Nifty Dec F: 21023 [ 21130 / 20991 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 5,740 contracts |

| Initial Balance |

|---|

| 37 points (21130 – 21093) |

| Volumes of 16,374 contracts |

| Day Type |

|---|

| Trend Down – 139 points |

| Volumes of 89,183 contracts |

NF opened higher even scaling above yesterday’s FA of 21119 while recording new ATH of 21130 in the A period but failed to get fresh demand and settled down into an Open Auction forming an ultra narrow range of just 37 points in the Initial Balance as it made a low of 21093 taking support right above previous day’s Gaussian Value.

The auction then made a C side extension to the downside almost swiping through previous Value as it made a low of 21065 and made the customary retracement to day’s VWAP via a swift bounce in the D period but stalled around the dPOC of 21111 as it left a PBH at 21114 and went on to make a fresh extension lower in the H TPO where it not only completed the pending 80% Rule but completed the 2 IB target of 21056 while making a low of 21043.

NF then gave a small bouce back to21085 leaving a fresh PBH right at day’s VWAP in the J period indicating that the sellers were in control and this resulted in a big drop lower in the K & L TPOs which saw the completion of the 3 IB objective of 21019 while making new lows of 20991 before giving a small bouce back to 21033 into the close leaving a Trend Day Down with both range & value forming an outside bar.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21111 F and VWAP of the session was at 21062

- Value zones (volume profile) are at 21031-21111-21121

- NF confirmed a FA at 21119 on 11/12 and the 1 ATR objective comes to 20993. This FA was re-visited on 12/12 but failed to get any demand leaving an initiative selling tail and a probe lower to 20991 completing the 1 ATR objective to the downside.

- NF confirmed a FA at 21106 on 08/12 and tagged the 1 ATR objective of 20975 on same day. This FA got revisted on 11/12 so is no longer a valid reference

- HVNs are at 20377 / 21032** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 20270

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

Business Areas for 13th Dec 2023

| Up |

| 21027 – Closing HVN (12 Dec) 21062 – VWAP from 12 Dec 21111 – dPOC from 12 Dec 21155 – 1 ATR from 21027 21201 – 1 ATR from 21073 |

| Down |

| 21004 – Buying tail (12 Dec) 20977 – SOC from 08 Dec 20931 – LVN from 05 Dec 20896 – VPOC from 05 Dec 20845 – HVN from 05 Dec |

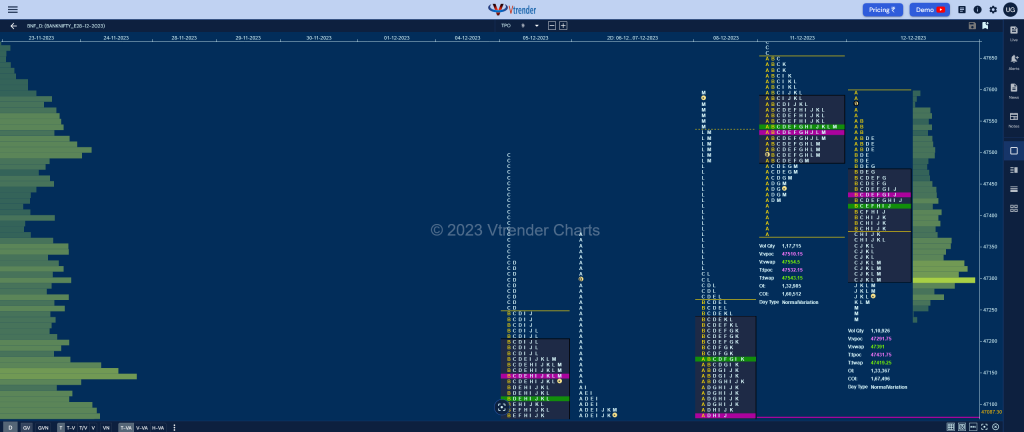

BankNifty Nov F: 47308 [ 47600 / 47237 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 9,588 contracts |

| Initial Balance |

|---|

| 220 points (47600 – 47380) |

| Volumes of 24,079 contracts |

| Day Type |

|---|

| Normal Variation – 362 points |

| Volumes of 1,10,926 contracts |

BNF made an OAIR start making an attempt to probe above previous Value but failed to find fresh demand as it tagged 47600 triggering the 80% Rule which it completed with the help of an extension handle at 47504 in the B period and went on to make a low of 47380 after which it continued with the habit of making a C side move dropping down to 47300 where it tested the 08th Dec buying extension handle of 47311.

The auction then made the typical probe back to VWAP post the C side leaving a nice responsive buying tail at the lows but could only manage to form similar highs at 47526 & 47523 in the D & E TPOs suggesting supply coming back at this yPOC zone after which it remained mostly in the IB range leaving couple of PBHs at 47480 & 47445 in the G & I periods confirming that the PLR remained to the downside.

The J TPO then made a move away from the IB making new lows for the day at 47270 completing the 1.5 IB objective and BNF made a mini spike lower to 47237 into the close leaving a HVN at 47295 suggesting some profit booking coming in by the sellers as it formed completely lower Value on the daily timframe.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 47431 F and VWAP of the session was at 47419

- Value zones (volume profile) are at 47297-47431-47467

- BNF confirmed a FA at 46961 on 08/12 and tagged the 1 ATR objective of 47437 on same day. The 2 ATR target comes to 47913

- HVNs are at 45127 / 47012** / 47147 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 44720

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

Business Areas for 13th Dec 2023

| Up |

| 47364 – SOC from 12 Dec 47445 – PBH from 12 Dec 47548 – Selling Tail (12 Dec) 47650 – Selling tail (11 Dec) 47789 – Weekly ATR |

| Down |

| 47295 – Closing HVN (12 Dec) 47171 – NeuX VWAP (08 Dec) 47087 – POC from 08 Dec 46961 – FA from 06 Dec 46831 – SOC from 07 Dec |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.