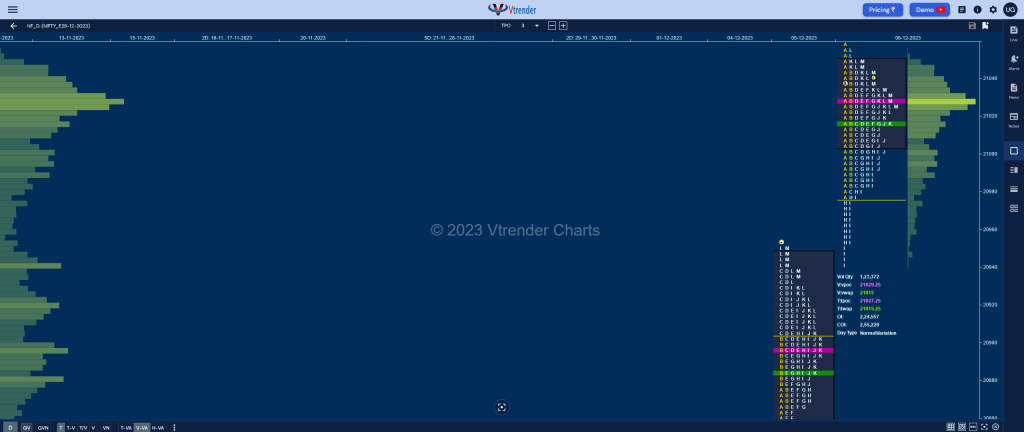

Nifty Dec F: 21039 [ 21054 / 20941 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 19,376 contracts |

| Initial Balance |

|---|

| 67 points (21044 – 20976) |

| Volumes of 43,522 contracts |

| Day Type |

|---|

| Neutral (NeuD) – 113 points |

| Volumes of 1,23,372 contracts |

NF opened with a gap up of almost 100 points continuing the imbalanced close of previous session (even leaving a freak tick at 21080 although OrderFlow did not show any volumes above 21040 at the open) but settled down into an OAOR (Open Auction Out of Range) leaving a narrow 67 point range Initial Balance (IB) as the B period remained inside A.

The auction remained inside the IB range with the C side leaving a typical PBL at 21016 and the D period matching the IBH of 21044 as for the first time in many days buyers failed to extend the IB and this led to a pretty late attempt by the sellers in the H TPO to probe lower as they managed to close the gap and even made a lower low of 20941 in the I completing the 1.5 IB target for the day.

However, NF found some buying coming back at the HVN of 20940 as it left a small responsive tail at the lows and went on to make higher highs till the L period making a look up above the IBH as it recorded new highs of 21054 but could not sustain closing just above the dPOC of 21029 leaving a Neutral Centre Day with completely higher Value.higher failing which it can begin to form a balance between the above 2 levels in the coming session(s).

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21029 F and VWAP of the session was at 21015

- Value zones (volume profile) are at 21003-21029-21049

- HVNs are at 20377 / 21029 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 20270

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

Business Areas for 07th Dec 2023

| Up |

| 21044 – IBH from 06 Dec 21075 – 1 ATR from 20941 21111 – 2 ATR (HVN 20845) 21158 – 2 ATR (VPOC 20896) 21209 – 2 ATR from 20941 |

| Down |

| 21015 – VWAP from 06 Dec 20975 – SOC from 06 Dec 20931 – LVN from 05 Dec 20896 – VPOC from 05 Dec 20845 – HVN from 05 Dec |

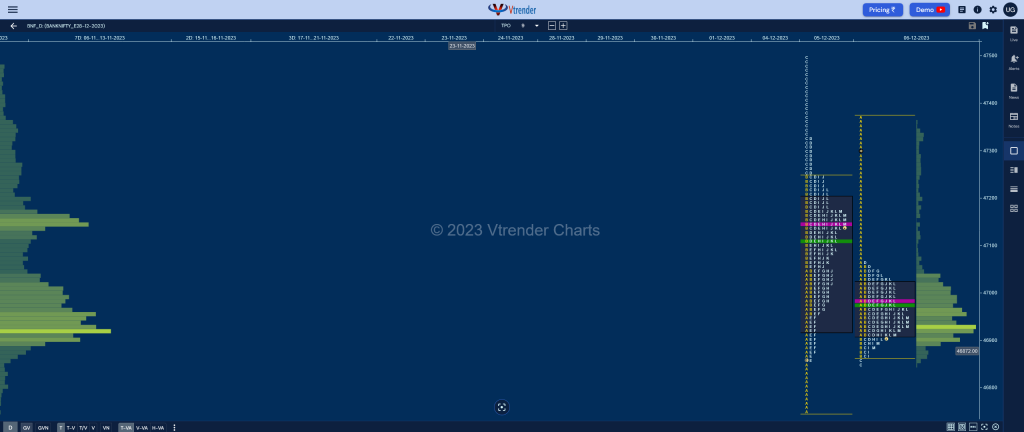

BankNifty Nov F: 46926 [ 47367 / 46845 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 21,981 contracts |

| Initial Balance |

|---|

| 497 points (47367 – 46871) |

| Volumes of 58,937 contracts |

| Day Type |

|---|

| Normal (‘b’ shape) – 523 points |

| Volumes of 1,78,813 contracts |

BNF opened higher testing the previous day’s selling zone from 47325 to 47493 and was swiftly rejected taking it back into the 3-1-3 profile’s Value Area as it completed the 80% Rule while making a low of 46911 in the A period itself and went on to make a lower low of 46871 in the B leaving a pretty large 497 point range Initial Balance (IB) with a long A period selling tail from 47058 to 47367.

The auction then made a typical C side extension to 46845 where it tested the lower singles of the 3-1-3 profile and got rejected giving the customary retracement to the day’s VWAP as it made an attempt to get into the A period tail but only managed to leave a PBH at 47065 after which it remained in a narrow range for the rest of the day building volumes & TPOs at 46926 where it eventually closed leaving a ‘b’ shape profile and an inside day.

The December series POC also has shifted higher to 46897 confirming that the early longs have been booking profits hence this phase of consolidation can continue further with today’s A period selling zone being the reference on the upside whereas on the downside, the buying singles from 46860 to 46659 would be the reference to look for initiative activity for a move away from this 2-day balance.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 46983 F and VWAP of the session was at 46972

- Value zones (volume profile) are at 46909-46983-47017

- HVNs are at 45127 / 46987** / 47147 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 44720

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

Business Areas for 07th Dec 2023

| Up |

| 46987 – Dec Series POC 47065 – Selling Tail (06 Dec) 47216 – IB Singles mid (06 Dec) 47325 – Selling tail (05 Dec) 47400 – C TPO POC (05 Dec) |

| Down |

| 46863 – Buy tail (06 Dec) 46759 – Singles mid (05 Dec) 46644 – Closing HVN (04 Dec) 46574 – Ext Handle (04 Dec) 46444 – Ext Handle (04 Dec) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.