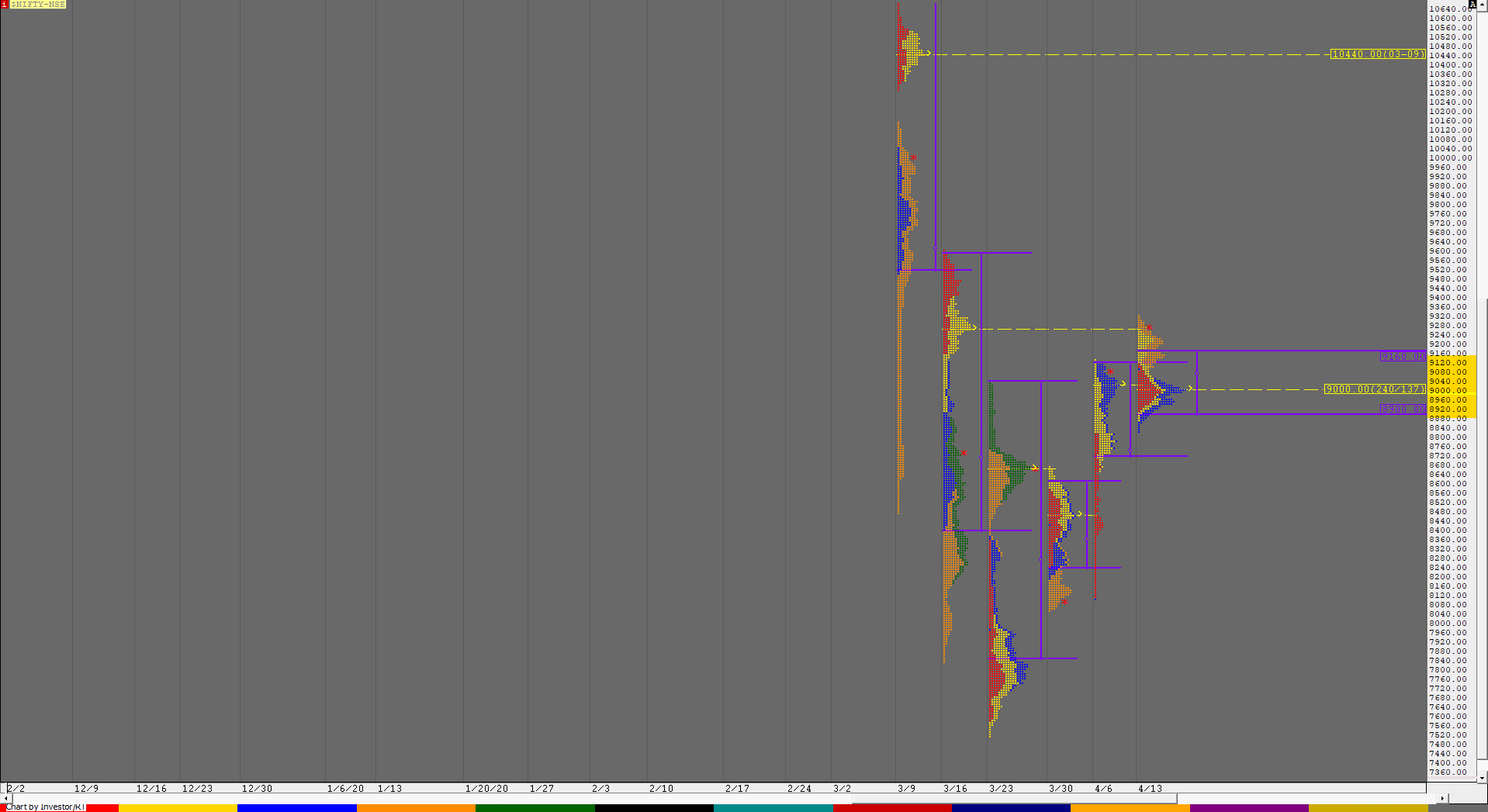

Nifty Spot Weekly Profile (13th to 17th Apr 2020)

Spot Weekly – 9266 [ 9324/ 8822 ]

Previous week’s report ended with this ‘Value also being completely higher at 8740-9020-9100 plus the close at the highs keeps it on track for a probe towards the weekly VPOC of 9260 & the FA of 9404 in the coming week provided it stays above the weekly VAH of 9100 and is able to sustain above the VWAP of the March series which was at 9148. On the downside, 9020 would be the important level on watch below which the PLR would change lower.‘

This week was all about rejections in Nifty as it opened the week just above the weekly VAH but got rejected at 9112 at open triggering the 80% Rule as it made a nice Gaussian profile in previous week’s Value while making a low of 8912. The auction then opened with a big gap up of 200 points on Wednesday after the holiday in between and took support just above the PDH indicating that the PLR had changed to Up and went on to extend higher post IB as it tagged that weekly VPOC of 9260 but was swiftly rejected which triggered a big move to the downside as it left an extension handle at 9114 and went on to make new lows for the week at 8874 leaving a big zone of singles from 8965 to 9107 as it closed the day at 8925. Thursday open saw this imbalance to the downside continue as Nifty made new lows of 8834 at open but was rejected from these new lows at it left a buying tail from 8864 to 8834 confirming a late ORR (Open Rejection Reverse) which indicated that the probe to the downside is done with after which it went on to probe higher making multiple REs as it got accepted in the previous day’s selling tail and made highs of 9054 before closing around the prominent POC of the 4-day composite it was forming. (Click here to view the MPLite chart). Nifty then opened with a huge gap up of 330 points on Friday with a freak OH tick of 9324 just below the PBH at 9346 but trended lower for the first half of the day as it made multiple REs and completed the 2 IB objective down while making lows of 9091 and seemed to be taking support at the weekly VAH as it left a small but important buying tail from 9109 at 9090 which marked the lows for the day after which the auction retraced the entire move down from the ‘B’ period and went on to tag 9295 as it spiked into the close before closing the week at 9266. The range for this week was a mere 502 points which was the lowest in 7 weeks with an overlapping & prominent POC around 9000 and a range expansion could be expected in the coming week(s). Value for the week is at 8900-9000-9160.

Click here to view this week’s auction in Nifty with respect to previous week’s profile on MPLite

Main Weekly Hypos for Nifty (Spot):

A) Nifty needs to sustain above 9265 for a probe to 9313-46 / 9404 / 9441*-58 / 9491-9507 & 9556-65

B) The auction staying below 9265 could test lower levels of 9222-16 / 9169-60 / 9120-08 / 9067-13* & 8978-59

Extended Weekly Hypos

C) If 9565 is taken out, Nifty can probe higher to 9602 / 9655-9702 / 9733-52 / 9801 & 9850

D) Break of 8959 could bring lower levels of 8913 / 8887-36 / 8790-48* / 8700 & 8649

-Additional Hypos*-

E) Above 9850*, Nifty could start a new leg up to 9906 / 9950-61 / 10001-50 / 10101-150 & 10202

F) Below 8649*, the auction can fall further to 8599-40/ 8510-8499 / 8445* / 8413-8394 & 8363-25

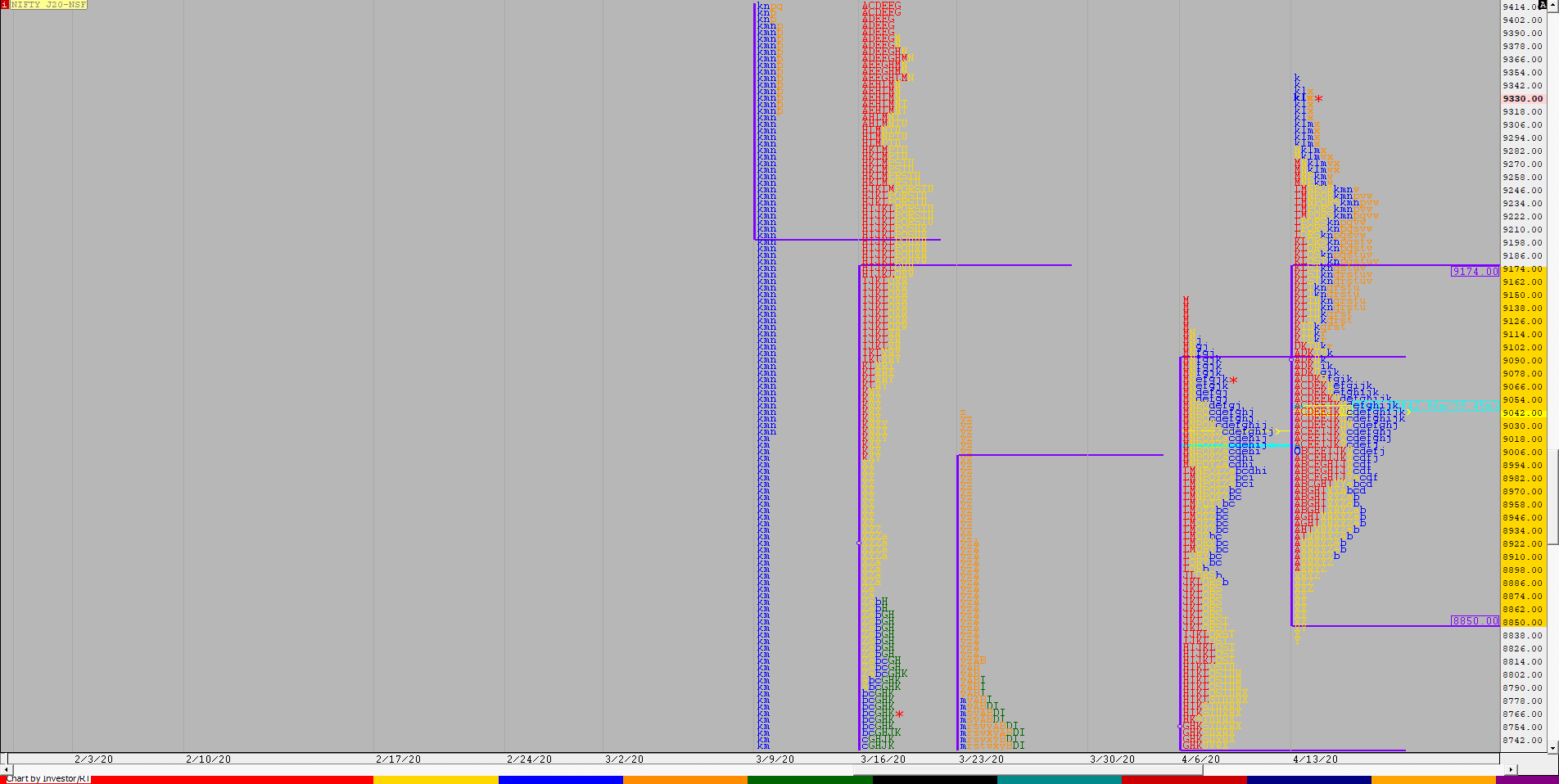

NF (Weekly Profile)

9311 [9350 / 8835]

Previous week’s report ended with this ‘The weekly profile resembles a ‘p’ shape with Value completely higher at 8736-9024-9090 and the close at the VAH means the PLR for the coming week would be to the upside towards the VPOC of 9169, the 1 ATR objective of 9211 from 8686 & finally that FA of 9384‘

NF had a mixed week with a balance on the first day after it opened lower but was followed by 2 big gap ups on Wednesday & Friday and both the days ended as Neutral Days indicating an equal fight between the buyers & sellers even as the auction tagged the 1 ATR objective of 9211 from the FA of 8686 and almost hit the positional reference of 9384 as it made highs of 9350 before closing the week at 9311. This week’s Value as well as the POC was overlapping to higher at 8850-9042-9174.

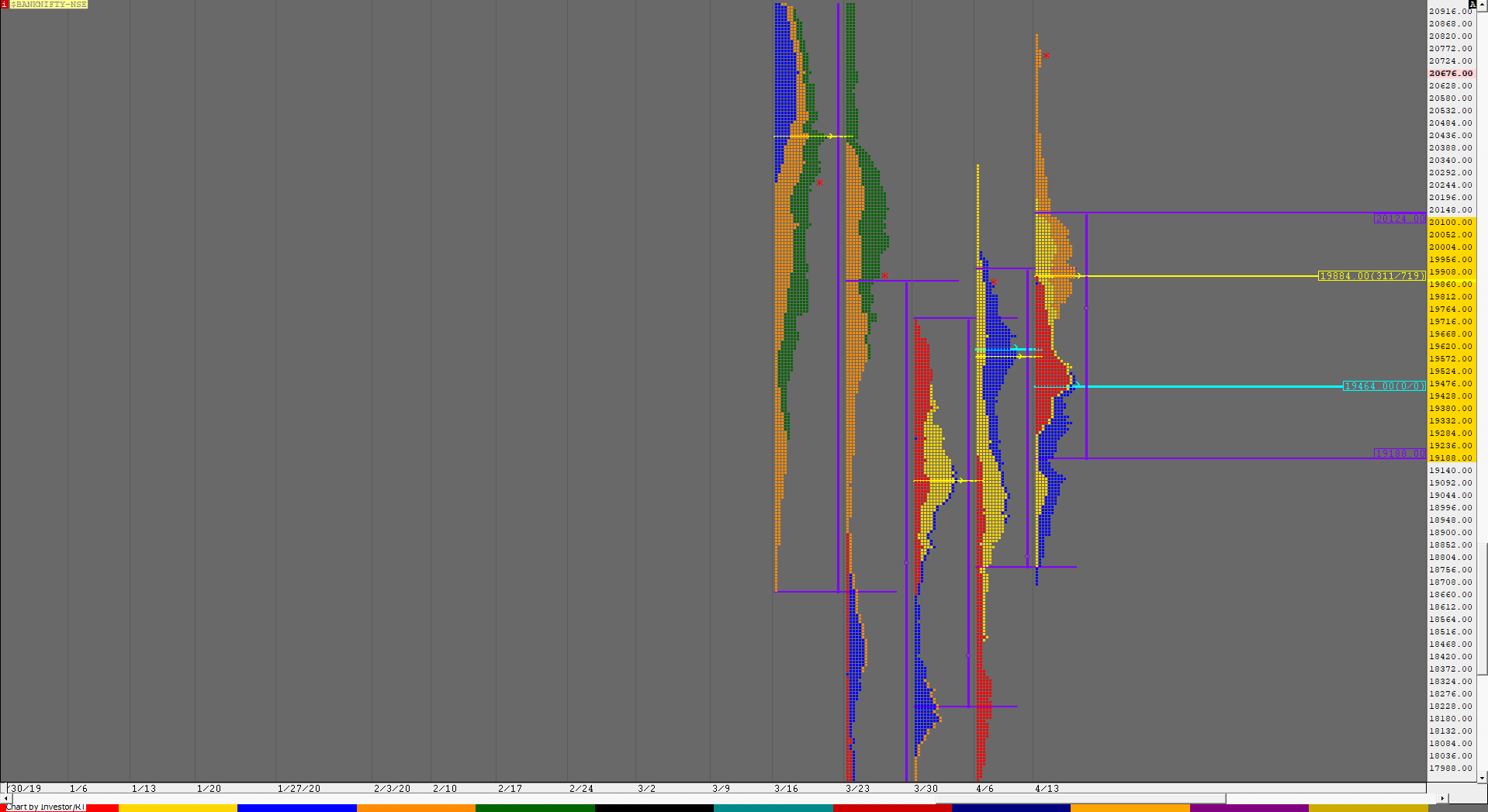

BankNifty Spot Weekly Profile (13th to 17th Apr 2020)

Spot Weekly – 20681 [ 20866 / 19729 ]

Previous week’s report ended with this ‘The PBLs (Pull Back Low) at 19167 & 19522 along with the promiment POC at 19608 would be the important references on the downside for the coming week which has overlapping to higher at 18768-19572-19944 and on the upside we have the singles at top of the weekly profile from 19988 to 20324 which needs to be taken out for the PLR to remain higher.’

BankNifty began this week with a Normal Day as it opened lower & broke below the first PBL of 19522 forming a balance in previous week’s Value on Monday leaving the narrowest range of 593 points in over a month which led to an imbalance on Wednesday as it opened higher getting into previous week’s selling tail of 19988 to 20324 but got stalled at 20184 which got confirmed as a FA later in the day as it left an extension handle at 19714 triggering a big fall as the auction completed the 3 IB objective to the downside as it made lows of 18777 which also the weekly VAL thus playing out the 80% Rule too before closing the day at 19057. BankNifty then opened lower on Thursday and made new lows for the week at 18703 almost tagging the 1 ATR target of 18691 from the FA but was rejected back as it left a buying tail in the IB from 18813 to 18703 which indicated that the downside could have been over. The auction then made a slow probe higher all day confirming that the reverse 80% Rule was taking place as it almost got back to the weekly POC and in this process had formed a nice 5-day composite balance with a prominent POC at 19496. (Click here to view the MPLite chart) Friday saw a huge gap up of almost 1000 points as BankNifty made a high of 20448 in the ‘A’ period but began to retrace the imbalance trending lower for the first half of the day as it made lows of 19729 in the ‘F’ period taking support just above that extension handle of 19714 of the previous day. The auction then began to form a balance building volumes near 19900 before it spiked higher in the last couple periods making a RE on the upside as it left a fresh extension handle at 20447 and went on to make highs of 20866 before closing the week at 20681 leaving a Neutral Extreme profile not just for the day but also for the week with the zone from 20184 to 20866 being the immediate reference and within that 20447 being the important level to watch. This week’s Value was overlapping to higher at 19188-19884-20124.

Main Weekly Hypos for Bank Nifty (Spot):

A) BankNifty needs to get above 20735 & sustain for a probe to 20809-880 / 20953-985 / 21026 / 21098-120 / 21171-245 / 21287-317 & 21390-463

B) Staying below 20665, the auction could test 20590-521 / 20447 / 20390-375 / 20324-248 / 20184-164 / 20094-22 & 19952-19882

Extended Weekly Hypos

C) Above 21463, BankNifty can probe higher to 21515-555 / 21610-685 / 21831-845 / 21910 / 21979-999 / 22055-125 & 22200

D) Below 19882, lower levels of 19830-811 / 19740 / 19665-600 / 19496*-461 / 19380-320 / 19252-188 & 19134-114 could come into play

-Additional Hypos*-

E) Above 22200*, BankNifty could start a new leg up to 22275-350 / 22395-425 / 22501-575 / 22650-726 / 22796 / 22848-875 & 22953-23040

F) Below 19114*, the auction can go down to 19044 / 18976-960* / 18875-835 / 18768-675 / 18595-565 / 18498-412 & 18272*

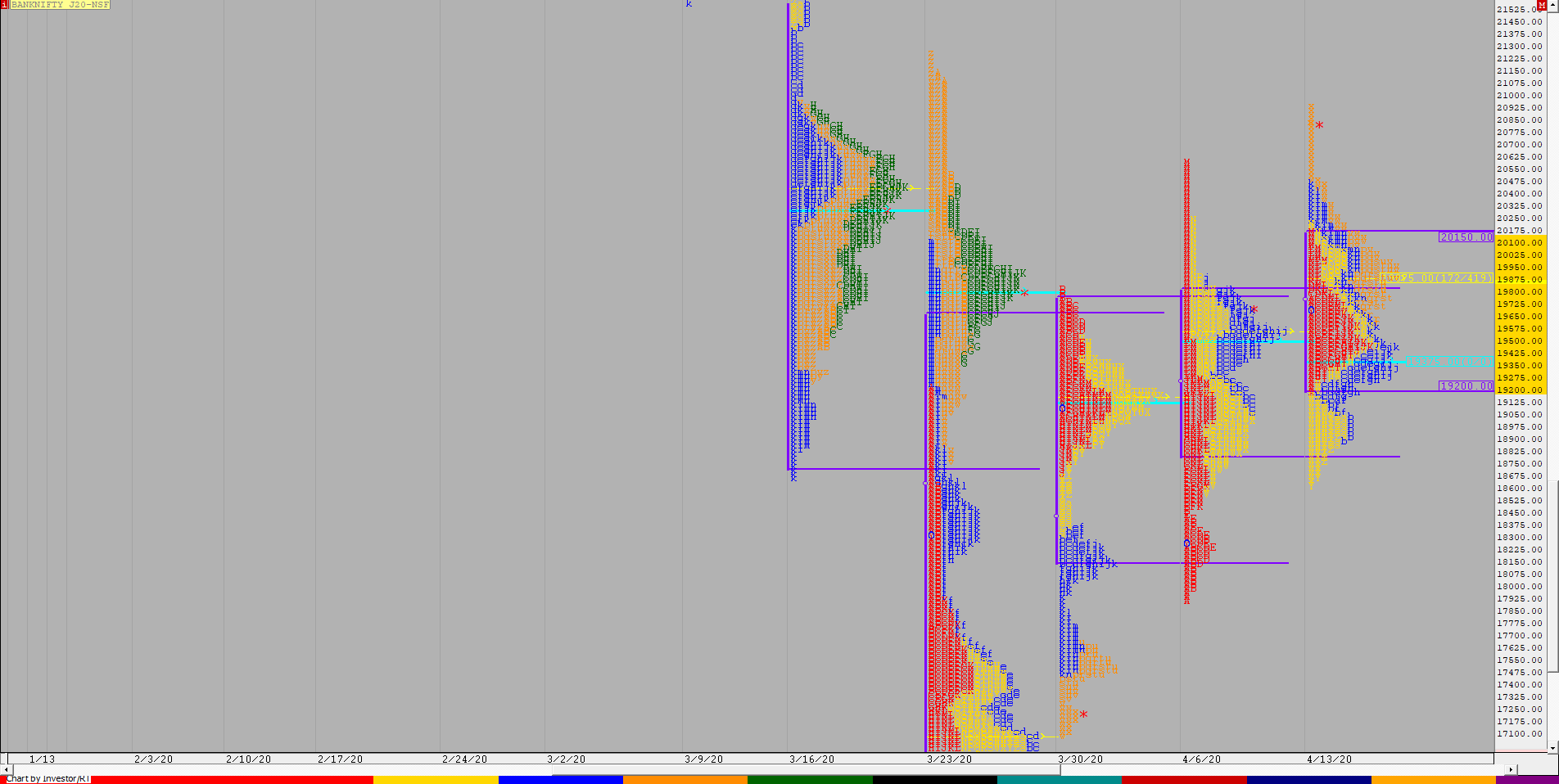

BNF (Weekly Profile)

19768 [ 20599 / 17921 ]

BNF made a nice balanced profile for the week with mostly overlapping Value at 19200-19875-20150 with a spike close from 20452 to 20934 which would be the opening reference for the next week. The profile also has a HVN at 19375 which could act as important support.