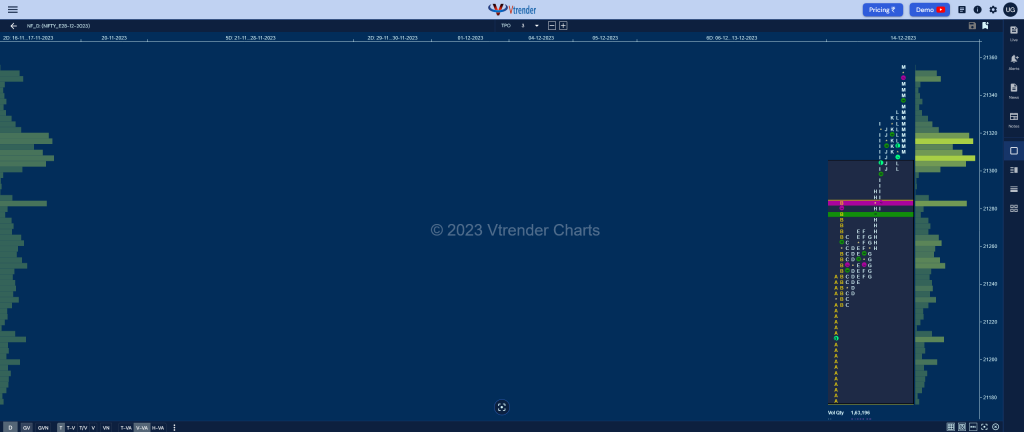

Nifty Dec F: 21327 [ 21355 / 21177 ]

| Open Type |

|---|

| OAOR + Drive (Open Auction Out of Range) |

| Volumes of 27,110 contracts |

| Initial Balance |

|---|

| 105 points (21282 – 21177) |

| Volumes of 53,342 contracts |

| Day Type |

|---|

| DD Trend Up – 178 points |

| Volumes of 1,63,196 contracts |

NF signalled the move away from the 6-day balance it was forming with a big gap up of 179 points plus a Drive higher as it left an initiative buying tail from 21229 to 21177 in the Initial Balance and went on to record new ATH of 21282 after which it made a retracement in the C side as it tested the A period tail with a PBL at 21228 which meant that the buyers were very much in control.

The auction then took a pause coiling in the range of B TPO till the G period before resuming the upmove with a RE in the H and followed it up with an extension handle at 21290 in the I TPO as it got some fresh initiative volumes with even the dPOC shifting higher to 21283 signalling that the buyers are pushing up their base as they hit 21324.

NF then made marginal new highs of 21329 & 21332 in the K & L TPOs but spiked higher to 21355 in the M period closing in an imbalance and a Double Distribution Trend Day Up with a strong chance of this imbalance continuing at the next open.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21282 F and VWAP of the session was at 21277

- Value zones (volume profile) are at 21179-21282-21303

- HVNs are at 20377 / 21032** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 20270

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

Business Areas for 15th Dec 2023

| Up |

| 21332 – Spike low (14 Dec) 21367 – 2 ATR (VPOC – 21111) 21417 – 1 ATR (yPOC – 21283) 21451 – 1 ATR (HVN – 21317) 21520 – Weekly ATR (21088) |

| Down |

| 21317 – HVN from 14 Dec 21277 – DD VWAP (14 Dec) 21228 – Buying Tail (14 Dec) 21177 – PDL 21131 – Singles mid (14 Dec) |

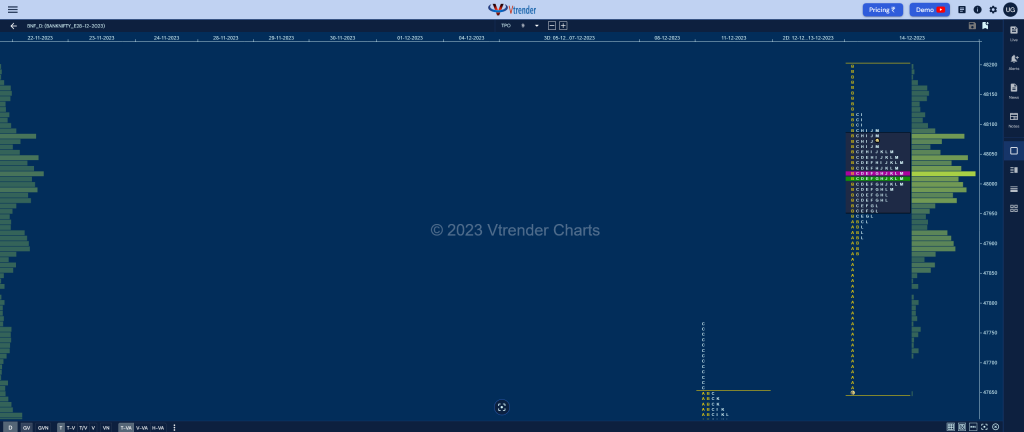

BankNifty Nov F: 48029 [ 48200 / 47650 ]

| Open Type |

|---|

| OAOR + Drive (Open Auction Out of Range) |

| Volumes of 32,259 contracts |

| Initial Balance |

|---|

| 550 points (48200 – 47650) |

| Volumes of 75,946 contracts |

| Day Type |

|---|

| Normal (‘p’ shape) – 550 points |

| Volumes of 1,48,088 contracts |

BNF also made a gap up open of more than 250 points and made an almost OL (Open=Low) start at 47650 which was the selling tail from 11th Dec displaying change of polarity at this important level as it went on to drive higher tagging new ATH of 47940 in the A period and followed it with an equally big move in the B TPO where it went on to hit 48200 forming a large 550 point range Initial Balance.

The auction then formed an inside bar in the C side signalling return of balance and remained in this range for rest of the day leaving a PBH at 48115 in the I period and a PBL at 47914 in the L forming a ‘p’ shape profile and a Normal Day with a prominent POC at 48022 which will be the opening reference for the next open with the PLR firmly to the upside.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48022 F and VWAP of the session was at 48010

- Value zones (volume profile) are at 47960-48022-48080

- BNF confirmed a FA at 46961 on 08/12 and tagged the 2 ATR objective of 47913 on 14/12. This FA is currently on ‘T+5’ day

- HVNs are at 45127 / 47012** / 47147 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 44720

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

Business Areas for 15th Dec 2023

| Up |

| 48051 – M TPO VWAP (14 Dec) 48158 – Selling tail mid (14 Dec) 48225 – 2 ATR (VPOC 47221) 48397 – 2 ATR (HVN 47393) 48533 – 1 ATR (yPOC 48022) |

| Down |

| 48022 – dPOC (14 Dec) 47914 – PBL from 14 Dec 47766 – IB singles mid (14 Dec) 47650 – PDL 47532 – Weekly POC |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.