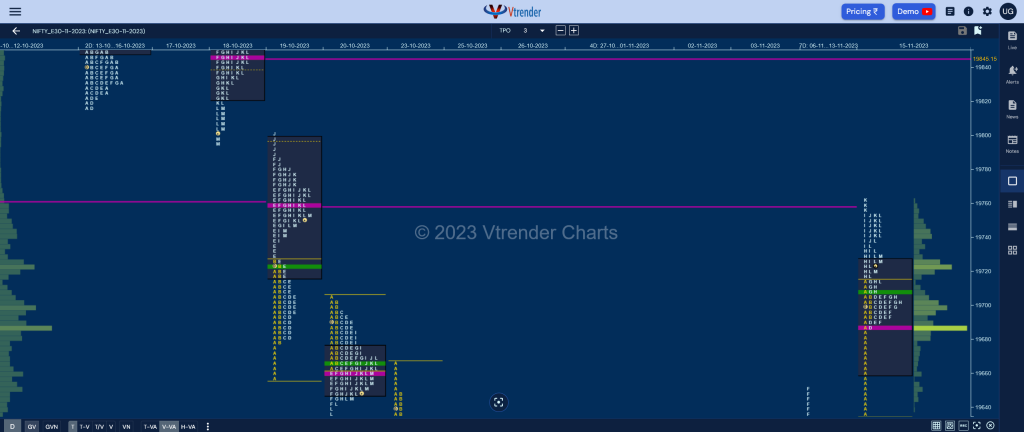

Nifty Nov F: 19723 [ 19763 / 19637 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 46,155 contracts |

| Initial Balance |

|---|

| 78 points (19714 – 19637) |

| Volumes of 58,908 contracts |

| Day Type |

|---|

| Normal Variation (‘p’ profile) – 127 points |

| Volumes of 1,22,153 contracts |

NF opened with a big gap up of 203 points completing the 2 ATR objective of 19704 from the FA of 19385 while making a high of 19714 after which it settled down into an OA (Open Auction) forming a mere 13 point inside bar in the B period as it left an initiative buying tail from 19692 to 19637 at the end of the Initial Balance.

The auction continued to consolidate taking support at the dPOC of 19687 multiple times till the G TPO before it made an extension on the upside in the H and went on to scale above 19th Oct’s VWAP of 19722 facilitating a probe to that day’s VPOC of 19758 which it tagged in the K period leaving a small responsive selling tail indicating profit booking.

NF then made a retracement back to 19715 in the L TPO taking support just above the extension handle of 19714 before closing around the HVN of 19722 leaving a ‘p’ shape profile for the day with completely higher Value with good chance of this imbalance extending in the coming session(s).

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19687 F and VWAP of the session was at 19707

- Value zones (volume profile) are at 19661-19687-19725

- NF confirmed a FA at 19385 on 06/11 and tagged the 2 ATR objective of 19704 on 15/11

- HVNs are at 19129 / 19213 / 19486** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 16th Nov 2023

| Up |

| 19740 – SOC from 15 Nov 19785 – Selling Tail (19 Oct) 19820 – Ext Handle (18 Oct) 19869 – TD VWAP (18 Oct) 19903 – Ext Handle (18 Oct) |

| Down |

| 19715 – Ext Handle (15 Nov) 19662 – IB singles mid (15 Nov) 19621 – Weekly Ext Handle 19592 – Gap Mid-point (15 Nov) 19554 – 1 ATR (yPOC 19687) |

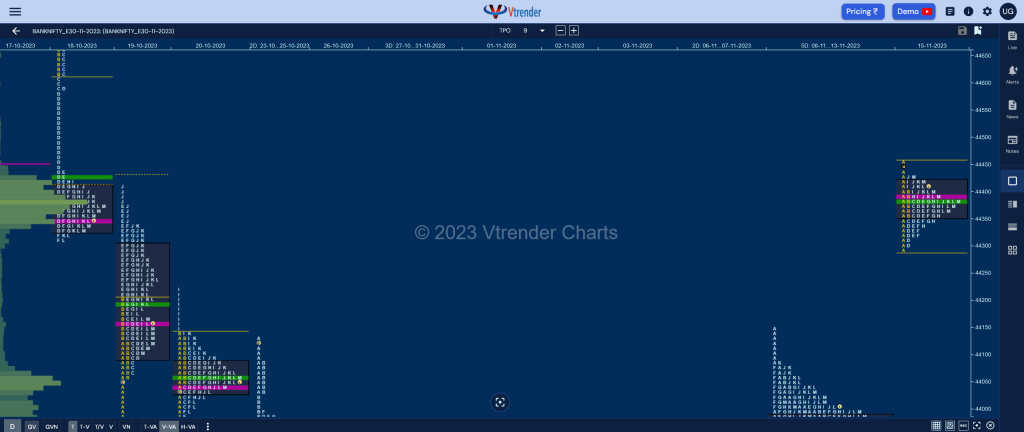

BankNifty Nov F: 44387 [ 44454 / 44290 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 33,896 contracts |

| Initial Balance |

|---|

| 165 points (44454 – 44290) |

| Volumes of 59,403 contracts |

| Day Type |

|---|

| Normal (Gaussian) – 165 points |

| Volumes of 2,19,687 contracts |

BNF also opened with a pretty large gap up of 436 points tagging 18th Oct’s DD VWAP of 44425 but made an almost OH (Open=High) start at 44450 stalling in mid-profile zone of singles from that day and took support right above the LVN reference of 44289 from 20th Oct indicating change of polarity as it made a low of 44290 in the opening 5 minutes of the day.

The auction then spent the rest of the day in this narrow 165 point range leaving a PBL at 44305 in the D period along with a closing PBH at 44430 in the M forming a Gaussian Curve for the day with a close right at the dPOC of 44388 signalling a pause after the imbalance it made after the 6-day balance from 06th to 13th Nov.

BNF looks good for more upside with the 18th Oct DD references of 44530 & 44620 being the immediate objectives along with that day’s selling tail from 44774 above which we have the weekly VPOC of 44869 (12-18 Oct) along with the daily one at 45024 (12 Oct) as the higher targets in the impending sessions.

Click here to view the latest profile in BNF on Vtrender Charts

Weekly Settlement (09th to 15th Nov) : 44387 [ 44454 / 43687 ]

BNF has formed a Neutral Extreme plus a Double Distribution profile on the weekly as it spend most of the time building a balance with a prominent POC at 43930 but made a move away on the last day with a big gap up forming completely higher Value at 44008-44389-44454 with the zone of singles from 44305 to 44074 and the VWAP at 44082 which will be the levels to watch for on the downside as the POC has moved higher to 44389 which it will need to sustain to continue higher towards the weekly VPOC of 44869 in the coming week.

Daily Zones

- Largest volume (POC) was traded at 44388 F and VWAP of the session was at 44384

- Value zones (volume profile) are at 44360-44388-44422

- HVNs are at 42928 / 43184 / 43832** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 16th Nov 2023

| Up |

| 44422 – VAH from 15 Nov 44530 – DD singles mid (18 Oct) 44620 – DD Ext Handle (18 Oct) 44774 – Selling Tail (18 Oct) 44869 – Weekly VPOC (12-18 Oct) |

| Down |

| 44360 – VAL from 15 Nov 44232 – Gap mid point 44159 – Singles mid (15 Nov) 44082 – Weekly VWAP 43978 – Closing PBL (13 Nov) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.