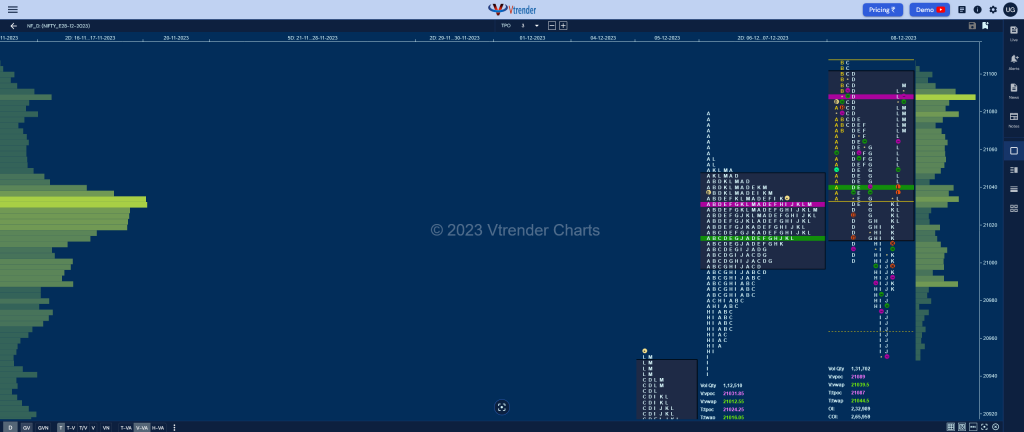

Nifty Dec F: 21075 [ 21106 / 20949 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 8,033 contracts |

| Initial Balance |

|---|

| 69 points (21104 – 21035) |

| Volumes of 23,870 contracts |

| Day Type |

|---|

| Neutral – 158 points |

| Volumes of 1,31,702 contracts |

NF made an Open Auction start sustaining above the composite POC of 21031 as it made a low of 21035 and probed higher scaling above the reference of 21075 to hit new highs of the series at 21104 in the B period after which it made the dreaded C side extension to 21106 and failed to get fresh demand forcing even the morning buyers to book profits as the dPOC shifted higher to 21100.

The auction then made a decisive break below day’s VWAP in the D period triggering a quick liquidation break as it almost completed the 80% Rule in the 2-day Value while hitting new lows for the day at 21001 and along with it confirming a FA (Failed Auction) at the top. The defence of VAL then resulted in a bounce back to the SOC (Scene Of Crime) of 21072 but left similar highs at 21075 & 21074 in the E & F TPOs suggesting that the FA was still in play.

NF then got back again into the 2-day Value once again in the G period and this time went on to break below the VAL of 20999 making a fresh RE (Range Extension) in the H TPO and followed it up with a lower low of 20950 in the I as it completed the 1 ATR objective of 20975 from the FA of 21106 but held the small buying tail of the composite leaving similar lows of 20949 in the J indicating downside getting limited.

The K period then gave more confirmation of the auction changing direction as it stopped the sequence of leaving lower highs since D and got back near day’s VWAP which was taken out in the L TPO triggering a quick move higher to 21095 into the close leaving a Neutral Centre Day with overlapping to higher Value with a FA at 21106 and a SOC (Scene Of Crime) at 20977 and one of these 2 levels will need to be taken out in the coming session(s) for a further move in that direction.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21089 F and VWAP of the session was at 21039

- Value zones (volume profile) are at 21013-21089-21099

- NF confirmed a FA at 21106 on 08/12 and tagged the 1 ATR objective of 20975 on same day. The 2 ATR target on downside comes to 20844

- HVNs are at 20377 / 21032** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 20270

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

Business Areas for 11th Dec 2023

| Up |

| 21089 – dPOC from 08 Dec 21111 – 2 ATR (HVN 20845) 21158 – 1 ATR (POC 21032) 21215 – 1 ATR (yPOC 21089) 21264 – Weekly 2 IB |

| Down |

| 21072 – SOC from 08 Dec 21039 – VWAP from 08 Dec 20977 – SOC from 08 Dec 20931 – LVN from 05 Dec 20896 – VPOC from 05 Dec |

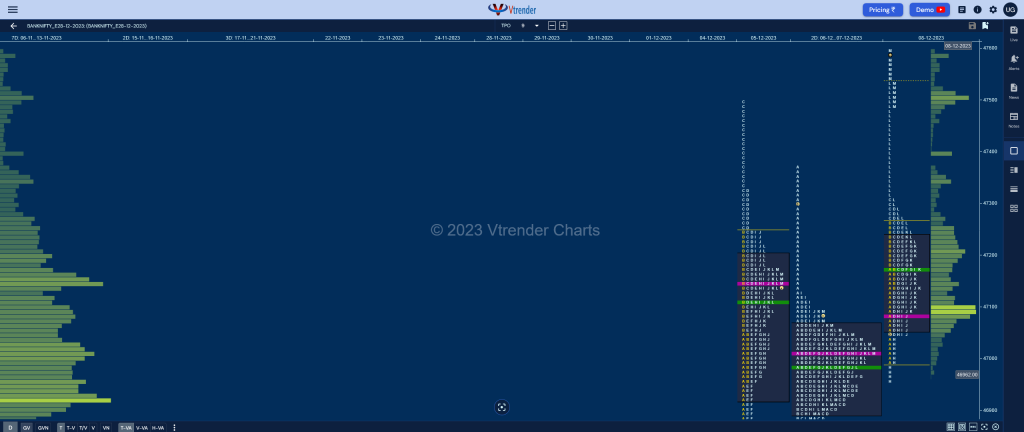

BankNifty Nov F: 47500 [ 47599 / 46961 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 10,106 contracts |

| Initial Balance |

|---|

| 274 points (47265 – 46991) |

| Volumes of 37,330 contracts |

| Day Type |

|---|

| Neutral Extreme – 638 points |

| Volumes of 1,82,335 contracts |

BNF made an OAIR start but gave a move away from the 2-day balance with an A period buying tail from 46991 to 47133 as it scaled above the initiative selling mid-point of 47216 from 06th Dec while making a high of 47265 in the B TPO after which it made the dreaded C side extension to 47312 and was swiftly rejected.

The auction made the customary test of day’s VWAP in the D period and even broke below it triggering a swipe down to 47043 where it got some demand coming back defending the 2-day VAH of 47063 and made a probe back to IBH in the E TPO but could only manage to tag 47272 indicating that the C side supply was defending this zone as it not only made lower lows in the F & G periods but made a RE (Range Extension) to the downside in the H making new lows for the day at 46961.

BNF however left a responsive buying tail in the H period and went on to test day’s VWAP in the I TPO where it left a PBH at 47169 indicating that the sellers were still in control who pushed it back down to 47045 but left similar low of 47044 in the J which also saw the dPOC shift lower to 47087 clearly meaning that the shorts were booking profits.g tail of the composite leaving similar lows of 20949 in the J indicating downside getting limited.

The all important K period then scaled above day’s VWAP and the PBH of 47169 triggering a big squeeze in the L TPO confirming a FA at lows and went onto gain momentum as it not only completed the 1 ATR objective of 47437 but went on to record new ATH of 47599 into the close leaving an ideal Neutral Extreme (NeuX) profile with the NeuX zone low of 47492 & the extension handle of 47311 being the important levels to watch on the downside for the rest of the series along with today’s VWAP of 47171 as the auction looks to make more headway on the upside in this unchartered teritory.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 47087 F and VWAP of the session was at 47171

- Value zones (volume profile) are at 47057-47087-47239

- BNF confirmed a FA at 46961 on 08/12 and tagged the 1 ATR objective of 47437 on same day. The 2 ATR target comes to 47913

- HVNs are at 45127 / 47012** / 47147 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 44720

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

Business Areas for 11th Dec 2023

| Up |

| 47502 – Closing HVN (08 Dec) 47650 – Weekly 2 IB 47789 – Weekly ATR 47913 – 2 ATR (FA 46961) 48077 – 2 ATR (yPOC 47087) |

| Down |

| 47492 – NeuX low (09 Dec) 47395 – L TPO POC (08 Dec) 47311 – Ext Handle (08 Dec) 47171 – NeuX VWAP (08 Dec) 47087 – POC from 08 Dec |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.