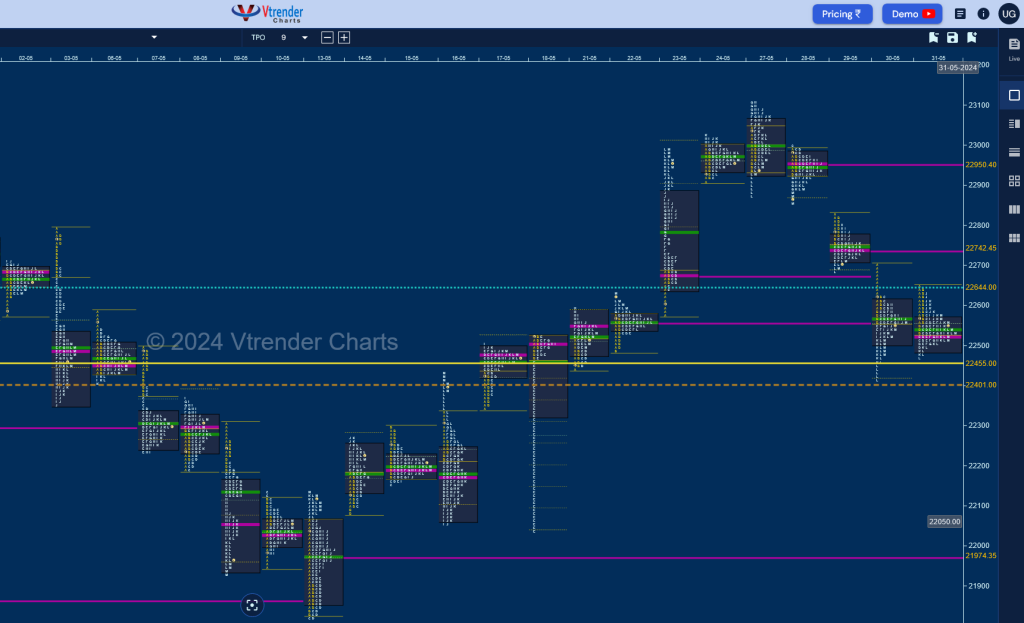

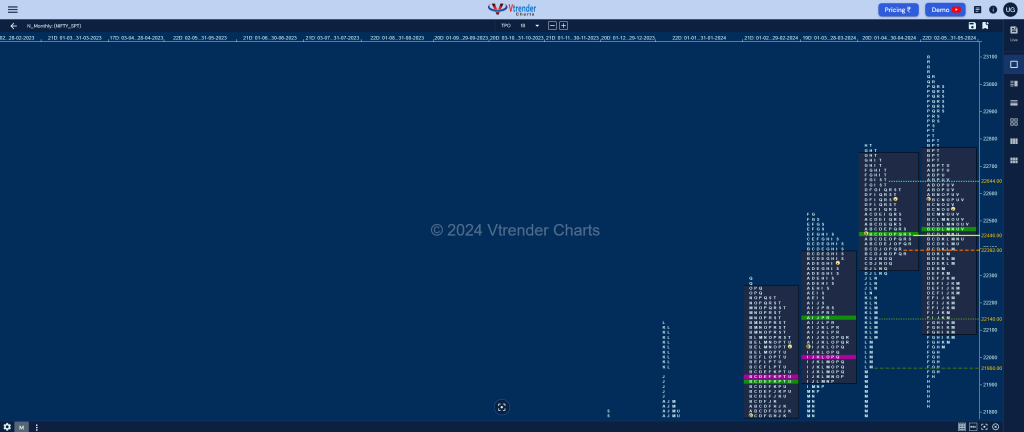

Nifty Spot: 22530 [ 23110 / 21821 ]

Previous month’s report can be viewed here

Nifty has formed a Neutral Centre monthly profile with completely overlapping Value at 22102-22479-22754 and has a good chance of giving a move away from this overlapping POC zone of 22460 to 22480 in June which is set to start with a big event.

The bottom of May was marked by a FA at 21821 as the auction took support in April’s buying zone from 21961 to 21777 and left a fresh responsive tail till 21932 along with a VPOC at 21974 (13 May) which marked the end of the downside. The auction then trended higher leaving an important PBL (Pull Back Low) at 22054 on 16th May along with a weekly VPOC at 22177 (13-17 May) before hitting new ATH of 23110 where it stalled leaving poor highs followed by a FA at 22998 along with a VPOC of 22950 on 28th with prominent seller footprints at 22858 & 22755 completing the 2 ATR target of 22540 while making a low of 22417 on 30th. The auction climbed back to 22653 on the last day of the month testing the June Series RO (Roll Over) point of 22645 but closed around the HVN of 22541 which will be the immediate reference on the upside as we get into a new month.

On the bigger timeframe, we have a huge 4-month balance which has been forming with the composite Value at 21903-22481-22577 so we need to get some definite cues of a move away from this which can result in a fresh imbalance with objectives of 23250, 23456 & 23925 on the upside whereas on the downside, below 21903 the lower targets would be 21500, 21229 & 20555 for the month of June.

Monthly Zones

- The settlement day Roll Over point (Jun 2024) is 22645

- The VWAP & POC of May 2024 Series is 22469 & 22479 respectively

- The VWAP & POC of Apr 2024 Series is 22402 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

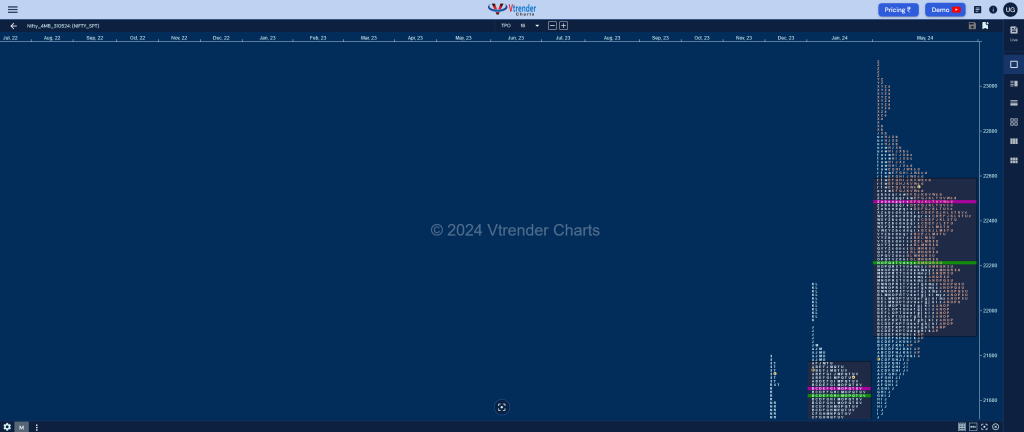

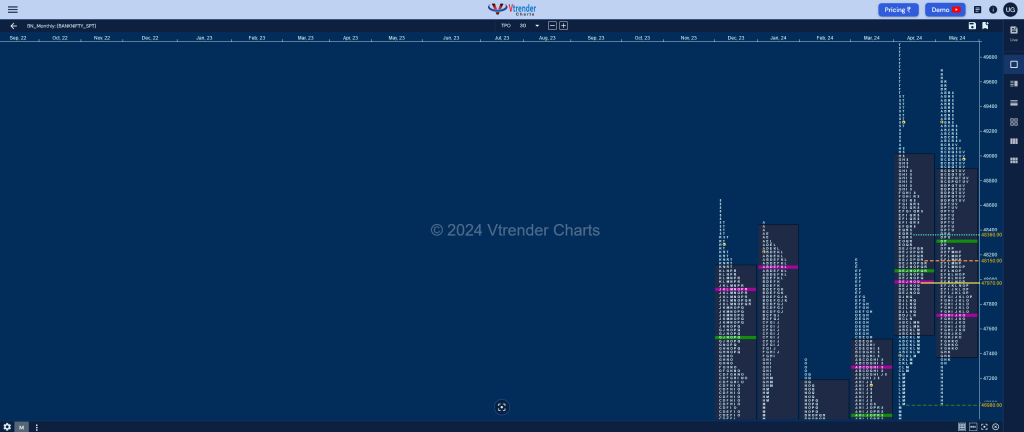

BankNifty Spot: 48984 [ 49688 / 46983 ]

Previous month’s report can be viewed here

BankNifty opened the month with a continuation of the long liquidation it started on 30th Apr where it had recorded new ATH of 49974 as it made an attempt to get into the selling tail from 49473 to 49974 but could only manage to tag 49607 on 03rd May leaving an initiative selling tail till 49246 resulting in a trending move lower as it swiped through previous month’s Value making lower lows on the daily timeframe culminating with a C side extension to 46983 on the 13th stalling right at the responsive buying tail of April and confirmed a FA there signalling the end of the down move.

The auction then probed higher over the next few sessions and even forged a big Trend Day of 957 points on the 23rd which was the biggest range of month signalling a move away from the RO point of 48360 as it went on to get back into previous month’s selling zone making new highs for May at 49688 but showed signs of exhaustion triggering a drop back to the RO point of 48360 in the last week before closing at 48984.

The Monthly profile is a Neutral Centre One which was completely inside previous range and has formed mostly inside Value at 47374-47726-48881 showing rejection at the extremes of April as seen in the responsive tails once again in May with the lower one being from 47313 to 46983 whereas the one at top from 49607 to 49688 with a close around the VAH but below the RO point of 49047 which will be the immediate reference on the upside & staying above which a probe towards ATH of 49974 & 50720 will be a probability whereas on the downside, this month’s VAH of 48881 will be the immediate support below which the series VWAP of 48367 & POC of 47726 would be the lower levels on watch and a break of which could give a test of the tail at lows.

Monthly Zones

- The settlement day Roll Over point (Jun 2024) is 49047

- The VWAP & POC of May 2024 Series is 48367 & 47726 respectively

- The VWAP & POC of Apr 2024 Series is 48176 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively