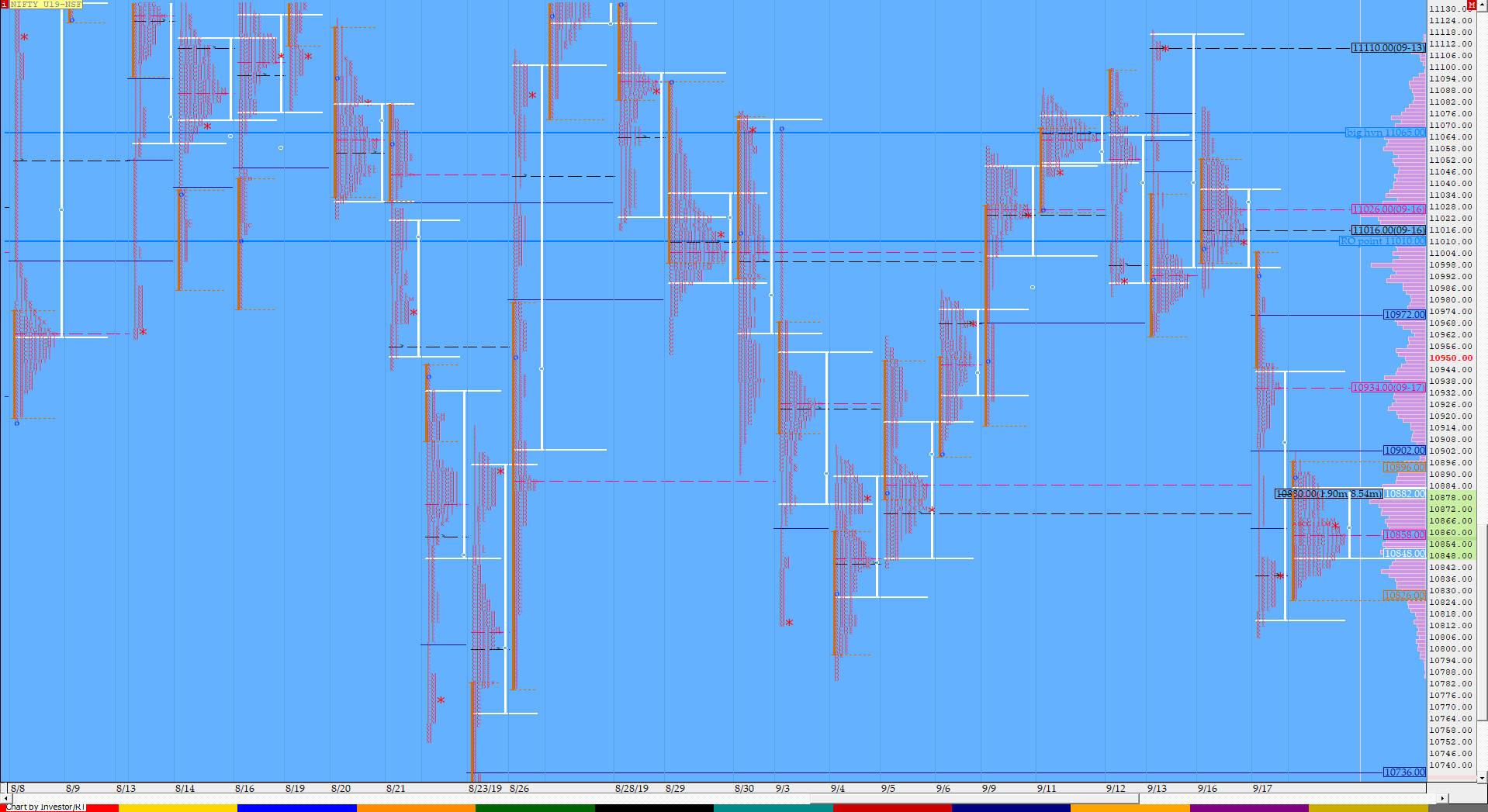

Nifty Sep F: 10855 [ 10900 / 10826 ]

A follow up after a Trend Day is rare as imbalance leads to balance & vice versa so after the Trend Day Down of Tuesday, it was only apt that the auction took a breather as it made a nice Gaussian profile staying inside previous day’s range but below the Trend Day VWAP of 10904. NF opened higher but was immediately rejected as it made highs of 10896 to probe lower in the IB (Initial Balance) as it broke below the yPOC of 10840 while making a low of 10826 but could not sustain below it indicating some demand coming in at lower levels. (Click here to view the profile chart for September NF for better understanding) The auction then stayed inside the IB range all day with a failed attempt to make a RE (Range Extension) higher in the ‘I’ period where it made a new day high of 10900 leaving a probable FA (Failed Auction) as NF then probed lower but once again took support at the HVN of 10840 while it left a PBL (Pull Back Low) of 10838 in the ‘L’ period. The auction has moved away from the 5 day balance with an initiative tail from 11017 to 10982 (as can be seen in the above link) so the PLR remains to the downside. On the larger time frame, NF (Sep series) has been forming a 32-day composite right from 31st July (click here to view the composite chart) with Value at 10880-11025-11095 so the immediate reference to the upside would be 10880 and an initiative move away from this zone could signal the start of a new IPM to the downside. However, sustaining above 10880 NF could probe higher to first check the extension handle & Trend Day VWAP of 10905 above which it could tag the Trend Day PBH of 10940 & the selling tail of 10982 to 11025.

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Day – Gaussian profile

- Largest volume was traded at 10880 F

- Vwap of the session was at 10864 with volumes of 111.3 L and range of 74 points as it made a High-Low of 10900-10826

- NF confirmed a FA at 10785 on 04/09 & tagged the 1 ATR objective of 10958. The 2 ATR move up comes to 11131. This FA has not been tagged and is now positional support.

- The Trend Day VWAP of 17/09 at 10904 would be important supply point.

- The Trend Day POC & VWAP of 26/08 at 10886 & 10951 would be important references on the downside. NF closed below both these references on 17/09.

- The Trend Day POC & VWAP of 19/07 at 11478 & 11523 are now positional references on the upside.

- The higher Trend Day VWAP of 05/07 at 11965 is another important reference higher.

- The settlement day Roll Over point is 11010

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

- The VWAP & POC of Jun Series is 11833 & 11714 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 10850-10880-10884

Hypos / Estimates for the next session:

a) NF needs to sustain above 10855 for a move to 10878-884 & 10904-910

b) Staying below 10854 at open, the auction can test 10826-818 & 10795-790

c) Above 10910, NF can probe higher to 10930-938 & 10976-982

d) Below 10790, auction becomes weak for 10770-760 / 10746-733 & 10716

e) If 10982 is taken out, the auction can rise to 10998-11004 & 11025-40

f) Break of 10716 can trigger a move lower to 10680-676 / 10655 & 10640-631

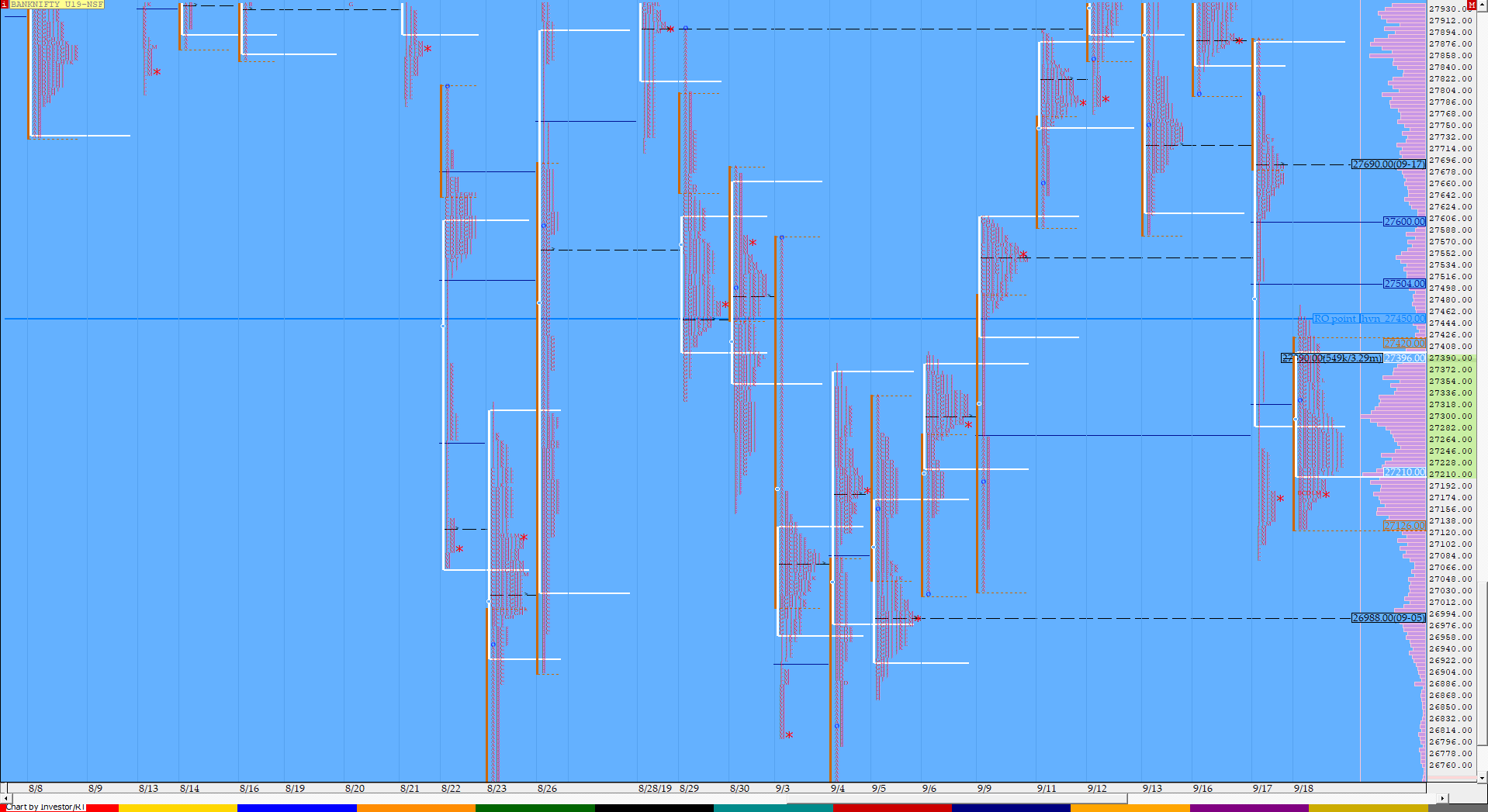

BankNifty Sep F: 27193 [ 27470 / 27127 ]

BNF gave a gap up of almost 200 points and probed higher making a high of 27423 in the opening minutes but faced rejection in the mid-profile selling tail of 27400 to 27515 from the previous day’s Trend Day Down as it reversed the auction and went on to close the gap in the IB while making a low of 27130. BNF was then confined to a narrow range around VWAP for the next 4 periods with the range also contracting as each TPO was inside the previous period till the ‘F’ period and this led to a range expansion in the ‘G’ period as the auction probed higher & went on to make a RE to the upside and followed it up with higher highs in the next 2 periods making highs of 27470 in the ‘I’ period but failed to sustain above IBH indicating lack of new buyers & this led to a test of VWAP as the auction made a low of 27210 leaving an outside bar of 260 points. BNF then made another rotation to IBH in the ‘K’ period leaving a PBH of 27410 and then went on to break below the range of ‘I’ in the closing 30 minutes as it briefly broke the IBL too while making a new day low of 27127 which also confirmed a FA at highs but would need re-confirmation in the next session as the close was well above the IBL. BNF has left an inside day with a balanced profile with failed attempts at both ends of IB so could be in for a big move once again in the coming session(s).

(Click here to view the chart of September BNF for better understanding)

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Neutral Day

- Largest volume was traded at 27400 F

- Vwap of the session was also at 27292 with volumes of 39.8 L in a session which traded in a range of 343 points making a High-Low of 27470-27127

- The Trend Day POC & VWAP of 17/09 at 27690 & 27509 would now be important references on the upside.

- The Trend Day VWAP of 19/07 at 30085 is now positional supply point.

- The higher Trend Day VWAP of 18/07 & 08/07 at 30598 & 30995 remain important references going forward

- The settlement day Roll Over point is 27450

- The VWAP & POC of August Series 27858 & 27960 respectively

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

- The VWAP & POC of Jun Series is 30914 & 30961 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 27224-27400-27412

Hypos / Estimates for the next session:

a) BNF needs to sustain above 27225 for a test of 27304-352 / 27400-410 & 27464

b) The auction gets weak below 27160-130 for a probe lower to 27079 / 27000-26982 & 26936-920

c) Above 27464, BNF can rise to 27510-515 / 27584-607 & 27690

d) Below 26920, lower levels of 26875 / 26815 & 26785-780 could come into play

e) Sustaining above 27690, BNF can give a fresh move up to 27730 / 27800 & 27860-880

f) Break of 26780 could trigger a move down 26710 / 26660-640 & 26593

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout