Nifty Dec F: 21557 [ 21590 / 21354 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 15,631 contracts |

| Initial Balance |

|---|

| 73 points (21427 – 21354) |

| Volumes of 37,711 contracts |

| Day Type |

|---|

| Normal Variation with Spike close – 236 points |

| Volumes of 1,49,664 contracts |

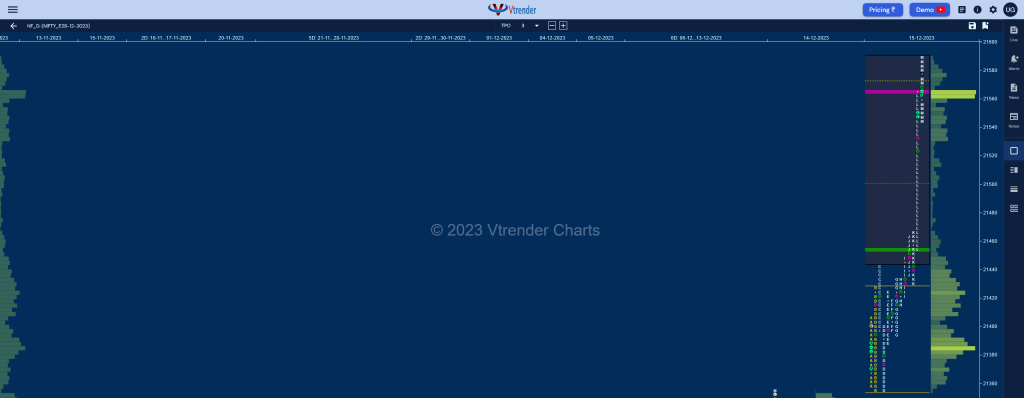

NF opened higher continuing the closing imbalance of previous session but failed to get fresh demand triggering a probe down as it made similar lows of 21357 & 21354 in the A & B periods respectively taking support at PDH of 21355 hinting at some buying coming back resulting in a fresh probe higher and completion of the 1 ATR objective of 21417 from yPOC of 21283 while making a high of 21427 at the close of the Initial Balance.

The auction then made the dreaded C side extension to 21442 which was swiftly rejected and even went on to break below the day’s VWAP causing the laggard longs to press the exit button as it went on to make a low of 21356 once again stalling just above PDH marking the completion of the downside for the day and began to form a balance till the H TPO.

NF then made a fresh RE (Range Extension) to the upside in the I period and followed it up with new highs of 21464 in the J as it completed the 1.5 IB target for the day but made equal highs of 21465 in the K displaying short term exhaustion as it made a small retracement to 21430 and held IBH which meant that the buyers were back in control and they went on to record a huge spike from 21465 to 21590 into the close but saw profit booking coming in as the dPOC shifted higher to 21564 which means with the entire spike zone would be the reference for the next open as it will need some acceptance and filling.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21564 F and VWAP of the session was at 21455

- Value zones (volume profile) are at 21444-21564-21588

- HVNs are at 20377 / 21032** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 20270

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

Business Areas for 18th Dec 2023

| Up |

| 21564 – dPOC from 15 Dec 21599 – 1 ATR (yVWAP 21455) 21650 21708 – 1 ATR (yVWAP 21564) 21759 |

| Down |

| 21545 – Closing singles (15 Dec) 21505 – Singles mid (15 Dec) 21455 – VWAP from 15 Dec 21402 – LVN from 15 Dec 21356 – Buying Tail (15 Dec) |

BankNifty Nov F: 48271 [ 48375 / 47780 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 32,570 contracts |

| Initial Balance |

|---|

| 275 points (48150 – 47875) |

| Volumes of 32,570 contracts |

| Day Type |

|---|

| Neutral Extreme – 595 points |

| Volumes of 1,53,715 contracts |

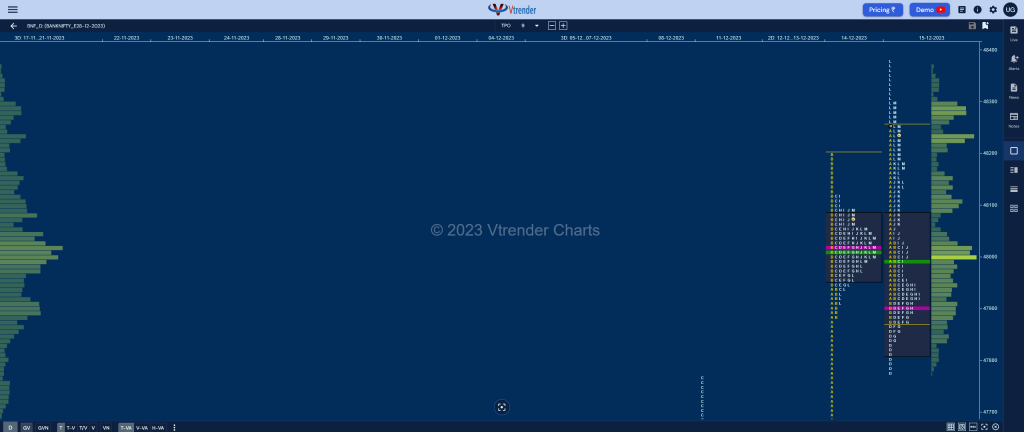

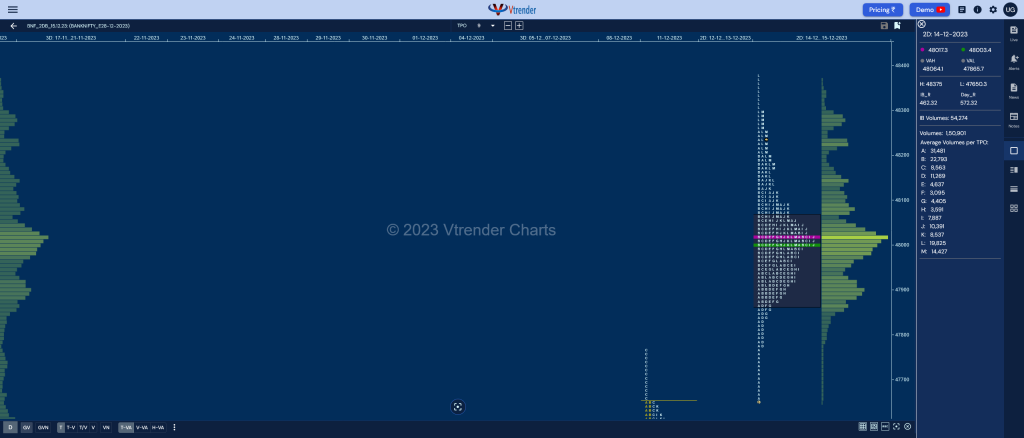

BNF opened with a freak OH (Open=High) tick at 48250 but there were no volumes above 48150 which meant that it made an OAIR start with no fresh demand coming in previous session’s B period selling tail as it promptly completed the 80% Rule in previous Value while making a low of 47923 in the A period and took support in the buying singles from 47883 to 47650 as it made a low of 47875 in the B TPO.

The auction then made a rare inside bar in the C side as it got back into previous Value but got stalled right at yPOC of 48022 as initiative buyers were still missing and this triggered a swipe lower in the D period resulting in a RE to 47780 as it made further inroads into 14th Dec’s A period tail but held just above the mid-point of 47766 signalling return of demand.

BNF then left a small responsive buying tail till 47837 in the G TPO and finally showed some initiative players coming at day’s VWAP in the I period as it made a trending move higher making multiple RE’s till the L where it hit 48375 before profit booking brought it back to 48271 into the close with the dPOC also shifting higher to 48234 leaving a Neutral Extreme Day Up but with completely overlapping Value leaving a nice 2-day balance with tails at both ends hence the composite Value of 47850-48020-48112 will be the zone to watch on the downside in the coming session(s) where as on the upside, it will need to negate today’s responsive selling tail from 48300 to 48375 to continue higher.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48234 F and VWAP of the session was at 48070

- Value zones (volume profile) are at 47960-48234-48308

- BNF confirmed a FA at 46961 on 08/12 and tagged the 2 ATR objective of 47913 on 14/12. This FA is currently on ‘T+6’ day

- HVNs are at 45127 / 47012 / 47145** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (December 2023) is 44720

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

Business Areas for 18th Dec 2023

| Up |

| 48300 – Selling tail (15-Dec) 48437 – 48575 – 1 ATR (yVWAP 48070) 48739 – 1 ATR (yPOC 48234) 48860 – Monthly 1.5 IB |

| Down |

| 48234 – dPOC from 15 Dec 48070 – NeuX VWAP (15 Dec) 47957 – SOC from 15 Dec 47837 – Buying tail (15 Dec) 47650 – 2-day composite low |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.