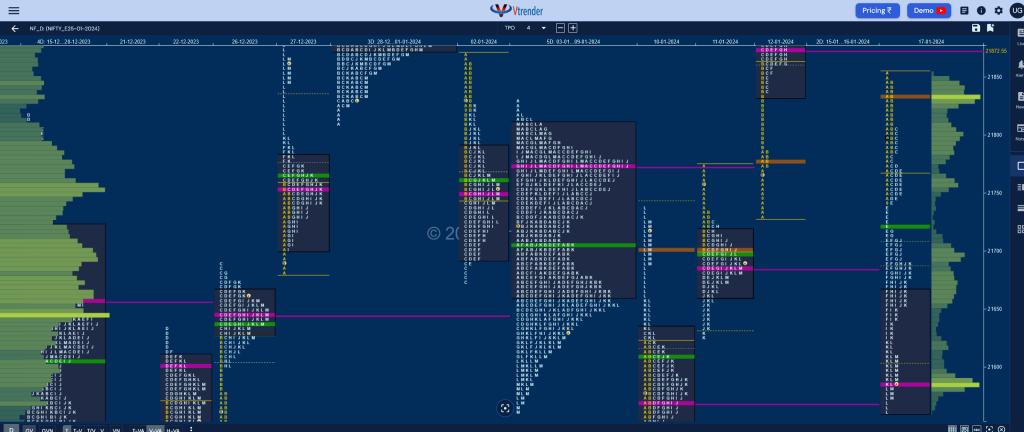

Nifty Jan F: 21589 [ 21854 / 21563 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 57,749 contracts |

| Initial Balance |

|---|

| 143 points (21854 – 21711) |

| Volumes of 81,200 contracts |

| Day Type |

|---|

| Trend – 291 points |

| Volumes of 2,29,664 contracts |

NF opened with a big gap down of 286 points completing the 2 ATR objective of 21770 from previous day’s FA of 22138 and gave a bounce back to 21854 stalling just below 12th Jan’s VPOC of 21872 as it left a small selling tail in the IB and went on to form a Trend Day Down tagging the lower VPOCs of 21686 & 21569 from 11th & 10th Jan respectively marking the change of the bigger trend also to the downside with today’s VWAP of 21721 being the immediate swing reference.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21587 F and VWAP of the session was at 21721

- Value zones (volume profile) are at 21563-21587-21664

- NF confirmed a FA at 22138 on 16/01 and completed the 2 ATR target of 21770 on 17/01

- HVNs are at 21755** / 21890 (** denotes series POC)

Weekly Zones

- (05-11 Jan) – NF has formed a Normal Variation profile to the downside which made a look down below previous lows but left an initaitive buying tail on the daily timeframe from 21528 to 21501 forming a nice balance over the 5 days with Value being completely inside at 21635-21703-21797 and this week’s VWAP also around the middle at 21690 where it closed and will need initiative volumes at one end in the coming week for a fresh imbalance to begin

- (29 Dec-04 Jan) – NF has formed a Neutral Centre weekly profile as it made a look up above previous highs but got rejected after making new ATH of 22025 and went on to make a low of 21579 taking support right above last week’s lower TPO HVN of 21570 filling up the low volumes zones and forming mostly overlapping Value at 21640-21748-21875 with a point to note that the sellers who had come in forming a base at 21890 had mostly booked profits at lower levels where it saw some short covering and fresh demand coming back.

Monthly Zones

- The settlement day Roll Over point (January 2024) is 21930

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

Business Areas for 18th Jan 2024

| Up |

| NA |

| Down |

| NA |

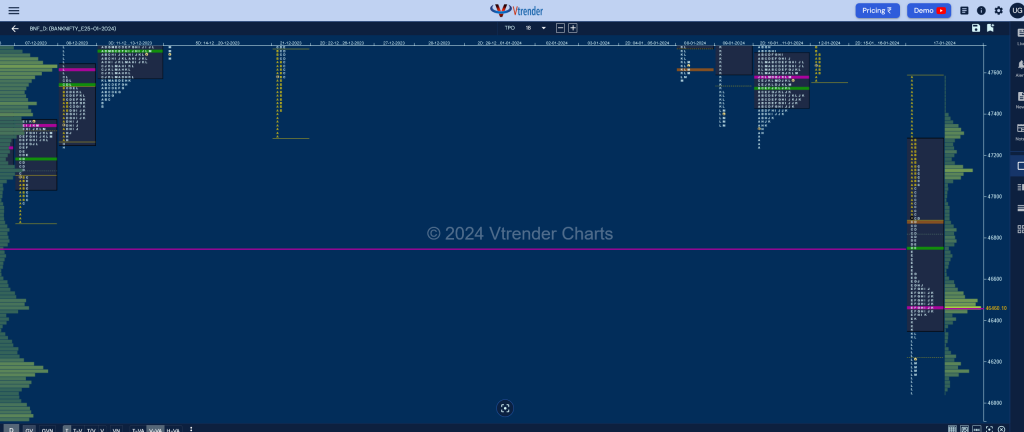

BankNifty Jan F: 46159 [ 47300 / 46050 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 85,649 contracts |

| Initial Balance |

|---|

| 700 points (47600 – 46900) |

| Volumes of 1,27,576 contracts |

| Day Type |

|---|

| Trend – 1549 points |

| Volumes of 3,96,435 contracts |

BNF opened with an unexpected & huge 1210 point gap lower and continued the plunge as it left an initiative selling tail from 47279 to 47600 and went on to leave 3 extension handles at 46900, 46717 & 46402 to form an elongated Trend Day profile of 1549 points as it made a low of 46050 with the help of a spike from 46321. Today’s POC of 46460 will be the immediate swing reference going forward with the VWAP of 46752 being the higher level to watch for the rest of the series as the imbalance could continue further to the downside in the coming session(s).

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 46460 F and VWAP of the session was at 46752

- Value zones (volume profile) are at 46366-46460-47284

- BNF confirmed a FA at 48440 on 16/01 and the completed the 2 ATR objective of 47386 on 17/01

- HVNs are at 47956 / 48007 / 48157** / 48555 (** denotes series POC)

Weekly Zones

- (11-17 Jan) – BNF made a slow and trending move higher for the first 4 days of the week getting above previous week’s VWAP of 47970 but marked the end of the upside with a daily FA at 48440 on 16th leaving a nice 2-day balance from where it made a big move away on the last day making it a hat-trick of Neutral Extreme weekly profiles to the downside re-confirming the lack of demand at the upper levels forming the biggest weekly range of the current series of 2389 points with mostly overlapping Value at 47110-48233-48432 with the NeuX VWAP at 47458

- (04-10 Jan) – BNF has once again formed a Neutral Extreme Down weekly profile which first filled up the low volume zone of previous week and then went on repair the poor lows with a sharp move lower testing the swing lows of 47303 (21-28 Dec) while tagging 47201 before giving a bounce back to 47666 into the close. Value for the week was completely overlapping at 47670-48076-48601 with the main supply reference being at the NeuX VWAP of 47970

- (29 Dec-03 Jan) – BNF has formed a Neutral Extreme which also reresents a Double Distribution Trend Down profile which got stalled right below previous week’s POC of 48879 on the upside and went on to fill the low volume zone till 48446 and made an initiative move with a small selling tail from 48346 to 48256 as it went on to make poor lows at 47763 forming a lower balance with the POC also shifting down to 47956. Value for the week was at 47765-47956-48542 with the important DD VWAP being at 48278 which will be the swing reference for the coming settlement.

Monthly Zones

- The settlement day Roll Over point (January 2024) is 48900

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

Business Areas for 18th Jan 2024

| Up |

| NA |

| Down |

| NA |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.