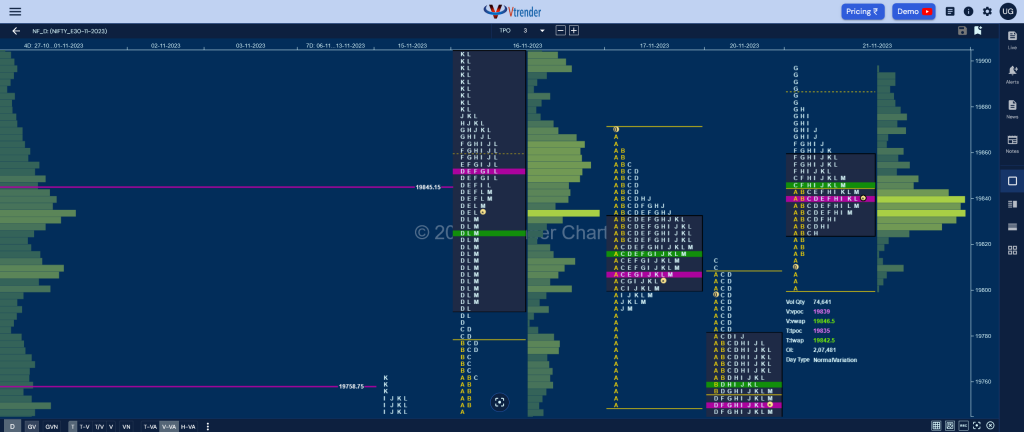

Nifty Nov F: 19841 [ 19898 / 19801 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 8,960 contracts |

| Initial Balance |

|---|

| 43 points (19844 – 19801) |

| Volumes of 18,043 contracts |

| Day Type |

|---|

| Normal Variation – 97 points |

| Volumes of 74,641 contracts |

NF not only made a higher open but went on to scale above the FA of 19813 and found some fresh demand coming in as it left an A period buying tail from 19815 to 19801 & hit new highs of 19844 in the B TPO forming a narrow 43 point range Initial Balance which was followed by a typical C side extension to 19848 giving an immediate retracement to day’s VWAP where it took support at 19825.

The auction then made subdued D & E periods coiling further within the C side range but stayed above VWAP which meant that the PLR (Path of Least Resistance) was to the upside and more confirmation of this came via an extension in the F TPO which was followed by a even bigger one in the G as it completed the 2 IB target of 19888 and went on to tag 16th Nov’s HVN of 19895 while making a high of 19898.

However, NF saw some profit booking by the buyers triggering a quick drop down to 19825 in the H period after which it remained in it’s range for the rest of the day forming a nice balance and a 3-1-3 profile with a nice balance in middle along with similar tails at both ends closing right at the dPOC of 19840.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19839 F and VWAP of the session was at 19846

- Value zones (volume profile) are at 19825-19839-19859

- NF confirmed a FA at 19813 on 20/11 and the 1 ATR objective on the downside comes to 19690. This FA got negated at open on 21/11 and closed above it opening the 1 ATR upside target of 19936

- NF confirmed a FA at 19385 on 06/11 and tagged the 2 ATR objective of 19704 on 15/11

- HVNs are at 19129 / 19213 / 19486** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 22nd Nov 2023

| Up |

| 19850 – L TPO POC (21 Nov) 19879 – Selling tail (21 Nov) 19908 – LVN from 16 Nov 19936 – 2 ATR (FA 19813) 19976 – Swing High (17 Oct) |

| Down |

| 19839 – dPOC from 21 Nov 19813 – FA from 20 Nov 19781 – Gap mid (20 Nov) 19750 – VPOC (20 Nov) 19718 – Swing Low (20 Nov) |

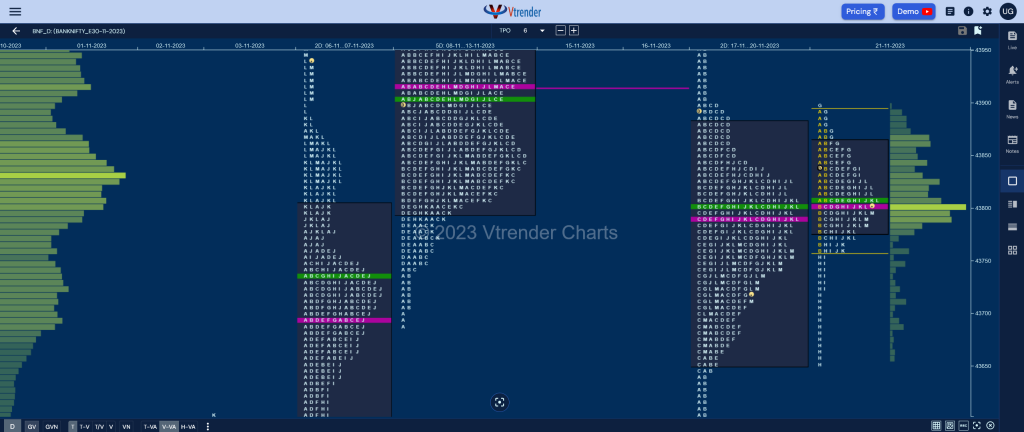

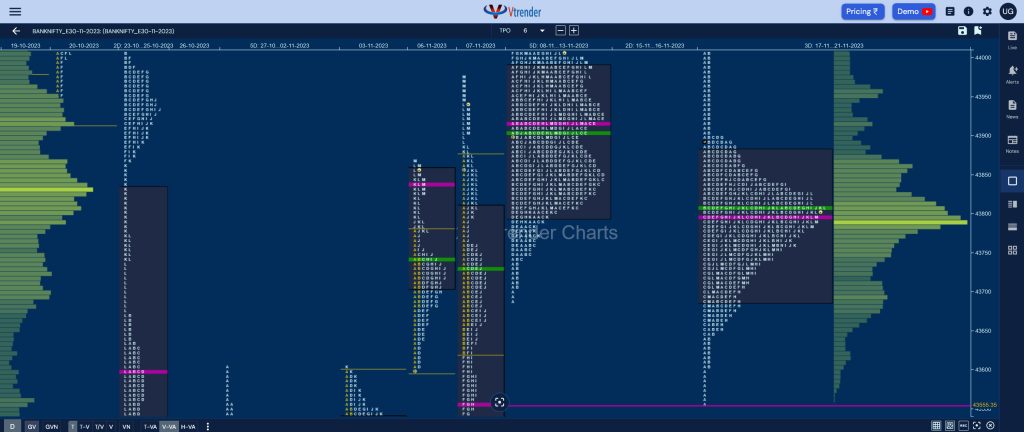

BankNifty Nov F: 43791 [ 43897 / 43655 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 8,274 contracts |

| Initial Balance |

|---|

| 127 points (43891 – 43763) |

| Volumes of 23,723 contracts |

| Day Type |

|---|

| Neutral Centre – 242 points |

| Volumes of 95,023 contracts |

BNF opened higher and made a look up above the 2-day composite VAH of 43881 but could not sustain and probed lower for the rest of the Initial Balance (IB) breaking below the 2-day POC of 43789 while making a low of 43763 in the B period after which it began to coil with the range contracting till the F TPO.

The auction then made an attempt to extend the IB on the upside in the G period where it made new highs of 43897 but once again did not get any demand above the 2-day Value and made an entry back into it triggering the 80% Rule which it completed with a swipe lower in the H TPO where it made a low of 43655 taking support just above the VAL of 43653 and giving an equally quick rebound to day’s VWAP leaving a PBH at 43838 in the I period.

The closing TPOs from J to M remained inside the I period range once again coiling as BNF built the highest volumes of the day at 43803 and closed around it leaving a Neutral Centre profile which looked like was filling up the 2-day balance making it a smoother Gaussian Curve so now we have the 3-day composite Value at 43686-43795-43880 and are currently right in the middle so will need some initiative volumes in the coming session(s) for a move away from here. (Click here to view the composite only on Vtrender Charts)

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 43803 F and VWAP of the session was at 43809

- Value zones (volume profile) are at 43781-43803-43865

- BNF confirmed a FA at 43897 on 21/11 and the 1 ATR objective on the downside comes to 43544.

- HVNs are at 42928 / 43184 / 43832** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 22nd Nov 2023

| Up |

| 43838 – PBH from 21 Nov 43920 – B TPO VWAP (17 Nov) 44010 – Selling Tail (17 Nov) 44124 – 1 ATR from yPOC (43803) 44262 – HVN from 16 Nov |

| Down |

| 43795 – 3-day POC (17-21 Nov) 43686 – 3-day VAL (17-21 Nov) 43555 – VPOC from 07 Nov 43423 – Gap mid-point (03 Nov) 43304 – VPOC from 02 Nov |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.