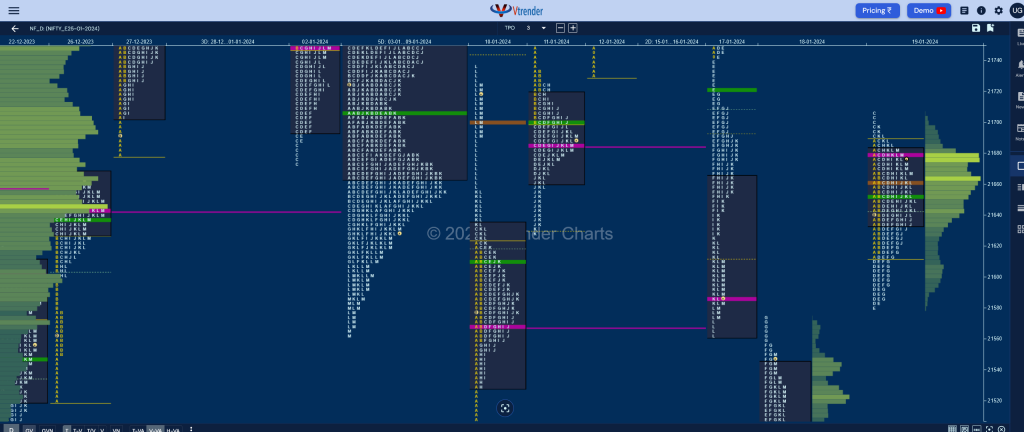

Nifty Jan F: 21672 [ 21708 / 21579 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 19,565 contracts |

| Initial Balance |

|---|

| 92 points (21687 – 21595) |

| Volumes of 39,966 contracts |

| Day Type |

|---|

| Neutral Centre – 129 points |

| Volumes of 1,25,832 contracts |

NF opened higher by exactly 100 points and went on to tag 21687 in the A period after which it made an inside bar in the B followed by a typical C side extension to 21708 which was swiftly rejected triggering a quick probe to the downside and couple of marginal REs (Range Extension) of 21581 & 21579 in the D & E TPOs confirming a FA (Failed Auction) at top.

The auction however did not find fresh supply below 17th Jan’s VPOC of 21587 and left a PBL (Pull Back Low) right there in the G period marking the end of the downside probe for the day and gave a slow bounce higher leaving another PBL at 21622 in the J before making an attempt to get into the C side singles but left similar highs of 21698 in the K & L TPOs even getting the dPOC to shift higher to 21679 where it eventually closed leaving a Neutral Centre Day and a well balanced profile with completely higher Value.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21679 F and VWAP of the session was at 21652

- Value zones (volume profile) are at 21634-21679-21684

- NF confirmed a FA at 22138 on 16/01 and completed the 2 ATR target of 21770 on 17/01

- HVNs are at 21662** / 21755 / 21890 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (12-18 Jan) – NF began with an initiative move away from previous week’s Value to the upside even scaling above the Jan RO (Roll Over) point of 21930 as it went on to make a high of 21995 on 12th and followed it up with new ATH of 22150 on 15th Jan but struggled to make a meaningful extension on the upside indicating exhaustion coming in and more confirmation of this came on the 16th where it left a FA at 22138 and formed a Neutral Centre profile from where the auction gave a trending move lower to 21316 over the last 2 days but left a buying tail till 21388 forcing profit booking as the weekly POC shifted down to 21469 leaving an elongated 833 point Neutral Extreme profile giving both new highs & lows for the series with overlapping to lower Value at 21320-31469-21694 with the NeuX VWAP at 21768 which will be the swing reference for the rest of the series

- (05-11 Jan) – NF has formed a Normal Variation profile to the downside which made a look down below previous lows but left an initaitive buying tail on the daily timeframe from 21528 to 21501 forming a nice balance over the 5 days with Value being completely inside at 21635-21703-21797 and this week’s VWAP also around the middle at 21690 where it closed and will need initiative volumes at one end in the coming week for a fresh imbalance to begin

- (29 Dec-04 Jan) – NF has formed a Neutral Centre weekly profile as it made a look up above previous highs but got rejected after making new ATH of 22025 and went on to make a low of 21579 taking support right above last week’s lower TPO HVN of 21570 filling up the low volumes zones and forming mostly overlapping Value at 21640-21748-21875 with a point to note that the sellers who had come in forming a base at 21890 had mostly booked profits at lower levels where it saw some short covering and fresh demand coming back.

Monthly Zones

- The settlement day Roll Over point (January 2024) is 21930

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

Business Areas for 20th Jan 2024

| Up |

| NA |

| Down |

| NA |

BankNifty Jan F: 45797 [ 46337 / 45584 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 21,382 contracts |

| Initial Balance |

|---|

| 201 points (46300 – 46099) |

| Volumes of 45,795 contracts |

| Day Type |

|---|

| Neutral Centre – 754 points |

| Volumes of 2,10,245 contracts |

BNF also made a gap up open of 286 points but could not clear previous session’s similar highs of 46358 and could only manage to tag 46300 in the A period after which it made marignal new lows for the day at 46099 in the B TPO taking support at the HVN of 46100 forcing a C side extension to 46337 where it got swiftly rejected as the supply came back strongly resulting in a big RE lower in the D confirming a FA at top.

The auction then stayed below the IBL and went on to complete the 1 ATR objective of 45728 in the I period and even made a look down below PDL recording new lows for the series at 45584 in the J where it left a small responsive buying tail till 45625 marking the end of the downside and gave a close just above the dPOC of 45759 leaving a Neutral Centre Day with completely overlapping Value.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 45800 F and VWAP of the session was at 45989

- Value zones (volume profile) are at 45592-45800-46060

- BNF confirmed a FA at 46337 on 19/01 and the completed the 1 ATR objective of 45928 on same day. The 2 ATR objective comes to 45119

- BNF confirmed a FA at 48440 on 16/01 and the completed the 2 ATR objective of 47386 on 17/01

- HVNs are at 47956 / 48007 / 48157** / 48555 (** denotes series POC)

Weekly Zones

- (11-17 Jan) – BNF made a slow and trending move higher for the first 4 days of the week getting above previous week’s VWAP of 47970 but marked the end of the upside with a daily FA at 48440 on 16th leaving a nice 2-day balance from where it made a big move away on the last day making it a hat-trick of Neutral Extreme weekly profiles to the downside re-confirming the lack of demand at the upper levels forming the biggest weekly range of the current series of 2389 points with mostly overlapping Value at 47110-48233-48432 with the NeuX VWAP at 47458

- (04-10 Jan) – BNF has once again formed a Neutral Extreme Down weekly profile which first filled up the low volume zone of previous week and then went on repair the poor lows with a sharp move lower testing the swing lows of 47303 (21-28 Dec) while tagging 47201 before giving a bounce back to 47666 into the close. Value for the week was completely overlapping at 47670-48076-48601 with the main supply reference being at the NeuX VWAP of 47970

- (29 Dec-03 Jan) – BNF has formed a Neutral Extreme which also reresents a Double Distribution Trend Down profile which got stalled right below previous week’s POC of 48879 on the upside and went on to fill the low volume zone till 48446 and made an initiative move with a small selling tail from 48346 to 48256 as it went on to make poor lows at 47763 forming a lower balance with the POC also shifting down to 47956. Value for the week was at 47765-47956-48542 with the important DD VWAP being at 48278 which will be the swing reference for the coming settlement.

Monthly Zones

- The settlement day Roll Over point (January 2024) is 48900

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

Business Areas for 20th Jan 2024

| Up |

| NA |

| Down |

| NA |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.