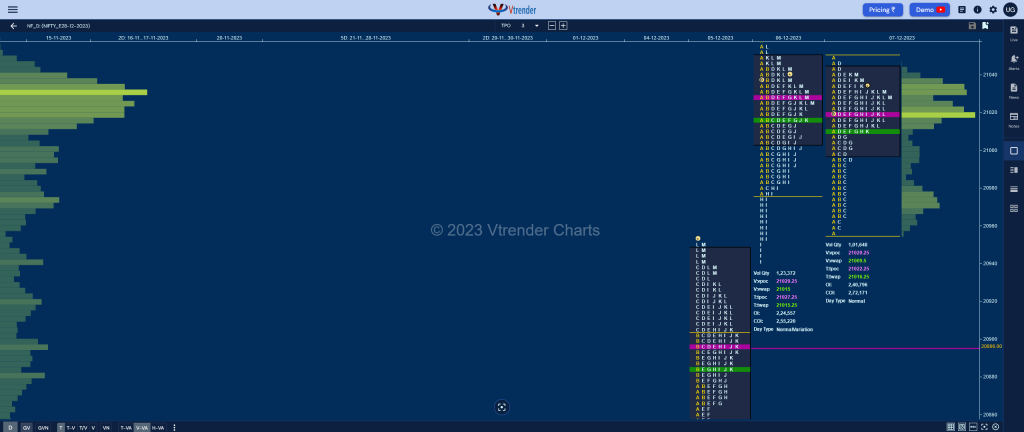

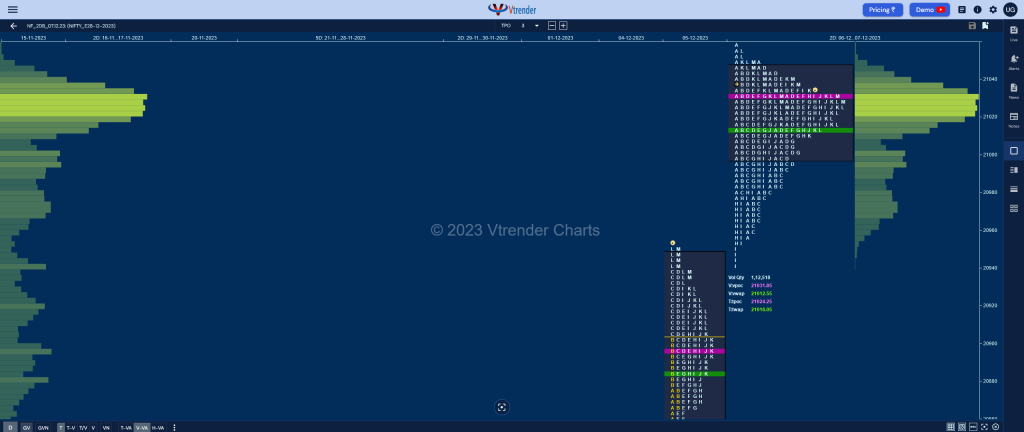

Nifty Dec F: 21030 [ 21048 / 20956 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 12,208 contracts |

| Initial Balance |

|---|

| 73 points (21029 – 20956) |

| Volumes of 28,491 contracts |

| Day Type |

|---|

| Normal (Inside) – 92 points |

| Volumes of 1,01,648 contracts |

NF made a rare OAIR start (first one of the Dec series) stalling right at yPOC of 21029 from where it made a swipe below previous Value while making a low of 20956 but could not take out the mini buying tail from 20953 to 20941 forming a narrow 31 point range inside bar in the B TPO. (P.S: Though there was a freak tick at 21048 at open, OF did not show any volumes above 21029)

The C side then did what it does best making a look down below B but getting rejected triggering a short covering squeeze into the D period where the auction made new highs for the day at 21046 but failed to get fresh demand and this lack of OTF (Other Time Frame) players then caused it to remain inside the range of D for the rest of the day building volumes at 21020 and leaving an inside bar plus a Normal Day.

We have had completely overlapping Value for the first time this series resulting in a 2-day Gaussian Curve with Value at 20999-21031-21047 and a close right at the POC so there is a good chance of a move away from here in the coming session(s) provided it is backed by initiative volumes with the PLR (Path of Least Resistance) still very much to the upside. (Click here to view the composite only on Vtrender Charts)

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21020 F and VWAP of the session was at 21009

- Value zones (volume profile) are at 20998-21020-21042

- HVNs are at 20377 / 21032** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 20270

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

Business Areas for 08th Dec 2023

| Up |

| 21047 – 2-day VAH (06-07 Dec) 21075 – 1 ATR from 20941 21111 – 2 ATR (HVN 20845) 21163 – 1 ATR (POC 21031) 21209 – 2 ATR from 20941 |

| Down |

| 21009 – VWAP from 07 Dec 20960 – Buying tail (07 Dec) 20931 – LVN from 05 Dec 20896 – VPOC from 05 Dec 20845 – HVN from 05 Dec |

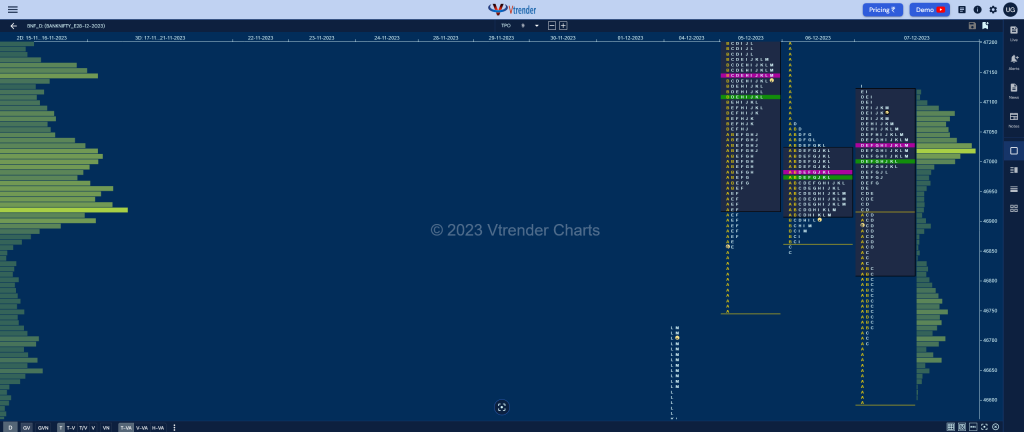

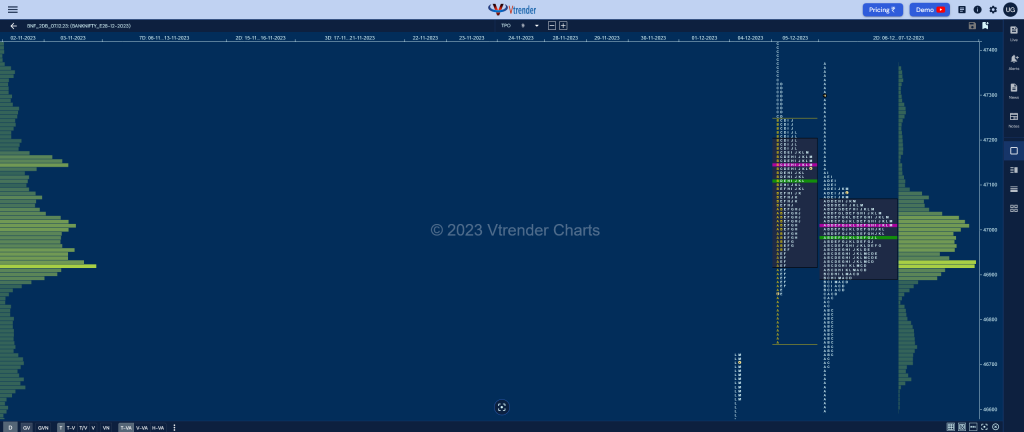

BankNifty Nov F: 46926 [ 47367 / 46845 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 26,002 contracts |

| Initial Balance |

|---|

| 309 points (46909 – 46600) |

| Volumes of 43,176 contracts |

| Day Type |

|---|

| Normal Variation – 525 points |

| Volumes of 1,23,436 contracts |

BNF opened right at previous VAL and seemed to give a drive down breaking below 05th Dec’s low of 46749 and tagging the closing HVN of 46644 from 04th Dec while making a low of 46600 taking support just above the extension handle of 46574 and all this action happened in the first 5 minutes of the day after which it got back above day’s VWAP at the close of A period and settled down into a narrow 99 point range inside bar in the B TPO leaving tails at both ends at the close of the Initial Balance.

The auction then made a typical C side probe below VWAP checking for fresh supply but failed to find any and was swiftly rejected leaving a PBL at 46700 triggering a RE (Range Extension) to the upside as it got back into previous day’s Value and promptly completed the 80% Rule with the D period making new highs of 47110 followed by marginal new highs of 47120 in the E TPO signalling absorbtion of selling from this old zone.

BNF consolidated and remained inside the range of E period for the rest of the day except for an attempt it made in the I TPO to probe higher but could only manage 47125 as it built the highest volumes for the day at 47026 and closed just above it leaving a ‘p’ shape kind of a profile with completely overlapping Value so the combination of a ‘b’ plus ‘p’ over the last 2 sessions means it is currently in a balance with the 2-day composite Value at 46894-47012-47063 and the structure is also a 3-1-3 profile with sellers being seen in the zone above 47125 to 47400 whereas on the downside, demand came back at 46830 levels yesterday which will be the immediate reference below which we have the buying singles from 46700 to 46600. (Click here to view the composite only on Vtrender Charts)

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 47026 F and VWAP of the session was at 46999

- Value zones (volume profile) are at 46816-47026-47118

- HVNs are at 45127 / 47012** / 47147 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 44720

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

Business Areas for 08th Dec 2023

| Up |

| 47063 – 2-day VAH (06-07 Dec) 47216 – IB Singles mid (06 Dec) 47400 – C TPO POC (05 Dec) 47502 – 1 ATR (yPOC 47026) 47650 – Weekly 2 IB |

| Down |

| 46999 – VWAP from 07 Dec 46831 – SOC from 07 Dec 46700 – Buying Tail (07 Dec) 46574 – Ext Handle (04 Dec) 46444 – Ext Handle (04 Dec) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.