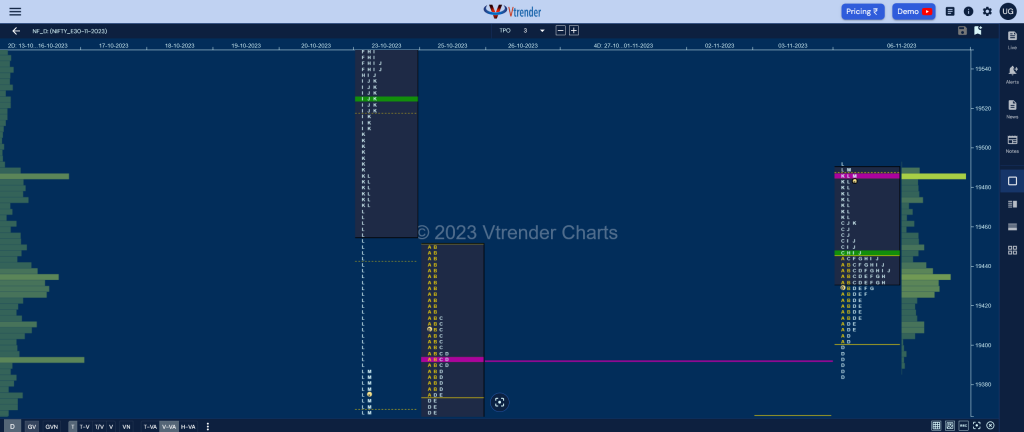

Nifty Nov F: 19486 [ 19492 / 19385 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 20,070 contracts |

| Initial Balance |

|---|

| 43 points (19445 – 19402) |

| Volumes of 34,260 contracts |

| Day Type |

|---|

| Neutral Extreme – 108 points |

| Volumes of 1,03,633 contracts |

NF made it a hat-trick of gap up starts opening higher by 122 points and remained above 25th Oct’s VPOC of 19392 and yet again for the third session settled into an Open Auction Out of Range forming a very narrow 43 point range Initial Balance between 19445 and 19402 after which it made a typical C side extension to 19463 repairing the poor highs from that day (25 Oct).

The auction however was swiftly rejected from these new highs not only resulting in a retracement back to day’s VWAP but went on to make an extension lower to 19385 in the D period where it found demand coming back as could be seen in the responsive buying tail it left after which it made a slow probe higher back to 19462 in the J TPO and followed it with an extension handle at 19463 in the K confirming a FA (Failed Auction) at lows.

NF went on to complete the 2 IB objective of 19488 while making a high of 19492 in the L period leaving a Neutral Extreme Day Up once again with completely higher Value but saw the dPOC shift to the top at 19485 into the close indicating profit booking by the buyers and would be the opening reference for the next session with today’s VWAP of 19446 being the important support for this week along with the FA at 19385.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19485 F and VWAP of the session was at 19446

- Value zones (volume profile) are at 19432-19485-19488

- NF confirmed a FA at 19385 on 06/11 and the 1 ATR objective comes to 19544

- HVNs are at 19062 / 19129 / 19213** / 19392 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 07th Nov 2023

| Up |

| 19485 – dPOC from 06 Nov 19525 – TD VWAP (23 Oct) 19571 – VPOC (23 Oct) 19621 – Ext Handle (23 Oct) 19666 – VWAP from 20 Oct |

| Down |

| 19446 – NeuX VWAP (06 Nov) 19415 – E TPO POC (06 Nov) 19385 – FA from 06 Nov 19330 – VPOC from 06 Nov 19299 – HVN from 03 Nov |

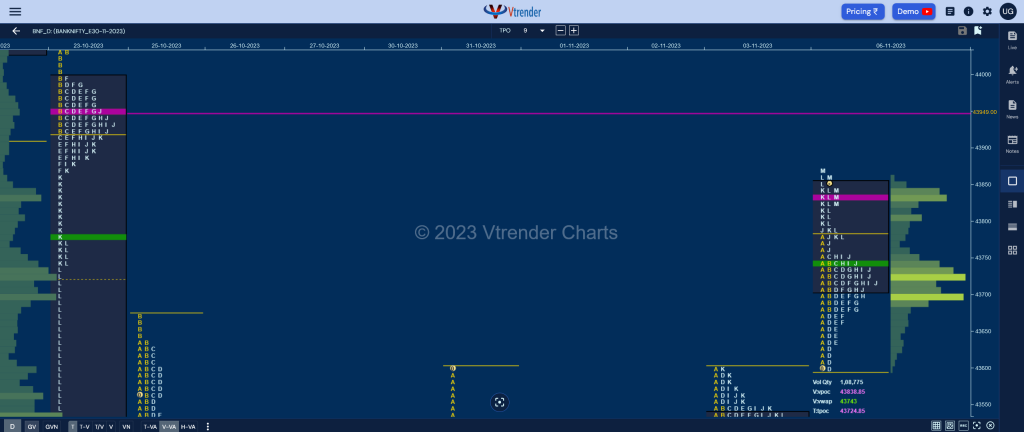

BankNifty Nov F: 43839 [ 43868 / 43602 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 15,836 contracts |

| Initial Balance |

|---|

| 93 points (43778 – 43685) |

| Volumes of 28,221 contracts |

| Day Type |

|---|

| Neutral Extreme – 206 points |

| Volumes of 1,08,775 contracts |

BNF made a freak OL (Open=Low) tick at 43598 but there were no volumes seen below 43701 as it went on to make a high of 43778 in the opening minutes stalling just below 23rd Oct’s Trend Day VWAP of 43784 and settled down into the third consecutive OAOR forming a narrow 93 point range Initial Balance as it made marignal new lows of 43685 in the B period.

The C side then tested the A TPO selling tail but could only manage to leave a PBH at 43750 triggering a probe lower in the D where the auction made a range extension completing the 1.5 IB objective of 43639 while making a low of 43602 but the entry into previous day’s range was rejected as seen in the small responsive buying tail till 43640.

The buyers then took complete control for the rest of the day as BNF made an One Time Frame probe to the upside from the F to the M TPOs almost tagging the 2 IB objective of 43871 which was also the extension handle from 23rd Oct while making a high of 43868 leaving a Neutral Extreme Day Up with completely higher value yet again but saw the dPOC shift higher to 43838 which will be the opening reference for the coming session with today’s VWAP of 43743 being the level which buyers will have to defend to continue the upside imbalance.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 43838 F and VWAP of the session was at 43743

- Value zones (volume profile) are at 43708-43838-43854

- HVNs are at 42928** / 43184 / 44040 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 07th Nov 2023

| Up |

| 43840 – M TPO VWAP (06 Nov) 43949 – VPOC (23 Oct) 44034 – Ext Handle (23 Oct) 44143 – Selling tail (20 Oct) 44289 – LVN from 20 Oct |

| Down |

| 43838 – dPOC from 06 Nov 43743 – NeuX VWAP (06 Nov) 43640 – Buying tail (06 Nov) 43514 – VPOC from 03 Nov 43423 – Gap mid-point (03 Nov) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.