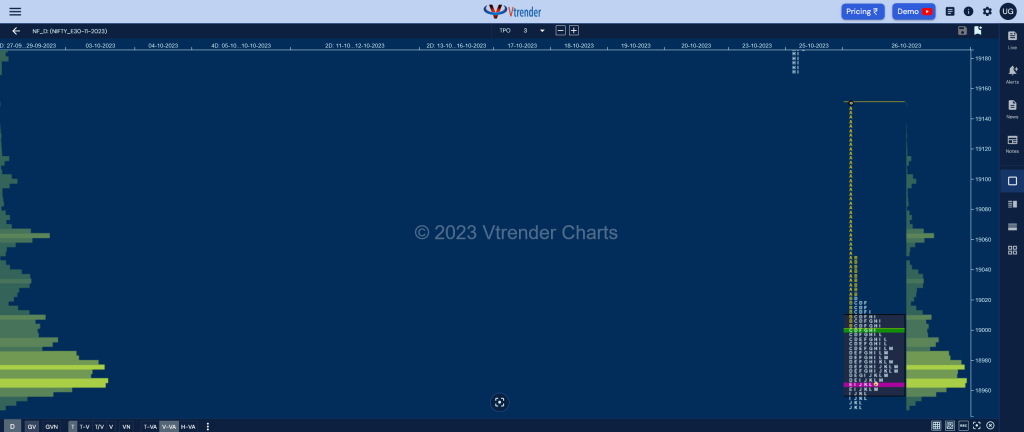

Nifty Nov F: 18972 [ 19149 / 18950 ]

| Open Type |

|---|

| OAOR + D (Open Auction Out of Range plus Drive) |

| Volumes of 19,294 contracts |

| Initial Balance |

|---|

| 148 points (19149 – 19002) |

| Volumes of 52,922 contracts |

| Day Type |

|---|

| Normal (‘b’ shape profile) – 200 points |

| Volumes of 2,08,803 contracts |

NF not only opened lower but confirmed a Drive Down after making an OH (Open=High) start at 19149 and went on to drop by 148 points in the Initial Balance after leaving an extension handle at 19025 in the B period while making a low of 19002.

The auction then made a typical C side probe lower to 18987 which got swiftly rejected giving a bounce back to day’s VWAP but stalled just below the B period extension handle of 19025 as it left a PBH at 19020 and went on to make couple of fresh REs (Range Extension) in the D & E TPOs but could only manage marginal new lows of 18968 & 18960 indicating that the huge imbalance from the last 3 days could be coming to a pause.

NF made couple of more probed above the VWAP in the F & I periods but left lower PBHs of 19012 & 18998 confirming rotation mode and made new lows of 18950 in the J TPO but did not find any fresh supply as it left similar lows over the next 2 periods before closing around the dPOC leaving a ‘b’ shape long liquidation profile with completely lower Value.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 18964 F and VWAP of the session was at 18999

- Value zones (volume profile) are at 18958-18964-19010

- HVNs are at 19062 / 19392 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19568 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 27th Oct 2023

| Up |

| 18977 – Weekly POC 19012 – PBH from 26 Oct 19048 – Selling Tail (26 Oct) 19098 – IB singles mid (26 Oct) 19149 – PDH 19188 – Gap mid (26 Oct) |

| Down |

| 18964 – dPOC from 26 Oct 18906 – Ext Handle (27 Jun) 18855 – 1 ATR (yVWAP 18999) 18820 – 1 ATR (yPOC 18964) 18784 – VPOC from 26 Jun 18754 – VWAP from 12 Jun |

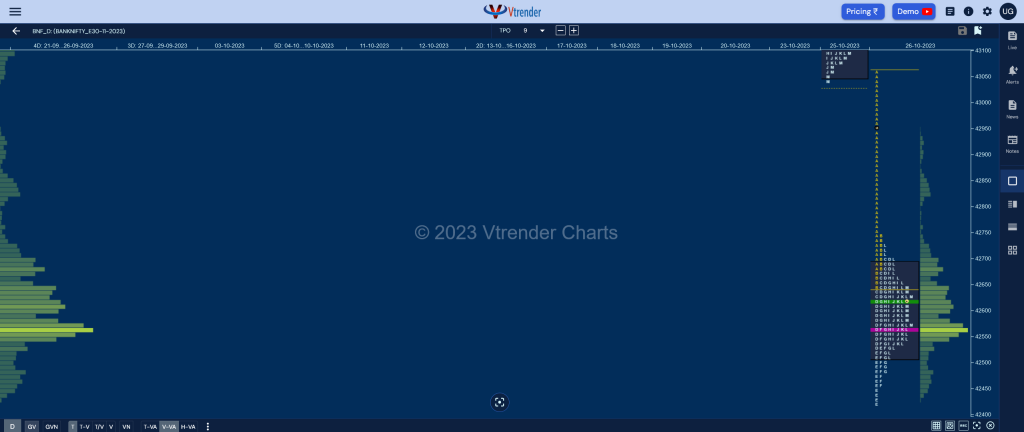

BankNifty Nov F: 42601 [ 43059 / 42422 ]

| Open Type |

|---|

| ORR (Open Rejection Reverse) |

| Volumes of 12,239 contracts |

| Initial Balance |

|---|

| 413 points (43059 – 42648) |

| Volumes of 35,890 contracts |

| Day Type |

|---|

| Normal Variation (‘b’ shape) – 637 points |

| Volumes of 2,04,399 contracts |

BNF also continued the downside imbalance with an Open Rejection Reverse start as it was swiftly rejected from previous day’s range and formed a large 413 point range Initial Balance while making a low of 42646 and leaving an A period selling tail from 42742 to 43059.

The auction then made a hat-trick of REs (Range Extension) over the next 3 TPOs completing the 1.5 IB objective of 42440 as it made a low of 42422 in the E period but left a small responsive buying tail marking the end of the downside for the day and settledn down into a balance for the rest of the day leaving a long liquidation ‘b’ shape profile with a close around the dPOC of 42564.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 42564 F and VWAP of the session was at 42622

- Value zones (volume profile) are at 42512-42564-42688

- HVNs are at 44040 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43860 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 27th Oct 2023

| Up |

| 42622 – VWAP from 26 Oct 42742 – Selling Tail (26 Oct) 42825 – A TPO POC (26 Oct) 42948 – Singles mid (26 Oct) 43119 – VPOC from 25 Oct 43259 – PBH from 25 Oct 43375 – Ext Handle (25 Oct) |

| Down |

| 42564 – dPOC from 26 Oct 42455 – Buying tail (26 Oct) 42333 – 2 ATR from 43119 42190 – April VPOC 42011 – VWAP from 13 Apr 41930 – April series VWAP 41827 – SOC from 13 Apr |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.