Nifty Nov F: 19497 [ 19535 / 19469 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 8,729 contracts |

| Initial Balance |

|---|

| 45 points (19535 – 19490) |

| Volumes of 19,078 contracts |

| Day Type |

|---|

| Normal (Gaussian) – 65 points |

| Volumes of 56,581 contracts |

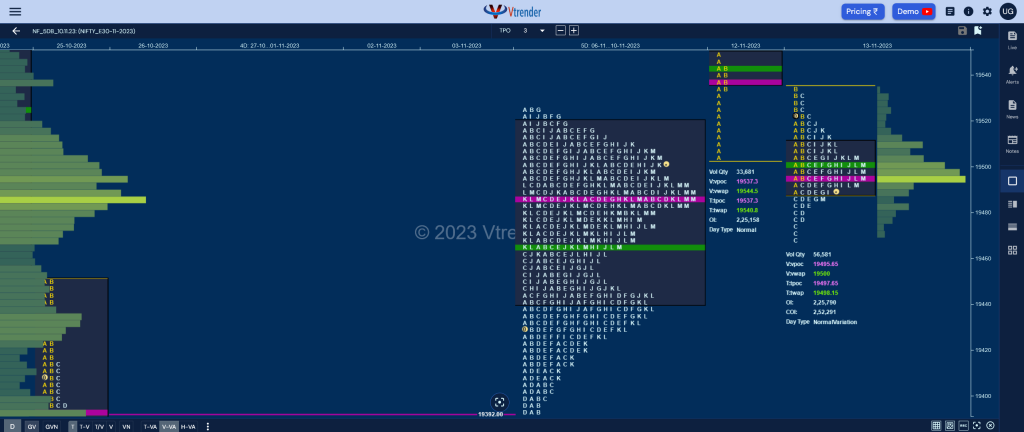

NF opened higher and remained above the 5-day POC of 19487 (06-10 Nov) while making a low of 19490 in the A period followed by a higher high of 19535 in the B leaving yet another narrow range in the Initial Balance of just 45 points stalling just below October’s POC of 19537.

Unable to extend further on the upside, the auction made a typical C side probe lower in search of buyers as it broke below 19487 and tested 10th Nov’s spike low of 19478 but could only manage to hit 19469 giving the customany retracement back to day’s VWAP and a slow rise further to 19518 where it left a PBH right below the composite VAH of 19519 as given in the Business Areas.

With the upside being limited, NF then made another unhurried move lower getting back to the magnet of 19487 into the close leaving a Normal Day and a Gaussian Curve between 2 important monthly references of 19537 (October POC) and 19468 (October VWAP) with a close right at the prominent POC of 19495 therefore has a bright chance of giving a move away from here in the coming session provided one of the 2 levels show initiative activity.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19495 F and VWAP of the session was at 19500

- Value zones (volume profile) are at 19489-19495-19511

- NF confirmed a FA at 19385 on 06/11 and the 1 ATR objective comes to 19544. This FA got re-visited on 10/11 and saw demand coming back hence is still a valid reference.

- HVNs are at 19129 / 19213 / 19486** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 15th Nov 2023

| Up |

| 19518 – PBH from 13 Nov 19542 – 1 ATR (VPOC 19397) 19571 – VPOC (23 Oct) 19621 – Ext Handle (23 Oct) 19666 – VWAP from 20 Oct |

| Down |

| 19478 – Buying tail (13 Nov) 19433 – VWAP from 10 Nov 19397 – dPOC from 10 Nov 19363 – Daily Ext Handle 19330 – VPOC from 06 Nov |

BankNifty Nov F: 44013 [ 44085 / 43801 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 9,307 contracts |

| Initial Balance |

|---|

| 111 points (44020 – 43909) |

| Volumes of 26,716 contracts |

| Day Type |

|---|

| Neutral – 284 points |

| Volumes of 1,15,235 contracts |

BNF opened higher above the 3-day composite VAH but made an OH (Open=High) start at 44020 and got back into the balance while making a low of 43909 in the A period triggering the 80% Rule to the downside after which it remained quiet in the B TPO staying in a narrow 68 point range between 43998 & 43930 leaving a narrow 111 point range IB (Initial Balance).

The auction then made a big C side extension lower completing the 80% Rule to the dot while making a low of 43801 from where it was swiftly rejected leaving a small responsive buying tail resulting in reverse 80% Rule in the E period where it got back above the 3-day VAH and remained above it indicating that the PLR (Path of Least Resistance) was now to the upside.

More confirmation of the buyers pressing advantage came in the first RE to the upside in the G TPO which was follower by higher highs in the J & K as BNF made a look up above 09th Nov’s Swing High of 44075 while hitting 44085 but could not sustain and made a small retracment down to 43978 before settling down around the dPOC of 43999 leaving a Neutral Day with overlapping to higher Value.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 43999 F and VWAP of the session was at 43961

- Value zones (volume profile) are at 43921-43999-44051

- HVNs are at 42928 / 43184 / 43832** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 15th Nov 2023

| Up |

| 44035 – L TPO POC (13 Nov) 44143 – Selling tail (20 Oct) 44289 – LVN from 20 Oct 44425 – DD VWAP (18 Oct) 44530 – DD singles mid (18 Oct) |

| Down |

| 43978 – Closing PBL (13 Nov) 43851 – Buying tail (13 Nov) 43746 – Weekly IBL (09 Nov) 43625 – SOC from 07 Nov 43514 – VPOC from 03 Nov |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.