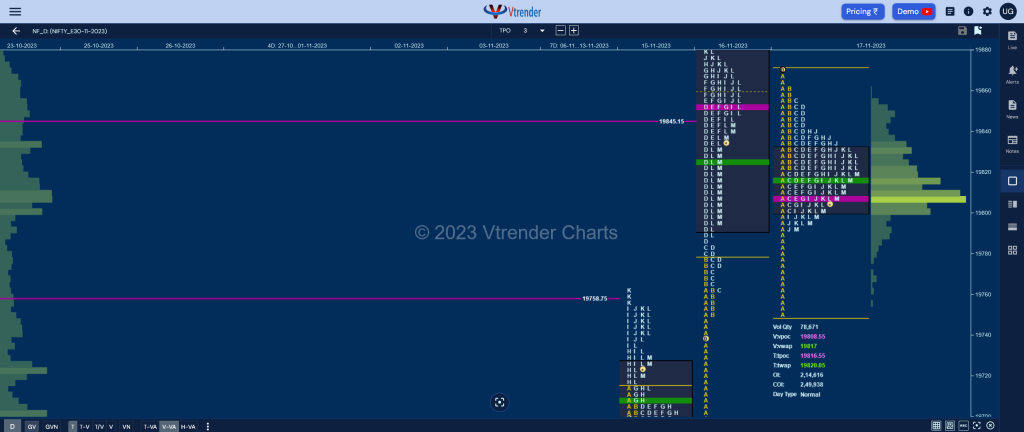

Nifty Nov F: 19806 [ 19861 / 19750 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 13,345 contracts |

| Initial Balance |

|---|

| 111 points (19861 – 19750) |

| Volumes of 28,650 contracts |

| Day Type |

|---|

| Normal (‘p’ profile) – 111 points |

| Volumes of 78,671 contracts |

NF opened with a gap down open and went on to make a low of 19750 taking support just above the buying tail from previous session and gave a sharp bounce tagging the yPOC of 19853 while making a high of 19861 in the A period after which it made a narrow 39 point range inside bar in the B leaving a zone of singles in previous value.

However, the lack of buying at 19853 led to multiple test of the A period buying tail througout the day as the auction consolidated inside the Trend Day profile forming a ‘p’ shape with a close right at the dPOC of 19808.

Today’s buying tail from 19792 to 19750 will be the zone to watch on the downside whereas on the upside, NF will need to sustain above today’s PBH of 19840 which can attract fresh demand for a probe higher to 19895 which was the HVN from 16th Nov where it saw profit booking by the Trend Day buyers.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19808 F and VWAP of the session was at 19817

- Value zones (volume profile) are at 19800-19808-19830

- NF confirmed a FA at 19385 on 06/11 and tagged the 2 ATR objective of 19704 on 15/11

- HVNs are at 19129 / 19213 / 19486** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 18964

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

Business Areas for 20th Nov 2023

| Up |

| 19808 – dPOC from 17 Nov 19840 – PBH from 17 Nov 19895 – HVN from 16 Nov 19934 – Swing High (16 Nov) 19976 – Swing High (17 Oct) |

| Down |

| 19792 – Buying Tail (17 Nov) 19749 – Buying Tail (16 Nov) 19702 – A TPO POC (16 Nov) 19662 – IB singles mid (15 Nov) 19621 – Weekly Ext Handle |

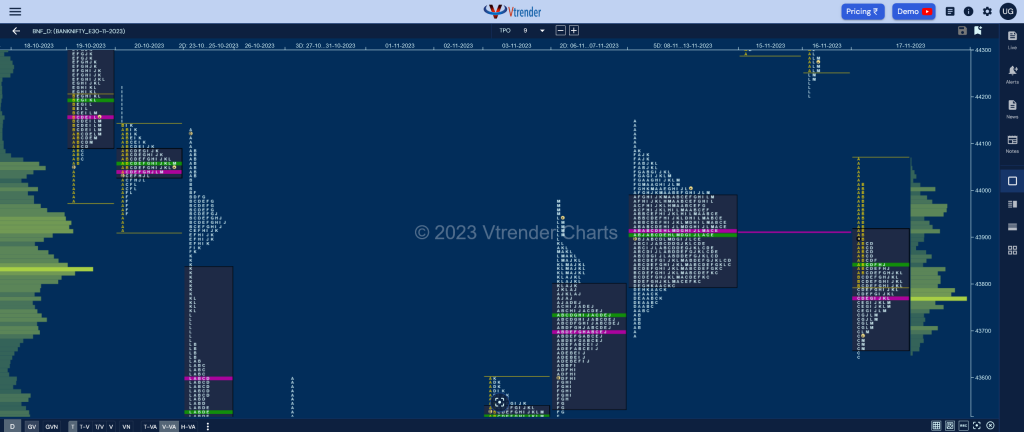

BankNifty Nov F: 43715 [ 44066 / 43649 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 38,518 contracts |

| Initial Balance |

|---|

| 266 points (44066 – 43800) |

| Volumes of 70,215 contracts |

| Day Type |

|---|

| Normal Variation – 416 points |

| Volumes of 1,77,076 contracts |

BNF opened with a huge 400 point gap down and went on to negate the 13th Nov Buying Tail from 43851 and duly completed the 80% Rule in the 5-day composite balance (08-13 Nov) while making a low of 43800 in the B period.

The auction then made a big C side extension down to 43649 making a look down below the composite low but gave the typical retracment back to day’s VWAP in the D TPO where it left a PBH at 43891 and remained inside the C period range for the rest of the day making a slow probe lower as it hit 43662 into the close.

BNF has left a ‘b’ shape long liquidation profile on the daily timeframe with completely lower Value so will remain weak below today’s POC of 43771 for a probe towards the daily VPOCs of 43514 & 43304 from 03rd & 02nd Nov respectively whereas on the upside, the zone from 43840 to 43891 could see supply adding more with the selling tail from 44010 being the higher reference for the coming sessions.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 43771 F and VWAP of the session was at 43840

- Value zones (volume profile) are at 43662-43771-43915

- HVNs are at 42928 / 43184 / 43832** (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (November 2023) is 42564

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

Business Areas for 20th Nov 2023

| Up |

| 43771 – dPOC from 17 Nov 43891 – PBH from 17 Nov 44010 – Selling Tail (17 Nov) 44082 – Weekly VWAP 44152 – Singles mid (17 Nov) |

| Down |

| 43710 – M TPO POC (17 Nov) 43625 – SOC from 07 Nov 43514 – VPOC from 03 Nov 43423 – Gap mid-point (03 Nov) 43304 – VPOC from 02 Nov |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.