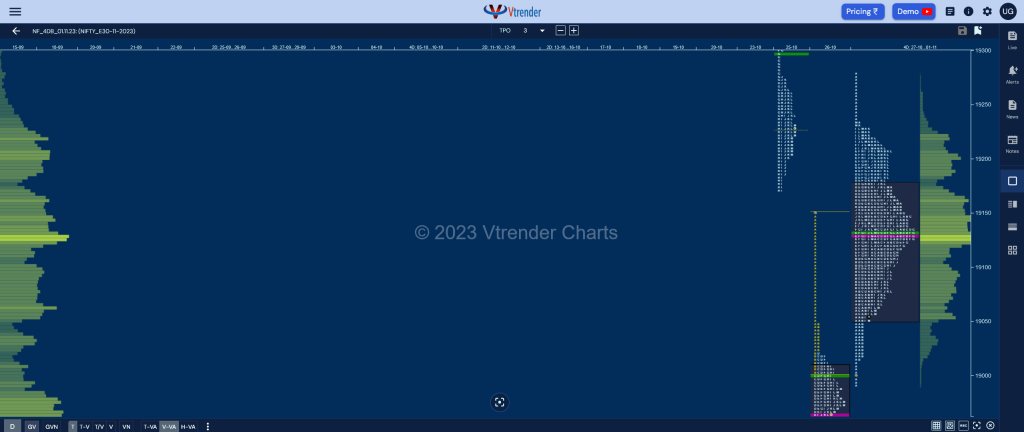

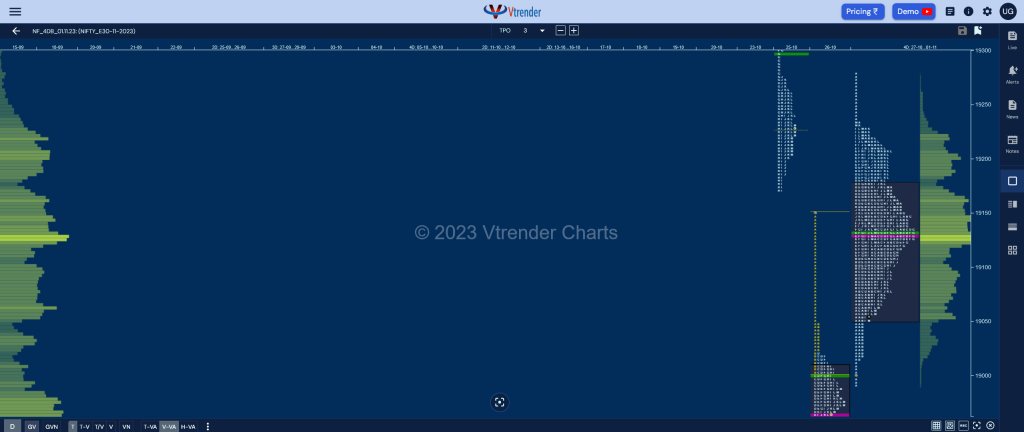

Market Profile Analysis dated 09th November 2023

Nifty Nov F: 19484 [ 19526 / 19471 ] Open Type OAIR (Open Auction In Range) Volumes of 6,938 contracts Poor Initial Balance 47 points (19526 – 19479) Volumes of 17,239 contracts Poor Day Type Normal (Gaussian Curve) – 55 points Volumes of 84,124 contracts Poor NF made an OAIR start completing the 80% Rule to […]

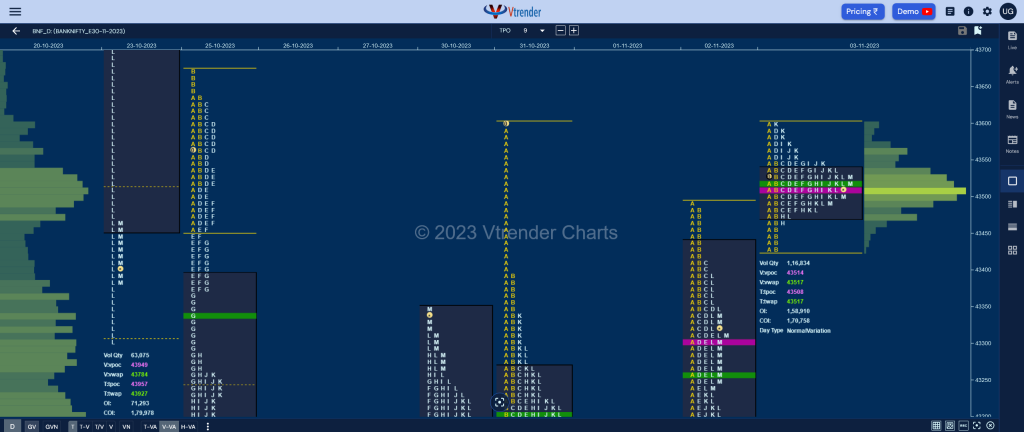

Market Profile Analysis dated 08th November 2023

Nifty Nov F: 19490 [ 19524 / 19467 Open Type OAOR (Open Auction Out of Range) Volumes of 9,102 contracts Poor Initial Balance 39 points (19524 – 19485) Volumes of 20,164 contracts Poor Day Type Normal (Gaussian Curve) – 57 points Volumes of 70,863 contracts Poor NF opened higher and stalled right at 23rd Oct’s Trend […]

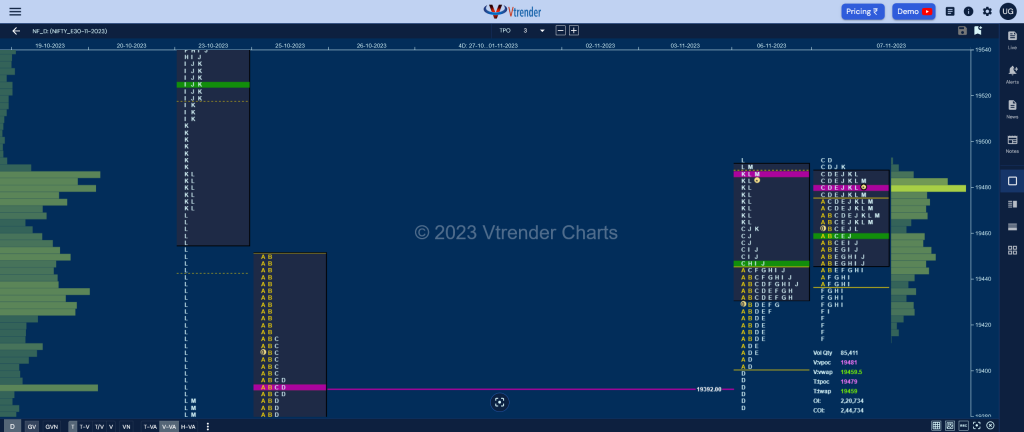

Market Profile Analysis dated 07th November 2023

Nifty Nov F: 19476 [ 19493 / 19415 ] Open Type OAIR (Open Auction In Range) Volumes of 10,813 contracts Poor Initial Balance 37 points (19493 – 19415) Volumes of 19,686 contracts Poor Day Type Neutral Centre – 79 points Volumes of 85,411 contracts Poor NF did not give a follow up to the NeuX (Neutral […]

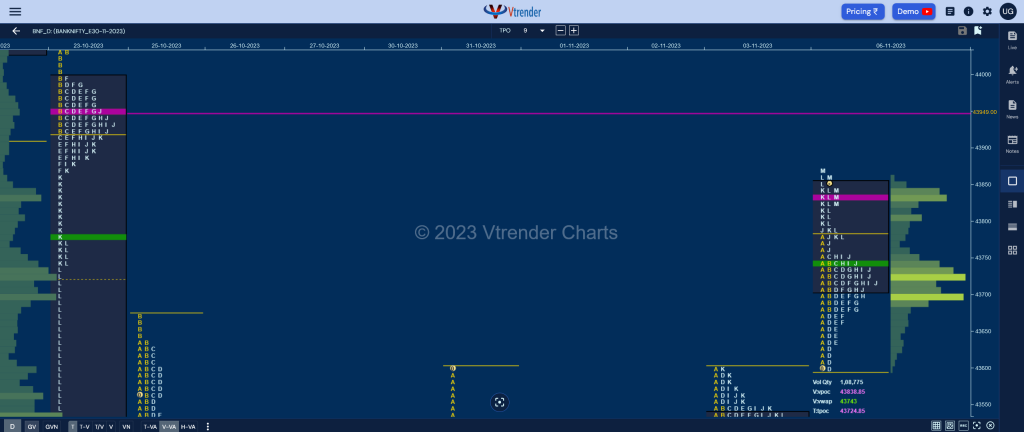

Market Profile Analysis dated 06th November 2023

Nifty Nov F: 19486 [ 19492 / 19385 ] Open Type OAOR (Open Auction Out of Range) Volumes of 20,070 contracts Below average Initial Balance 43 points (19445 – 19402) Volumes of 34,260 contracts Range below average & volumes average Day Type Neutral Extreme – 108 points Volumes of 1,03,633 contracts Below average NF made it […]

Market Profile Analysis dated 03rd November 2023

Nifty Nov F: 19306 [ 19363 / 19280 ] Open Type OAOR (Open Auction Out of Range) Volumes of 22,133 contracts Below average Initial Balance 41 points (19363 – 19322) Volumes of 38,850 contracts Range below average & volumes above Day Type Normal Variation (3-1-3) – 83 points Volumes of 99,737 contracts Below average NF once […]

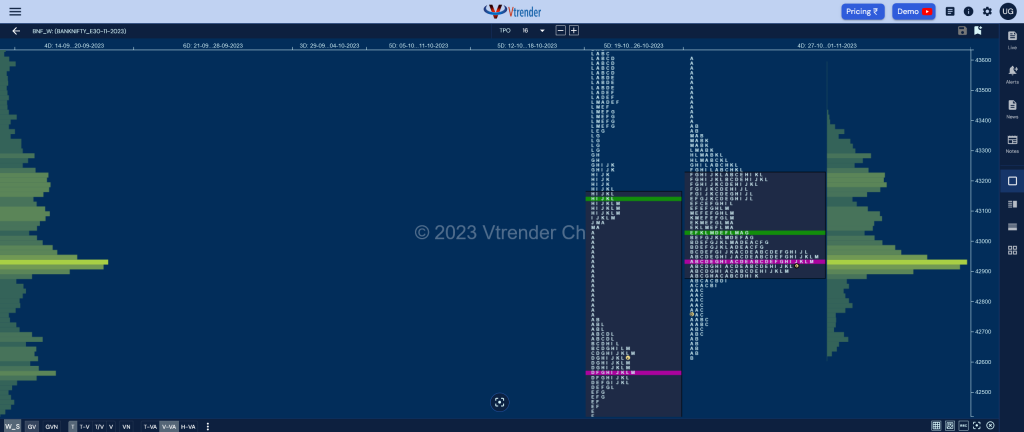

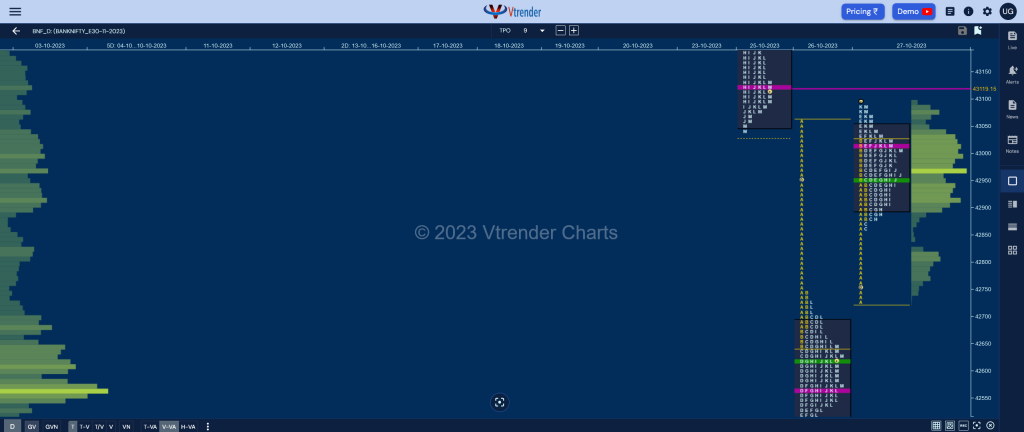

Monthly charts (October 2023) and Market Profile Analysis

Nifty Oct Spot: 19079 [ 19849 / 18940 ] Previous month’s report ended with this ‘The monthly profile is an elongated 967 point range one with overlapping to higher Value at 19421-19675-19973 and has a buying tail from 19432 to 19255 along with an extension handle at 19458 which will be the swing zone for the […]

Market Profile Analysis dated 02nd November 2023

Nifty Nov F: 19238 [ 19256 / 19140 ] Open Type OAOR (Open Auction Out of Range) Volumes of 27,005 contracts Below average Initial Balance 62 points (19246 – 19184) Volumes of 47,850 contracts Range below average & volumes above Day Type Neutral Extreme – 117 points Volumes of 1,51,510 contracts Below average NF not only […]

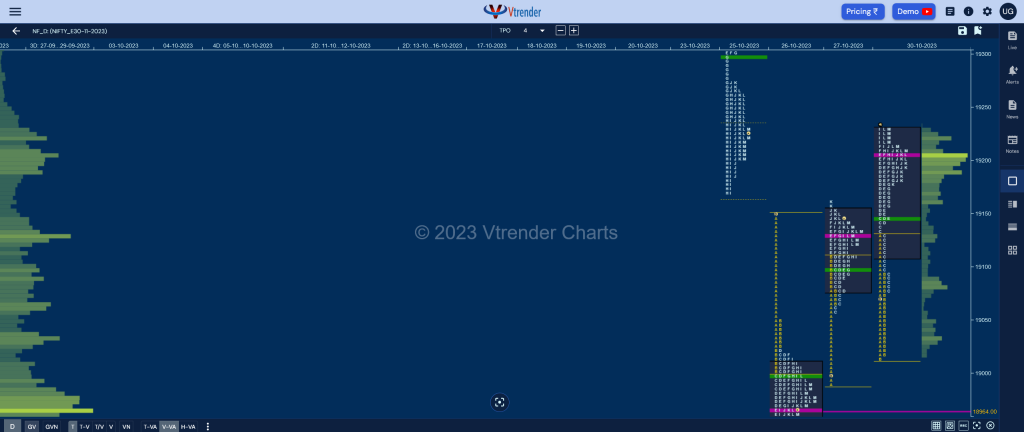

Market Profile Analysis dated 01st November 2023

Nifty Nov F: 19060 [ 19174 / 19050 ] Open Type OAIR (Open Auction In Range) Volumes of 11,479 contracts Below average Initial Balance 84 points (19174 – 19090) Volumes of 31,647 contracts Average Day Type Normal Variation – 124 points Volumes of 1,00,474 contracts Below average NF opened below yPOC of 19150 and made a […]

Market Profile Analysis dated 31st October 2023

Nifty Nov F: 19158 [ 19279 / 19120 ] Open Type ORR (Open Rejection Reverse) Volumes of 16,951 contracts Above average Initial Balance 131 points (19279 – 19148) Volumes of 39,907 contracts Above average Day Type Normal (‘b’ shape) – 159 points Volumes of 1,25,003 contracts Average NF made a higher open right at 25th Oct’s […]

Market Profile Analysis dated 30th October 2023

Nifty Nov F: 19221 [ 19234 / 19014 ] Open Type OAIR (Open Auction In Range) Volumes of 14,386 contracts Average Initial Balance 115 points (19130 – 19014) Volumes of 36,233 contracts Above average Day Type Double Distribution (DD) – 220 points Volumes of 1,21,659 contracts Average NF made another OAIR start probing lower in the […]