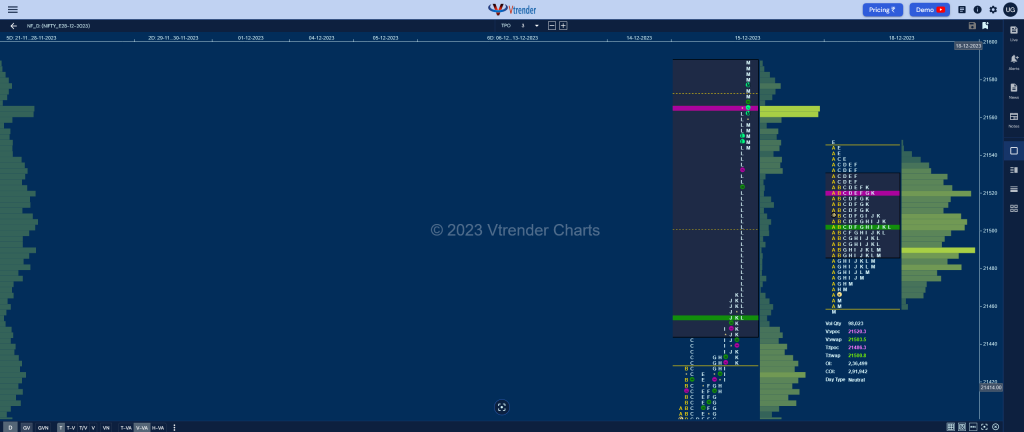

Nifty Dec F: 21477 [ 21547 / 21458 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 17,173 contracts |

| Initial Balance |

|---|

| 83 points (21544 – 21461) |

| Volumes of 37,175 contracts |

| Day Type |

|---|

| Normal (Gaussian) – 89 points |

| Volumes of 98,023 contracts |

NF opened lower into the L TPO singles from previous session and dropped further down to test the extension handle and spike low of 21465 as it made a low of 21461 in the A period where it got swiftly rejected and reversed the probe to the upside as it went on to check the day’s high even making a marginal extension to 21547 in the E TPO.

The auction however failed to get any fresh demand at these new highs triggering another rotation lower over the next 3 TPOs as it left a PBL at 21470 in the H before giving a small bounce above day’s VWAP in the K but was rejected from the dPOC which was forming at 21520 and this second failure by the demand to show up led to a fresh drop into the close resulting in marginal new lows of 21458 for the day.

NF has formed an inside bar both in terms of range as well as value which was on expected lines as can been seen in the nice Gaussian Curve we now have in 15th Dec’s L TPO singles zone from 21465 to 21545 and will need initiative players to turn up at either the VWAP of that day which was at 21455 or at the POC which was at 21564 for a move away from this balance in the coming session(s).

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21520 F and VWAP of the session was at 21503

- Value zones (volume profile) are at 21488-21520-21530

- HVNs are at 20377 / 21032** (** denotes series POC)

Weekly Zones

- (08-14 Dec 2023) – NF left a Neutral Extreme weekly profile to the upside after making an attempt to move away from previous week’s prominent POC of 21032 to the downside which got stalled as it left similar lows of 20902 & 20900 while forming a 4-day balance with the composite POC at 21088 and the failed attempt to the downside triggered an initiative move higher on the last day as it left a buying tail from 21228 to 21177 and went on to hit new ATH of 21355 into the close. Value for the week was overlapping to higher at 20925-21088-21124 with the VWAP at 21101 and will be the new swing reference on the downside

- (01-07 Dec 2023) – The first week of the current series was a Trend One up with an initiative buying tail from 20345 to 20292 followed by another zone of singles from 20640 to 20402 as it went on to make a high of 21046 leaving a small selling tail at the top and saw the POC shift near the top to 21032 suggesting profit booking by the longs. Value was completely higher at 20697-21032-21045 with the Trend Up VWAP at 20800

- (Oct-Nov 2023) – NF had left 4 weekly VPOCs on the downside at 19077, 19248, 19800 & 20189 before the December series began indicating that the major trend was already to the upside

- Click here to view the weekly MarketProfile charts of NF

Monthly Zones

- The settlement day Roll Over point (December 2023) is 20270

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

Business Areas for 19th Dec 2023

| Up |

| 21490 – HVN from 18 Dec 21520 – dPOC from 18 Dec 21564 – VPOC from 15 Dec 21601 – 1 ATR (PDL 21458) 21634 – 1 ATR (HVN 21490) |

| Down |

| 21468 – M TPO POC (18 Dec) 21430 – PBL from 15 Dec 21384 – HVN from 15 Dec 21356 – Buying Tail (15 Dec) 21317 – HVN from 14 Dec |

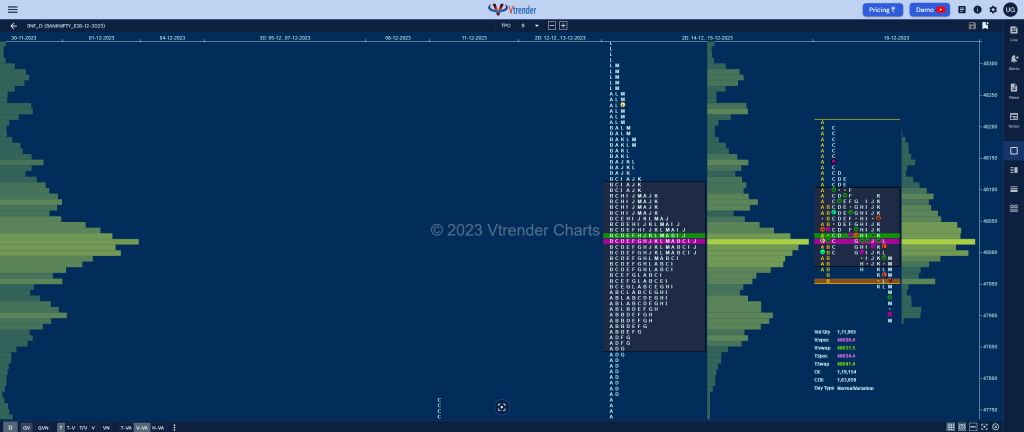

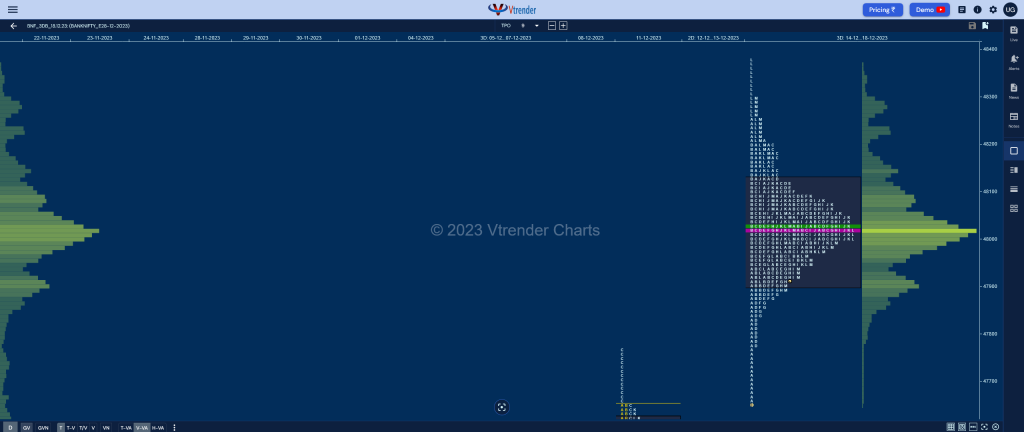

BankNifty Nov F: 47947 [ 48206 / 47890 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 19,211 contracts |

| Initial Balance |

|---|

| 240 points (48206 – 47955) |

| Volumes of 36,425 contracts |

| Day Type |

|---|

| Normal(spike close)-305 points |

| Volumes of 1,11,965 contracts |

BNF opened with a gap down open of over 250 points tagging the 2-day composite POC of 48020 but made a quick swipe higher to 48206 but showed only 0s above 48124 in the OrderFlow and with no fresh demand coming in triggered new lows for the day at 47955 in the B period as it tagged the SOC of 47957 from 15th Dec.

The auction then gave a sharp reaction with a typical C side probe higher getting back above 48124 and almost hitting the morning freak tick of 48206 while making a high if 48195 but once again failed to attract new buyers which inturn led to a slow probe lower to 47971 in the H TPO where it left a PBL hinting at demand coming back just above the reference of 47957.

BNF then made a probe above the day’s VWAP in the J & K periods but could only manage to hit 48095 leaving a PBH triggering a drop down into the close as it made a mini spike from 47945 to 47890 in the M TPO leaving a Normal Day with completely inside range & value leaving a nice 3-day Gaussian Curve with Value at 47899-48023-48125 and could continue to remain in this balance unless it gives a move away from here on initiative volumes in the coming session(s).

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48020 F and VWAP of the session was at 48030

- Value zones (volume profile) are at 47986-48020-48100

- BNF confirmed a FA at 46961 on 08/12 and tagged the 2 ATR objective of 47913 on 14/12. This FA has not been tagged and is now a positional reference

- HVNs are at 45127 / 47012 / 47145** (** denotes series POC)

Weekly Zones

- (07-13 Dec 2023) – It was time for consolidation after the trending move in the previous week as BNF formed a relatively narrow range 3-1-3 profile for the week with overlapping to higher Value at 47125-47393-47621 and will need initiative activity to negate one of the tails to get back to imbalance mode in the coming week

- (01-06 Dec 2023) – The first week of the December series was an elongated triple distribution trend up one with an initiative buying tail from 44942 to 44762 signalling a move away from the larger timeframe balance it had been forming with the help of two more zone of singles, first one from 45856 to 45602 and then from 46860 to 46724 as it went on to record new ATH of 47494 but came in form of the dreaed C side extension on 05th Dec triggering a profit booking round as BNF closed the week right at the POC of 46927 with the VWAP at 46416 which will be the swing reference for longs going forward

- (Oct-Nov 2023) – BNF had left a lone VPOC on the downside in October at 43170 before moving away from this on the upside in November forming a Double Distribution Trend Up profile with a prominent TPO POC at 44048 and the volume POC at 44607

- Click here to view the weekly MarketProfile charts of BNF

Monthly Zones

- The settlement day Roll Over point (December 2023) is 44720

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

Business Areas for 19th Dec 2023

| Up |

| 47955 – HVN from 18 Dec 48125 – 3-day VAH (14-18 Dec) 48234 – VPOC from 15 Dec 48375 – Swing High (15 Dec) 48496 – 1 ATR (HVN 47955) |

| Down |

| 47899 – 3-day VAL (14-18 Dec) 47780 – 3-day buying tail 47650 – 3-day composite low 47532 – Weekly HVN (07-13 Dec) 47393 – Weekly POC (07-13 Dec) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.