Give a man a fish…

They say if you give a man a fish, he will eat it for a day, but if you teach them how to fish, he will eat it for a lifetime. Showing you how to fish, so that you become an independent trader working with market generated information and with the ability to stay in […]

The 4 stages of a Trader’s Life. Which one are you in?

As in Life so in Markets I have always believed that the markets and nature are very close and in fact the markets are nothing but the thoughts, views, actions and perspectives of a lot of people across the world as they look at it through different angles. In many ways, the market is like […]

What is exactly the Orderflow?

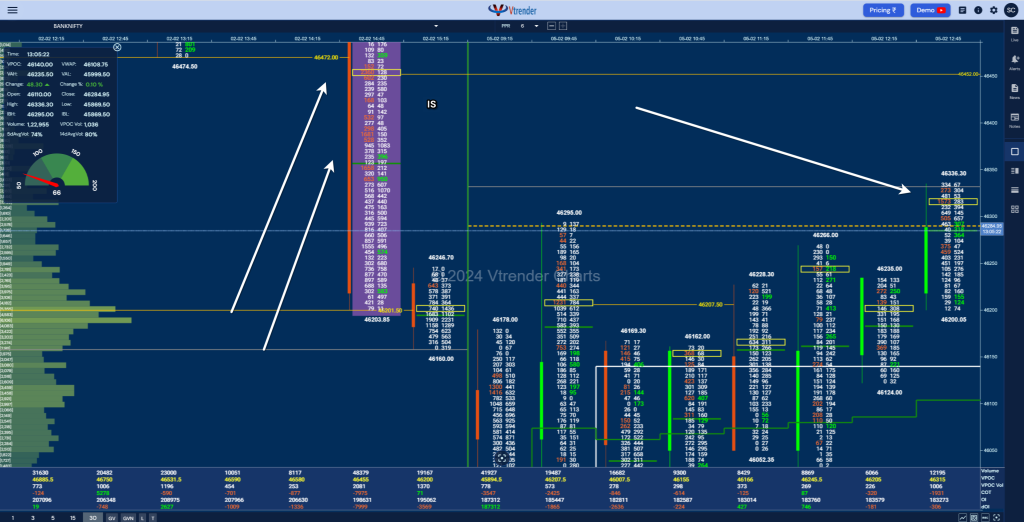

What is this term called Orderflow? and how does knowing it help my trading? Orderflow simply means reading the demand and supply side of the market. Because it is read live and based on current actual traded volumes of the market, we have what are called Orderflow charts. Orderflow replicates the transactions taking at the […]

Data drives everything

On Orderflow interpretations and Orderflow charts I thought long and hard on doing a small write- up on Orderflow interpretations and the charts we get based on the data we feed into them , which in turn drive hard rupees into the markets, with an expectation that they would come back to you a percentage […]

Volume Spikes – How to exploit them

How to trade Volume Spikes? If you traded the market actively this past week, then 2 things would have stood out for you- a) the market was in a range ( easily found out by many) b) the change at the extremes of this range was sudden and produced a large price swing. I’m going […]

Market Profile The evolution

The Evolution of Market Profile It’s fascinating how Market Profile consolidates diverse trading insights under one umbrella. The world of MarketProfile from the 70’s and 80’s has kept pace with the fast changing derivatives markets of today, incorporating the latest information available to keep a trader at par with the message of the market At […]

The MarketProfile revealed: A Comprehensive Guide for Modern Traders

Engaging Discussions on Market Profile: Last week, engaging conversations on my Twitter handle @Am_Shai sparked intriguing dialogues about Market Profile, leading to insightful email exchanges. This blog aims at diving deeper into those conversations, encouraging a wider discussion within our trading community. Your insights and feedback are invaluable as we explore the multifaceted aspects of […]

Order Flow Analysis – Strategies used to trade

The term “Order Flow” throws up mixed expressions when used by different kind of traders. For us at Vtrender and the small community of traders we work with on the Nifty and the Bank Nifty futures, for every session, Order Flow trading is a way of life! For many of us we cannot think […]

How a Market Profile chart gives an edge to trade

There are times the markets move the average range in say a widely traded instrument such as the Nifty futures. These are the times the markets are quieter and confirming to the normal, and most traders and most systems of trading would be good enough to get you through to profits, in your chosen strategy. […]

Level 1- Market Profile Essentials

The trading community at Vtrender trades on MarketProfile and uses OrderFlow to plot entries and exits for the trades. Below is a short 15-minute presentation which will give you a good understanding on a) what constitutes a good learning process b) how to master a trading process c) how MarketProfie gives you an edge as you make trading decisions. Before you go through […]