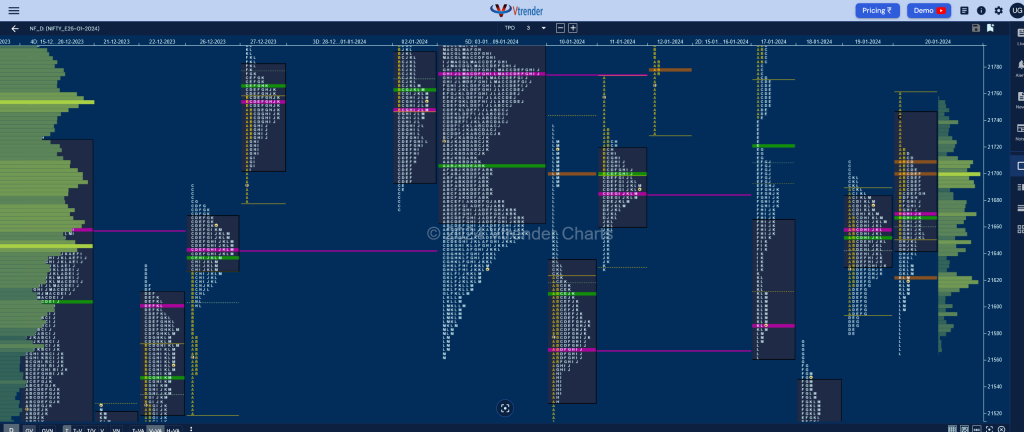

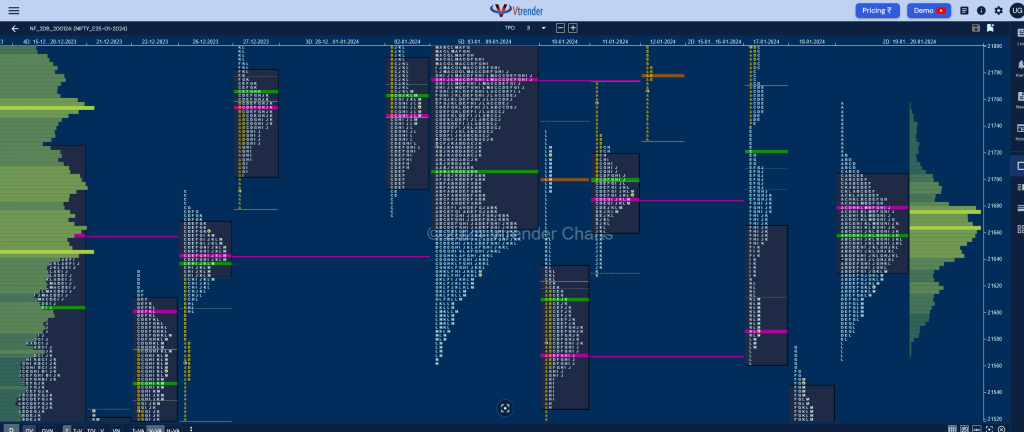

Nifty Jan F: 21604 [ 21759 / 21566 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 10,583 contracts |

| Initial Balance |

|---|

| 108 points (21759 – 21651) |

| Volumes of 25,276 contracts |

| Day Type |

|---|

| 3-1-3 profile – 194 points |

| Volumes of 72,894 contracts |

NF opened higher scaling above 17th Jan’s Trend Day VWAP of 21721 as it went on to make a high of 21759 but could not sustain marking the return of supply which was seen in an initiative selling tail till 21719 being confirmed and a probe back into previous day’s range and Value as it made new lows of 21651 in the B period.

The auction then formed a narrow range narrow range balance building couple of HVNs at 21708 & 21700 before making a RE (Range Extension) lower in the G period where it completed the 80% Rule in previous Value while making a low of 21625 and remained in the G period range till the J TPO after which it made couple of fresh REs in the K & L making a look down below the poor lows of previous session as it made a low of 21566 but was immediately rejected leaving a responsive buying tail till 21598 before closing the day around the lower HVN of 21623.

NF has formed a 3-1-3 profile and an outside bar in terms of range with overlapping to higher Value giving a nice 2-day Gaussian Curve with Value at 21631-21679-21704 and has a good chance to give a move away from here in the coming session(s).

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21670 F and VWAP of the session was at 21668

- Value zones (volume profile) are at 21642-21670-21744

- NF confirmed a FA at 22138 on 16/01 and completed the 2 ATR target of 21770 on 17/01

- HVNs are at 21662** / 21755 / 21890 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (12-18 Jan) – NF began with an initiative move away from previous week’s Value to the upside even scaling above the Jan RO (Roll Over) point of 21930 as it went on to make a high of 21995 on 12th and followed it up with new ATH of 22150 on 15th Jan but struggled to make a meaningful extension on the upside indicating exhaustion coming in and more confirmation of this came on the 16th where it left a FA at 22138 and formed a Neutral Centre profile from where the auction gave a trending move lower to 21316 over the last 2 days but left a buying tail till 21388 forcing profit booking as the weekly POC shifted down to 21469 leaving an elongated 833 point Neutral Extreme profile giving both new highs & lows for the series with overlapping to lower Value at 21320-31469-21694 with the NeuX VWAP at 21768 which will be the swing reference for the rest of the series

- (05-11 Jan) – NF has formed a Normal Variation profile to the downside which made a look down below previous lows but left an initaitive buying tail on the daily timeframe from 21528 to 21501 forming a nice balance over the 5 days with Value being completely inside at 21635-21703-21797 and this week’s VWAP also around the middle at 21690 where it closed and will need initiative volumes at one end in the coming week for a fresh imbalance to begin

- (29 Dec-04 Jan) – NF has formed a Neutral Centre weekly profile as it made a look up above previous highs but got rejected after making new ATH of 22025 and went on to make a low of 21579 taking support right above last week’s lower TPO HVN of 21570 filling up the low volumes zones and forming mostly overlapping Value at 21640-21748-21875 with a point to note that the sellers who had come in forming a base at 21890 had mostly booked profits at lower levels where it saw some short covering and fresh demand coming back.

Monthly Zones

- The settlement day Roll Over point (January 2024) is 21930

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

Business Areas for 23rd Jan 2024

| Up |

| 21631 – 2-day VAL (19-20 Jan) 21679 – 2-day VAL (19-20 Jan) 21719 – 2-day Tail (19-20 Jan) 21768 – Weekly VWAP (12-18 Jan) 21815 – B TPO VWAP (17 Jan) |

| Down |

| 21579 – 2-day tail (19-20 Jan) 21516 – L TPO VWAP (18 Jan) 21469 – VPOC from 18 Jan 21430 – C TPO halfback (18 Jan) 21388 – Buying Tail (18 Jan) |

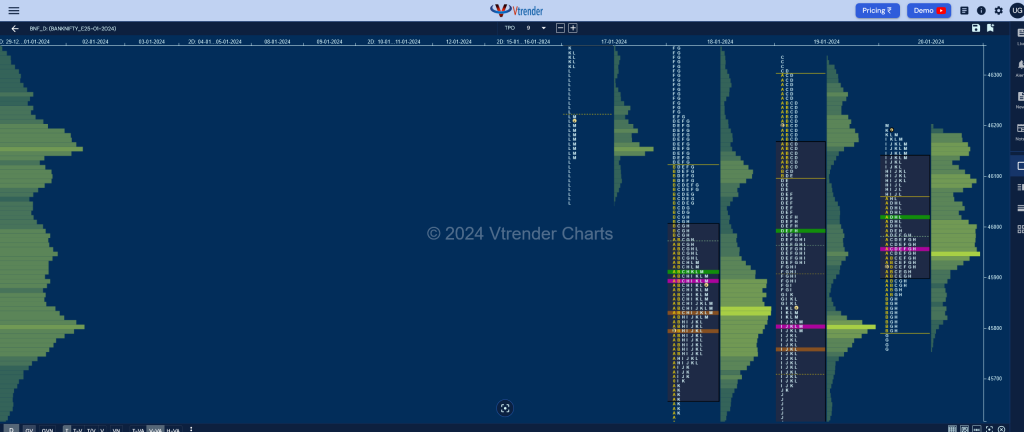

BankNifty Jan F: 46136 [ 46210 / 45760 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 14,011 contracts |

| Initial Balance |

|---|

| 259 points (46059 – 45800) |

| Volumes of 33,624 contracts |

| Day Type |

|---|

| Neutral Extreme – 450 points |

| Volumes of 1,18,727 contracts |

BNF made a 252 point gap up open but made an almost OH (Open=High) start at 46050 and probed lower for the rest of the IB (Initial Balance) as it made a low of 45800 in the B period taking support right at yPOC which led to a rotation to the upside in the C & D TPOs stalling right below 46050 while making a high of 46045.

The auction then made an attempt to extend lower in the G period but could only manage to tag 45760 leaving a small but important tail at lows indicating lack of supply and went on to make a trending move higher for the rest of the day making multiple REs confirming a FA (Failed Auction) at lows and leaving a Neutral Extreme Day Up with both value and range being completely inside previous profile.

BNF has been forming a balance in the current week with 2 FAs at 46337 & 45760 which will be the levels to be taken out on initiative activity in the coming session(s) for a further probe in that direction with today’s POC of 45950 being the immeidate support on the downside.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 45900 F and VWAP of the session was at 46019

- Value zones (volume profile) are at 45800-45950-46092

- BNF confirmed a FA at 45760 on 20/01 and the 1 ATR objective comes to 46396

- BNF confirmed a FA at 46337 on 19/01 and the completed the 1 ATR objective of 45928 on same day. The 2 ATR objective comes to 45119

- BNF confirmed a FA at 48440 on 16/01 and the completed the 2 ATR objective of 47386 on 17/01

- HVNs are at 47956 / 48007 / 48157** / 48555 (** denotes series POC)

Weekly Zones

- (11-17 Jan) – BNF made a slow and trending move higher for the first 4 days of the week getting above previous week’s VWAP of 47970 but marked the end of the upside with a daily FA at 48440 on 16th leaving a nice 2-day balance from where it made a big move away on the last day making it a hat-trick of Neutral Extreme weekly profiles to the downside re-confirming the lack of demand at the upper levels forming the biggest weekly range of the current series of 2389 points with mostly overlapping Value at 47110-48233-48432 with the NeuX VWAP at 47458

- (04-10 Jan) – BNF has once again formed a Neutral Extreme Down weekly profile which first filled up the low volume zone of previous week and then went on repair the poor lows with a sharp move lower testing the swing lows of 47303 (21-28 Dec) while tagging 47201 before giving a bounce back to 47666 into the close. Value for the week was completely overlapping at 47670-48076-48601 with the main supply reference being at the NeuX VWAP of 47970

- (29 Dec-03 Jan) – BNF has formed a Neutral Extreme which also reresents a Double Distribution Trend Down profile which got stalled right below previous week’s POC of 48879 on the upside and went on to fill the low volume zone till 48446 and made an initiative move with a small selling tail from 48346 to 48256 as it went on to make poor lows at 47763 forming a lower balance with the POC also shifting down to 47956. Value for the week was at 47765-47956-48542 with the important DD VWAP being at 48278 which will be the swing reference for the coming settlement.

Monthly Zones

- The settlement day Roll Over point (January 2024) is 48900

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

Business Areas for 23rd Jan 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.