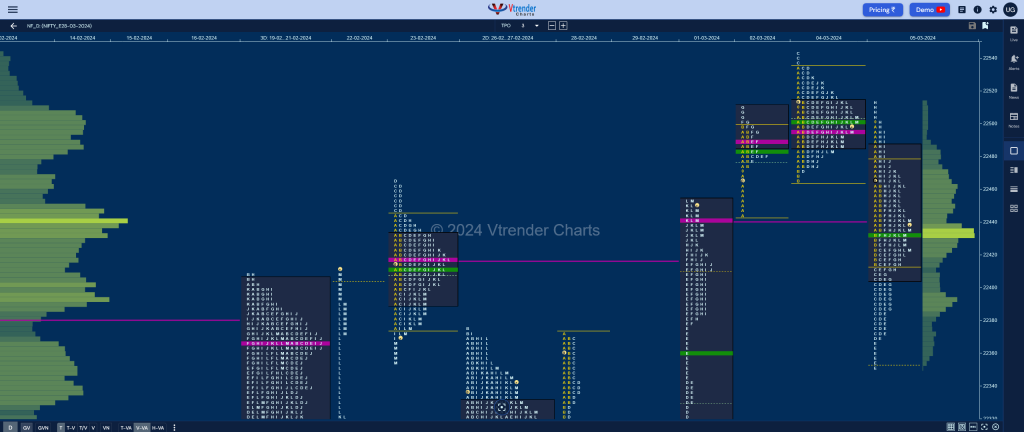

Nifty Mar F: 22433 [ 22517 / 22352 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 9,444 contracts |

| Initial Balance |

|---|

| 98 points (22500 – 22412) |

| Volumes of 23,851 contracts |

| Day Type |

|---|

| Neutral Centre – 165 pts |

| Volumes of 1,24,564 contracts |

NF made a move away to the downside from previous day’s Gaussian Curve leaving an A period selling tail and breaking below 01st Mar’s VPOC of 22443 as it went on to make multiple REs (Range Extension) till the E TPO testing the Trend Day VWAP of 22360 where it saw profit booking by the sellers & some demand coming back.

The auction then confirmed a small responsive buying tail not only stopping the OTF (One Time Frame) lower but got back above day’s VWAP and even made a RE to the upside in the H period where it got back into previous day’s Value and completed the 80% Rule.

However, NF saw supply coming back as it got rejected from yPOC of 22497 and made a retracement back to day’s VWAP and remained in a narrow range for the rest of the day forming a perfect Neutral Centre profile with the dPOC & VWAP aligning at 22433 and a close right there.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22433 F and VWAP of the session was at 22432

- Value zones (volume profile) are at 22405-22433-22487

- NF confirmed a FA at 22022 on 29/02 and completed the 2 ATR objective of 22456

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (23-29 Feb) – to be updated

Monthly Zones

- The settlement day Roll Over point (March 2024) is 22188

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

Business Areas for 06th Mar 2024

| Up |

| 22437 – Weekly IBH 22479 – I TPO h/b 22517 – PDH 22552 – 1 ATR (PDL 22352) 22605 – 1 ATR (WPOC 22113) |

| Down |

| 22420 – Closing PBL (05-Mar) 22387 – PBL (05-Mar) 22344 – Ext Handle (01-Mar) 22305 – IBH (01-Mar) 22259 – Buy Tail (01-Mar) |

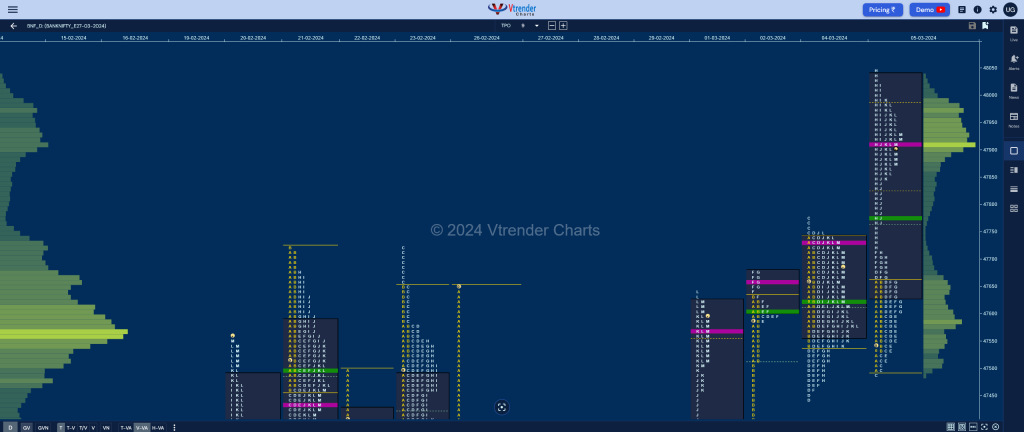

BankNifty Mar F: 47909 [ 48048 / 47487 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 11,941 contracts |

| Initial Balance |

|---|

| 162 points (47745 – 47543) |

| Volumes of 26,631 contracts |

| Day Type |

|---|

| Neutral Extreme– 561 points |

| Volumes of 1,55,486 contracts |

BNF made an OAIR start and remained in previous day’s range forming a narrow 162 point range IB (Initial Balance) with similar highs at 47658 and made a typical C side extension lower to 47487 which not only was swiftly rejected but resulted in a FA (Failed Auction) as it made new highs for the day in the D period.

The low volumes swipe saw the auction make a quick rotation back lower below VWAP in the E TPO where it left a PBL at 47515 and saw the FA being defended which brought in fresh demand leading to a fresh RE in the F period followed by an extension handle at 47714 in the H triggering a massive short covering squeeze to 48048.

BNF however left a small responsive selling tail at the top and got back to test day’s VWAP in the J period leaving a PBL at 47767 after which it coiled for the rest of the day building volumes at 47907 where the POC eventually shifted from 47587 leaving a Neutral Extreme Day Up so today’s VWAP will be an important reference in the coming session(s) for a move towards the 1 ATR target of 48170 from the FA which was confirmed today.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 47907 F and VWAP of the session was at 47780

- Value zones (volume profile) are at 47632-47907-48036

- BNF confirmed a FA at 47487 on 05/03 and the 1 ATR objective comes to 48170

- HVNs are at NA** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (22-29 Feb) – to be updated

Monthly Zones

- The settlement day Roll Over point (March 2024) is 46610

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

Business Areas for 06th Mar 2024

| Up |

| 47930 – M TPO high 48016 – Selling tail (05 Mar) 48119 – Jan VPOC 48242 – Sell tail top (17 Jan) 48379 – Mid-profile tail (12 Jan) 48480 – VPOC (12 Jan) |

| Down |

| 47907 – dPOC (05 Mar) 47767 – PBL (05 Mar) 47657 – G TPO VWAP 47587 – HVN (05 Mar) 47487 – FA (05 Mar) 47375 – Ext Handle (01 Mar) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.