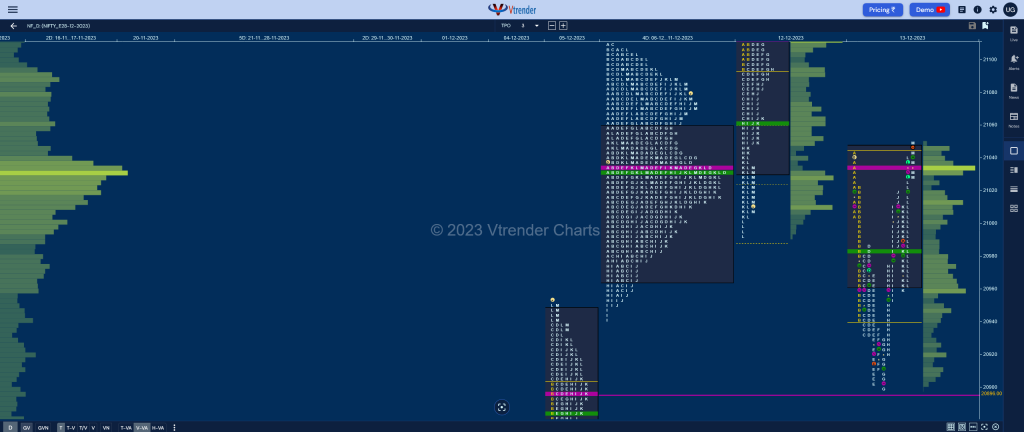

Nifty Dec F: 21034 [ 21049 / 20900 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 9,026 contracts |

| Initial Balance |

|---|

| 102 points (21044 – 20942) |

| Volumes of 28,605 contracts |

| Day Type |

|---|

| Neutral Centre – 149 points |

| Volumes of 1,29,598 contracts |

NF opened slightly higher testing previous day’s K period POC of 21040 which was a supply zone but could only manage to hit 21044 as the sellers came back strongly and drove it lower in the B TPO not only confirming a selling tail from 21021 to 21044 but also left an extension handle at 21003 as it went on to make a low of 20942 which was also the lows of the 5-day composite it had been forming.

The auction then made the dreaded C side extension to 20931 stalling right at the LVN from 05 Dec and made a typical probe back to day’s VWAP in the D period where it got rejected leaving a PBH at 20985 which was just below the 5-day composite VAL indicating that it wants to move away from this balance and more confirmation of this came in the E TPO where it made new lows of 20902.

NF then made another attempt to extend lower in the G period but could only manage to tag 20900 taking support just above 05th Dec’s VPOC of 20896 hinting that some demand was coming back in this zone and the H TPO validated this view by getting back to day’s VWAP and followed it up getting back into the 5-day composite Value in I period before negating the morning extension handle of 21003 in the J while making a high of 21020.

The K period made a suprisingly consolidating move probing below the VWAP as it tested the dPOC of 20960 which was succesfully defended as could be seen in the PBL it left at 20958 and this turned out to be a launcing pad for the auction to shoot higher into the close even making marginal new highs of 21049 and saw the dPOC shift higher matching with the 5-day POC of 21034 eventually closing there leaving a Neutral Centre Day and with today’s VWAP of 20982 holding can fill up the upper part from 21034 to 21084 in the coming session(s) before making another attempt to move away from that magnet of 21034.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21034 F and VWAP of the session was at 20982

- Value zones (volume profile) are at 20962-21034-21046

- NF confirmed a FA at 21119 on 11/12 and the 1 ATR objective comes to 20993. This FA was re-visited on 12/12 but failed to get any demand leaving an initiative selling tail and a probe lower to 20991 completing the 1 ATR objective to the downside.

- HVNs are at 20377 / 21032** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 20270

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

Business Areas for 14th Dec 2023

| Up |

| 21034 – dPOC from 13 Dec 21062 – VWAP from 12 Dec 21111 – VPOC from 12 Dec 21165 – 1 ATR from 21034 (yPOC) 21222 – 2 ATR from 20960 (HVN) |

| Down |

| 21018 – L TPO VWAP (13 Dec) 20982 – VWAP from 13 Dec 20935 – SOC from 13 Dec 20896 – VPOC from 05 Dec 20845 – HVN from 05 Dec |

BankNifty Nov F: 47396 [ 47447 / 47111 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 11,961 contracts |

| Initial Balance |

|---|

| 249 points (47361 – 47111) |

| Volumes of 34,422 contracts |

| Day Type |

|---|

| Normal Variation – 336 points |

| Volumes of 1,27,010 contracts |

BNF opened around the SOC of 47364 and saw the sellers come back strongly as it gave an ORR (Open Rejection Reverse) kind of a start breaking below the 08th Dec’s NeuX VWAP of 47171 and making a low of 47111 stalling just below that day’s VPOC of 47087 in the A period but saw a combination of profit booking and some demand coming back in this important zone as B TPO made an inside bar leaving a small but important buying tail at the lows.

The C side then made a rare double inside bar giving more confirmation that the downside move was done with and the auction was back to forming a balance which continued on till the G period where it left a PBL at 47183 after which it went on to get back into previous Value even making a RE in the H TPO and followed it up with higher highs of 47447 in the J tagging the yPOC 47431 but stalling right at the PBH of 47445.

BNF then gave a quick dip back to day’s VWAP in the K period but showed change of polarity at the 47261 level leaving a PBL there and went on to get back to yPOC of 47431 into the close leaving a Normal Variation Day Up forming a HVN at 47393 which will be the reference for the next open and will need to stay above it for more upside as the defence of 47087 clearly indicating OTF (Other Time Frame) buyers coming back.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 47221 F and VWAP of the session was at 47255

- Value zones (volume profile) are at 47137-47221-47351

- BNF confirmed a FA at 46961 on 08/12 and tagged the 1 ATR objective of 47437 on same day. The 2 ATR target comes to 47913

- HVNs are at 45127 / 47012** / 47147 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 44720

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

Business Areas for 14th Dec 2023

| Up |

| 47431 – PBH from 13 Dec 47548 – Selling Tail (12 Dec) 47650 – Selling tail (11 Dec) 47789 – Weekly ATR 47913 – 2 ATR (FA 46961) |

| Down |

| 47393 – Closing HVN (13 Dec) 47255 – VWAP from 13 Dec 47126 – Byuing Tail (13 Dec) 46961 – FA from 06 Dec 46831 – SOC from 07 Dec |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.