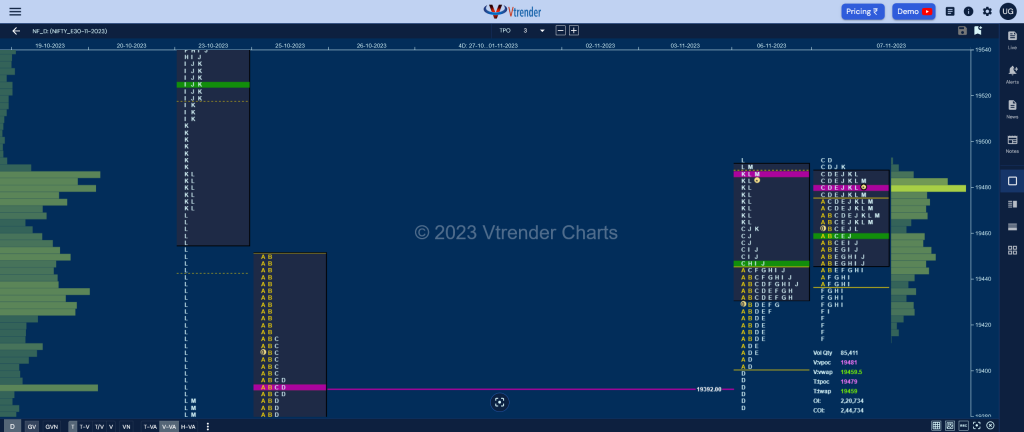

Nifty Nov F: 19476 [ 19493 / 19415 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 10,813 contracts |

| Initial Balance |

|---|

| 37 points (19493 – 19415) |

| Volumes of 19,686 contracts |

| Day Type |

|---|

| Neutral Centre – 79 points |

| Volumes of 85,411 contracts |

NF did not give a follow up to the NeuX (Neutral Extreme) close of previous session by opening lower and testing the NeuX VWAP of 19446 as it made a low of 19438 in the opening minutes but could not sustain leaving a very narrow 37 point range Initial Balance with the B period completely inside A indicating that only locals were in play.

The auction then made a C side extension higher tagging the yPOC of 19485 and the buyers got an opportunity to extend further in the D TPO where it made marginal new highs of 19493 but failed to come to the party triggering a quick drop in the E & F periods where it even made new lows of 19415 taking support exactly at yesterday’s E TPO marking the end of the downside as it left a small responsive buying tail.

NF then left a Scene Of Crime at 19443 confirming that the PLR (Path of Least Resistance) was to the upside as it went on to tag 19489 in the J period but could not extend any futher forming a Neutral Centre Day with completely inside Value and will need initiative buying above 19487 to continue the probe further up in the 23rd Oct Trend Day Down profile whereas on the downside, today’s Scene Of Crime (SOC) of 19443 will be the important support below which we can get a re-visit to the FA (Failed Auction) of 19385

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19481 F and VWAP of the session was at 19459

- Value zones (volume profile) are at 19447-19481-19485

- NF confirmed a FA at 19385 on 06/11 and the 1 ATR objective comes to 19544

- HVNs are at 19062 / 19129 / 19213** / 19392 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 08th Nov 2023

| Up |

| 19481 – dPOC from 07 Nov 19525 – TD VWAP (23 Oct) 19571 – VPOC (23 Oct) 19621 – Ext Handle (23 Oct) 19666 – VWAP from 20 Oct |

| Down |

| 19462 – Closing PBL (07 Nov) 19425 – Buying tail (07 Nov) 19385 – FA from 06 Nov 19330 – VPOC from 06 Nov 19299 – HVN from 03 Nov |

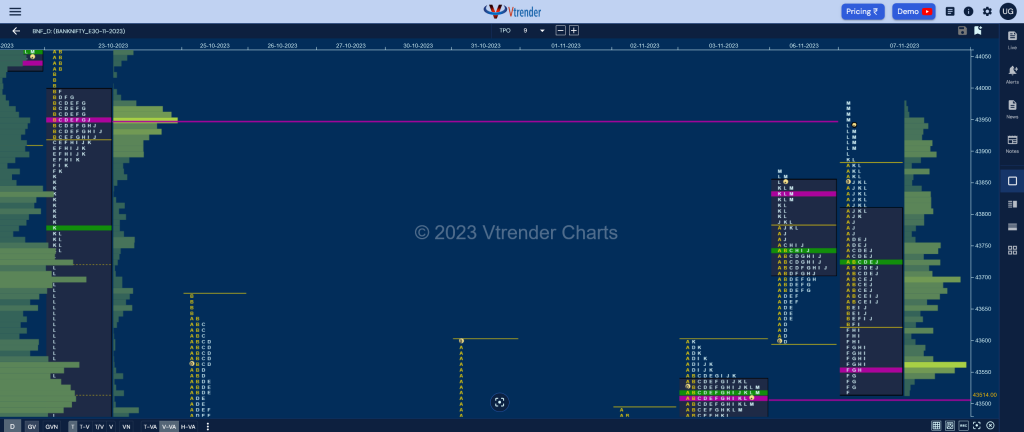

BankNifty Nov F: 43926 [ 43979 / 43517 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 12,086 contracts |

| Initial Balance |

|---|

| 99 points (43724 – 43625) |

| Volumes of 28,871 contracts |

| Day Type |

|---|

| Neutral Extreme – 462 points |

| Volumes of 1,65,356 contracts |

BNF opened below the yPOC of 43838 and broke below the VWAP of 43743 indicating supply coming back and they managed to made a Range Extension (RE) lower in the first half of the day leaving an extension handle at 43625 and making a low of 43517 in the F period almost tagging 03rd Nov’s VPOC of 43514. (P.S: There was a freak tick at 43875 at open but OrderFlow showed no volumes above 43720)

The auction having met one of its objectives on the downside then began to show signs of reversal which started with the dPOC shifting lower to 43555 indicating sellers booking profits which was followed by a probe above day’s VWAP in the I TPO implying that the buyers were taking control and more confirmation came in form of an extension handle at 43758 as it went on to get above PDH and made a spike higher into the close tagging the 23rd Oct’s VPOC of 43949 while making a high of 43979.

BNF closed as a Neutral Extereme (NeuX) Day Up forming an Outside Bar and the NeuX zone from 43885 to 43979 will be the opening reference for the next session with today’s VWAP of 43729 being the important support level which needs to hold for this upside probe to continue towards 18th Oct’s Double Distribution (DD) profile’s references.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 43555 F and VWAP of the session was at 43729

- Value zones (volume profile) are at 43521-43555-43809

- HVNs are at 42928** / 43184 / 44040 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 08th Nov 2023

| Up |

| 43938 – Selling tail (07 Nov) 44034 – Ext Handle (23 Oct) 44143 – Selling tail (20 Oct) 44289 – LVN from 20 Oct 44425 – DD VWAP (18 Oct) |

| Down |

| 43885 – NeuX Low (07 Nov) 43758 – Extension Handle (0 Nov) 43625 – SOC from 07 Nov 43514 – VPOC from 03 Nov 43423 – Gap mid-point (03 Nov) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.