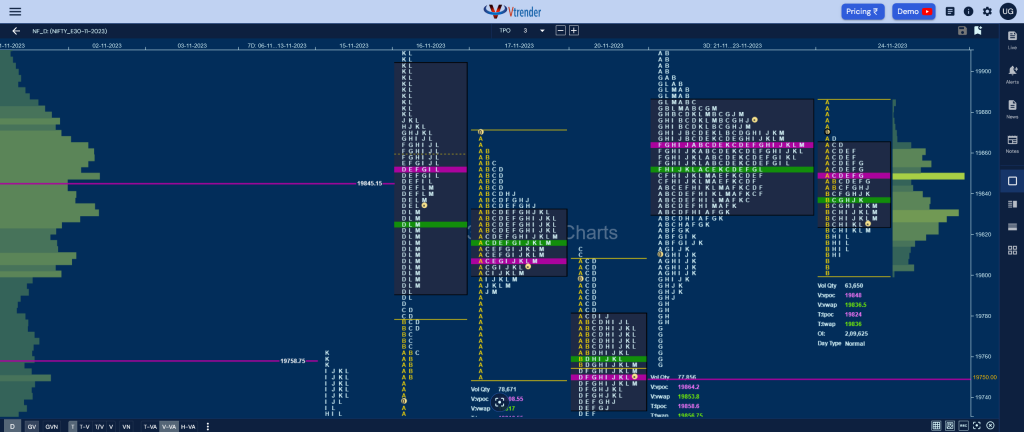

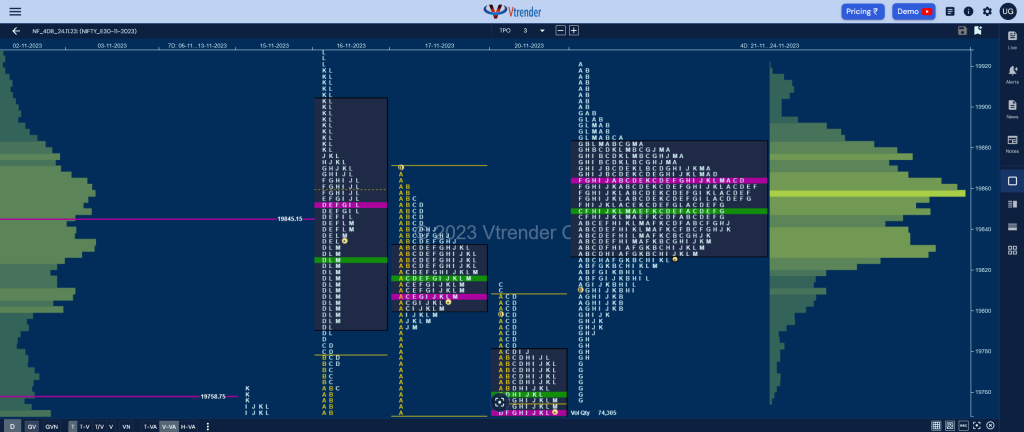

Nifty Nov F: 19827 [ 19885 / 19800 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 5,006 contracts |

| Initial Balance |

|---|

| 85 points (19885 – 19800) |

| Volumes of 17,497 contracts |

| Day Type |

|---|

| Normal – 85 points |

| Volumes of 63,650 contracts |

NF made an OAIR start and tested the 3-day VAH of 19884 while making a high of 19885 and failed to get fresh demand triggering a probe lower as it not only completed the 80% Rule in the balanced profile but went on break below 22nd Nov’s SOC of 19818 to hit 19800 in the B period forming a relatively large range of 85 points in the Initial Balance.

However, the auction failed to get initiative selling at the lows which meant it was still not ready to start a new imbalance as it first went on to leave a PBH at 19868 in the D TPO where it failed to sustain above the composite POC of 19864 and made way for a slow probe lower leaving a PBL at 19809 in the H period after which it contracted the range even further forming a 3-1-3 profile and a Normal Day.

The balance continued to develop on the 4th day and we now have a smoother Gaussian Curve which looks complete with the Value at 19828-19863-19883 and NF has a very good chance to give a move away from here in the coming session(s) but on the condition that it gets initiative acitivity at one of the ends. (Click here to view the composite only on Vtrender Charts)

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19848 F and VWAP of the session was at 19836

- Value zones (volume profile) are at 19826-19848-19836

- NF confirmed a FA at 19385 on 06/11 and tagged the 2 ATR objective of 19704 on 15/11

- HVNs are at 19129 / 19213 / 19486** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 28th Nov 2023

| Up |

| 19848 – dPOC from 24 Nov 19883 – 4-day VAH (21-24 Nov) 19917 – Selling Tail (23 Nov) 19952 – 1 ATR (yPOC 19848) 20007 – SOC from 22 Sep |

| Down |

| 19809 – Buying Tail (24 Nov) 19750 – VPOC (20 Nov) 19718 – Swing Low (20 Nov) 19687 – VPOC (15 Nov) 19640 – 2 ATR (yPOC 19848) |

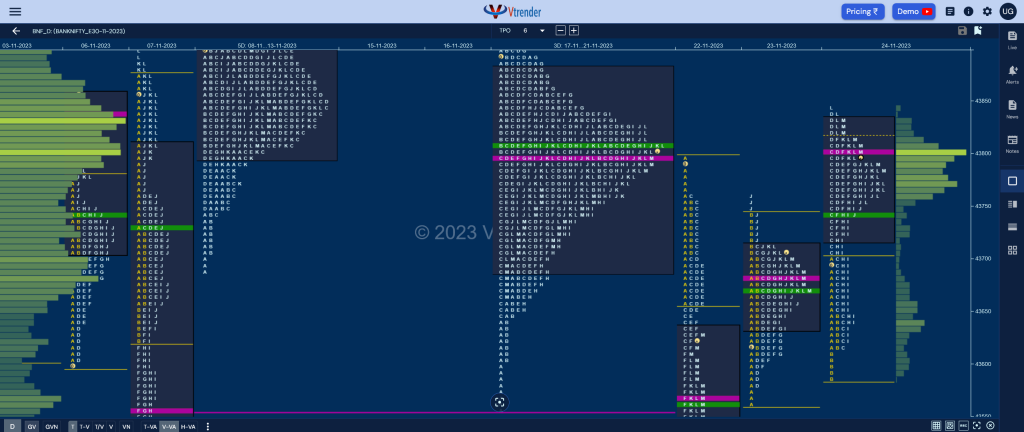

BankNifty Nov F: 43805 [ 43845 / 43586 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 6,059 contracts |

| Initial Balance |

|---|

| 114 points (43700 – 43586) |

| Volumes of 17,497 contracts |

| Day Type |

|---|

| Normal Variation – 259 points |

| Volumes of 99,064 contracts |

BNF made yet another quiet open in previous Value and went on to probe below it in the IB (Initial Balance) while making a low of 43586 in the B period taking support right above yesterday’s buying tail from 43581 and went on to make a huge C side extension to the upside tagging the 21st Nov VPOC of 43803 (3-day composite POC from 17th to 21st Nov was also at 43795) while making a high of 43811.

The auction made higher highs of 43839 in the D TPO where it tested the weekly VWAP of 43834 but could not sustain above it and in fact got some fresh supply coming back resulting in a probe lower and a break of day’s VWAP in the H period which was followed by a lower low of 43625 in the I where it saw demand coming back just above the IB singles of 43616 to 43586 triggering a swift move back above VWAP which in turn led to higher highs over the next 3 TPOs.

BNF made a marginal fresh RE in the L TPO hitting 43845 but once again could not sustain and closed around the dPOC of 43800 leaving a Normal Variation Day Up with completely higher Value for the second consecutive session but has previous selling references here at 43844 & 43920 which it will need to take out for a probe towards the selling tail from 44010 to 44066 from 17th Nov whereas on the downside, today’s VWAP of 43743 along with I period POC of 43724 will be the immediate support below which it can test today’s buying tail from 43616.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 43800 F and VWAP of the session was at 43743

- Value zones (volume profile) are at 43716-43800-43834

- BNF confirmed a FA at 43897 on 21/11 and tagged 1 ATR objective of 43544 on 22/11. The 2 ATR target on the downside comes to 43191

- HVNs are at 42928 / 43184 / 43832** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 28th Nov 2023

| Up |

| 43839 – Selling tail (24 Nov) 43920 – B TPO VWAP (17 Nov) 44010 – Selling Tail (17 Nov) 44124 – 1 ATR from VPOC (43803) 44262 – HVN from 16 Nov |

| Down |

| 43800 – dPOC from Nov 43724 – I TPO POC (24 Nov) 43616 – Buying Tail (24 Nov) 43488 – SOC from 22 Nov 43395 – Buying tail (22 Nov) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.