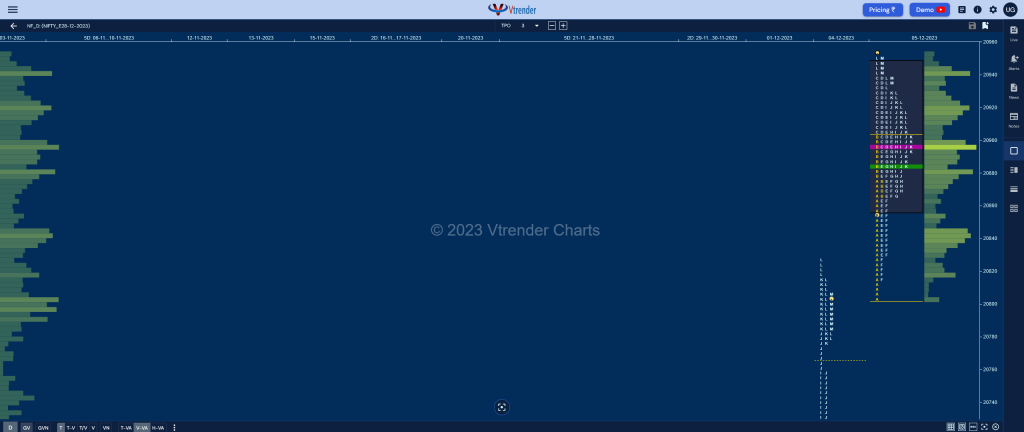

Nifty Dec F: 20942 [ 20955 / 20802 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 17,277 contracts |

| Initial Balance |

|---|

| 100 points (20902 – 20802) |

| Volumes of 37,546 contracts |

| Day Type |

|---|

| Normal Variation – 153 points |

| Volumes of 1,31,822 contracts |

NF opened higher but made a probe back into previous range taking support right at the M TPO POC of 20802 showing change of polarity at this level reversing the probe to the upside as it went on to form a 100 point Initial Balance (IB) and even made a good C side extension to 20938 which was followed by marginal new highs of 20940 in the D indicating exhaustion.

The auction then broke below day’s VWAP in the E period triggering a deeper retracement down to 20815 in the F as it manage to hold the morning buying tail which was a sign that the demand was coming back which in turn led to a slow OTF (One Time Frame) probe higher for the rest of the day as it repaired the poor highs of morning and completed the 1.5 IB target of 20953 while making a high of 20955 into the close.

NF yet again closed in an imbalance so has a good chance of continuing this upmove in the coming session although the momentum has slowed down a bit which is expected after the huge rise it has had over the past 6 sessions with today’s VWAP of 20884 along with buying tail of 20815 being the levels to watch on the downside.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 20896 F and VWAP of the session was at 20884

- Value zones (volume profile) are at 20856-20896-20948

- HVNs are at 20377 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 20270

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

Business Areas for 06th Dec 2023

| Up |

| -NA- |

| Down |

| -NA- |

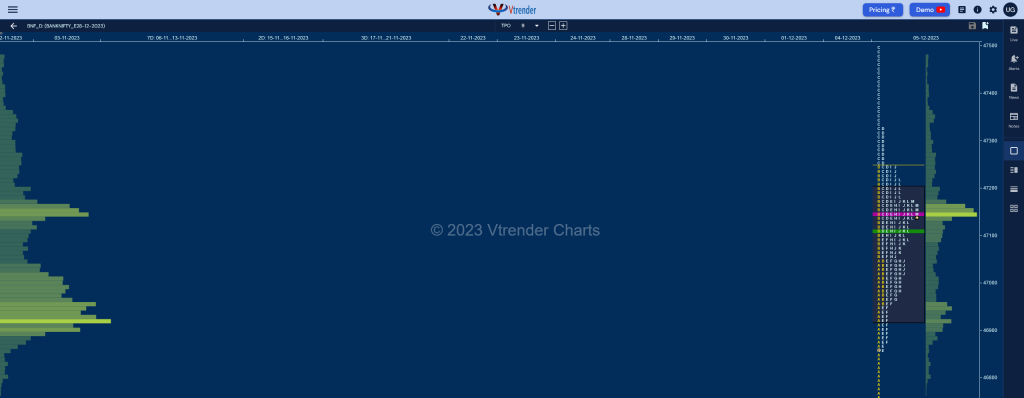

BankNifty Nov F: 47152 [ 47493 / 46749 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 27,821 contracts |

| Initial Balance |

|---|

| 499 points (47248 – 46749) |

| Volumes of 69,444 contracts |

| Day Type |

|---|

| Normal Variation (3-1-3) – 745 points |

| Volumes of 2,46,726 contracts |

BNF also made a gap up open of almost 200 points and made a dip to 46749 taking support at the gap mid-point of 46757 indicating that the upside momentum was still strong as it went on to leave an extension handle at 47045 and recorded new ATH of 47248 in the B period and followed it up with a big extension to 47493 in the C side almost tagging the 1.5 IB objective of the day which was at 47498.

The D period however got back into the IB (Initial Balance) leaving a long responsive selling tail at the top indicating longs had begun to take profits and more confirmation of this came as the auction broke below day’s VWAP in the E TPO negating the extension handle of 47045 and making a quick drop down to 46860 holding the A period singles as it confirmed a PBL there.

BNF then made a slow probe higher scaling back above VWAP in the H TPO and tagging the IBH of 47428 in the I but could not find any fresh demand as it left similar highs and made a quiet close right at the dPOC of 47147 leaving a nice 3-1-3 profile for the day marking the end of the upside imbalance and the possible start of a balance in the coming session(s) unless it gets fresh initiative buying in today’s selling singles from 47325 to 47493.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 47147 F and VWAP of the session was at 47112

- Value zones (volume profile) are at 46917-47147-47197

- HVNs are at 45127 / 47125 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 44720

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

Business Areas for 06th Dec 2023

| Up |

| – NA – |

| Down |

| – NA – |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.