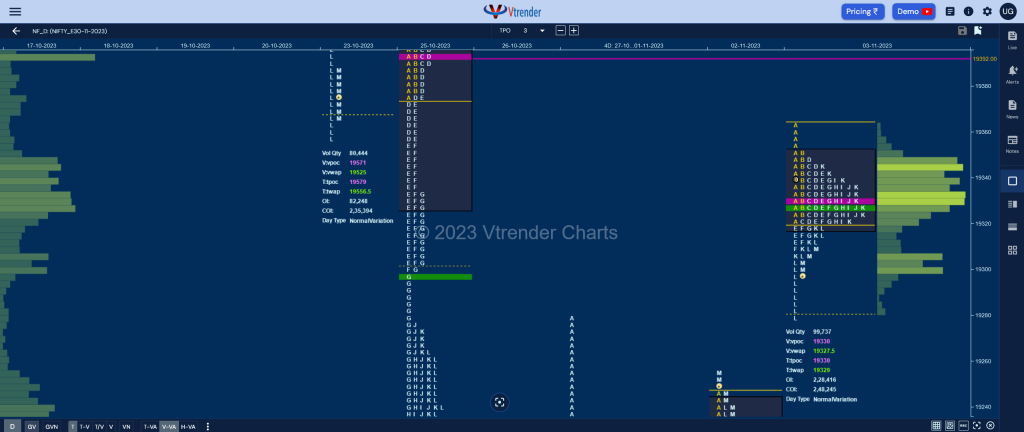

Nifty Nov F: 19306 [ 19363 / 19280 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 22,133 contracts |

| Initial Balance |

|---|

| 41 points (19363 – 19322) |

| Volumes of 38,850 contracts |

| Day Type |

|---|

| Normal Variation (3-1-3) – 83 points |

| Volumes of 99,737 contracts |

NF once again opened with a gap up for the second consecutive day and tagged the extension handle of 19357 from 25th Oct but could not sustain above it settling into an OAOR as it formed an ultra narrow 41 point range Initial Balance between 19322 to 19363 and made a typical C side extension to 19320 triggering a bounce back to day’s VWAP as it made a high of 19347 in the D. (P.S: There was a freak tick at 19413 at open but no volumes were seen above 19363 in OrderFlow)

The auction then not only confirmed a PBH at 19347 but went on to make couple of marignal REs (Range Extension) at 19313 & 19310 in the E & F periods but did not see any fresh volumes coming in triggering a slow bounce higher and a PBH at 19345 in the all important K TPO setting up a small spike lower from 19305 to 19280 in the L which will be the zone to watch in the coming session as Spike Rules will be in play.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19330 F and VWAP of the session was at 19327

- Value zones (volume profile) are at 19318-19330-19350

- HVNs are at 19062 / 19129 / 19213** / 19392 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 06th Nov 2023

| Up |

| 19327 – VWAP from 03 Nov 19351 – Selling tail (03 Nov) 19392 – VPOC from 25 Oct 19450 – Poor High (25 Oct) 19489 – 1 ATR (yPOC 19330) |

| Down |

| 19299 – HVN from 03 Nov 19246 – NeuX low (02 Nov) 19211 – NeuX VWAP (02 Nov) 19168 – SOC from 02 Nov 19129 – 4-day VPOC (01 Nov) |

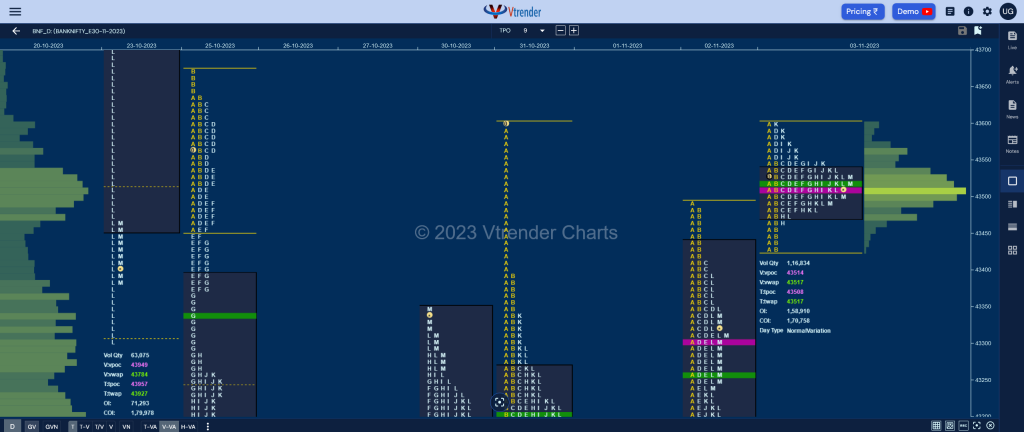

BankNifty Nov F: 43509 [ 43490 / 42978 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 17,035 contracts |

| Initial Balance |

|---|

| 169 points (43599 – 43430) |

| Volumes of 44,050 contracts |

| Day Type |

|---|

| Normal (Gaussian) – 174 points |

| Volumes of 1,16,834 contracts |

BNF made another gap up open of 204 points tagging 25th Oct’s SOC of 43560 but settled down into an Open Auction Out of Range taking support just above the gap mid-point of 43423 while making similar lows of 43432 & 43430 in the Initial Balance forming a mere 169 point range and contracted even further for rest of the day leaving a PBL at 43467 in the H period.

The auction made an attempt to extend higher in the K TPO but could only manage marginal new highs of 43604 indicating responsive selling coming in as it got back to day’s prominent POC of 43514 leaving a nice Gaussian Curve with completely higher Value and looking set for a move away from here in the coming session.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 43514 F and VWAP of the session was at 43517

- Value zones (volume profile) are at 43476-43514-43540

- HVNs are at 42928** / 43184 / 44040 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 06th Nov 2023

| Up |

| 43514 – dPOC (03 Nov) 43637 – Selling Tail (25 Oct) 43784 – TD VWAP (23 Oct) 43870 – Ext Handle (23 Oct) 43949 – VPOC (23 Oct) |

| Down |

| 43467 – PBL from 03 Nov 43304 – VPOC from 02 Nov 43146 – LVN from 02 Nov 43046 – Buying tail (02 Nov) 42911 – VPOC from 01 Nov |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.