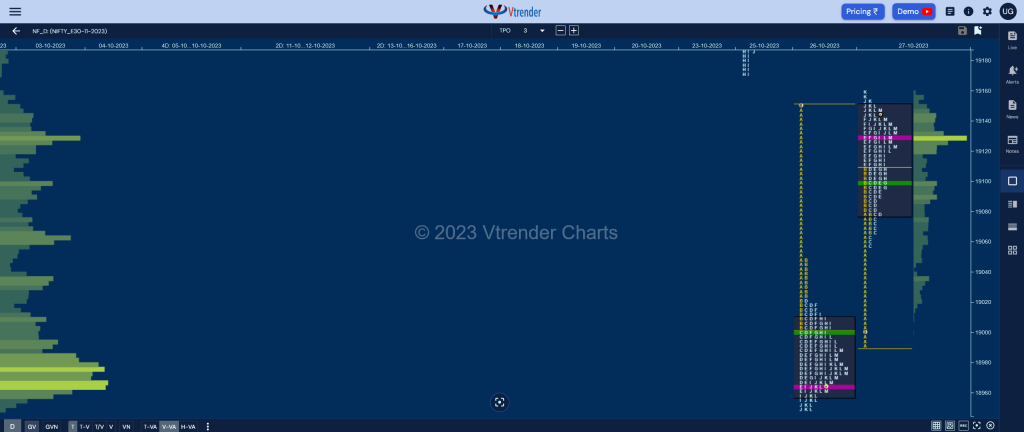

Nifty Nov F: 19131 [ 19160 / 18990 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 18,969 contracts |

| Initial Balance |

|---|

| 119 points (19109 – 18990) |

| Volumes of 44,596 contracts |

| Day Type |

|---|

| Normal (‘p’ shape profile) – 169 points |

| Volumes of 1,21,503 contracts |

NF opened slightly higher right at previous day’s VWAP and scaled above it trapping the laggard shorts which in turn triggered a short covering probe higher to 19109 in the Initial Balance negating more than half of yesterday’s A period selling tail after which it made a typical contra move in the C side testing the day’s VWAP which was successfully defended with a PBL at 19056.

The auction then went on to make couple of REs to the upside in the E & F TPOs where it made new highs of 19140 but the inablity to get above PDH resulted in a small probe lower where once again it took support just above day’s VWAP in the G period confirming a second PBL at 19095 indicating that the upside probe is still not over.

There was another set of fresh but small REs in the J & K TPOs where NF made a look up above PBH but could not sustain and left a small responsive selling tail at the top suggesting that the OTF sellers could be back which forced the morning buyers to book profits as the dPOC shifted higher to 19128 around where it closed leaving a Normal Day and a ‘p’ shape short covering profile.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19129 F and VWAP of the session was at 19099

- Value zones (volume profile) are at 19078-19129-19150

- HVNs are at 19062 / 19392 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19568 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 30th Oct 2023

| Up |

| 19154 – Selling tail (27 Oxt) 19188 – Gap mid (26 Oct) 19220 – Weekly VWAP 19275 – PBH (25 Oct) 19326 – G TPO POC (25 Oct) |

| Down |

| 19129 – dPOC (27 Oct) 19099 – VWAP (27 Oct) 19056 – Buying Tail (27 Oct) 18990 – PDL 18964 – VPOC (26 Oct) |

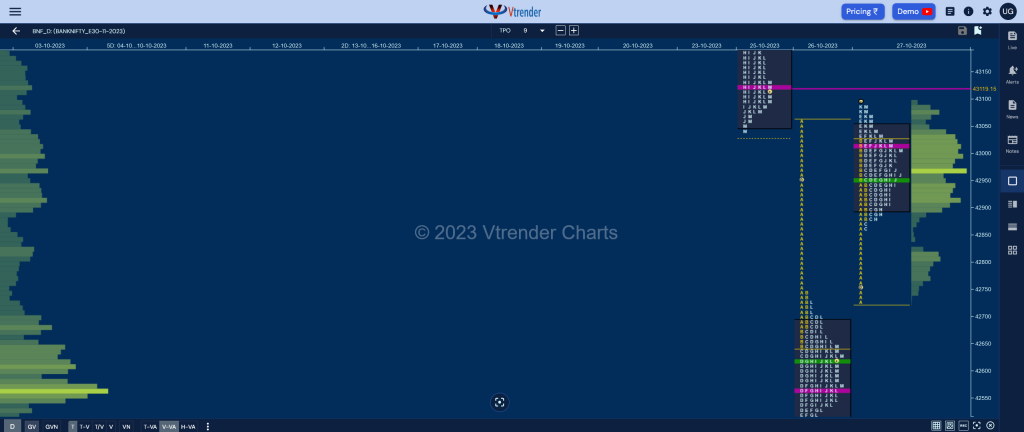

BankNifty Nov F: 43043 [ 43100 / 42730 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 16,333 contracts |

| Initial Balance |

|---|

| 290 points (43020 – 42730) |

| Volumes of 43,927 contracts |

| Day Type |

|---|

| Normal (‘p’ shape profile) – 370 points |

| Volumes of 1,14,860 contracts |

BNF opened with a 154 point gap up confirming that the OTF sellers had booked profits in the previous session as it went on to get accepted in the initaitive selling tail making a high of 43020 in the Initial Balance & leaving an A period buying tail from 42876 to 42730 which got tested in a C side probe lower leaving a PBL at 43860 which meant that the supply was still not coming back.

The auction then made couple of Range Extensions to the upside in the E & K TPOs but could only manage marginal new highs of 43070 & 43086 forming a ‘p’ shape profile for the day with the dPOC shifting higher to 43014 into the close and even made a small spike to 43100 in the closing minutes stalling just below 25th Oct’s VPOC of 43116 which will be the immediate reference on the upside along with previous week’s VWAP of 43150 for the next session.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 43014 F and VWAP of the session was at 42948

- Value zones (volume profile) are at 42894-43014-43045

- HVNs are at 44040 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43860 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 30th Oct 2023

| Up |

| 43045 – VAH (27 Oct) 43150 – Weekly VWAP 43259 – PBH (25 Oct) 43337 – DD VWAP (25 Oct) 43461 – LVN (25 Oct) |

| Down |

| 43014 – dPOC (27 Oct) 42948 – VWAP (27 Oct) 42860 – Buying Tail (27 Oct) 42730 – PDL 42622 – VWAP (26 Oct) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.