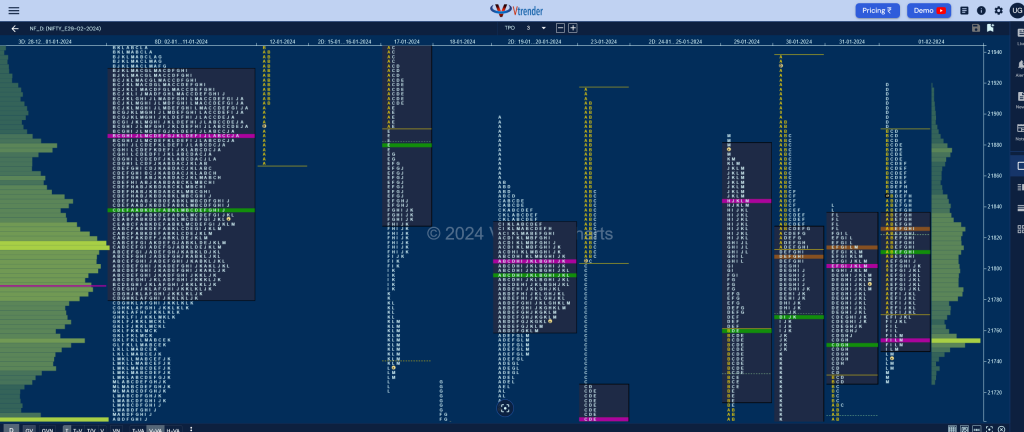

Nifty Feb F: 21751 [ 21920 / 21725 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 12,380 contracts |

| Initial Balance |

|---|

| 118 points (21890 – 21772) |

| Volumes of 35,533 contracts |

| Day Type |

|---|

| Neutral Extreme – 195 points |

| Volumes of 1,80,971 contracts |

NF opened in previous Value and gave an initiative move to the upside on lower than average volumes in the Initial Balance (IB) where it left a buying tail from 21809 to 21772 and went on to probe above PDH making a high of 21890 followed by a rare narrow range C side with a similar high of 21889.

The auction then made an attempt to extend in the D TPO scaling into the A period selling singles from 30th Jan but could only manage to tag 21920 getting swiftly rejected which was followed by a break of day’s VWAP in the E which led to further downside and new lows for the day confirming a FA (Failed Auction) at top with the F TPO recording new lows of 21752 taking support just above previous VWAP of 21750.

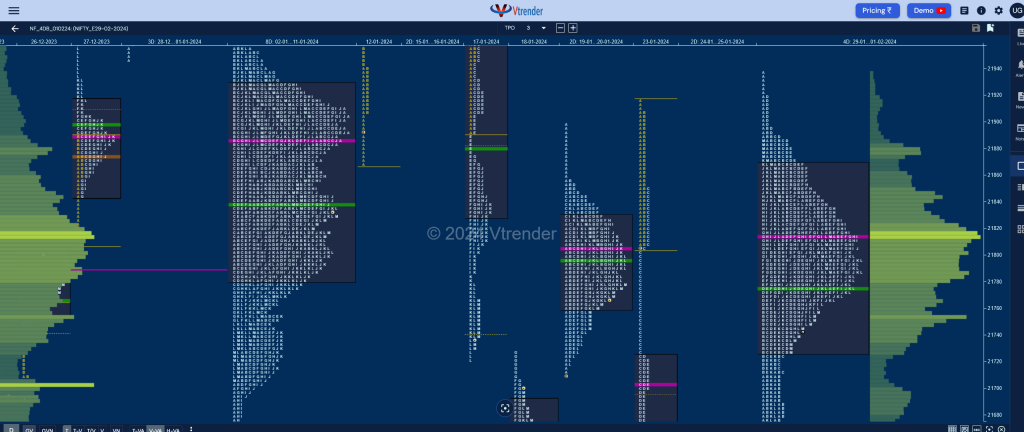

NF then gave a bounce back above day’s VWAP in the H period but got rejected leaving a PBH at 21855 indicating that the sellers were in control and they managed to push it further down into the close making fresh REs in the I, L & M TPOs hitting new lows of 21725 and saw the dPOC shift lower to 21754 suggesting profit booking by the shorts leaving a Neutral Extreme Day Down but for the 4th day in succession forming overlapping value as a result of which we have a nice composite from 29th Jan (Click here to view the 4-day composite only on Vtrender Charts) with Value at 21726-21813-21869 with the VAL being tested and has a good chance of the other extreme coming into play in the next session of 21726 holds.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21754 F and VWAP of the session was at 21810

- Value zones (volume profile) are at 21747-21754-21835

- NF confirmed a FA at 21920 on 01/02 and the 1 ATR target on downside comes to 21654

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (29 Jan-01 Feb) – NF opened higher this week and remained above previous week’s VWAP of 21540 throughout even making a look up above the highs of 21916 but left a daily FA at 21920 forming overlapping value on all 4 days leaving a Neutral profile and a nice Gaussian Curve with completely higher Value at 21726-21813-21869 with a very prominent POC which will act as a magnet unless we get an initiative move away from here in the coming week

- (19-25 Jan) – NF has formed a Neutral Extreme weekly profile in a relatively large range of 21916 to 21287 with mostly lower Value at 21349-21416-21583 and also represents a Double Distribution shape with the upper HVN at 21804 and a small zone of singles in the middle of the profile from 21640 to 21670 seperating the lower distribution where it has also left a small buying tail at a prior weekly VPOC of 21296 (08-14 Dec) which will be the support zone for the coming week whereas on the upside, this week’s VWAP of 21540 will need to taken out and sustained for a move towards 21804 and the mini tail from 21908

Monthly Zones

- The settlement day Roll Over point (February 2024) is 21419

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

Business Areas for 02nd Feb 2024

| Up |

| 21754 – dPOC from 01 Feb 21810 – NeuX VWAP (01 Feb) 21856 – PBH from 01 Feb 21890 – Selling tail (01 Feb) 21940 – C TPO POC (17 Jan) 21986 – VPOC from 17 Jan |

| Down |

| 21733 – Buying tail (01 Feb) 21690 – B TPO halfback (31 Jan) 21652 – Buying Tail (31 Jan) 21611 – IB tail mid (31 Jan) 21581 – Jan series VWAP 21540 – Gap mid (29 Jan) |

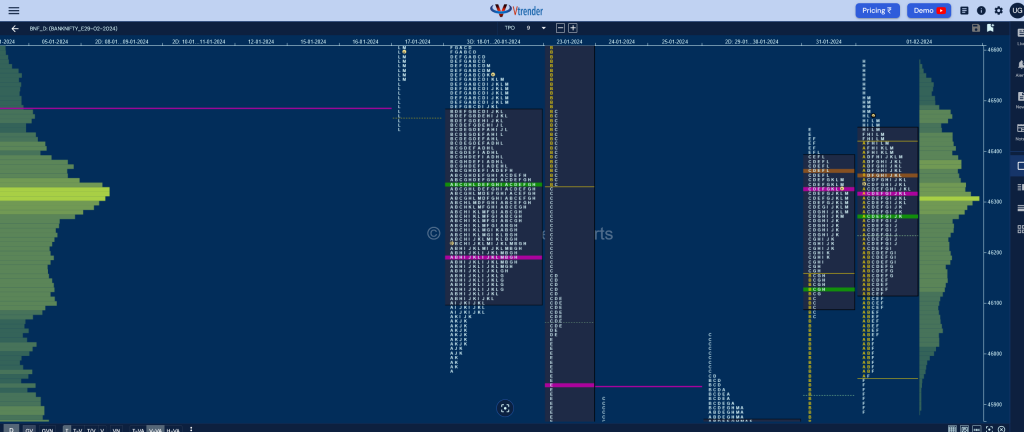

BankNifty Feb F: 46437 [ 46581 / 45882 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 20,615 contracts |

| Initial Balance |

|---|

| 492 points (46444 – 45952) |

| Volumes of 56,576 contracts |

| Day Type |

|---|

| Neutral Extreme – 699 points |

| Volumes of 2,75,867 contracts |

BNF made an OAIR start leaving similar highs as previous session indicating lack of demand and probe lower in the A period hitting 45952 taking support right at the 2-day composite (29-30 Jan) selling tail showing change of polarity after which it remained in the A period range till the E TPO building on previous Value.

The auction then made a extension lower in seach of buyers in the F period and was swiftly rejected at 45882 taking support right previous week’s NeuX VWAP of 45883 and holding above the 2-day VAH of 45864 confirming demand coming back which triggered a short covering swipe higher even confirming a FA (Failed Auction) at lows and making a RE to 46581 in the H TPO.

However, BNF could not scale above the 23rd Jan extension handle of 46630 and made a quick retracment back below day’s VWAP in the I period which was defended as seen in the PBL it left at 46186 after which it went on to get back above IBH into the close forming a Neutral Extreme Day Up with completely overlapping Value hence leaving a nice 2-day composite at 46080-46331-46408 which will be the zone to watch at the next open as we have a good chance to move away from here with the PLR (Path of Least Resistance) to the upside.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 46314 F and VWAP of the session was at 46276

- Value zones (volume profile) are at 46119-46314-46445

- BNF confirmed a FA at 45882 on 01/02 and is on trace to complete the 1 ATR target of 46639 whereas the 2 ATR objective comes to 47396

- HVNs are at NA (** denotes series POC)

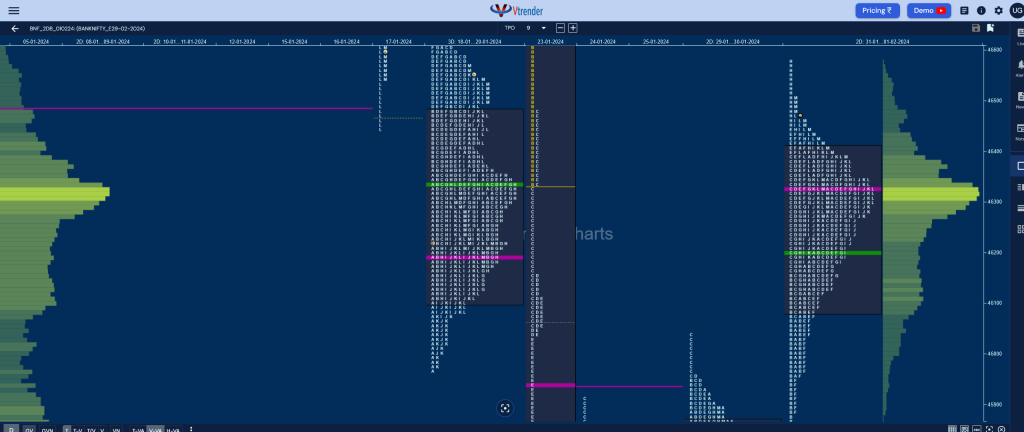

Weekly Zones

- Weekly Charts can be viewed here

- (29-31 Jan) – BNF took support multiple times at previous week’s VWAP of 45492 forming a Neutral Extreme weekly profile to the upside giving a move away from the prominent POC of 45717 on the last day where it went on to hit new highs of 46444 forming overlapping to higher Value at 46429-45717-45994 but this week’s NeuX VWAP of 45883 will be the important reference going forward if it has to continue higher towards the selling tail from 46720 & extension handle of 47115 in the coming week

- (19-25 Jan) – BNF has also formed a Neutral Extreme weekly profile in a range of 46892 to 44851 with completely lower Value at 44903-44997-45626 but has seen the POC shift to the lows hinting at profit booking by sellers so can give a bounce with this week’s VWAP of 45492 being an important reference for the buyers to take out in case of the upmove to continue in the new series

Monthly Zones

- The settlement day Roll Over point (February 2024) is 44999

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

Business Areas for 02nd Feb 2024

| Up |

| 46444 – IBH from 01 Feb 46581 – NeuX high (01 Feb) 46685 – Selling Tail (23 Jan) 46840 – A TPO POC (23 Jan) 46976 – PBH from 17 Jan 47124 – Trend Day VWAP (17 Jan) |

| Down |

| 46408 – 2-day VAH (31Jan-01Feb) 46276 – NeuX VWAP (01 Feb) 46080 – 2-day VAL (31Jan-01Feb) 45952 – Buying tail (01 Feb) 45864 – 2-day VAH (29-30 Jan) 45717 – Weekly POC |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.