Exploring the Dynamics of Order Flow in Market Trading

Introduction to Order Flow in Trading Order flow is not just another trading concept; it’s a deep dive into the actual transactions that drive market movements. Unlike traditional tools that only reflect the outcomes of market actions, order flow offers a direct view into the real transactions and intentions of market participants. This blog aims […]

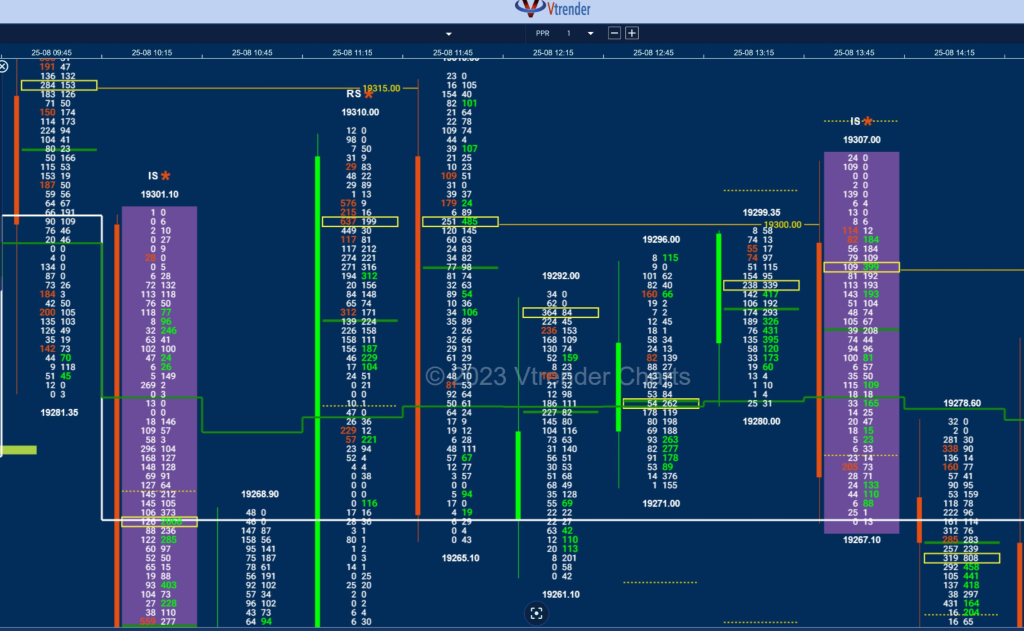

The Nuances of Traded Volumes in Order Flow

Traded Volumes in Order Flow – A New Perspective In the complex world of derivative trading, one cannot underestimate the role of traded volumes in predicting future market moves. Even seasoned traders occasionally find themselves “upside down,” a situation where their trading positions are at odds with the prevailing market direction. This article delves deep […]

What happened at 18165 F today

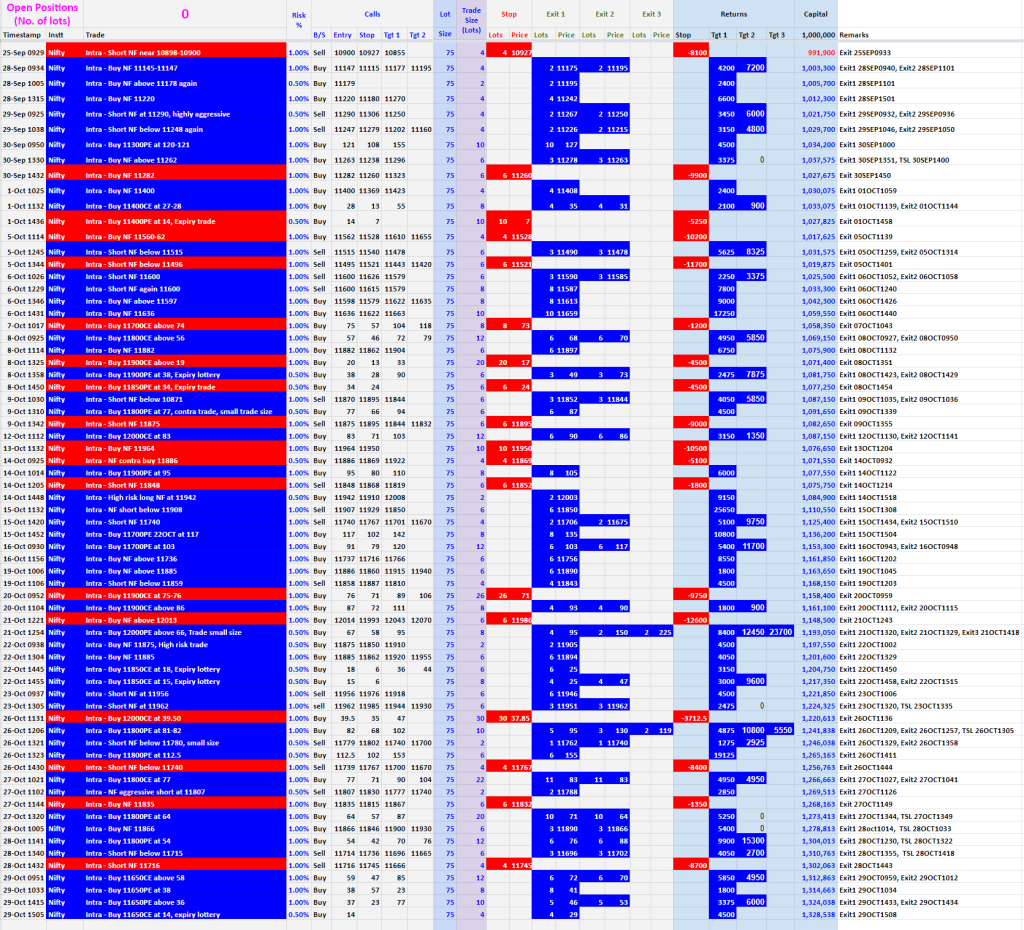

Performance report of MarketProfile and Orderflow (up 32% again) trading strategies used in the Vtrender Trading Room

The Nifty was up 11.28% in November, which was a highly impressive trend month. In #MarketProfile we call it a trend month, which means that there was only one player- the Buyers in control of the market and dominated it from Open to Close. This is highly impressive considering that there was high newsf low […]

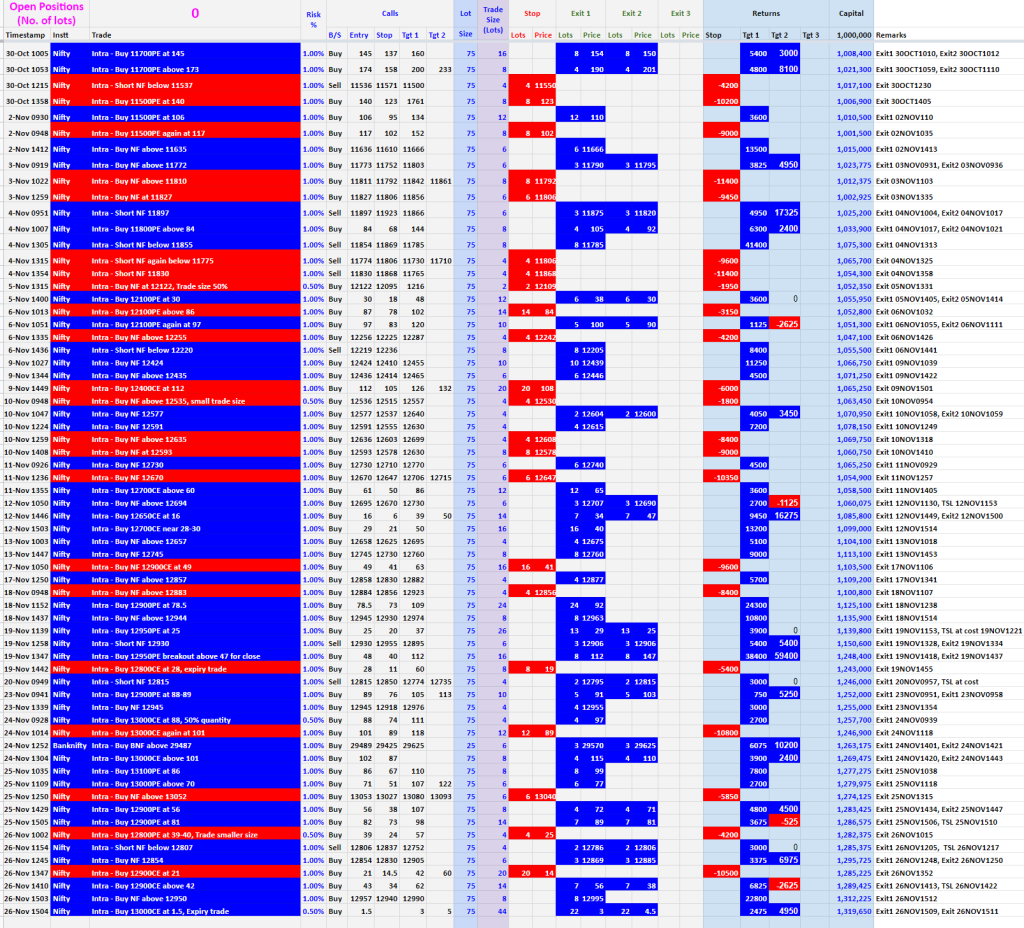

Performance report in Oct (up 32%) based on MarketProfile and Orderflow strategies

The Nifty managed a 8% upmove in the month of October. Very impressive indeed! We smiled. Everytime the market moves like the way it did in October, our chances of doing 4X of that move rises. Yes we have developed strategies which help us make multiples of the index move . And 4X is good. […]

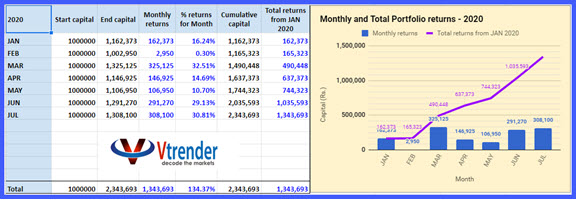

MarketProfile Performance report in July 2020

The power of trading with the NOW We work with the solid foundation of the MarketProfile and use the Orderflow to navigate in the decision making. Listed below are the trades we took from the concepts listed in the Training Library and used the power of the Orderflow charts to fine tune the entries and […]

AMA on 23rd June in the VTR

The details of the #AMA in the Trading Room on 23rd June 2020 09:48 Shai: @everyone, since the market is quiet, we will do an open AMA session from 10.15 am to 10.45 am today. Ask me anything you want on MarketProfile, OrderFlow and the charts. LIve from 10.15 to 10.45, bring along your questions 10:14 Govind : […]

Budget day MarketProfile and Orderflow charts

As many of you know, the budget session was held on a non – working day with special provisions made for supplying data for charts etc . As we resume back on Monday, this session of Saturday won’t be referenced in historical data as we move back to a “Normal” mode. This is just a […]

What is exactly the Orderflow?

What is this term called Orderflow? and how does knowing it help my trading? Orderflow simply means reading the demand and supply side of the market. Because it is read live and based on current actual traded volumes of the market, we have what are called Orderflow charts. Orderflow replicates the transactions taking at the […]

Data drives everything

On Orderflow interpretations and Orderflow charts I thought long and hard on doing a small write- up on Orderflow interpretations and the charts we get based on the data we feed into them , which in turn drive hard rupees into the markets, with an expectation that they would come back to you a percentage […]