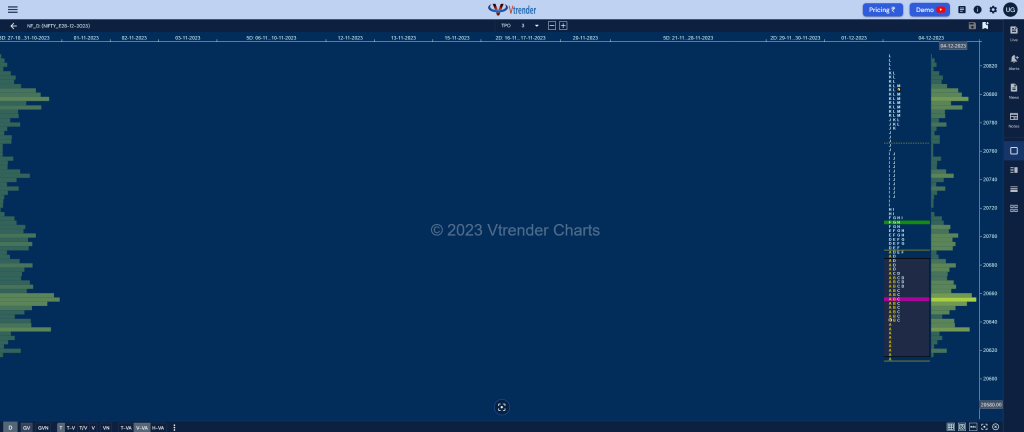

Nifty Dec F: 20799 [ 20828 / 20615 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 33,335 contracts |

| Initial Balance |

|---|

| 75 points (20690 – 20615) |

| Volumes of 55,664 contracts |

| Day Type |

|---|

| Trend Day – 213 points |

| Volumes of 1,46,319 contracts |

NF opened with a large 265 point gap up and formed a 75 point range Initial Balance (IB) and understandably took a pause as it remaned in it for the C side but then began an OTF (One Time Frame) probe higher from the D period which became stronger from the I TPO where it left an extension handle at 20718 and followed it with another one at 20757 in the J completing the 2 IB objective of 20765 for the day.

However, the auction was not done yet and went on to make higher highs in the K & L periods also where it hit 20828 falling just short of the 3 IB mark of 20839 and saw some profit booking by the longs as it gave a quick retracement down to 20778 forming a HVN at 20797 where it eventually closed.

The day’s profile is an elongated Trend One Up with a pretty long initiative buying tail from 20640 to 20375 which will be the main demand zone going forward for the December series along with today’s VWAP of 20711 whereas on the upside, NF will need to show fresh demand above 20797 to continue higher failing which it can begin to form a balance between the above 2 levels in the coming session(s).

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 20655 F and VWAP of the session was at 20711

- Value zones (volume profile) are at 20619-20655-20711

- HVNs are at NA** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 20270

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

Business Areas for 05th Dec 2023

| Up |

| 20802 – Selling tail (04 Dec) 20855 – Monthly ATR (19849) 20913 – 2 ATR (yPOC 20655) 20957 – 1 ATR from PDH |

| Down |

| 20797 – Closing HVN (04 Dec) 20757 – Ext Handle (04 Dec) 20711 – Trend Day VWAP (04 Dec) 20674 – D TPO POC (04 Dec) 20635 – A TPO POC (04 Dec) |

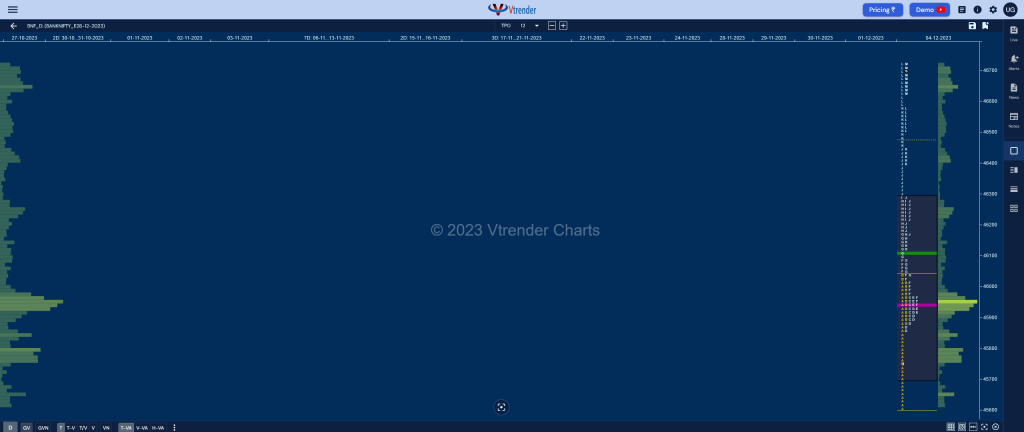

BankNifty Nov F: 46659 [ 46725 / 45602 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 66,500 contracts |

| Initial Balance |

|---|

| 433 points (46035 – 45602) |

| Volumes of 1,06,607 contracts |

| Day Type |

|---|

| Trend Day – 1123 points |

| Volumes of 2,62,850 contracts |

BNF looked the stronger of the 2 indicies as it not only opened higher by huge 679 points but continued to drive up making new highs of 46038 in the B TPO as it left an intimidating A period buying tail from 45887 to 45602 and similar to NF had a quiet inside bar in the C side as it caught up on some breath.

The auction then made a test of day’s VWAP in the D but got swiftly rejected leaving a PBL at 45856 triggering a massive trending move higher for the rest of the day as it first left couple extension handles at 46080 & 46289 and recorded new ATH of 46444 in the J period after which it gave another big move into the close while making new highs of 46574 in the K TPO before spiking higher to 46725.

BNF has also left an elongated 1123 point Trend Up profile with a close in imbalance which can expected to continue at the open in the next session after which it could begin to form a balance for the rest of this weekly settlement before giving the next move away on 08th Dec when the RBI Policy is scheduled. The immediate extension handle of 46444 along with today’s VWAP of 46128 would be the levels to watch on the downside whereas on the upside, it can keep flying in this unchartered teritory which it has never been before as long as it remains above the spike zone from 46574 to 46725.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 45950 F and VWAP of the session was at 46128

- Value zones (volume profile) are at 45748-44950-46442

- HVNs are at NA (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 44720

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

Business Areas for 05th Dec 2023

| Up |

| 46689 – M TPO VWAP (04Dec) 46787 – Weekly 2 ATR (yPOC 44611) 46944 – 2 ATR (yVWAP 46128) 47052 – 1 ATR (HVN 46644) 47133 – 1 ATR from PDH |

| Down |

| 46644 – Closing HVN (04 Dec) 46574 – Ext Handle (04 Dec) 46444 – Ext Handle (04 Dec) 46289 – Ext Handle (04 Dec) 46128 – Trend Day VWAP (04 Dec) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.