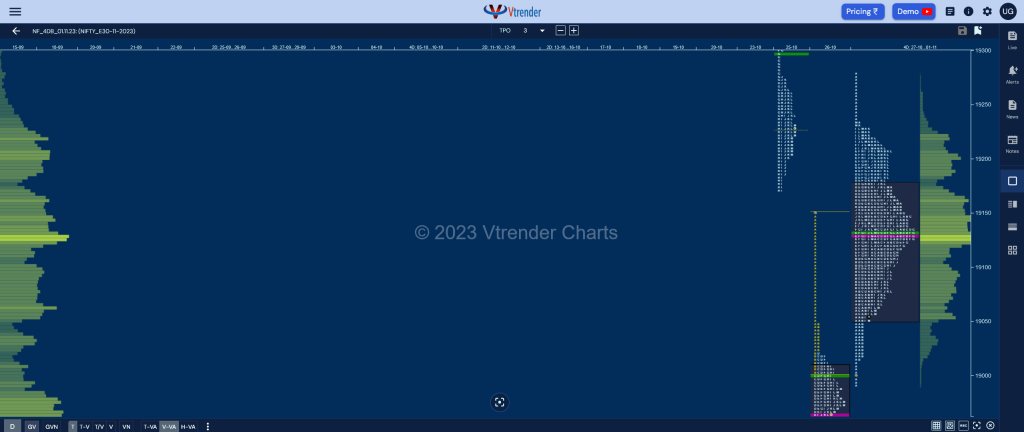

Nifty Nov F: 19060 [ 19174 / 19050 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 11,479 contracts |

| Initial Balance |

|---|

| 84 points (19174 – 19090) |

| Volumes of 31,647 contracts |

| Day Type |

|---|

| Normal Variation – 124 points |

| Volumes of 1,00,474 contracts |

NF opened below yPOC of 19150 and made a look down below PDL of 19120 as it made a low of 19111 but did not find any fresh supply triggering a move back into previous range & value even making new highs of 19174 but stalled just below yVWAP of 19178 indicating that the sellers were defending this zone.

The auction then made new lows of 19091 in the B period testing 30th Oct’s SOC (Scene Of Crime) of 19094 where it took support and began to contract for the next 4 TPOs building volumes at 19120 after which it made an attempt to probe higher in the G but could only manage to leave a PBH of 19149 just below yPOC of 19150 signalling the return of supply.

More confirmation came in form of a Range Extension lower in the H period followed by lower lows of 19050 in the I as NF completed the 1.5 IB target of the day almost tagging 30th Oct’s B TPO VWAP of 19048 where it saw profit booking by the shorts triggering a bounce higher to 19095 stopping just below day’s VWAP and made one final retracement lower into the close even hitting marignal new lows of 19050 and saw the dPOC shift lower to 19054.

On the higher timeframe, we have a nice 3-1-3 composite forming over the last 4 days with the Value at 19051-19129-19176 and the auction could continue to smoothen this balance for the next session staying inside the above value before starting a fresh imbalance through an initiative move away from one of the extremes which on the upside is the selling tail from 19234 to 19279 whereas on the downside is from 19014 to 18990 (Click here to view the composite only on Vtrender Charts)

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19054 F and VWAP of the session was at 19102

- Value zones (volume profile) are at 19054-19054-19120

- HVNs are at 19062 / 19129 / 19392 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 02nd Nov 2023

| Up |

| 19062 – LVN from 01 Nov 19129 – 4-day POC (27 Oct to 01 Nov) 19176 – 4-day VAH (27 Oct to 01 Nov) 19235 – A TPO POC (31 Oct) 19275 – PBH (25 Oct) |

| Down |

| 19048 – B TPO VWAP (30 Oct) 18990 – Buy Tail low (27 Oct) 18964 – VPOC (26 Oct) 18906 – Ext Handle (27 Jun) 18855 – 1 ATR (26 Oct VWAP) |

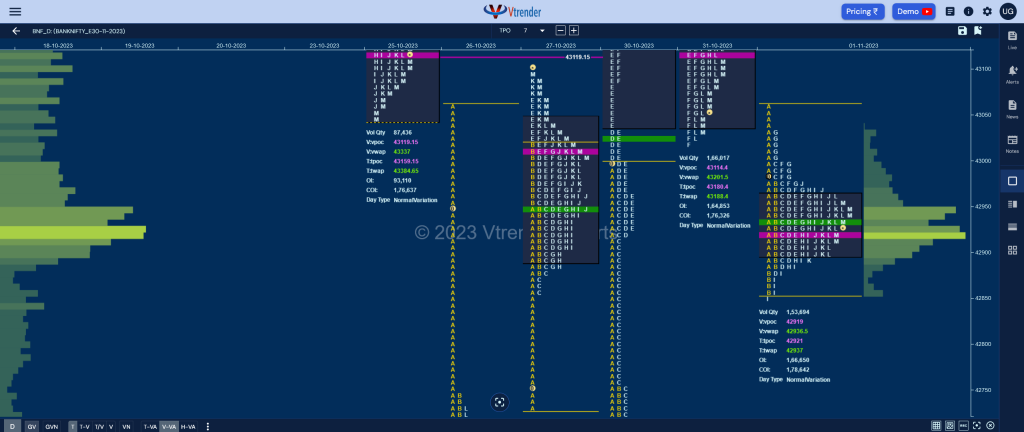

BankNifty Nov F: 42928 [ 43063 / 42849 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 15,980 contracts |

| Initial Balance |

|---|

| 202 points (43062 – 42860) |

| Volumes of 43,307 contracts |

| Day Type |

|---|

| Normal (Gaussian) – 213 points |

| Volumes of 1,53,964 contracts |

BNF opened lower repairing the poor lows from previous profile and made an attempt to get back in yesterday’s Value but was swiftly rejected from 43062 where it saw sellers adding and it went on to probe lower for the rest of the Initial Balance (IB) making a low of 42860 in the B period where it saw some profit booking resulting in a retracement back to day’s VWAP.

The auction then remained in the narrow 202 point IB range for most part of the day making a PBH at 43031 in the G TPO where the morning seller returned triggering a fresh probe lower even hitting marginal new lows of 42849 in the I period but once again saw profit booking in this zone as the range further narrowed down into the close.

The day’s profile is a nice Gaussian Curve with the attempt to move away from previous Value to the downside being aborted due to lack of supply at 42860 which caused BNF to settled down at the developing series POC of 42928 and with 42860 holding, there is a good chance that it could get back into 31st Oct’s Value and test the A period selling tail of that day provided 43031 is taken out and sustained.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 42919 F and VWAP of the session was at 42936

- Value zones (volume profile) are at 42897-42919-42959

- HVNs are at 42928 / 43184 / 44040 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 02nd Nov 2023

| Up |

| 42928 – Series POC 43031 – Selling Tail (01 Nov) 43114 – VPOC from 31 Oct 43268 – VAH from 31 Oct 43389 – Selling Tail (31 Oct) |

| Down |

| 42860 – Buying tail (01 Nov) 42750 – SOC from 30 Oct 42623 – Swing Low (30 Oct) 42564 – VPOC (26 Oct) 42455 – Buying tail (26 Oct) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.