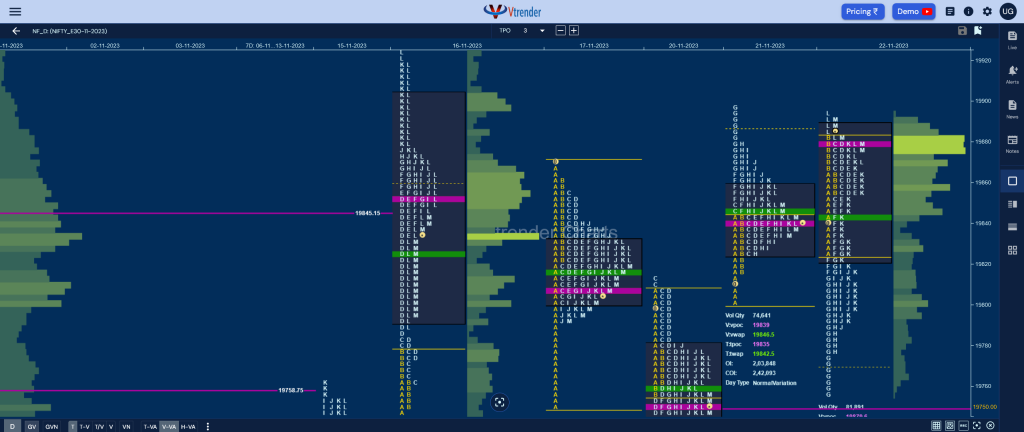

Nifty Nov F: 19884 [ 19894 / 19755 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 4,475 contracts |

| Initial Balance |

|---|

| 55 points (19881 – 19826) |

| Volumes of 11,252 contracts |

| Day Type |

|---|

| Neutral Extreme – 139 points |

| Volumes of 81,891 contracts |

NF opened in previous value taking support just above yVAL of 19825 in the opening minutes and probed higher for the rest of the Initial Balance (IB) as it tested the selling tail from 19879 to 19898 but could only manage to tag 19881 indicating lack of demand in this zone after which it began to coil further between yPOC of 19839 & IBH till the E period.

The sellers then made a move starting in the F TPO where they not only broke below 19839 but also made new lows for the day at 19815 and went on to follow it up with another big RE in the G period as it took out the FA reference of 19813 and went on to make a low of 19755 completing the 2 IB objective of the day and stalling right above 20th Nov’s VPOC of 19750.

The auction then left a small responsive buying tail signalling profit booking after which it consolidated below the IBL forming another mini balance before the killer K TPO made a big move not only getting back into the IB and swipiing through previous Value but followed it up with new highs for the day at 19894 in the L period and saw big volumes coming in at 19879 as the dPOC shifted there into the close leaving a Neutral Extreme Day Up.

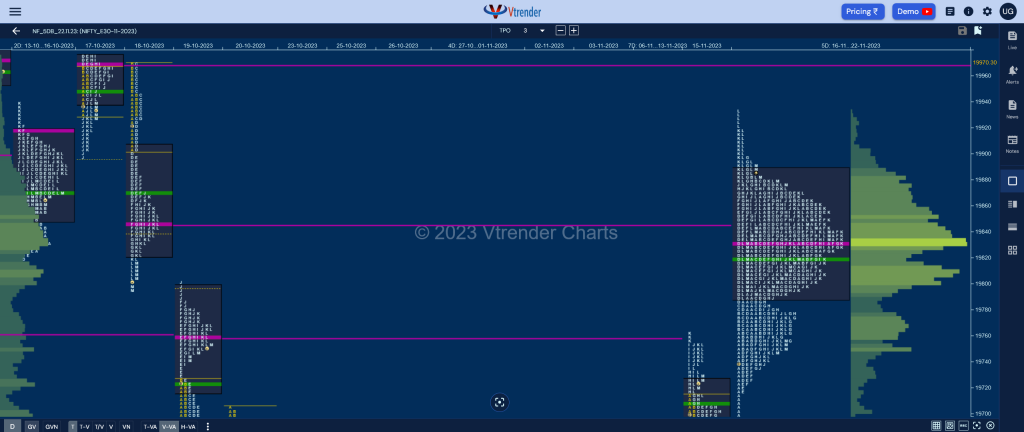

NF spent the fourth session inside the 16th Nov elongated Trend Day profile testing both the extremes and has formed a nice 5-day composite with Value at 19789-19832-19888 and looks good for a move away from this balance in the coming session(s) provided we get a strong open with initiative volumes. (Click here to view the composite only on Vtrender Charts)

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19879 F and VWAP of the session was at 19843

- Value zones (volume profile) are at 19823-19879-19889

- NF confirmed a FA at 19813 on 20/11 but could not tag the downside 1 ATR objective as it got negated at open on 21/11 and closed above it opening the 1 ATR upside target of 19936 but broke below it on 22/11 making it invalid

- NF confirmed a FA at 19385 on 06/11 and tagged the 2 ATR objective of 19704 on 15/11

- HVNs are at 19129 / 19213 / 19486** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 23rd Nov 2023

| Up |

| 19888 – 5-day VAH (16-22 Nov) 19908 – LVN from 16 Nov 19940 – 1 ATR from 19832 19976 – Swing High (17 Oct) 20007 – SOC from 22 Sep |

| Down |

| 19879 – dPOC from 22 Nov 19843 – NeuX VWAP (22 Nov) 19818 – SOC from 22 Nov 19778 – Buying tail (22 Nov) 19750 – VPOC (20 Nov) |

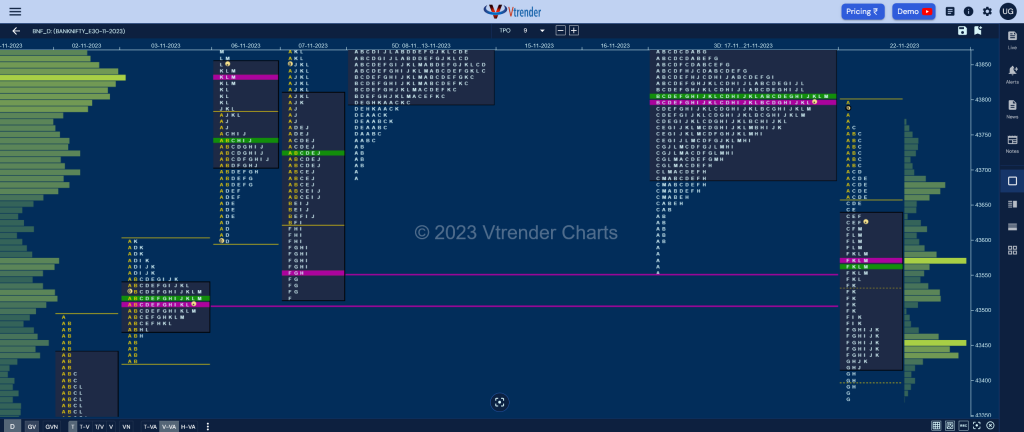

BankNifty Nov F: 43588 [ 43795 / 43375 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 9,456 contracts |

| Initial Balance |

|---|

| 134 points (43795 – 43661) |

| Volumes of 19,401 contracts |

| Day Type |

|---|

| Double Distribution – 420 points |

| Volumes of 2,05,507 contracts |

BNF also opened in previous Value but made it’s intension clear with an almost OH (Open=High) start right at the 3-day composite POC of 43795 and broke below the VAL of 43686 while making a low of 43666 in the A period but made a small bounce getting back to 43754 in the B TPO after which it made a typical C side false move to 43759 which was swiftly rejected triggering a fresh move to the downside and resulting in new lows for the day at 43615.

The auction then took a pause forming a narrow range in the D & E periods where it remained inside the range of C before the sellers struck back once again in the F TPO making a huge RE lower breaking below the twin VPOCs of 43555 & 43514 (07th & 03rd Nov) and went on to repair the poor lows of 43430 from 03rd Nov while making new lows of 43375 in the G which also marked the completion of the 3 IB target for the day.

Having completed a major objective, BNF then formed a mini balance till the J period with volumes building at 43435 signalling that the shorts were booking out and made a good bounce higher in the closing TPOs from K to M negating the zone of singles from the F as it got above the extension handle of 43615 while hitting 43627 leaving a Double Distribution Day Down but with the singles being breached into at the close.

Click here to view the latest profile in BNF on Vtrender Charts

Weekly Settlement (16th to 22nd Nov) : 43587 [ 44552 / 43375 ]

BNF opened the week with a probe higher as it hit new highs for the series at 44552 but ended up forming a Neutral profile with a prominent POC at 44459 after which it made a gap down below the important weekly VWAP reference of 44082 and formed a 3-day balance with completely lower Value and a prominent POC at 43795 from where it gave another move away to the downside making new lows for the week at 43375 leaving an elongated 1178 point range Double Distribution profile to the downside which was also an Outside Bar but saw the weekly POC shift lower to 43570 which means that the sellers may have booked out. This week’s Value was completely lower at 43506-43570-43967 with the VWAP at 43834 which will be the important reference on the upside for the final settlement week of the November series along with the DD zone from 44010 to 44214.

Daily Zones

- Largest volume (POC) was traded at 43569 F and VWAP of the session was at 43560

- Value zones (volume profile) are at 43419-43569-43635

- BNF confirmed a FA at 43897 on 21/11 and tagged 1 ATR objective of 43544 on 22/11. The 2 ATR target on the downside comes to 43191

- HVNs are at 42928 / 43184 / 43832** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 23rd Nov 2023

| Up |

| 43631 – LVN from 22 Nov 43760 – Selling Tail (22 Nov) 43834 – Weekly DD VWAP 43920 – B TPO VWAP (17 Nov) 44010 – Selling Tail (17 Nov) |

| Down |

| 43569 – dPOC from 22 Nov 43488 – SOC from 22 Nov 43395 – Buying tail (22 Nov) 43304 – VPOC from 02 Nov 43146 – LVN from 02 Nov |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.