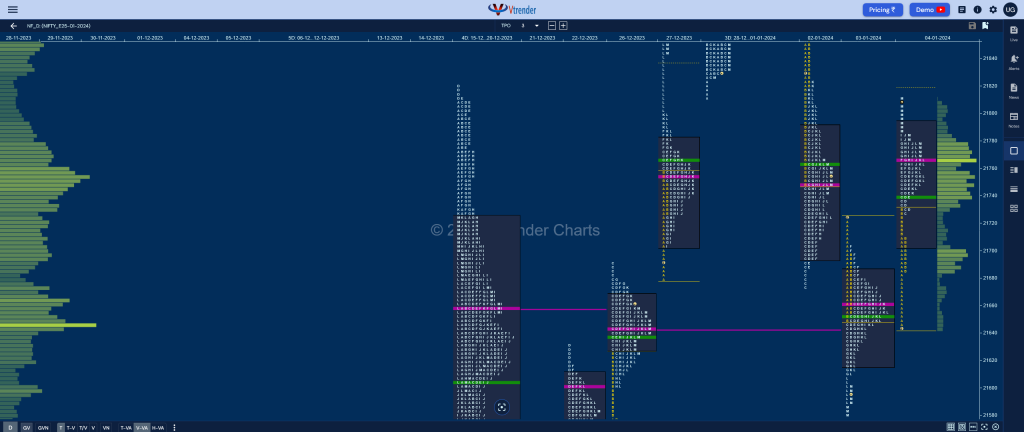

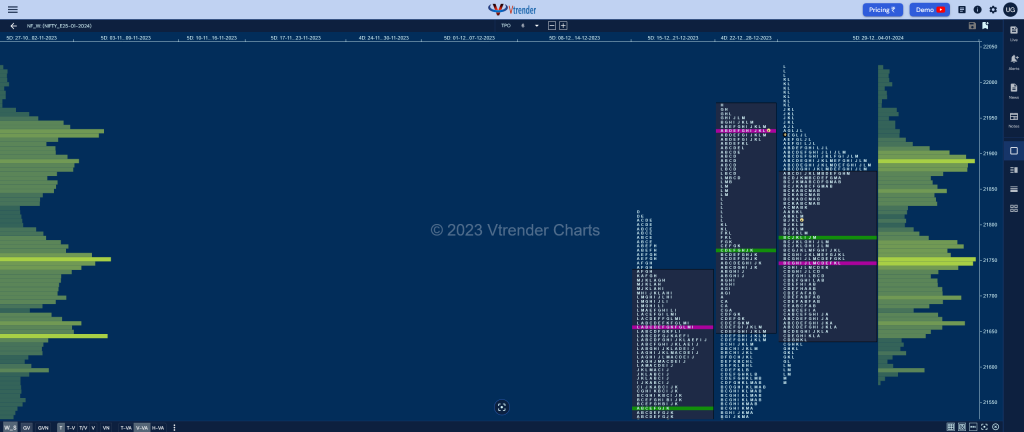

Nifty Jan F: 21786 [ 21810 / 21616 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 16,560 contracts |

| Initial Balance |

|---|

| 114 points (21730 – 21616) |

| Volumes of 39,847 contracts |

| Day Type |

|---|

| Normal Variation – 194 points |

| Volumes of 1,21,774 contracts |

NF made a gap up open trapping the laggard shorts of previous day’s spike close swiping through previous Value as it left an initiative buying tail from 21685 to 21616 and went on to tag the PDH of 21730 at the close of the IB (Initial Balance) after which it tagged 02nd Jan’s VPOC of 21748 with a C side extension & continued to make a slow OTF (One Time Frame) probe higher till the I period where it hit 21785 stalling right below the RS (Responsive Seller) reference of 21790 from 02nd Jan.

The auction then signalled the end of OTF in the J TPO and gave a retracement to day’s VWAP in the K period where it left an important PBL at 21742 signalling that the buyers were now in control and they managed to take it back above VWAP in the L before giving a small spike to 21810 in the closing TPO.

Spike Rules will be in play at open for the next session and the zone to watch would be 21770 to 21810 with today’s VWAP of 21739 being the important reference on the downside whereas on the upside, NF will need to show fresh demand above today’s spike for a probable move into the 3-day balance it had formed from 28th Dec to 01st Jan.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21767 F and VWAP of the session was at 21739

- Value zones (volume profile) are at 21704-21767-21795

- HVNs are at 21748** / 21890 (** denotes series POC)

Weekly Zones

- (29 Dec-04 Jan) – NF has formed a Neutral Centre weekly profile as it made a look up above previous highs but got rejected after making new ATH of 22025 and went on to make a low of 21579 taking support right above last week’s lower TPO HVN of 21570 filling up the low volumes zones and forming mostly overlapping Value at 21640-21748-21875 with a point to note that the sellers who had come in forming a base at 21890 had mostly booked profits at lower levels where it saw some short covering and fresh demand coming back.

Monthly Zones

- The settlement day Roll Over point (January 2024) is 21930

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

Business Areas for 05th Jan 2024

| Up |

| 21789 – M TPO VWAP (04 Jan) 21824 – PBH from 02 Jan 21874 – 3-day VAL (28Dec-01Jan) 21931 – 3-day VPOC (28Dec-01Jan) 21970 – 1 ATR (yPOC 21767) |

| Down |

| 21770 – Spike low (04 Jan) 21739 – VWAP from 04 Jan 21685 – Buying Tail (04 Jan) 21643 – IB tail mid (04 Jan) 21598 – Closing HVN (03 Jan) |

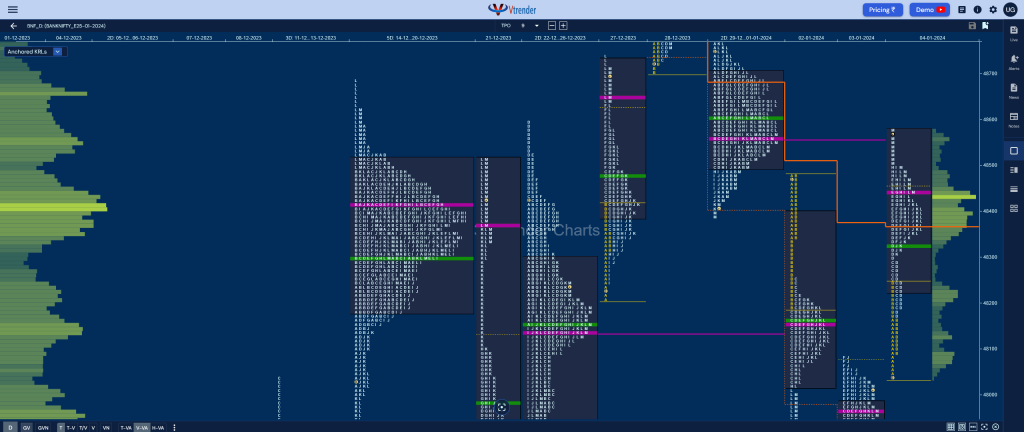

BankNifty Jan F: 48501 [ 48581 / 47995 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 15,308 contracts |

| Initial Balance |

|---|

| 255 points (48250 – 47995) |

| Volumes of 38,849 contracts |

| Day Type |

|---|

| Double Distribution 586 points |

| Volumes of 1,54,623 contracts |

BNF opened higher and went on to break above previous session’s poor highs leaving an initiative buying tail from 48092 to 47995 along with an extension handle at 48165 as it made a high of 48250 in the B period after which it made a typical C side move to 48287 stalling just below the big seller reference of 48316 and gave the customary retracement to day’s VWAP but took support just above 48165 as it left a PBL at 48177.

The auction then made a fresh RE in the D TPO itself leaving another extension handle at 48287 and followed it with higher highs of 48470 in the E stopping just below the selling tail from 02nd Jan giving the second PBL for the day in the F period where it made a low of 48338.

BNF then got into rotation mode hitting marginal new highs of 48498 & 48500 in the H & I TPOs and a swipe lower down to 48310 in the K as it held the D period extension handle of 48287 triggering a late spike higher to 48581 into the close as it got into the 2-day balance from 29th Dec to 01st Jan and tagged the composite POC of 48555 but stalled just below the VWAP of 48602 leaving a Double Distribution Trend Day Up.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48439 F and VWAP of the session was at 48327

- Value zones (volume profile) are at 48226-48439-48576

- HVNs are at 47956** / 48555 (** denotes series POC)

Weekly Zones

- (29 Dec-03 Jan) – BNF has formed a Neutral Extreme which also reresents a Double Distribution Trend Down profile which got stalled right below previous week’s POC of 48879 on the upside and went on to fill the low volume zone till 48446 and made an initiative move with a small selling tail from 48346 to 48256 as it went on to make poor lows at 47763 forming a lower balance with the POC also shifting down to 47956. Value for the week was at 47765-47956-48542 with the important DD VWAP being at 48278 which will be the swing reference for the coming settlement.

Monthly Zones

- The settlement day Roll Over point (January 2024) is 48900

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

Business Areas for 05th Jan 2024

| Up |

| 48500 – Sell tail (04 Jan) 48622 – VWAP from 01 Jan 48740 – SOC from 01 Jan 48900 – VOC from 28 Dec 49018 – 1 ATR (yPOC 48439) |

| Down |

| 48440 – Spike low (04 Jan) 48327 – VWAP from 04 Jan 48177 – PBL from 04 Jan 48092 – Buying Tail (04 Jan) 47964 – VPOC from 03 Jan |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.