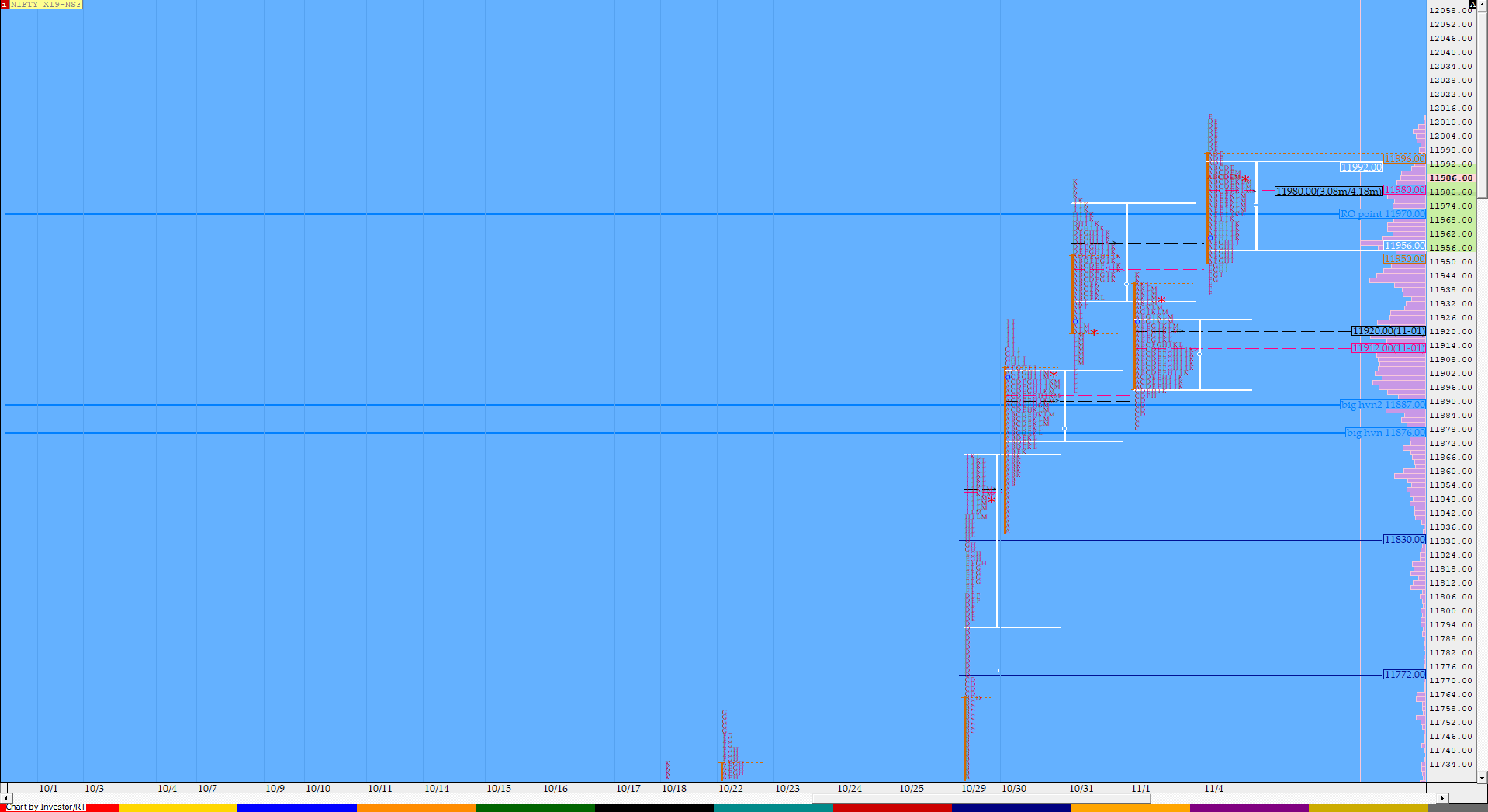

Nifty Nov F: 11980 [ 12013/ 11936 ]

HVNs – 11667 / 11814 / 11860 / 11910-920 / (11936) / 11980

NF opened with a gap up confirming the multi-day FA at 11895 and drove higher though on lower volumes as it scaled above PDH and went on to take out the previous week’s high also in the IB (Initial Balance) itself making a high of 11996. The auction then made a RE (Range Extension) to the upside in the ‘D’ period after making a very narrow range inside bar in ‘C’ as it made new day highs of 12010 and made a marginally new high at 12013 as the ‘E’ period began but could not sustain above the IBH falling short of the 1.5 IB extension of 12020 and the 1 ATR objective from 11895 which was at 12023. This failure lead to a big liquidation move as NF not only broke below VWAP decisively but also went on to make a RE to the downside in the ‘F’ period thus confirming a fresh FA at 12013 as it made lows of 11936 but even this range extension did not sustain as the auction got rejected from the important level of 11940 to make a slow probe back to VWAP and closed at the HVN & dPOC of 11980 completing a hat-trick of Neutral Days. The day’s range and volumes were once again on the lower side though the Value formed was completely higher and looks like the IPM (Initial Price Movement) from 29th Oct could be coming to a close and the auction could either balance or give a good retracement in the coming sessions though more confirmation in the form of lower Value on daily is needed for this.

(Click here to view NF make higher Value above the 2-day composite)

- The NF Open was an Open Drive Up on low volumes (OD) which failed

- The day type was a Neutral Day

- Largest volume was traded at 11980 F

- Vwap of the session was at 11972 with volumes of 78.7 L and range of 77 points as it made a High-Low of 12013-11937

- NF confirmed a multi-day FA at 11895 on 04/11 and just fell short of the 1 ATR target of 12023.

- NF confirmed a FA at 12013 today and the 1 ATR move down comes to 11896.

- NF confirmed a multi-day FA at 11465 on 16/10 and completed the 2 ATR move up of 11776. This FA has not been tagged since & hence is now positional support

- NF confirmed a FA at 11503 on 17/10 and completed the 2 ATR move up of 11808. This FA has not been tagged since & hence is now positional support

- NF confirmed a FA at 11162 on 09/10 and completed the 2 ATR move up of 11554. This FA has not been tagged since & hence is now positional support

- The Trend Day VWAP of 29/10 at 11810 will be important reference on the downside.

- The settlement day Roll Over point (Nov) is 11970

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11958-11980-11995

Hypos / Estimates for the next session:

a) NF needs to sustain above 11980 for a move higher to 12003-10 / 12030 & 12051-56

b) Immediate support is at 11964-952 below which the auction could test 11920 / 11901-895 & 11874

c) Above 12056, NF can probe higher to 12079-82 / 12098-105 & 12121-133

d) Below 11874, auction becomes weak for 11850 / 11832-829 & 11810-795

e) If 12133 is taken out, the auction go up to to 12151-166 / 12181-194 & 12226

f) Break of 11795 can trigger a move lower to 11771-767 / 11749 & 11716-709

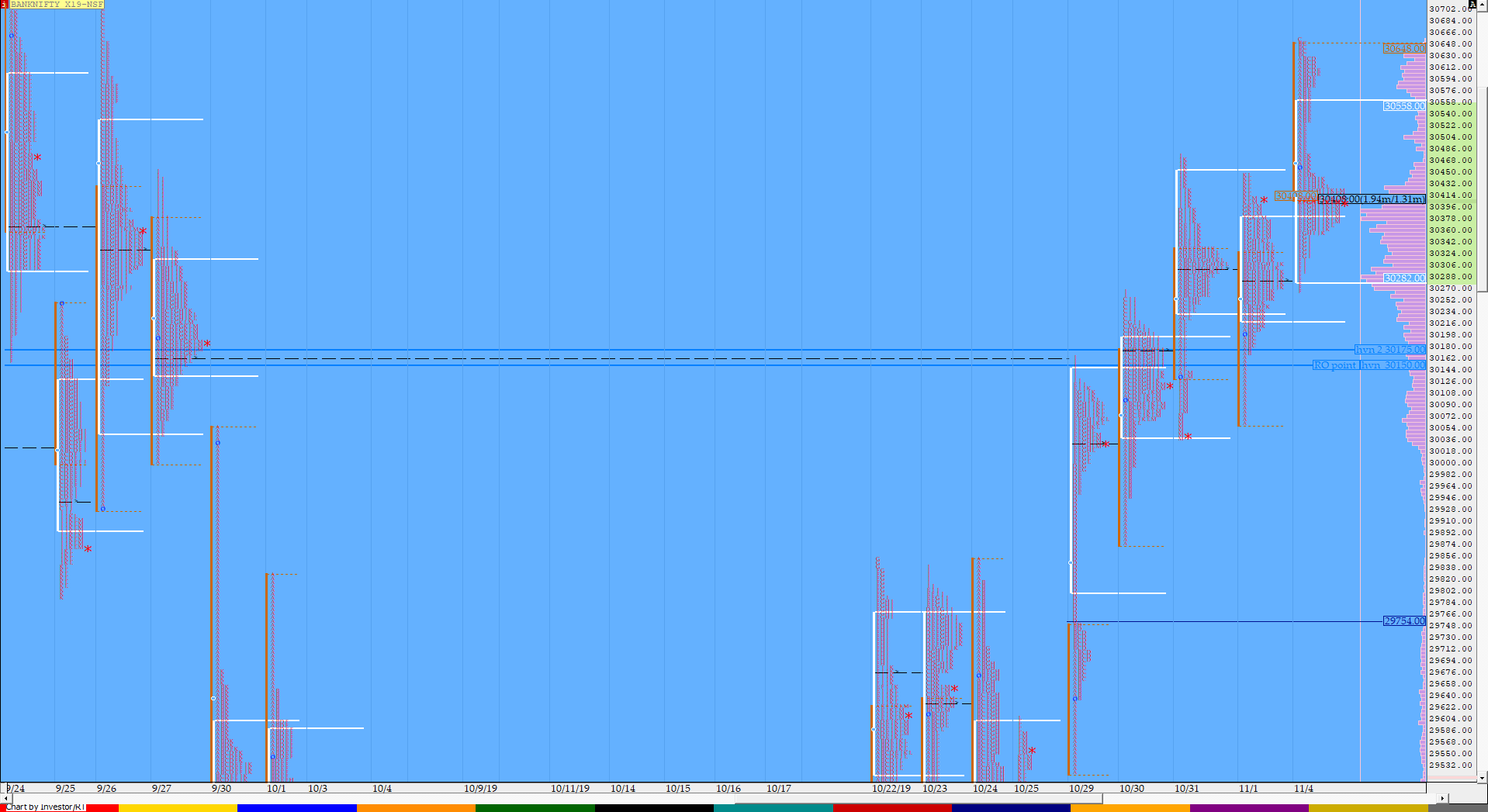

BankNifty Nov F: 30396 [ 30658 / 30267]

HVNs – 30075 / 30150 / 30270 / 30410 / (30585)

(Click here to view this week’s action in BNF )

BNF also made a gap up start along with a drive higher again on lower volumes as it got above previous week’s high of 30475 in the opening 5 minutes itself and went on to make highs of 30628 in the ‘A’ period after which it broke below VWAP briefly which was a signal that this move is not managed by OTF players. The auction got back above VWAP to make new highs of 30658 as it made the dreaded ‘C’ period extension but was immediately rejected which gave more confirmation of weak hands driving this move. BNF then made a narrow range bar in the ‘D’ period but stayed below the IBH & once it broke below VWAP at the start of the ‘E’ period there was a quick fall as it made a RE to the downside and thereby confirming a FA at 30658 as it made lows of 30363. The auction continued to probe lower in the ‘F’ period where it made lows of 30267 completing the 1.5 IB objective and also testing the important HVN reference of 30288 where it seemed to find demand as BNF stayed above 30290 to make a slow probe to VWAP but could not get above it leaving a PBH (Pull Back High) of 30478 in the ‘K’ period and closed around the HVN & dPOC of 30410 leaving a Neutral Day profile which has a low volume zone between 30475 to 30575 which could get filled before the auction moves away from here.

- The BNF Open was an Open Drive Up on low volumes (OD) which failed

- The day type was a Neutral Day

- Largest volume was traded at 30410 F

- Vwap of the session was at 30449 with volumes of 34.5 L and range of 391 points as it made a High-Low of 30658-30267

- BNF confirmed a FA at 30658 on 04/11 and the 1 ATR move down comes to 30097.

- BNF confirmed a FA at 27900 on 09/10 and completed the 2 ATR move up of 29779. This FA has not been tagged since & hence is now positional support

- The Trend Day VWAP of 29/10 at 29945 will be important reference on the downside. This was tagged on 30/10 and broken but was swiftly rejected so proves to be support.

- The higher Trend Day VWAP of 08/07 at 30995 remains important reference going forward

- The settlement day Roll Over point (Nov) is 30150

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

- The VWAP & POC of August Series 27858 & 27960 respectively

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 30283-30410-30565

Hypos / Estimates for the next session:

a) BNF sustaining above 30410 could rise to 30475-480 / 30540-575 & 30625-650

b) Immediate support is at 30380-350 below which the auction could test 30288-270 / 30227-213 & 30160-150

c) Above 30650, BNF can probe higher to 30725-750 / 30800 & 30895

d) Below 30150, lower levels of 30099-72 / 30024-29995 & 29945 could come into play

e) If 30895 is taken out, BNF can give a fresh move up to 30995-31005 / 31100-152 & 31210

f) Break of 29945 could trigger a move down 29880-855 / 29749 & 29695/span>

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout