Nifty Dec F: 21084 [ 21119 / 21032 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 12,995 contracts |

| Initial Balance |

|---|

| 64 points (21110 – 21046) |

| Volumes of 25,078 contracts |

| Day Type |

|---|

| Neutral Centre – 87 points |

| Volumes of 78,735 contracts |

NF made an Open Auction start testing both sides as it revisted previous session’s FA of 21106 while making a high of 21110 but failed to get fresh demand triggering a probe lower to 21046 where it took support just above yVWAP of 21039 forming a narrow 64 point range Initial Balance as the B TPO remained inside A but in an action replay of last Friday made the dreaded C side extension to 21119.

Needless to say, the auction then not only got back to day’s VWAP but broke below it resulting in new lows for the day at 21040 which also confirmed a fresh FA at highs and followed it with a lower low of 21032 in the D period stopping right at the prominent weekly POC from last settlement marking the end of the downside for the day.

The rest of the day saw a narrow range balance forming as NF left a PBL at 21041 in the G TPO along with a closing PBH at 21106 in the L leaving an ideal Gaussian Curve on the daily timeframe with mini tails at both ends and a prominent POC at 21074 with Value being completely inside Friday’s Neutral profile.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21074 F and VWAP of the session was at 21076

- Value zones (volume profile) are at 21058-21074-21090

- NF confirmed a FA at 21119 on 11/12 and the 1 ATR objective comes to 20993

- NF confirmed a FA at 21106 on 08/12 and tagged the 1 ATR objective of 20975 on same day. This FA got revisted on 11/12 so is no longer a valid reference

- HVNs are at 20377 / 21032** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 20270

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

Business Areas for 12th Dec 2023

| Up |

| 21093 – L TPO VWAP (11 Dec) 21119 – FA from 11 Dec 21158 – 1 ATR (POC 21032) 21199 – 1 ATR (yPOC 21074) 21245 – 1 ATR (FA 21119) |

| Down |

| 21074 – dPOC from 11 Dec 21032 – Previous Day Low 20977 – SOC from 08 Dec 20931 – LVN from 05 Dec 20896 – VPOC from 05 Dec |

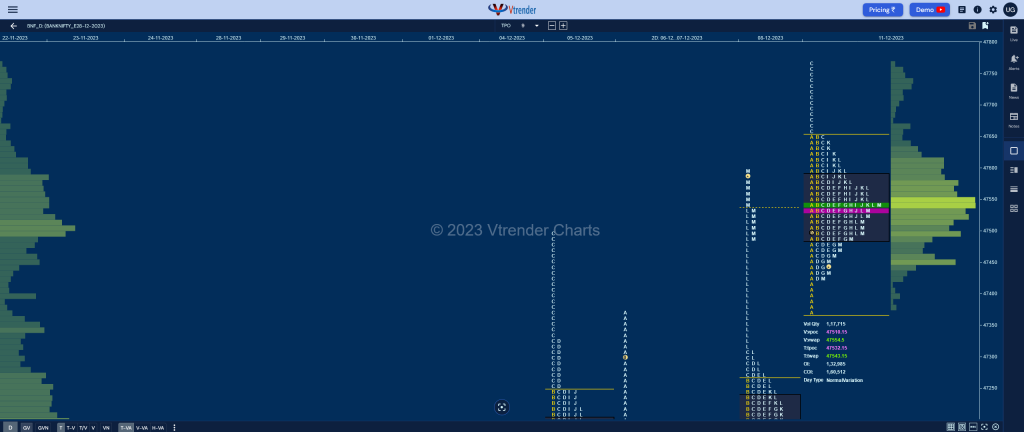

BankNifty Nov F: 47491 [ 47770 / 47368 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 18,888 contracts |

| Initial Balance |

|---|

| 282 points (47650 – 47368) |

| Volumes of 38,981 contracts |

| Day Type |

|---|

| 3-1-3 profile – 402 points |

| Volumes of 1,32,985 contracts |

BNF also went Open Auction as it first tagged the pending objective of 47650 on the upside and then went on to test the closing zone of singles from previous session’s Neutral Extreme profile which was from 47492 to 47311 while making a low of 47368 where it seemed to have got some fresh demand coming back as could be seen in the quick bounce back to 47650 at the close of Initial Balance.

The auction then made a typical C side extension and a pretty good one at that as it made new ATH of 47770 but similar to what happened on 05th Dec, this upmove turned out to be a fake one fueled more by locals who seem to have got stuck as it immediately made a retracement down to day’s VWAP even swiping below it as these laggard longs were forced out while it left a PBL at 47428 in the D period.

BNF then remained in the narrow range between 47428 and the IBH of 47650 forming a nice 3-1-3 balanced profile for the day with a prominent POC at 47532 and will need to show initiative activity at either the buying tail from 47427 to 42368 or the responsive selling one from 47650 to 47770 for a fresh move in that direction in the coming session(s).

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 47532 F and VWAP of the session was at 47543

- Value zones (volume profile) are at 47492-47532-47590

- BNF confirmed a FA at 46961 on 08/12 and tagged the 1 ATR objective of 47437 on same day. The 2 ATR target comes to 47913

- HVNs are at 45127 / 47012** / 47147 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 44720

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

Business Areas for 12th Dec 2023

| Up |

| 47532 – dPOC from 11 Dec 47650 – Selling tail (11 Dec) 47789 – Weekly ATR 47913 – 2 ATR (FA 46961) 48077 – 2 ATR (yPOC 47087) |

| Down |

| 47450 – HVN from 11 Dec 47311 – Ext Handle (08 Dec) 47171 – NeuX VWAP (08 Dec) 47087 – POC from 08 Dec 46961 – FA from 06 Dec |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.