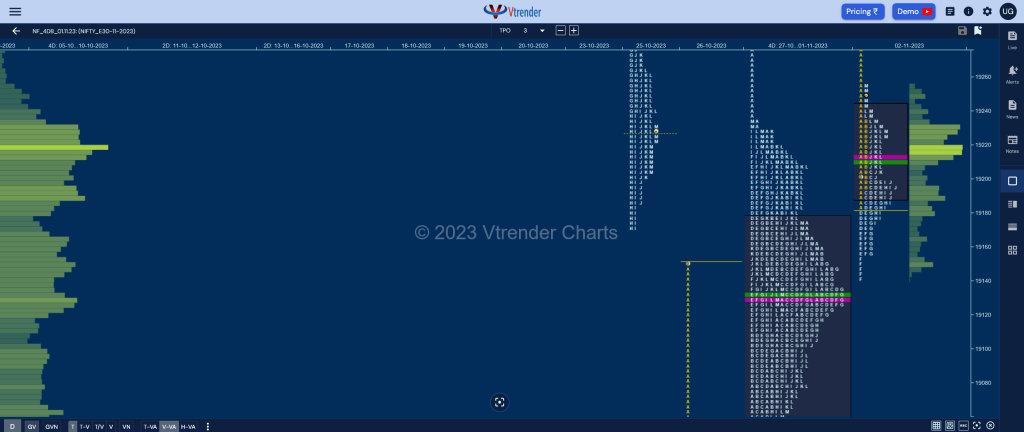

Nifty Nov F: 19238 [ 19256 / 19140 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 27,005 contracts |

| Initial Balance |

|---|

| 62 points (19246 – 19184) |

| Volumes of 47,850 contracts |

| Day Type |

|---|

| Neutral Extreme – 117 points |

| Volumes of 1,51,510 contracts |

NF not only opened with a gap up of 140 points but went on to test the 4-day composite selling tail from 19234 to 19279 while making a high of 19246 in the A period but as expected saw some supply coming back in this zone as it settled down into an Open Auction Out of Range (OAOR) forming a narrow 62 point range and remained inside this in the B TPO. (P.S: There was a freak tick at 19451 at open but no volumes were seen above 19246 in OrderFlow)

The auction continued to consolidate in the C side where it remained in a mere 19 point range almost tagging the IBL of 19184 and did not find any demand coming back which made the sellers to extend lower over the next 3 TPOs getting back into the 4-day composite Value triggering the 80% Rule as it went on to make a low of 19140 in the F stalling just above the gap mid-point of 19130 plus the composite POC which was at 19129 and left a small responsive buying tail marking the end of the OTF (One Time Frame) probe down from the open.

NF then went on to make higher highs in the remaining TPOs (except for K period where it made an inside bar) reversing the OTF to the upside for the rest of the day closing in a small spike higher to 19256 leaving a Neutral Extreme Day Up and forming completely higher Value than the 4-day balance it had formed indicating that the PLR (Path of Least Resistance) would be to the upside with today’s VWAP of 19211 being the level to hold on the downside.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19214 F and VWAP of the session was at 19211

- Value zones (volume profile) are at 19188-19214-19244

- HVNs are at 19062 / 19129 / 19218** / 19392 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 03rd Nov 2023

| Up |

| 19246 – NeuX zone (02 Nov) 19279 – Swing High (31 Oct) 19326 – G TPO POC (25 Oct) 19357 – Ext Handle (25 Oct) 19392 – VPOC from 25 Oct |

| Down |

| 19211 – NeuX VWAP (02 Nov) 19168 – SOC from 02 Nov 19129 – 4-day VPOC (01 Nov) 19095 – PBH from 01 Nov 19054 – VPOC from 01 Nov |

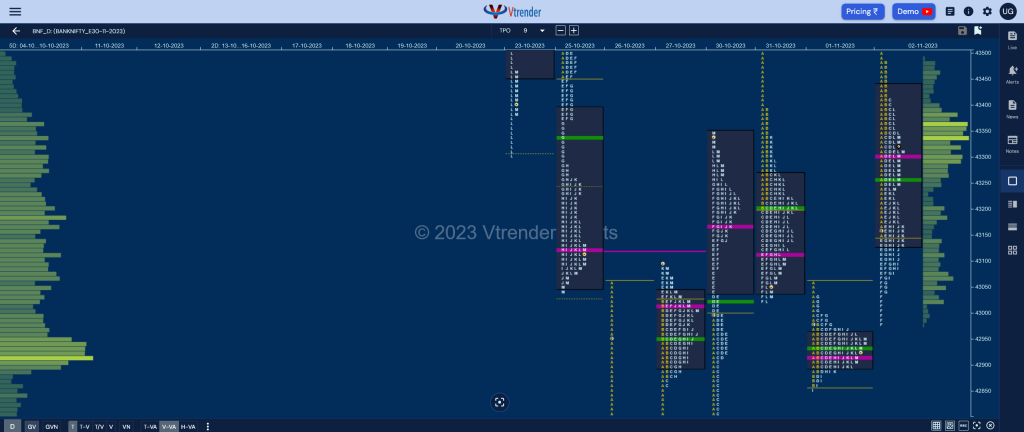

BankNifty Nov F: 43320 [ 43490 / 42978 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 27,670 contracts |

| Initial Balance |

|---|

| 340 points (43490 – 43150) |

| Volumes of 56,392 contracts |

| Day Type |

|---|

| Normal Variation (3-1-3) – 512 points |

| Volumes of 1,99,297 contracts |

BNF made a much stronger open above 31st Oct’s VPOC of 43114 with an almost OL (Open=Low) start at 43150 followed by a drive higher to 43490 in the A period getting into the 31st Oct Selling Tail but stalling just below the mid-point of 43496 indicating that this zone was still being defended by sellers and more confirmation of the upside being limited came with the break of day’s VWAP in the B TPO. (P.S: There was a freak tick at 43555 at open but no volumes were seen above 43490 in OrderFlow)

The auction then continued to probe lower over the next 4 TPOs even making couple of Range Extensions in the E & F periods where it closed the gap and completed the 1.5 IB objective of 42980 while making a low of 42978 but more importantly stopped just above previous day’s Gaussian Curve’s VAH of 42959 and left a small responsive buying tail which meant that some demand was coming back here.

The G TPO then made higher highs not only stopping the OTF move down but reversed the probe to the upside for the rest of the day as BNF climbed back above VWAP into the close and left a PBH at 43395 before closing around the dPOC of 43304 leaving a 3-1-3 profile for the day with completely higher Value.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 43304 F and VWAP of the session was at 43258

- Value zones (volume profile) are at 43130-43304-43434

- HVNs are at 42928** / 43184 / 44040 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 03rd Nov 2023

| Up |

| 43326 – Closing HVN (02 Nov) 43487 – Selling Tail (02 Nov) 43560 – SOC (25 Oct) 43637 – Selling Tail (25 Oct) 43784 – TD VWAP (23 Oct) |

| Down |

| 43304 – dPOC from 02 Nov 43146 – LVN from 02 Nov 43046 – Buying tail (02 Nov) 42911 – VPOC from 01 Nov 42849 – Swing Low (01 Nov) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.