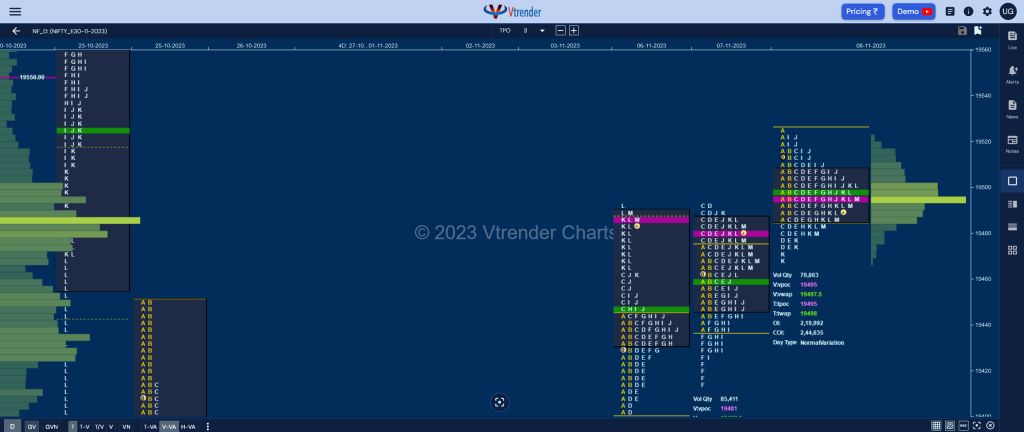

Nifty Nov F: 19490 [ 19524 / 19467

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 9,102 contracts |

| Initial Balance |

|---|

| 39 points (19524 – 19485) |

| Volumes of 20,164 contracts |

| Day Type |

|---|

| Normal (Gaussian Curve) – 57 points |

| Volumes of 70,863 contracts |

NF opened higher and stalled right at 23rd Oct’s Trend Day VWAP of 19525 settling down into an OAOR forming yet another narrow 39 point range Initial Balance after which it made couple of extensions lower in the C & D periods tagging the yPOC of 19481 but left similar lows of 19474 & 19475 indicating lack of supply in this zone.

The auction then made a slowing probe higher making a replica of the structure it left at lows on the upside too as it formed poor highs at 19522 in the I & J TPOs and absence of buyers in this zone triggered a fresh probe to the downside in the K period where it made new lows for the day at 19467 taking support just above yesterday’s PBL of 19462.

With only locals in play all day, NF has formed an ultra narrow 57 point range Gaussian Curve on the daily with a very prominent POC at 19495 and will be looking for initiative volumes at the next open to start a fresh imbalance away from this magnet.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19495 F and VWAP of the session was at 19497

- Value zones (volume profile) are at 19487-19495-19507

- NF confirmed a FA at 19385 on 06/11 and the 1 ATR objective comes to 19544

- HVNs are at 19129 / 19213 / 19486** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 09th Nov 2023

| Up |

| 19495 – dPOC from 08 Nov 19525 – TD VWAP (23 Oct) 19571 – VPOC (23 Oct) 19621 – Ext Handle (23 Oct) 19666 – VWAP from 20 Oct |

| Down |

| 19474 – Buying tail (08 Nov) 19443 – SOC from 07 Nov 19415 – E TPO POC (06 Nov) 19385 – FA from 06 Nov 19330 – VPOC from 06 Nov |

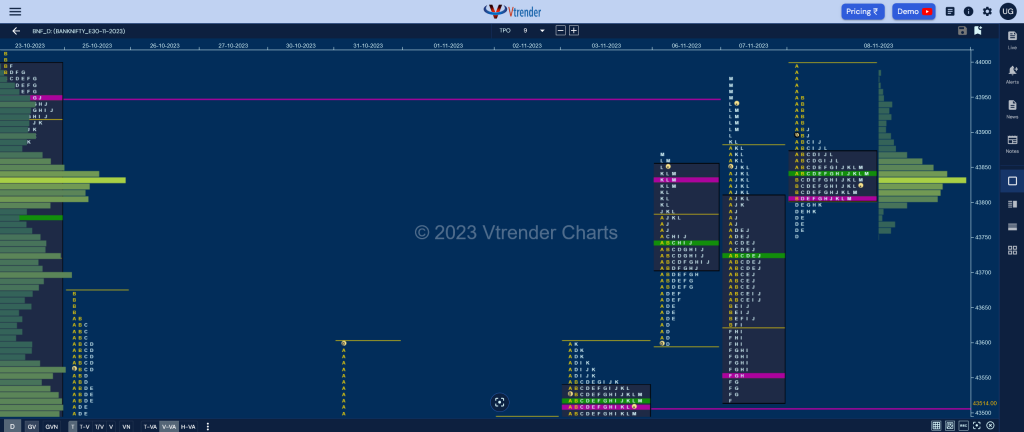

BankNifty Nov F: 43836 [ 43996 / 43751 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 14,561 contracts |

| Initial Balance |

|---|

| 186 points (43996 – 43810) |

| Volumes of 33,124 contracts |

| Day Type |

|---|

| Normal (‘b’ shape) – 245 points |

| Volumes of 1,50,800 contracts |

BNF opened with look up above PDH but could only manage marginal new highs of 43996 and was swiftly rejected back into the Neutral Extreme zone of 43979 to 43885 and went on to break below it as it made a low of 43810 in the B period forming a narrow 186 point range Initial Balance.

The auction then had a silent C side as it remained inside the B TPO after which it made an extension lower in the D TPO testing the lower extension handle of 43758 from yesterday while making a low of 43751 and took support there marking the end of the downside for the day.

The rest of the day saw BNF remain in a narrow range of just 115 points leaving a PBH at 43907 along with a PBL at 43792 in the J & K periods respectively building volumes at 43805 as it formed a ‘b’ shape long liquidation profile implying that the buyers were booking profits and as long as today’s tiny initiaitive selling tail from 43942 to 43996 is held and the auction remains below 43805, it can drop further down towards the daily VPOCs of 43555 & 43304 in the coming sessions.

Click here to view the latest profile in BNF on Vtrender Charts

Weekly Settlement (02nd to 08th Nov) : 43836 [ 43996 / 42978 ]

BNF has formed an elongated 1018 point range weekly profile with good range extensions to the upside after it took support at 42978 just above previous week’s prominent POC of 42928 and went on to make higher highs on all 5 days of this weekly settlement as it made a high of 43996 but saw some good profit booking happening as the dPOC shifted to 43835 and will be the reference for the coming week. Value was completely higher at 43488-43835-43952 and this week’s VWAP of 43593 will remain a swing reference for the longs to remain in the game.

Daily Zones

- Largest volume (POC) was traded at 43805 F and VWAP of the session was at 43844

- Value zones (volume profile) are at 43805-43805-43869

- HVNs are at 42928 / 43184 / 43832** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 09th Nov 2023

| Up |

| 43844 – VWAP from 08 Nov 43947 – Selling Tail (08 Nov) 44034 – Ext Handle (23 Oct) 44143 – Selling tail (20 Oct) 44289 – LVN from 20 Oct |

| Down |

| 43805 – dPOC from 08 Nov 43729 – NeuX VWAP (0 Nov) 43625 – SOC from 07 Nov 43514 – VPOC from 03 Nov 43423 – Gap mid-point (03 Nov) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.