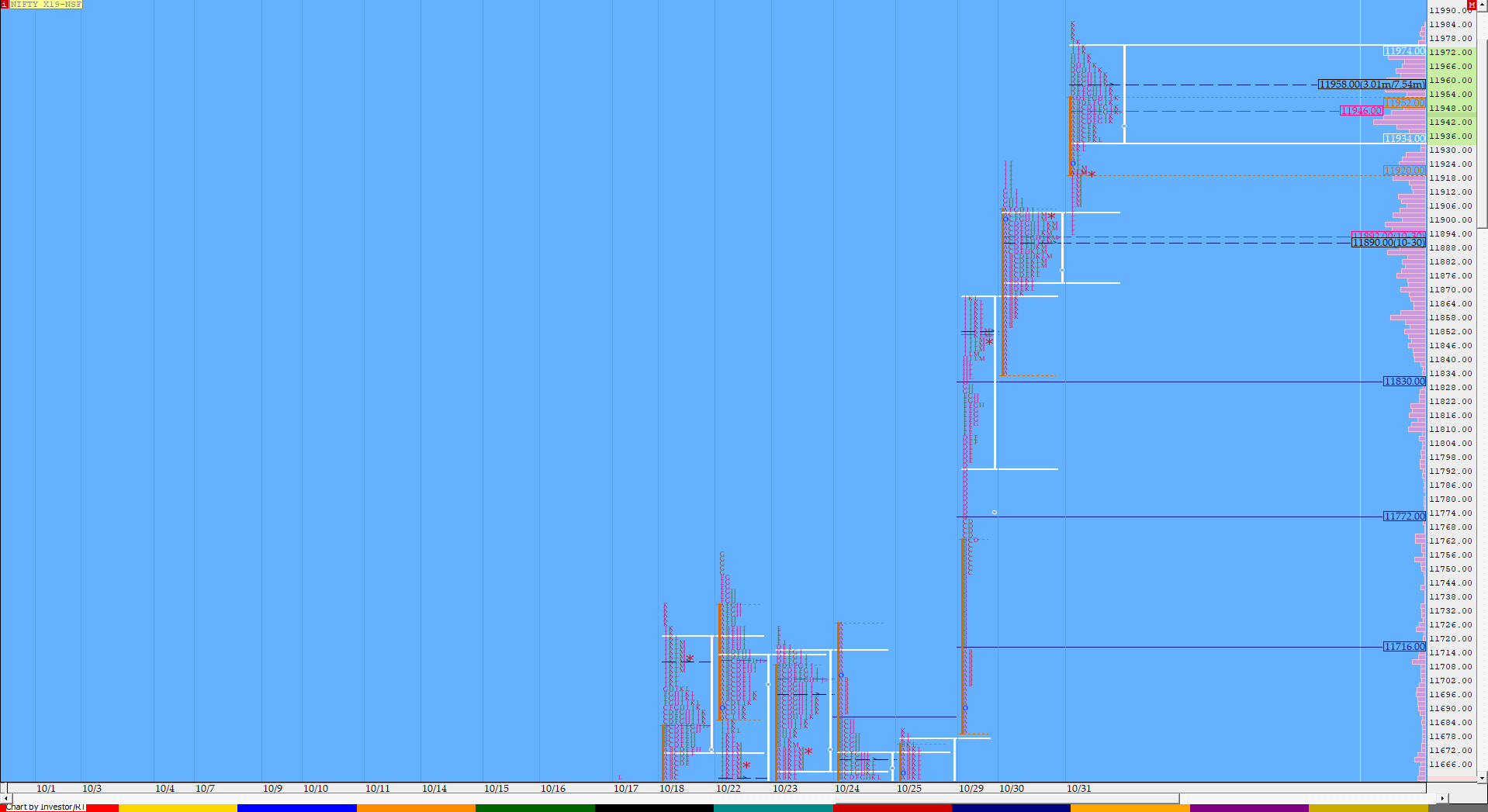

Nifty Nov F: 11928 [ 11945/ 11878 ]

HVNs – 11667 / 11814 / 11860 / 11910-920 / (11936) / 11958 / (11970)

NF made a narrow range day of just 67 points to start the new series with a Gaussian profile as it stayed below the yPOC of 11958 but also did not find new selling below 11895 where it has left a probable multi-day FA which would get confirmed if the auction sustains above 11940 at open in the next session.

(Click here to view this week’s action in the Nov NF )

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Neutral Day

- Largest volume was traded at 11920 F

- Vwap of the session was at 11910 with volumes of 72.6 L and range of 67 points as it made a High-Low of 11945-11878

- NF confirmed a multi-day FA at 11465 on 16/10 and completed the 2 ATR move up of 11776. This FA has not been tagged since & hence is now positional support

- NF confirmed a FA at 11503 on 17/10 and completed the 2 ATR move up of 11808. This FA has not been tagged since & hence is now positional support

- NF confirmed a FA at 11162 on 09/10 and completed the 2 ATR move up of 11554. This FA has not been tagged since & hence is now positional support

- The Trend Day VWAP of 29/10 at 11810 will be important reference on the downside.

- The settlement day Roll Over point (Nov) is 11970

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11902-11920-11931

Hypos / Estimates for the next session:

a) NF has immediate supply at 11936 above which it could rise to 11958-964 / 11985 & 12003-23

b) Immediate support is at 11920 below which the auction could test 11901-895 / 11874-850 & 11832-829

c) Above 12023, NF can probe higher to 12045-56 / 12079-82 & 12098-105

d) Below 11829, auction becomes weak for 11810-795 / 11771-767 & 11749

e) If 12105 is taken out, the auction go up to to 12121-133 / 12151-165 & 12181-194

f) Break of 11749 can trigger a move lower to 11716-709 / 11689-667* & 11645

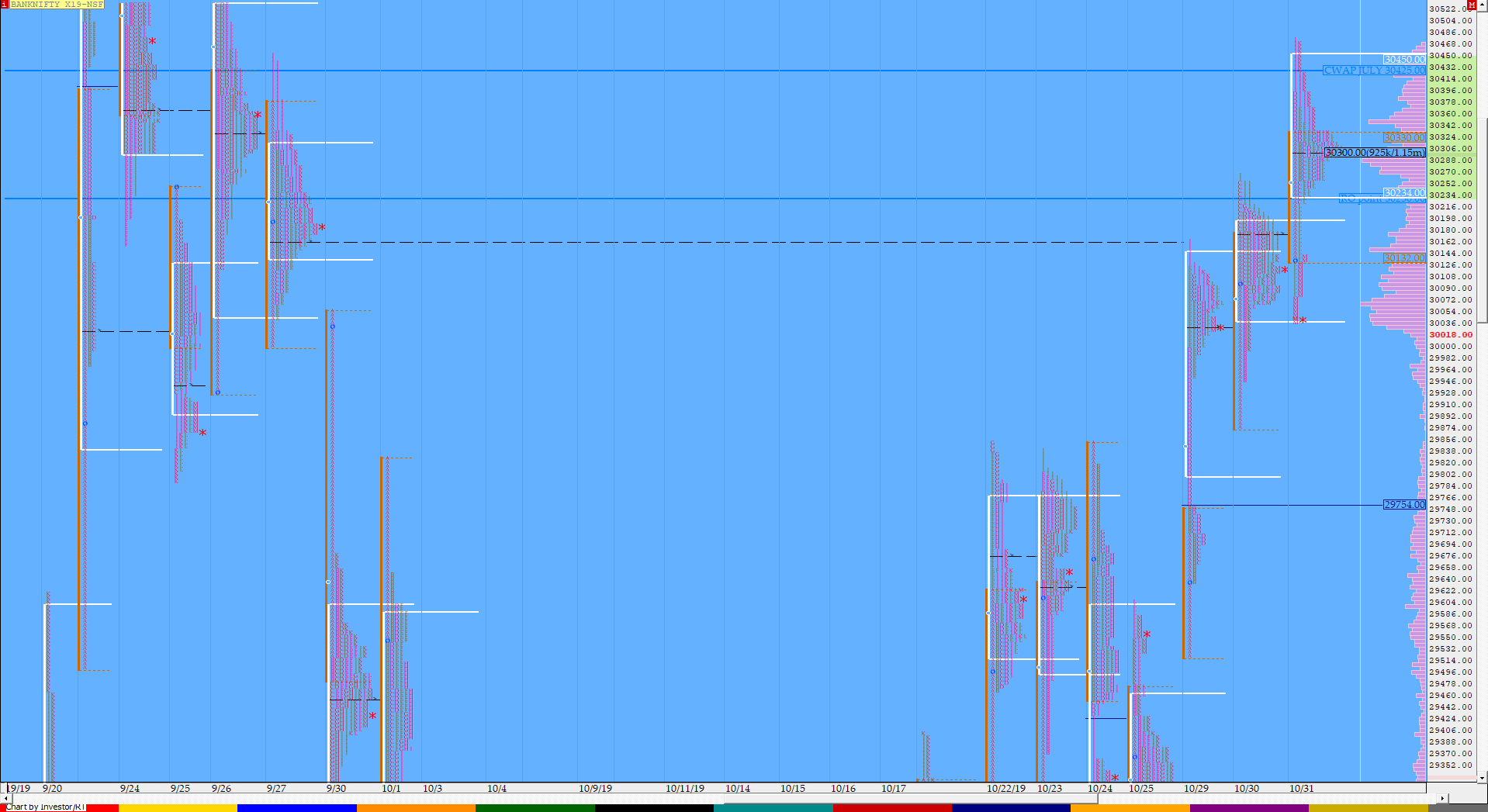

BankNifty Nov F: 30374 [ 30449 / 30063]

HVNs – 30075 / 30150 / 30285 / 30369 / 30430

(Click here to view this week’s action in the Nov BNF )

BNF made an inside bar on the daily as it formed a ‘p’ shape profile for the day with an overlapping POC of last 2 days at 30285 which will be the important reference for the next session as the auction could give a move away from this.

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up

- Largest volume was traded at 30285 F

- Vwap of the session was at 30287 with volumes of 32.9 L and range of 386 points as it made a High-Low of 30449-30063

- BNF confirmed a FA at 27900 on 09/10 and completed the 2 ATR move up of 29779. This FA has not been tagged since & hence is now positional support

- The Trend Day VWAP of 29/10 at 29945 will be important reference on the downside. This was tagged on 30/10 and broken but was swiftly rejected so proves to be support.

- The higher Trend Day VWAP of 08/07 at 30995 remains important reference going forward

- The settlement day Roll Over point (Nov) is 30150

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

- The VWAP & POC of August Series 27858 & 27960 respectively

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 30239-30285-30392

Hypos / Estimates for the next session:

a) BNF has immediate supply in zone of 30424-440 above which it could rise to 30495 / 30565-600 & 30725-750

b) Sustaining below 30350, the auction gets weak for a test of 30288 / 30227-213 / 30150 & 30105-075

c) Above 30750, BNF can probe higher to 30800 / 30895 & 30995-31005

d) Below 30075, lower levels of 30024-29995 / 29945 / 29880-855 & 29749

e) If 31005 is taken out, BNF can give a fresh move up to 31100-152 / 31210-260 & 31310

f) Break of 29749 could trigger a move down 29695 / 29635-628 / 29570-510 & 29460-435

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout