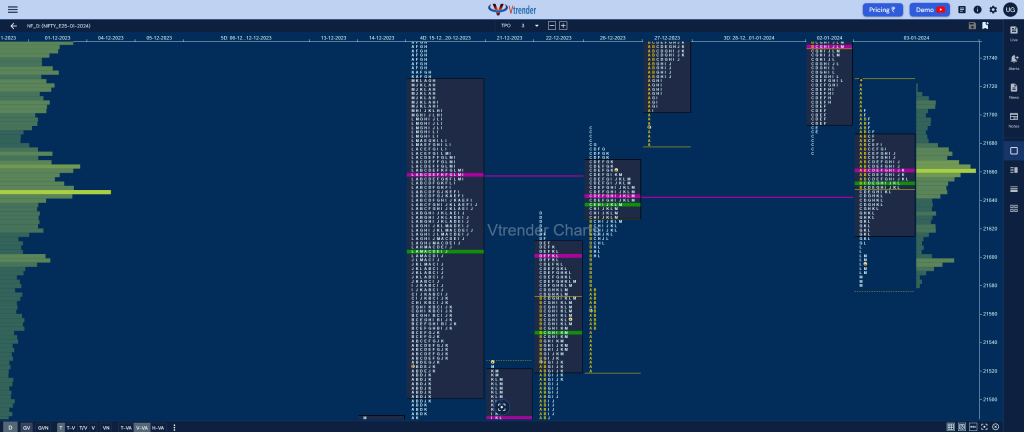

Nifty Jan F: 21600 [ 21730 / 21579 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 10,826 contracts |

| Initial Balance |

|---|

| 80 points (21730 – 21650) |

| Volumes of 35,841 contracts |

| Day Type |

|---|

| Normal Variation – 151 points |

| Volumes of 1,35,616 contracts |

NF made an OH (Open=High) at 21730 just below yPOC of 21748 and went on to probe below previous lows as it made a low of 21650 in the Initial Balance and went on to tag 26th Dec’s VPOC of 21644 with a C side extension to 21634 after which it gave a typical bounce back to day’s VWAP even making a look up above it in the E & F periods.

The auction however got rejected from the morning singles leaving a PBH (Pull Back High) at 21704 and the sellers managed to make a fresh RE (Range Extension) lower in the G TPO while hitting 21610 completing the 1.5 IB target for the day and gave another bounce back to VWAP in the H & I periods leaving a lower PBH at 21680 indicating that the downside was still open.

NF was in the process of forming a nice Gaussian Curve for the day with a prominent POC at 21662 but a rejection from just below VWAP in the L TPO resulted in a spike lower to 21579 into the M as it broke into the mid-profile singles from 26th Dec of 21600 to 21576 building a HVN at 21598 where it saw some profit booking leaving another day of completely lower Value.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21662 F and VWAP of the session was at 21652

- Value zones (volume profile) are at 21615-21662-21686

- HVNs are at 21890 (** denotes series POC)

Weekly Zones

- to be updated…

Monthly Zones

- The settlement day Roll Over point (January 2024) is 21930

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

Business Areas for 04th Jan 2024

| Up |

| 21610 – Spike high (03 Jan) 21662 – dPOC from 03 Jan 21704 – Selling Tail (03 Jan) 21748 – VPOC from 02 Jan 21790 – L TPO POC (02 Jan) |

| Down |

| 21598 – Closing HVN (03 Jan) 21550 – Buying Tail (26 Dec) 21501 – LVN from 22 Dec 21440 – FA from 22 Dec 21384 – VWAP from 21 Dec |

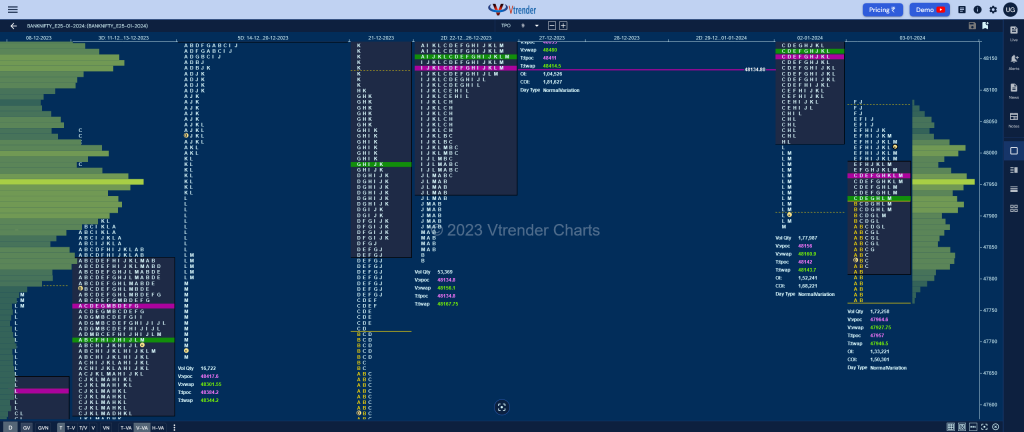

BankNifty Jan F: 47932 [ 48086 / 47763 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 15,308 contracts |

| Initial Balance |

|---|

| 156 points (47919 – 47763) |

| Volumes of 36,728 contracts |

| Day Type |

|---|

| Normal Variation – 323 points |

| Volumes of 1,72,345 contracts |

BNF opened below the spike lows continuing the downside imbalance probing below 26th Dec’s low of 47830 and making a low of 47763 in the A period taking support just above the buying extension handle of 47720 from 21st Dec and formed similar lows in the B TPO suggesting that the downside was getting exhausted as it got back into the spike zone.

The auction then made a C side extension to 47975 and for a change did not give a retracment back to VWAP and went on to make couple of REs higher in the E & F periods completing the 2 IB objective of the day at 48074 while making a high of 48086 but could not sustain in previous Value and gave a depp retracement breaking below VWAP in the G TPO where it made a low of 47844 which was incidentally matching with 26th Dec’s buying tail which had got broken at the open.

BNF found some responsive buying and got back above VWAP making higher highs till the J period but stalled right at 48078 re-confirming lack of demand in this zone which triggered another rotation down to 47854 in the L TPO and saw big volumes being transacted at 47956 as even the current series POC shifts there suggesting that the shorts are booking profits. However, Value was completely lower once again with the day’s profile showing similar lows as well as highs so will need some initiative volumes at either end for a fresh probe in that direction in the coming session(s).

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 47964 F and VWAP of the session was at 47927

- Value zones (volume profile) are at 47810-47964-47986

- HVNs are at 47956** / 48555 (** denotes series POC)

Weekly Zones

- 29 Dec-03 Jan – BNF has formed a Neutral Extreme which also reresents a Double Distribution Trend Down profile which got stalled right below previous week’s POC of 48879 on the upside and went on to fill the low volume zone till 48446 and made an initiative move with a small selling tail from 48346 to 48256 as it went on to make poor lows at 47763 forming a lower balance with the POC also shifting down to 47956. Value for the week was at 47765-47956-48542 with the important DD VWAP being at 48278 which will be the swing reference for the coming settlement.

Monthly Zones

- The settlement day Roll Over point (January 2024) is 48900

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

Business Areas for 04th Jan 2024

| Up |

| 47964 – dPOC from 03 Jan 48078 – Selling tail (03 Jan) 48160 – VWAP from 02 Jan 48316 – B TPO POC (02 Jan) 48431 – Spike high (01 Jan) |

| Down |

| 47927 – VWAP from 03 Jan 47844 – PBL from 03 Jan 47720 – Ext Handle (21 Dec) 47575 – B TPO VWAP (21 Dec) 47425 – Buying Tail (21 Dec) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.