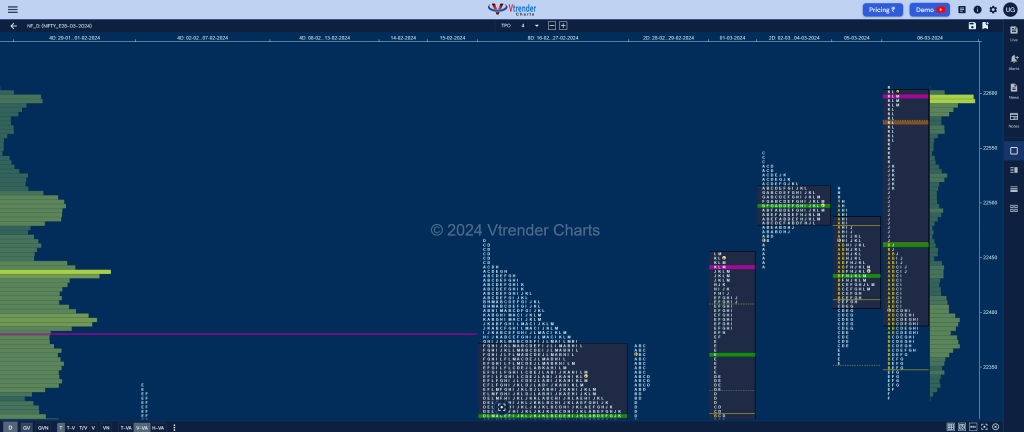

Nifty Mar F: 22593 [ 22605 / 22322 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 9,152 contracts |

| Initial Balance |

|---|

| 113 points (22463 – 22350) |

| Volumes of 44,114 contracts |

| Day Type |

|---|

| Neutral Extreme – 283 pts |

| Volumes of 1,87,651 contracts |

NF made an OAIR start testing previous session’s PBL (Pull Back Low) of 22387 and got back into the value triggering the 80% Rule but could only manage to tag 22463 from where it got back lower making new lows of 22350 in the B period after which a bit of coiling happened in the C & D TPOs as it stayed mostly below VWAP.

The auction then made couple of REs (Range Extension) lower in the E & F periods but could only manage marginal new lows of 22327 & 22322 holding above 01st Mar’s buying extension handle of 22316 displaying that the sellers were doing a bad job as it continued to consolidate forming a balance till the H TPO.

NF then made an initiaitve move to the upside starting from the I period resulting in a big trending move as it not only swiped through previous value & range but went on to record new ATH of 22605 into the close leaving a Neutral Extreme Day Up with a good chance of the imbalance to continue at the next open.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22596 F and VWAP of the session was at 22460

- Value zones (volume profile) are at 22390-22596-22603

- NF confirmed a FA at 22022 on 29/02 and completed the 2 ATR objective of 22456

- HVNs are at 22443** / 22497 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (23-29 Feb) – to be updated

Monthly Zones

- The settlement day Roll Over point (March 2024) is 22188

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

Business Areas for 07th Mar 2024

| Up |

| 22596 – POC (06 Mar) 22662 – Weekly ATR 22701 – 1 ATR (HVN 22497) 22743 – 1 ATR (M_IBH 22547) 22792 – 1 ATR (yPOC 22596) |

| Down |

| 22575 – HVN (06 Mar) 22514 – Mid-profile tail 22460 – NeuX VWAP (06 Mar) 22412 – I TPO halfback 22365 – SOC (06 Mar) |

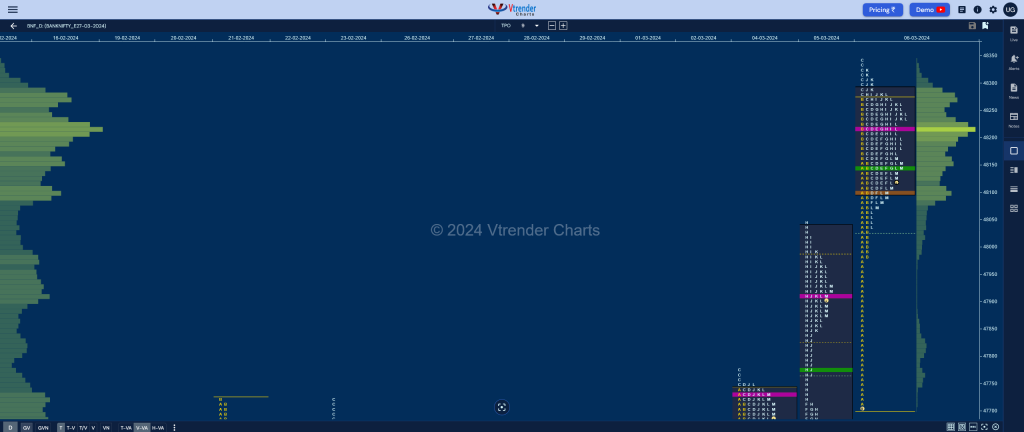

BankNifty Mar F: 48117 [ 48345 / 47705 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 15,542 contracts |

| Initial Balance |

|---|

| 568 points (48273 – 47705) |

| Volumes of 70,299 contracts |

| Day Type |

|---|

| Normal– 640 points |

| Volumes of 2,59,529 contracts |

BNF opened lower but made an OL (Open=Low) start at 47705 getting demand back at the extension handle of 47714 from previous session as it went on to drive higher for the rest of the IB (Initial Balance) scaling above previous highs and hitting 48273 forming a large 568 point range which was well above average for the first hour.

The auction then made the dreaded C side extension to 48345 marking the end of the upside for the day as it got back to balance mode leaving a ‘p’ shape profile and a Normal Day with completely higher Value with a long initiative buying tail from 47980 to 47705 along with a prominent POC at 48217.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48217 F and VWAP of the session was at 48147

- Value zones (volume profile) are at 48103-48217-48289

- BNF confirmed a FA at 47487 on 05/03 and completed 1 ATR objective comes of 48170 on 06/03. The 2 ATR target comes to 48853

- HVNs are at 47584** / 48217 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (01-06 Mar) – BNF left a Trend Up weekly profile hitting the 2 IB target of 48343 forming completely higher value at 47444-47567-48229 with a closing HVN at 48217 which will be the immediate reference on the upside in the coming week staying above which it could go for the higher VPOC of 48480 and HVN of 48864 from the weekly profile of 11th to 17th Jan whereas on the downside, this week’s VWAP of 47694 will be an important swing support.

Monthly Zones

- The settlement day Roll Over point (March 2024) is 46610

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

Business Areas for 07th Mar 2024

| Up |

| 48166 – L TPO VWAP (06 Mar) 48324 – Sell tail (06 Mar) 48480 – VPOC (12 Jan) 48592 – Poor Lows (15 Jan) 48699 – VPOC (15 Jan) |

| Down |

| 48100 – Closing HVN (06 Mar) 47980 – Buying Tail (06 Mar) 47842 – IB single mid 47694 – Weekly VWAP 47567 – Weekly POC |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.