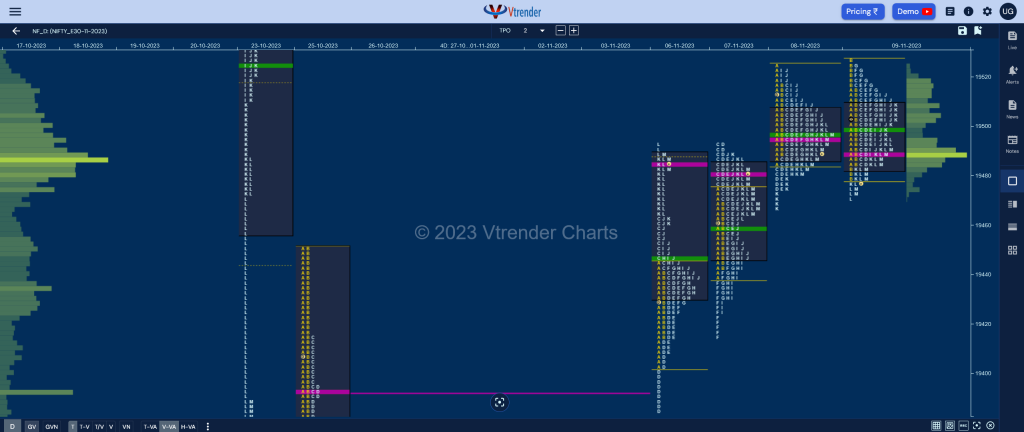

Nifty Nov F: 19484 [ 19526 / 19471 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 6,938 contracts |

| Initial Balance |

|---|

| 47 points (19526 – 19479) |

| Volumes of 17,239 contracts |

| Day Type |

|---|

| Normal (Gaussian Curve) – 55 points |

| Volumes of 84,124 contracts |

NF made an OAIR start completing the 80% Rule to the downside in previous Value as it made a low of 19484 in the A period after which it made new lows of 19479 in the B but this probe below was swiftly rejected resulting in a quick short covering bounce and new highs of 19526 at the close of the Initial Balance.

However, the auction yet again failed to get fresh demand at the 23rd Oct Trend Day VWAP of 19525 and the absence of initiative volumes meant that the balance would continue which is what it did for the rest of the day leaving a PBL at 19484 in the D TPO followed by a PBH at 19524 in the G almost forming a replica of previous day’s Gaussian Curve.

NF has formed completely overlapping Value with the dPOC at 19489 as the magnet of 19495 could not get the initiative volumes for a fresh imbalance to start but the set up is still active and the start of the new weekly settlement from tomorrow may get the expected expansion of range as well as volumes.

Click here to view the latest profile in NF on Vtrender Charts

Weekly Settlement (03rd to 09th Nov) : 19484 [ 19526 / 19280 ]

NF opened the week with a gap up which it sustained building volumes at 19330 and went on to form a Double Distribution (DD) profile to the upside which was also a Neutral one leaving a zone of singles from 19351 to 19402 but showed exhaustion to the upside as it first left couple of similar highs at 19492 & 19493 and then the next set of same highs at 19524 & 19526 stalling right at 23rd Oct’s Trend Day VWAP leaving an extremely top heavy weekly profile with an ultra prominent POC at 19487 which will be the reference for the coming week and sustaining below it could trigger a fill up of the lower part of the profile with the objectives starting from this week’s VWAP of 19440 below which we have the daily FA of 19385 from 06th Nov and the VPOC of 19330 from 03rd.

Daily Zones

- Largest volume (POC) was traded at 19489 F and VWAP of the session was at 19498

- Value zones (volume profile) are at 19483-19489-19509

- NF confirmed a FA at 19385 on 06/11 and the 1 ATR objective comes to 19544

- HVNs are at 19129 / 19213 / 19486** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 10th Nov 2023

| Up |

| 19489 – dPOC from 09 Nov 19525 – TD VWAP (23 Oct) 19571 – VPOC (23 Oct) 19621 – Ext Handle (23 Oct) 19666 – VWAP from 20 Oct |

| Down |

| 19473 – Buying tail (09 Nov) 19443 – SOC from 07 Nov 19415 – E TPO POC (06 Nov) 19385 – FA from 06 Nov 19330 – VPOC from 06 Nov |

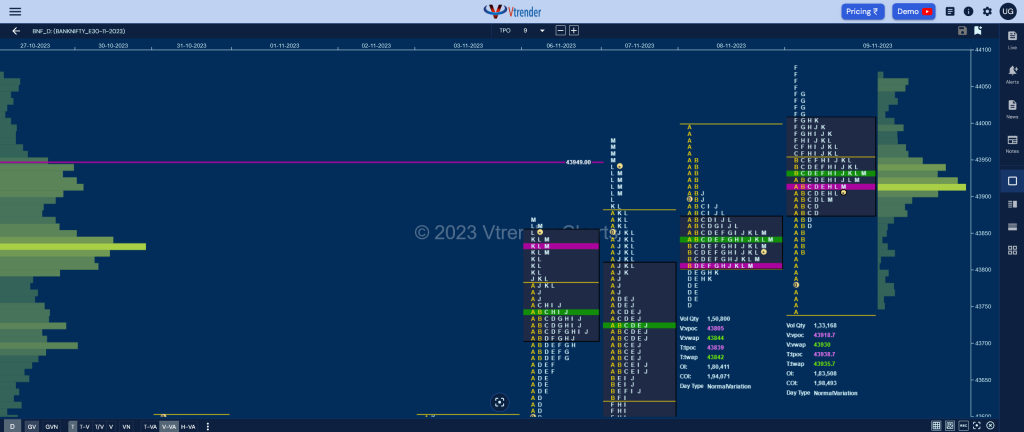

BankNifty Nov F: 43916 [ 44075 / 43746 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 17,648 contracts |

| Initial Balance |

|---|

| 204 points (43950 – 43746) |

| Volumes of 39,667 contracts |

| Day Type |

|---|

| Normal Variation (3-1-3 profile) – 328 points |

| Volumes of 1,33,168 contracts |

BNF opened with a look down below PDL but for the second concecutive day got demand coming back above 07th Nov’s NeuX VWAP of 43729 as it left an initiative buying tail from 43825 to 43746 and went on to test previous session’s selling singles from 43947 to 43996 while making a high of 43949 in the Initial Balance.

The auction then made a typical C side extension to 43969 and gave an immediate retracement back to the day’s VWAP leaving a PBL at 43861 in the D period indicating that the morning buyers were still active after which it made a big range extension to the upside in the F TPO completing the 1.5 IB objective of 44052 and tagging the weekly TPO HVN of 44064 as it hit new highs of 44075 but could not extend any futher leaving a small responsive selling tail at the top.

The rest of the day then saw a mini balance being formed as BNF came back down to the day’s VWAP and closed right at the day’s POC of 43918 leaving a picture perfect 3-1-3 profile with completely higher Value and looks set to start a fresh imbalance in the coming session(s) provided one of today’s buy-side or sell-side singles are taken out by initiative volumes.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 43918 F and VWAP of the session was at 43930

- Value zones (volume profile) are at 43880-43918-44008

- HVNs are at 42928 / 43184 / 43832** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 10th Nov 2023

| Up |

| 43930 – VWAP from 09 Nov 44043 – Selling tail (09 Nov) 44143 – Selling tail (20 Oct) 44289 – LVN from 20 Oct 44425 – DD VWAP (18 Oct) |

| Down |

| 43918 – dPOC from 09 Nov 43825 – Buying Tail (09 Nov) 43729 – NeuX VWAP (07 Nov) 43625 – SOC from 07 Nov 43514 – VPOC from 03 Nov |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.