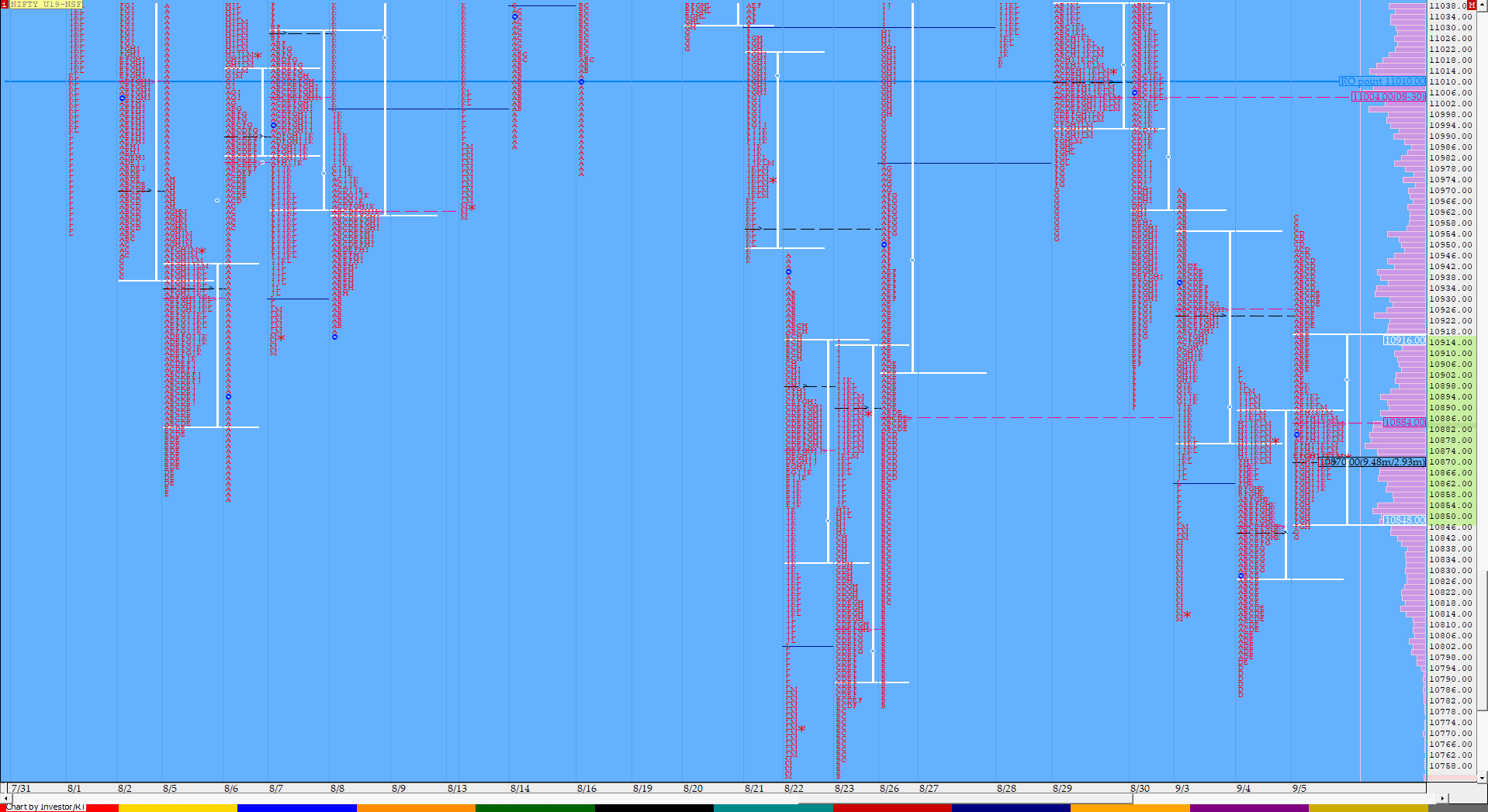

Nifty Sep F: 10882 [ 10960 / 10843 ]

NF gave an almost OL start at yVAH of 10882 indicating that it wanted to probe higher which it did as it got above previous day high of 10905 making a high of 10948 in the IB while leaving a small buying tail from 10904 to 10879. (Click here to view the profile chart for September NF for better understanding) The auction then made a RE (Range Extension) in the most dreaded ‘C’ period yet again as it went on to tag the 1 ATR objective from yesterday’s FA of 10785 as it made a high of 10960 but could not sustain above it as the ‘D’ period broke below the lows of ‘C’ indicating that the drive open on low volumes is losing its strength. Breaking of VWAP on a drive open mostly leads to the test of the other extreme and today was no different as NF trended in the ‘E’ period lower once it closed below VWAP is it not negated the buying tail getting back into the previous day’s range but went on to make new lows for the day at 10873 which in turn confirmed a new FA of 10960 – the third one in 5 days in the new series. NF continued it’s probe down for the next 2 periods as it tagged the yPOC of 10845 while completing the 1.5 IB move and found support there making a balance for the remaining part of the day with a slow probe higher as it tagged VWAP in the ‘K’ period but could not scale above it leaving yet another Neutral Day which also resembles a DD (Double Distribution) profile with the HVN of the lower distribution forming at 10870 which will be the immediate support in the coming session with 10940 being the reference on the upside if NF manages to get into the upper distribution. NF is in the process of forming a nice balance over the last 3 days (click here to view the composite) and could give a move away from here in the coming session(s).

- The NF Open was an Open Drive Up on lower volumes which failed (OD)

- The day type was a Neutral Day

- Largest volume was traded at 10870 F

- Vwap of the session was at 10892 with volumes of 129.8 L and range of 117 points as it made a High-Low of 10960-10843

- NF confirmed a FA at 10960 on 06/09 . The 1 ATR move down comes to 10796

- NF confirmed a FA at 10785 on 04/09 & tagged the 1 ATR objective of 10958. The 2 ATR move up comes to 11131

- NF confirmed a FA at 11079 on 29/08 & tagged the 1 ATR objective of 10906 on 30/08. The 2 ATR move down comes to 10733. This FA is currently on ‘T+5’ Days

- The Trend Day POC & VWAP of 26/08 at 10886 & 10951 would be important references on the downside.

- The Trend Day POC & VWAP of 19/07 at 11478 & 11523 are now positional references on the upside.

- The higher Trend Day VWAP of 05/07 at 11965 is another important reference higher.

- The settlement day Roll Over point is 11010

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

- The VWAP & POC of Jun Series is 11833 & 11714 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 10847-10870-10916

Hypos / Estimates for the next session:

a) Staying above 10881, NF can test 10896-910 & 10926-940

b) Immediate support is at 10870 below which auction can test 10850-845 & 10822-818

c) Above 10940, NF can probe higher to 10955-962 / 10977 & 11004-10

d) Below 10818, auction becomes weak for 10795-785 / 10760 & 10746-733

e) If 11010 is taken out, the auction can rise to & 11028-35 / 11049 & 11068-79

f) Break of 10733 can trigger a move lower to 10716 & 10680-676

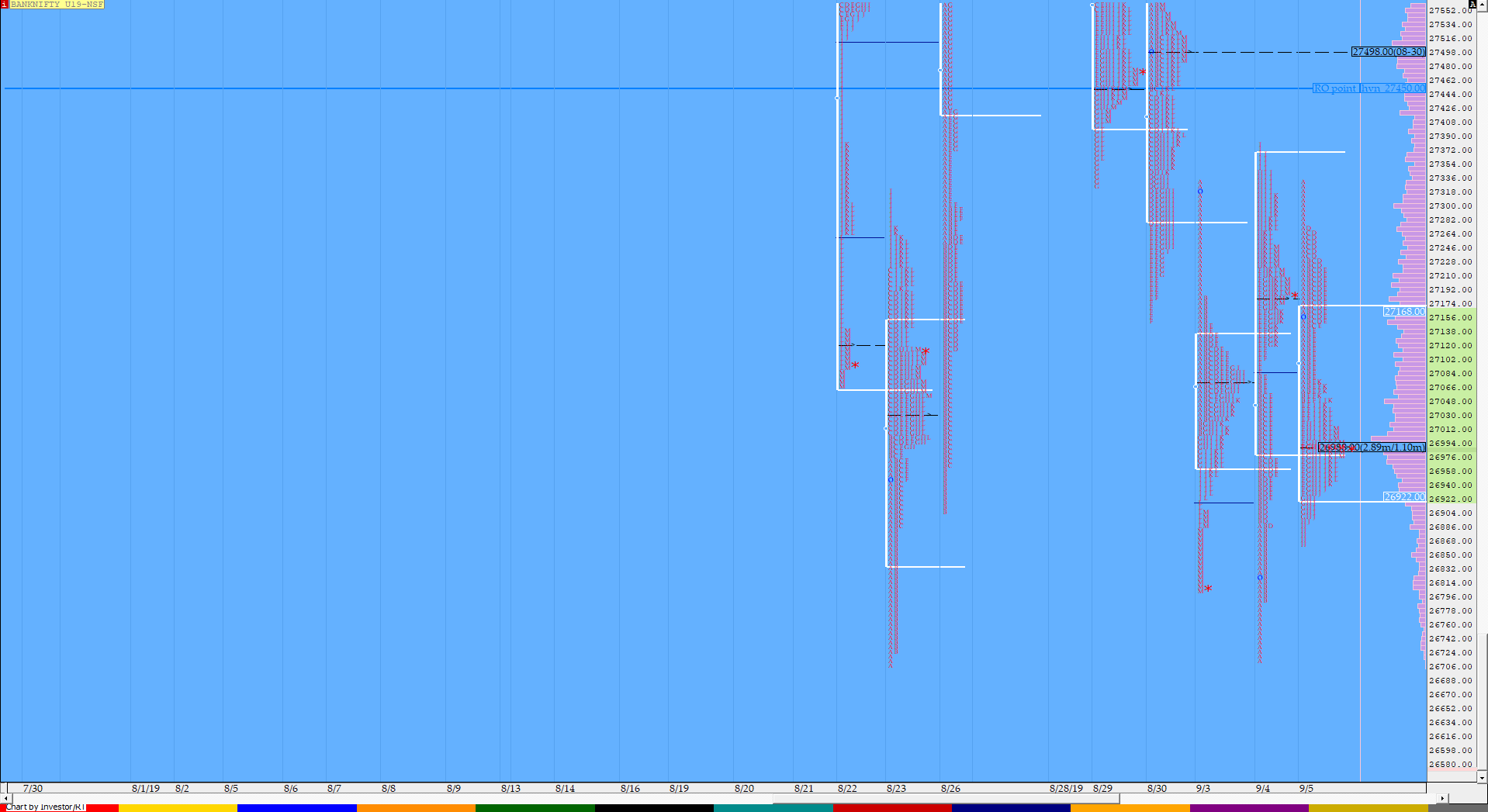

BankNifty Sep F: 26994 [ 27335 / 26862 ]

BNF also seemed to give a drive higher at open all be it on lower volumes from the yPOC of 27180 as it probed higher in the ‘A’ period tagging high of 27335 but was swiftly rejected as it could not get above the yVAH and broke below VWAP inside the first 15 minutes which meant failure of the drive after which it trended lower making new lows of the day and tagging 27050 in the IB. (Click here to view the profile chart for September BNF for better understanding) The auction then gave a retracement to VWAP and scaled above it as it made a high of 27276 in the D period but once again was rejected after which it trended lower for the next 4 periods making multiple REs (Range Extension) completing the 1.5 IB move of 26908 in the G period & making a lower low of 26862 in the H period which made an outside bar where the OTF (One Time Frame) move downside came to an end. BNF then made a balance for the rest of the day staying below VWAP as it left a pull back high of 27075 before closing at the developing HVN of 27000. BNF left an inside bar on the daily and is also forming a 3-day balance like NF so has a good chance of giving a move away from here in the coming session(s).

- The BNF Open was an Open Test Drive Up which failed (OTD)

- The day type was a Normal Variation Day (Down)

- Largest volume was traded at 27000 F

- Vwap of the session was also at 27063 with volumes of 42.2 L in a session which traded in a range of 473 points making a High-Low of 27335-26862

- The Trend Day VWAP of 19/07 at 30085 is now positional supply point.

- The higher Trend Day VWAP of 18/07 & 08/07 at 30598 & 30995 remain important references going forward

- The settlement day Roll Over point is 27450

- The VWAP & POC of August Series 27858 & 27960 respectively

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

- The VWAP & POC of Jun Series is 30914 & 30961 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 26890-27000-27153

Hypos / Estimates for the next session:

a) BNF needs to stay above 27000 and sustain for a rise to 27060-75 / 27120-136 & 27185-195

b) Staying below 27000, the auction could test 26940-920 / 26875 & 26815

c) Above 27195, BNF can probe higher to 27225 / 27278 & 27335-380

d) Below 26815, lower levels of 26785-780 / 26710 & 26660-640 could come into play

e) Sustaining above 27380, BNF can give a fresh move up to 27410-440 / 27498-510 & 27585

f) Break of 26640 could trigger a move down 26593 / 26535-520 & 26465-440

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout